Posted on 05/31/2022 6:44:06 AM PDT by blam

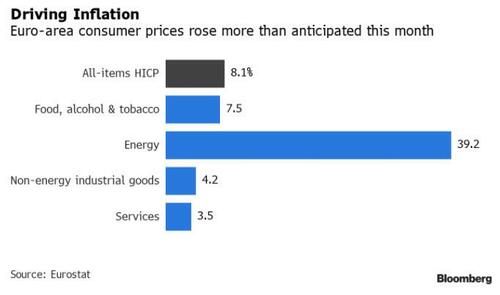

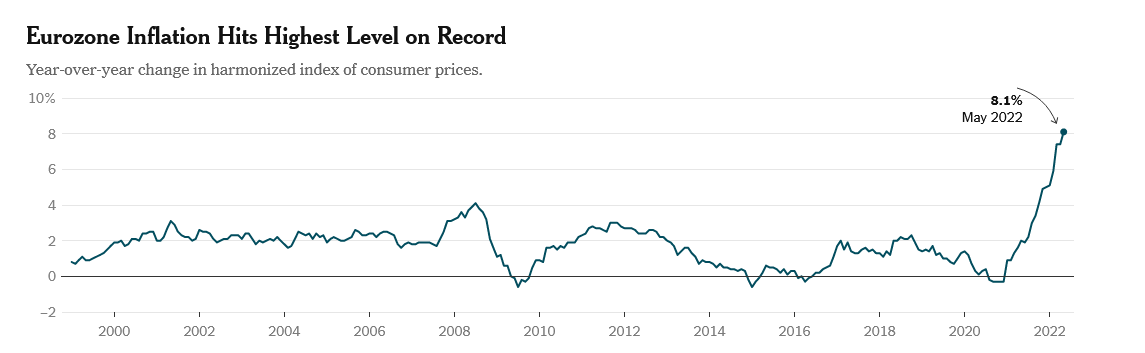

Following Germany’s post-Weimar record high inflation print, the European Union’s consumer price inflation data this morning surged to a record high at +8.1% YoY (notably hotter than the +7.8% YoY expected).

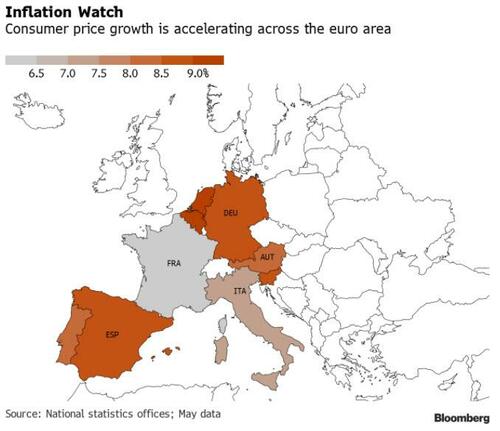

The inflation impulses are broad based across all the major European nations…

Source: Bloomberg

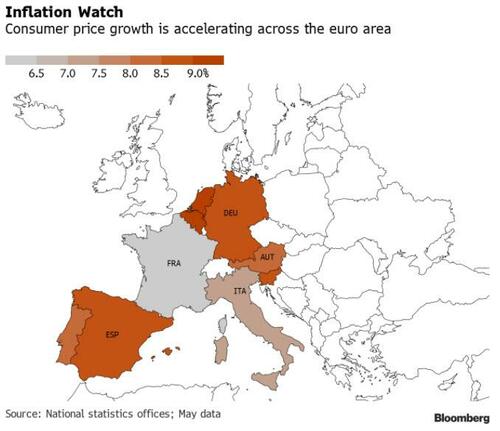

The surge in European inflation is dominated by energy prices rising, and food costs…

Source: Bloomberg

Finally, we note that the recently agreed EU import ban on a major portion of Russian oil, meanwhile, risks further stoking pressure on prices.

The report comes just 10 days before a crucial ECB meeting where officials are set to announce the conclusion of large-scale asset purchases and confirm plans to raise interest rates in July for the first time in more than a decade.

“Inflation is an enormous economic risk,” German Finance Minister Christian Lindner told a news conference in Berlin.

“We must fight it so that no economic crisis results and a spiral takes hold in which inflation feeds off itself.”

Don’t look now, but the market’s expecting the ECB to raise rates by the same amount as the Fed over the next year! pic.twitter.com/k0ouYghlTI

— Rishi Mishra (@aRishisays) May 30, 2022

President Christine Lagarde indicated last week that quarter-point increases are likely at meetings in July and September.

As Bloomberg reports, Chief economist Philip Lanebacked that timeline on Monday, calling moves of that size a “benchmark pace” in exiting stimulus, which also includes large-scale bond-buying.

Some officials have floated the idea of hiking by a half-point for the first time in the ECB’s history — mirroring the latest Federal Reserve decision. Dutch Governing Council member Klaas Knot has said inflation numbers for May and June will determine whether such a step is warranted.

Get back to work Mrs. Largarde!

“European Inflation Soars To Record High, Pressures ECB”

More STICKING IT TO PUTIN!!!!

We had the sales manager of the largest European sawmill in our office last week. He stated that hey were looking to sell a larger percentage of their lumber to the states because the European construction market has come to a halt ever since the Ukraine war.

There was a major gypsum plant in the Ukraine and a steel mill that were both destroyed. These plants shipped throughout EU countries. Without steel and drywall it is difficult to build new buildings.

“a spiral takes hold in which inflation feeds off itself”

This finance minister actually “gets it”.

They need to fire him before his intelligence gets contagious.

Look at bar graph. The Climate A-Holes and their media allies are directly to blame for this. They have criminalized the truth. If call out the hoax you are exiled or worse.

“The surge in European inflation is dominated by energy prices rising”

no surprise to anyone with a half a brain: energy is THE primary input into everything that makes up modern living, including resource extraction, resource refining, manufacturing, transportation, farming, fertilizer and agricultural chemicals, food preservation, medical care, communications and telecommunications, computing, internet, online commerce, construction and construction materials, clothing, and heating and cooling ...

i wonder if the lefties are willing to give all of that up because “climate change” ...

“Look at bar graph. The Climate A-Holes and their media allies are directly to blame for this. They have criminalized the truth. If call out the hoax you are exiled or worse.”

I’ve noticed the major Ukraine War cheerleaders now seem resigned to Russia’s impending victory. And they blame it on the US (i.e., NATO) not willing to start a ground war and/or an air war with Russia, in Russia’s backyard.

There are some REALLY SICK people around.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.