Posted on 06/10/2022 9:39:36 AM PDT by blam

Social Security has a problem. As Democrats push to expand entitlements to include free preschool and subsidized child care, little attention is getting paid to Social Security is a financial trainwreck.

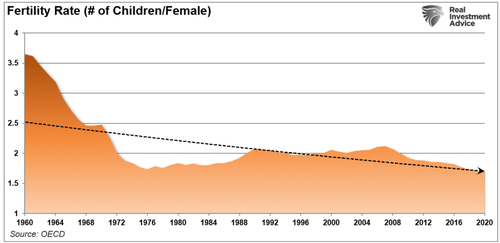

“The program’s payouts have exceeded revenue since 2010, but the recent past is nowhere near as grim as the future. According to the latest annual report by Social Security’s trustees, the gap between promised benefits and future payroll tax revenue has reached a staggering $59.8 trillion. That gap is $6.8 trillion larger than it was just one year earlier. The biggest driver of that move wasn’t Covid-19, but rather a lowering of expected fertility over the coming decades.” – Stark Realities

Note the last sentence.

When President Roosevelt first enacted social security in 1935, the intention was to serve as a safety net for the elderly. However, at that time, life expectancy was roughly 60-years of age. Therefore, expectations were that participants would not be drawing on social security for very long from an actuarial basis. Furthermore, roughly 16-workers paid into social security for each welfare participant.

Of course, given that politicians like to use government coffers to buy votes, additional amendments got added to social security to expand the participation in the program. Such included adding domestic labor in 1950 and widows and orphans in 1956. They lowered the retirement age to 62 in 1961 and increased benefits in 1972. Then politicians added more beneficiaries, from the disabled to immigrants, farmers, railroad workers, firefighters, ministers, federal, state, and local government employees, etc.

While politicians and voters continued to add more beneficiaries to the welfare program, the number of workers steadily declined. Today, there are barely 2-workers for each beneficiary.

As we will discuss, “Demography is destiny.”

The $96 Trillion Graveyard

“Politicians promised you benefits, but never funded them. That’s according to truthinaccounting.org, which noted that there’s $96.3 trillion owed in promised but unfunded Medicare and Social Security benefits — $55.1 trillion for Medicare and $41.2 trillion for Social Security.

While Uncle Sam has $5.9 trillion in assets, the $129 trillion owed in bills — including military and civilian retirement benefits — means the U.S. is in the hole for $123 trillion. Just the unfunded liabilities in Medicare and Social Security add up to $96 trillion.

It is a stunning amount coming due over the next 75 years. The Treasury Department sticks its proverbial head in the sand and does not even list the liabilities on the balance sheet of the federal government.” – – Adam Andrzejewski

Let that soak in for a minute.

According to the Social Security Trustees’ annual report (pdf), the Social Security program will be insolvent in 13 years by 2035. At present, the program cannot guarantee full benefits to current retirees. The Social Security Old-Age & Survivors Insurance (OASI) trust fund will deplete its reserves by 2034.

The Social Security Disability Insurance (SSDI) trust fund is better financially. However, the combined trust fund will deplete by 2035 when today’s youngest retirees turn 75 and 54-year-olds enter full retirement age.

Once the program becomes insolvent, all beneficiaries will face across-the-board benefit cuts of 20 percent.

In 2022, the Trustees estimate Social Security to run a cash-flow deficit of $112 billion, which comes to 1.3 percent of taxable payroll. Over the next decade, Social Security will run deficits of almost $2.5 trillion, equivalent to 0.8 percent of GDP or 2.1 percent of taxable payroll.

By 2040, the annual deficit will grow to 3.4 percent of taxable payroll, moving even higher to 4.3 percent by 2096.

It is an insurmountable problem.

Can It Be Fixed?

Currently, most people suggest that a few minor tweaks, such as increasing the retirement age, can solve the long-term funding problem.

They could not be more wrong.

How do we know this? Because adjustments made previously to the welfare programs still fell well short of future assumptions.

For example, in 1977, Congress passed an amendment that altered the tax formulas to raise more money,increasing withholding from 2% to 6.15%. As President Carter remarked,

“Now this legislation will guarantee that from 1980 to the year 2030, the Social Security funds will be sound.”

The financial picture declined almost immediately, and by the early 1980s, the system was again in crisis. Then, In 1983, a panel investigated the long-run solvency of Social Security, and in 1983 amendments were put into place to raise social security taxes and raise the full retirement age.

Once again, these fixes failed to fix the long-term funding problem of the welfare program for the simple reason that increasing taxes and a declining number of individuals won’t cover the growing number of welfare recipients.

Today, the problem remains the same. Increasing taxes and extending retirement ages won’t solve the long-term insolvency of too many beneficiaries.

The only reality is that eventually, the benefits promised to the elderly will likely not get paid in full. Or, the younger generation, who vote for socialism, will be saddled with trillions in extra taxes with nothing in return.

Other Measures Just As Dismal

There are several other measures of the unfunded liability problem. However, they are just as dismal.

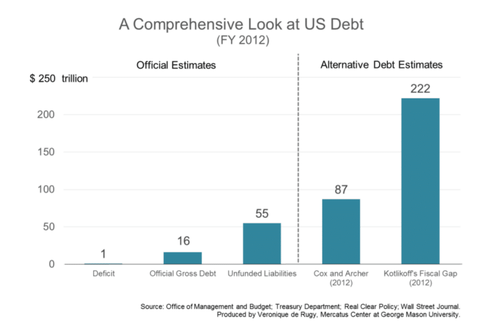

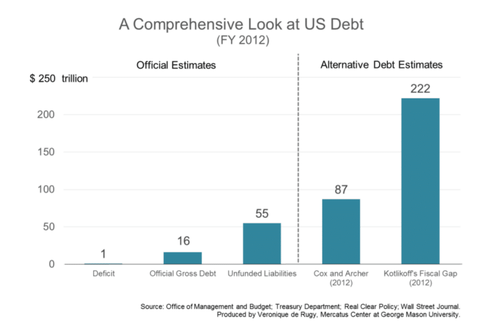

◾Former chairman of the SEC, Chris Cox, and former chairman of the House Ways & Means Committee Bill Archer (2012) report roughly $87 trillion in unfunded liabilities using data from the Medicare and Social Security Trustees’ Reports. Their measures account for the unfunded liabilities—including Social Security, Medicare, and federal workers’ pensions—in addition to the official debt.

◾Boston University economist Laurence Kotlikoff calculates a “fiscal gap” amount of $222 trillion using the Congressional Budget Office’s alternative long-term budget forecast. The fiscal gap measure considers the present value of all the expenditures now through the end of time (including servicing the official debt). It subtracts all the projected taxes from that amount.

◾Such means the government would have to invest $87 trillion or $222 trillion right now in something that will earn a certain positive rate of return to meet its future obligations, mainly concerning entitlement programs.

◾Both alternative debt figures dwarf the $16 trillion official debt figure, even when you add the $55 trillion Treasury estimate for unfunded liabilities to $71 trillion.

This money is not due in the future; it’s like a credit card bill the country owes right now. If we don’t pay interest on it, the debt will continue to accumulate. Addressing our unfunded liabilities problem requires fundamental entitlement reform and reductions in federal spending.”

– Veronique de Rugy, Mercatus Center

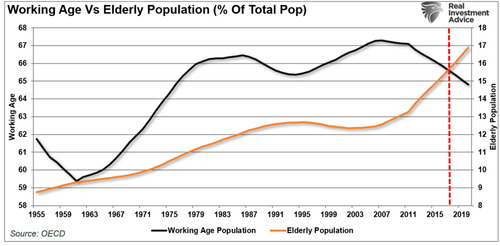

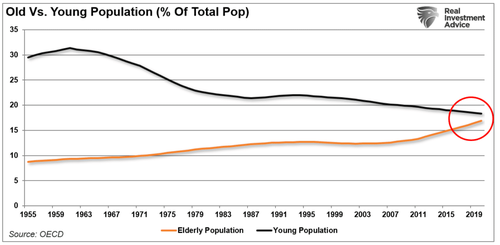

No matter how you calculate the numbers, the problem remains the same. Too many obligations and a demographic crisis. As noted by official OECD estimates, the aging of the population relative to the working-age population has already crossed the “point of no return.”

While politicians and financial gurus suggest that future retirees won’t face a significant shortfall, the problem comes down to fertility rates. So to solve the demographic “timebomb,” either you have to decrease the number of people drawing on the system markedly or massively increase the number paying into it.

A recent study shows the latter is not likely.

Researchers from the Center for Sexual Health Promotion at Indiana University School of Public Health showed Americans continue to have less sex. Research found that 28% of adults reported not having intercourse over the prior year in 2018. Adolescents were also increasingly abstinent, with 89% reporting not having sex over the previous 12 months in 2018.

The data also permitted the researchers to estimate how often the average American adult aged 18-49 has sex each year. In 2009, it was about 63 times. In 2018, it was about 47 times.

Interestingly, the researchers put forth some hypotheses behind the decline in sexual activity:

◾Less alcohol consumption (not spending time in bars/restaurants)

◾More time on social media and playing video games

◾Lower wages lead to lower rates of romantic relationships

◾Non-heterosexual identities

The problem with less sex, and non-heterosexual identities, are fewer births.

Such will exacerbate the problem of social welfare programs as the young and old populations continue to diverge.

An Insolvable Problem

As millions of baby boomers begin to retire, another problem also emerges. Demographic trends are relatively easy to forecast and predict. However, each year until 2025, we will see successive rounds of boomers reach the 62-year-old threshold.

There is a twofold problem as these successive crops of boomers heads into retirement. First, each boomer has not produced enough children to replace themselves. Such leads to a decline in the number of taxpaying workers. It takes about 25 years to grow a new taxpayer. We can estimate, with surprising accuracy, how many people born in a particular year will live to retirement. The retirees of 2070 were born in 2003, and we can see and count them today.

The second problem is the employment problem. The decline in economic prosperity discussed previously is caused by excessive debt and declining income growth due to productivity increases. Furthermore, the shift from manufacturing to a service-based society will continue to lead to reduced taxable incomes.

This employment problem is critical.

By 2025, each married couple will pay Social Security retirement benefits for one retiree and their own family’s expenses. Therefore, either taxes must rise or other government services must get cut.

Back in 1966, each employee shouldered $555 of social benefits. Today, each employee has to support more than $18,000 of benefits. The trend is unsustainable unless wages or employment increases dramatically, and based on current trends, such seems unlikely.

The entire social support framework faces an inevitable conclusion where wishful thinking will not change that outcome. The question is whether elected leaders will make needed changes now, or later when they are forced upon us.

For now, we continue to “Whistle past the $96 Trillion graveyards.”

You notice they NEVER talk about welfare money running out. For those bums living on welfare, the money is ALWAYS available for eternity. /spit

If you’re not already collecting, do it NOW before it is too late.

I’m 64 but took early SS because I saw what a ripoff waiting until I MIGHT reach 67 &1/2. I know the longer I live I’ll be getting less, but I don’t think SS will even be available once I’m in my late 80s, if I ever reach that far.

1940: 159.4 : 1

1945: 41:9 : 1

1950: 16.5 : 1

1960: 5.1 : 1

1980: 3.2 : 1

2000: 3.4 : 1

2013: 2.8 : 1

The number of beneficiaries climbed faster than the number of covered workers. today Every three employees supports one person on social security, plus the federal overhead to run it.

This is a system which was flawed from the start and can not be fixed.

It was r’s and d’s who ruined the world. The US was destroyed post WWII by those parties. Trade, immigration, spending, etc. The youth of now, had no part in that destruction.

Our choices are all difficult.

We can raise the retirement age to qualify for full benefits.

We can raise Social Security taxes.

We can trim back benefits.

We can cut benefits further for higher-income people, based on the idea that they don’t need Social Security as much as those who don’t have retirement savings or 401k type plans.

We can inflate the Social Security trust fund with money from general tax revenues, but that’s a non starter when we have trillion dollar deficits in the general federal budget.

We can increase the money supply to pay all promised benefits, but the resulting inflation will erode the buying power of those benefits.

We can compel, encourage, force , the 401k and IRA assets which people have, to be integrated into the Social Security trust fund.

None of these options are good ideas, in my opinion. But I expect some combination of these actions to be taken eventually.

It sounds like a good plan to rapidly reduce Social Security and Medicare costs would be to kill off millions of America’s seniors using a poisonous vaccine that the government orders to be mandatory.

Hmmmmm... no mention of means testing. It will be sold as another “rich have to pay their fair share” deal.

“THAT MONEY IS YOURS.”

No, no it isn’t.

It’s a TAX. that’s all it is, just like every other Tax. Goobermint can increase, decrease, amend apend at will.

You have NO claim to anything unless Goobermint grants it.

There is no “pot of money” with your name on it.

Like the old saying goes: If you can stand in front of it and defend it with a gun, you never really owned it anyway.

Live, save and invest accordingly.

I have the same philosophy. I started receiving SS money at the earliest possible moment following my 62nd birthday.

“Our choices are all difficult.”

Your list misses:

Create a virus that kills old people, flood the country with lots of young breeders and “workers”, and print dollars til Nancy’s eyebrows go over the top of her head and inflate away, then just make a new currency.

I should have taken Social Security at 29.

I started early. You make as much money up to age 80 and change. Now if you have a high income it might not be worth starting early.

But for me, for now, it was the best short-term option.

(Create a virus that kills old people)

Yep

Now don’t mention death panels and Obamacare

That would be a tinfoil conspiracy!!

Government annexation of private retirement plans (IRAs, 401(k)s, etc.)

Frankly, I’ve been expecting just that.

When the Mark of the Beast comes in the middle the 7 years, everything will be locked down. 401(k), Social Security, regular wages and any form of cash will be illegal IMHO.

And then the two questions will be:

Will that be right hand?

Or forehead?

_______

BEST response result:

Revelation 20:4

King James Version

4 And I saw thrones, and they sat upon them, and judgment was given unto them: and I saw the souls of them that were beheaded for the witness of Jesus, and for the word of God, and which had not worshipped the beast, neither his image, neither had received his mark upon their foreheads, or in their hands; and they lived and reigned with Christ a thousand years.

https://www.biblegateway.com/passage/?search=Revelation%2020%3A4&version=KJV

Revelation 14:9-12

King James Version

9 And the third angel followed them, saying with a loud voice, If any man worship the beast and his image, and receive his mark in his forehead, or in his hand,

10 The same shall drink of the wine of the wrath of God, which is poured out without mixture into the cup of his indignation; and he shall be tormented with fire and brimstone in the presence of the holy angels, and in the presence of the Lamb:

11 And the smoke of their torment ascendeth up for ever and ever: and they have no rest day nor night, who worship the beast and his image, and whosoever receiveth the mark of his name.

12 Here is the patience of the saints: here are they that keep the commandments of God, and the faith of Jesus.

https://www.biblegateway.com/passage/?search=Revelation%2014%3A9-12&version=KJV

Simple and probable solution: just print more money!

AND COVID-19(84) showed just how rapidly the world 🌎🌍 could be transformed with mandatory lockdowns and economic restrictions.

A dry run for the Mark of the Beast, one way or another.

They need to start rewarding young couples that stay together and have children.

“taxable payroll”

That is going to be expanded. Look for Congress to define “taxable payroll” to include dividends and capital gains and to raise the limits on income that can be taxed.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.