Posted on 04/12/2022 2:05:36 PM PDT by blam

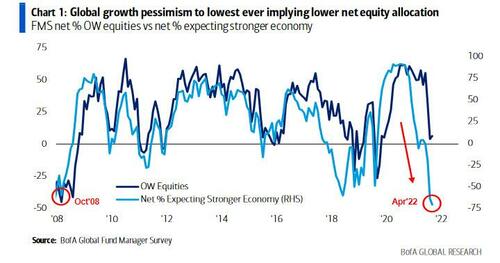

One month after the March Fund Manager Survey was downright “apocalyptic” with the majority seeing a bear market and stagflation, and with optimism plunging to levels right before Lehman, today Bank of America published the latest, April FMS (available to pro subs in the usual place) in which the bank’s doom-and-gloomy Chief Investment Strategist Michael Hartnett found that his view is shared by even more Wall Street professionals, because the survey which polled 329 panelists managing $929 billion in AUM, found that global growth expectations plunged even more compared to last month, and dropped to fresh all-time lows (net -71%) …

… even as the percentage of those overweight equities remains stubbornly high (expect this number to slide in the coming weeks alongside stocks) and as BofA notes “The disconnect between global growth and equity allocation remains staggering. Investors got slightly more bullish on equities. Though still at depressed levels, equities are nowhere near “recessionary” close-your-eyes-and-buy levels.” As a reminder, we first flagged this “rare disconnect” back in September, and since then it’s only gotten worse.

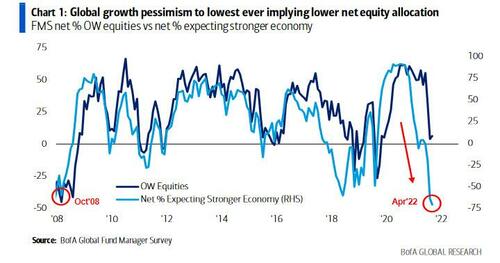

Meanwhile, adding to the dire sentiment (if not risk positioning), stagflation expectations have soared to the highest since August 2008.

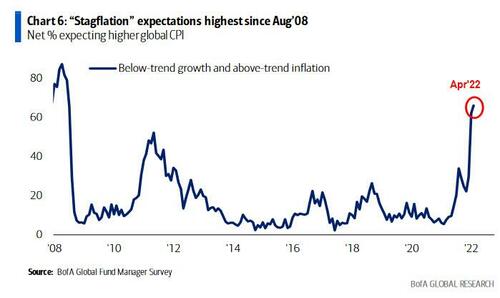

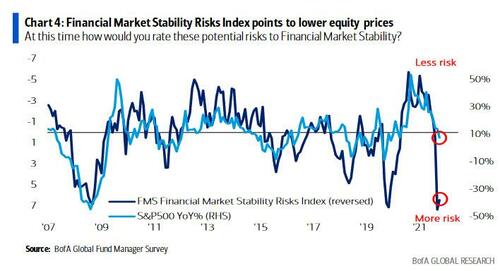

That’s not the only paradox: investors/FMS respondents remain stubbornly bullish on stocks even as they concede that financial market stability risks comparable to the COVID shock and GFC. Here, too, BofA warns that “the high perceived risk to financial market stability points to a further decline in equity prices.” Of course, nobody cares.

But wait, there’s more: not only are profit expectations the lowest since Covid (when the global economy shut down and corporate earnings cratered) with other previous instances of such low levels include the collapse of LTCM, bursting of the Dotcom bubble, and the Lehman bankruptcy…

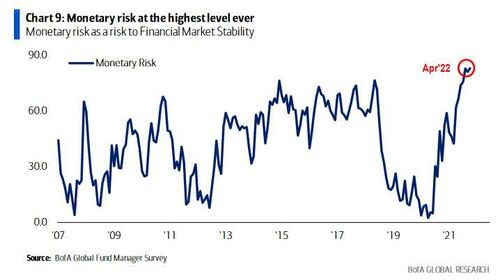

… but according to the FMS, the monetary risk is now at the highest level ever!

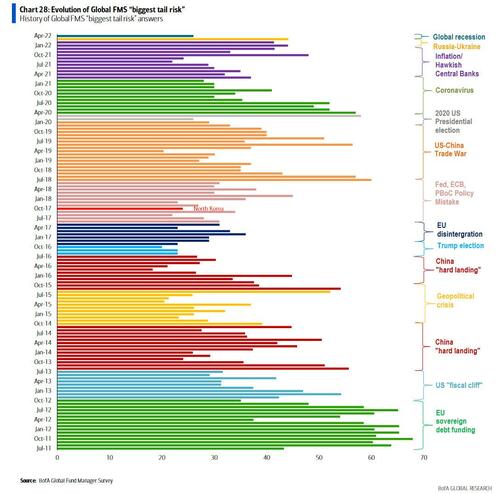

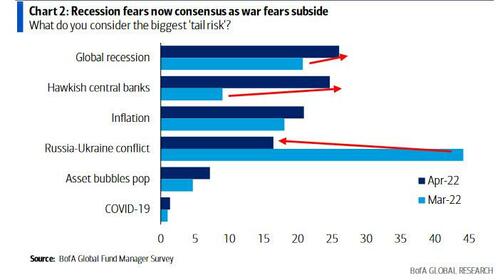

While there is more in the full note, the common refrain is simple: recession (and stagflation) is now consensus, the only question is when. Sure enough, “Global Recession” is – for the first time this decade – now seen as the “biggest tail risk” (as shown below, the dominant concerns of investors since 2011 have been Eurozone debt and potential breakdown; Chinese growth; populism, quantitative tightening & trade wars, global coronavirus; now inflation/bond tantrum and central bank rate hikes.)

Incidentally, behind global recession as top “tail risk” according to 26% of FMS investors; the #2 risk is Hawkish central banks, #3 is Inflation, and #4 is Russia-Ukraine conflict

So how does one make sense of this seemingly contradictory sentiment, where the majority of Wall Street now expect a recession yet they refuse to trade accordingly and remain solidly in the risk on camp?

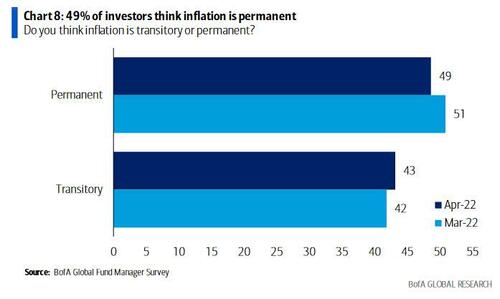

For the answer we have to look at prevailing views about inflation, and where despite today’s 8.5% CPI print, the hottest in 40 years, just 49% of respondents believe that inflation is permanent (down from 51% a month ago), while a whopping 43% believe it is transitory (of course, just a few months ago virtually everyone said inflation is transitory)

One can also see the shift in sentiment toward CPI in what may be the most important chart in the entire FMS, one showing that just a few months after a record number of investors (correctly) predicted higher global CPI, the net % of investors who think inflation will trend lower has increased to net -40% (more or less in keeping with the average recessionary levels of -57%).

In other words, with less than half thinking inflation is permanent, and a growing number of respondents saying inflation will soon become deflation and isn’t really a concern, that means that it is only a matter of time before the Fed will step in with more easing, QE, etc. just as soon as the current inflationary tidal wave fades away. As such it makes no sense to sell stocks here because what one should be doing is frontrunning the Fed’s next easing. It’s also why despite near record inflation prints, ever fewer sell their risk assets.

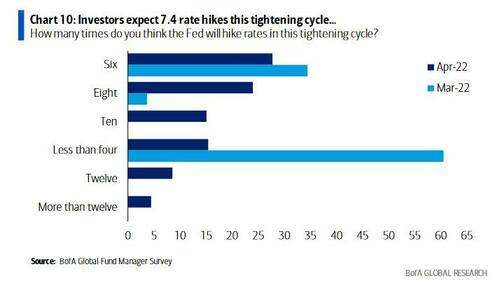

And since so many think inflation is transitory, the prevailing consensus sees only 7.4 hikes this tightening cycle (well below what the actual fed funds futures market predicts at 9 or more.

To be sure, while still a major increase compared to March when consensus expected just 4.4 hikes for all of 2022 (and when the S&P traded… roughly where it is now)…

… the 7.4 hikes expected now is almost 6 fewer than the market is pricing for the current cycle through mid-2023, including three 50bps rate hikes in May, June and July.

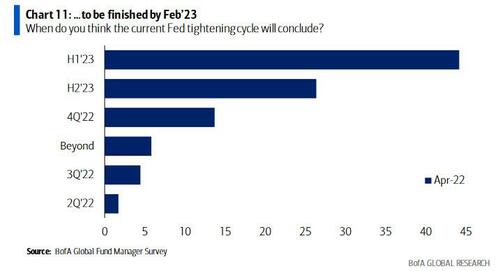

In other words, all else equal there is a huge divergence between what the market is pricing in and what (still bullish) fund managers think will happen. Although, mercifully, this decoupling should resolve itself one way or another in the very near future as there are 6 rate hikes priced in over just the next three meetings, while the majority of FMS expect that the Fed’s tightening cycle will end before the first half of 2023…

… as nearly half of investors still see inflation as purely a transitory phenomenon.

Putting it all together, as Jim Bianco has done, managers are being dragged screaming and kicking into the idea that inflation is “not transitory,” and the Fed will get aggressive to stop it. So, persistent, sticky inflation is still not fully priced into markets, despite what rate expectations markets actually say. And so, as Bianco concludes, “the debate will continue until it is.”

And it’s also why Wall Street’s biggest bear, and the author of the monthly Fund Manager Survey, Michael Hartnett, writes that “we remain in “sell-the-rally” camp as Profit-Policy set-up means Jan/Feb sell-off was appetizer not main course of ’22.”

“Deflation Next? Will The Bullwhip Do The Fed’s Job On Inflation”

I was wondering if we see this on Trucks. There are still tons of trucks waiting for chips not delivered to the dealers. If the trucks are shipped out at the same time, I think there will be some discounting.

I have a simpler explanation. If you sell your stocks, where do you put your money? Keep it liquid or in cash? Whether you put it in a money market, a savings account, or bury it in your yard you are guaranteed to lose at least 8% per year from inflation (probably a lot more as Bidenomic inflation continues to skyrocket). Buy gold? The two largest gold producing countries in the world are China and Russia. Either country can decrease or increase the price of gold anytime they want simply by increasing or decreasing their production. At least in the stock market you have a possibility of breaking even or coming out ahead.

Yeah, well they are wrong. After a severe crash - not a recession - we will get deflation....maybe. A recession won't do it. Not with money printing at a breakneck pace.

I believe that what is clouding many people's judgement is that we are entering truly uncharted territory. Too many variables coming together that could cause a perfect storm.

Why Is Deflation Worse Than Inflation?

https://www.thefreemanonline.org/why-is-deflation-worse-than-inflation/

That thar is one heck of a sentence!

Yep...I think that's the apocalyptic part in the title of this article.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.