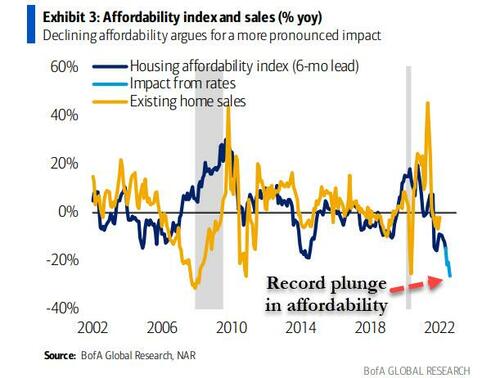

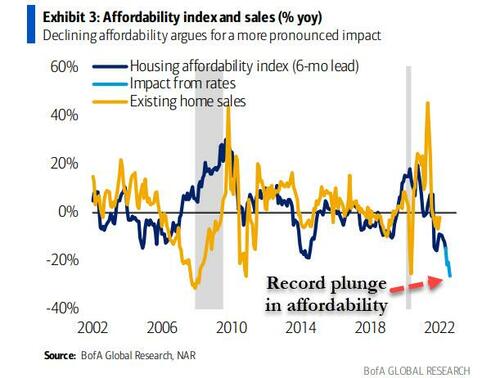

as it stands, housing affordability is about as low as it's ever been

Posted on 04/14/2022 7:48:06 AM PDT by Browns Ultra Fan

Mortgage interest rates continue their meteoric rise (along with home prices), the result of which is a tanking of consumer confidence in home buying.

The University of Michigan survey of consumers about buying conditions for housing remains depressed due to rising mortgage rates and surging home prices.

Bankrate’s 30Y mortgage rate is down slightly today to 5.06% as the 2-year Treasury yield declines and the anticipated rate hikes have fallen to 9.19.

As I mentioned earlier, mortgage credit availability hasn’t recovered from the “China Covid Correction.”

(Excerpt) Read more at confoundedinterest.net ...

Wow, mortgage rates over 5% now? Compared to recent years of rates less than 3% and some even in the low 2% range, buyers better get used to higher rates and higher mortgage payments.

As I recall, the historical rate for mortgages has been around 6%, with some excursions above and below over the last 40 years.

Now it is bad for the Fed to raise interest rates because it makes buying a home more difficult.

Complainers gotta complain.

In a better world there would be no Fed and interest rates would be determined by the market. In that case interest rates would most likely be hovering in the low double-digits by now. This would have maybe led the voting public to finally get serious about holding their "representatives" to task for letting the deficit get so far out of hand.

Either that, or all of the recent immigrants would have gotten their "representatives" to give them more cash handouts to handle the additional costs due to rising interest rates, or pass a law to make interest rates above a certain level illegal.

I bought my first house at 10.5% VA.

Whoever said that you (or anyone) has a right to cheap money? I mean, besides LizardFeather Warren, and Mitt Romney and Boyney Sanders and ..... all the Covid-19 spending.

But, I digress.

Can you imagine how cheap a house would be (and have to be) if people had to save up to buy one? Or they had to build it as they lived on the land?

I know we don’t live in that world, but it is time to realize that grumbling doesn’t change things.

But maybe it makes you feel better?

(Heck, vote-cheating is what changes things.)

They're fretting over the damage to the housing market from rates no longer being at unnaturally low levels. How did all those houses get bought all those years at the higher levels?

“Can you imagine how cheap a house would be (and have to be) if people had to save up to buy one? “

What would happen in that case is, you would have multi-generational households, where parents, grandparents, and grown up kids lived cramped in the same house.

It’s the way it is in most undeveloped country that don’t have a functional credit system.

So which one do you prefer?

Since you’re Nigerian you probably have first hand experience you could tell us about.

“great, so when do we see a meaningful correction in the housing market?”

Shouldn’t be long before house prices start falling. Right now the prices are still high because people want to get in before interest rates go even higher.

With rates going up it’ll soon reach a point where fewer and fewer will be able to afford the monthly payments and demand will fall along with prices.

In the meantime is the interest for savings going up?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.