Posted on 03/23/2022 4:55:02 AM PDT by blam

As the latest existing home sales report cautioned, with NAR chief economist Larry Yun warning that “housing affordability continues to be a major challenge, as buyers are getting a double whammy: rising mortgage rates and sustained price increases,” BofA joins the chorus warning that last year’s housing euphoria is unlikely to repeat and this year will be a much more challenging year for the housing market given significant headwinds to affordability and ongoing supply-side challenges.

Among the numerous headwinds facing US housing, BofA warns that the Russia/Ukraine conflict adds a new factor to the mix as higher oil and commodity prices will weigh on the consumer’s ability to spend elsewhere, increase uncertainty and recession concerns, and support higher input costs for builders. On the flip side, interest rates may not move much higher and energy-producing areas could see stronger housing demand.

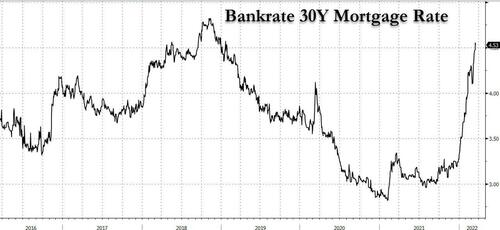

Here are some more details: The pickup in mortgage rates this year has been fast and furious, with the 30yr fixed mortgage rate averaging 4.5% according to Bankrate. This is the highest since 2018 and up more than nearly 100bp from the December average of 3.26%.

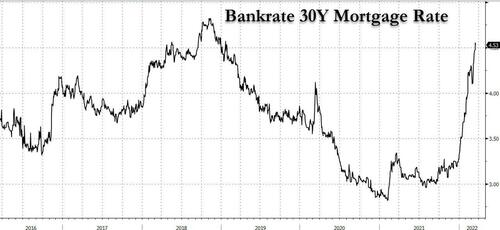

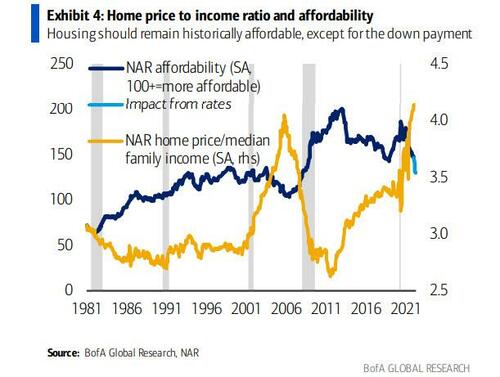

The NAR affordability index provides a way to understand the rates impact to housing demand. Booming home price appreciation last year contributed to diminishing affordability, with the NAR index down 14.7% yoy in December—the latest data point.

The massive rates move this year suggests that the affordability index will see another significant move lower. Paradoxically, further strong home price gains will add to the affordability pullback — BofA currently expects 10% appreciation in Case-Shiller home prices this year, largely due to a continuation of the historical supply demand imbalance.

Supply could further decline as existing homeowners, who account for 40%+ of sales, feel the “lock-in” effect as there is greater disincentive to move and replace their current mortgage that likely has a lower fixed rate, lowering housing turnover.

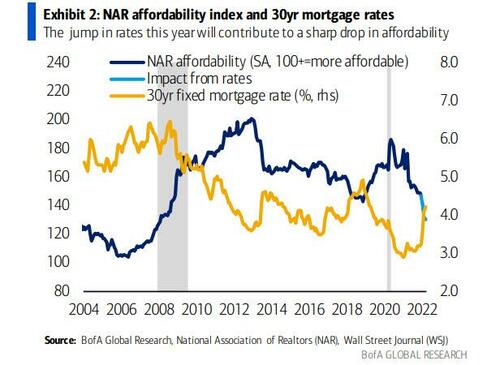

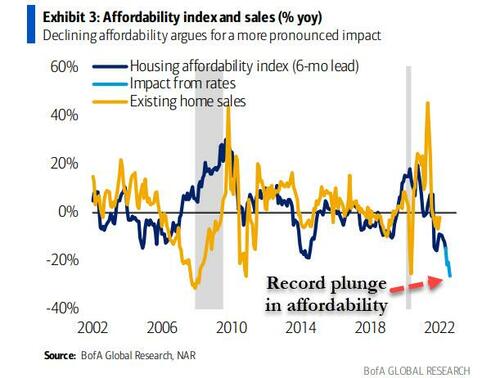

Housing affordability therefore tends to lead the trajectory for existing home sales, by roughly half a year. According to BofA, the rates shock suggests affordability will be down more than 25% yoy by March – a record decline – with additional downside from higher home prices! If demand follows a similar trajectory, existing home sales could fall below 5mn saar by 2H 2022.

There are likely offsets: BofA lists strong income growth and household balance sheets, favorable demographics, shifting preferences due to remote work, or even a pull forward in demand given expectations of higher rates. However, all that merely justifies the plunge in affordability and the risks are that US consumers get hammered from the coming stagflation; in any case BofA expects overall existing home sales of 5.6mn, pulling back -10% to 2020 levels.

Curiously, despite the upcoming record plunge in housing affordability this year, on a historical basis housing will remain historically affordable (mortgage rates used to be much higher once upon a time, bouncing around 6% during the housing boom era of the early 2000s).

But a major problem is that the barriers to entry are the highest they’ve ever been from the perspective of affording the down payment, which is typically the biggest financial hurdle for first-time homebuyers. As NAR’s Larry Yun put it, “Some who had previously qualified at a 3% mortgage rate are no longer able to buy at the 4% rate.”

Last, and perhaps worst, based on seasonally adjusted NAR data, the median 1-family existing home price to median family income ratio reached a new record high of 4.1 at the end of 2021, surpassing the previous high at the peak of the housing bubble.

The costs and financial hurdles to buying a home are not the only thing that have been on a tear recently. Rents have been on fire over the past year, with the Zillow Observed Rent index soaring 14.9% yoy to $1,904 in January.

Given housing costs are rising broadly, the question many households face is which is less painful: to buy or to rent? Using Zillow Home Value and Observed Rent Indexes, the home price/rent ratio has worsened dramatically since the pandemic, jumping to 171. And since the hurdle from home prices and affording the down payment is the worst on record, tilting the equation towards renting.

Calculating the implied mortgage based on Zillow home prices and current mortgage rates, BofA finds that the mortgage payment/rent ratio has also been on the rise and is nearly back towards the high of the prior business cycle. That said, the ratio is less than one, suggesting it is still better to buy than rent. This ratio does not account for property taxes or other expenses tied to homeownership, however. When those are included, it’s a toss up whether one should rent or buy…

Consumers appear to understand they are stuck in a lose-lose situation when it comes to buying or renting. If you can afford the historically high down payment, then you will save money on the mortgage compared to paying rent unless mortgage rates spike higher from here.

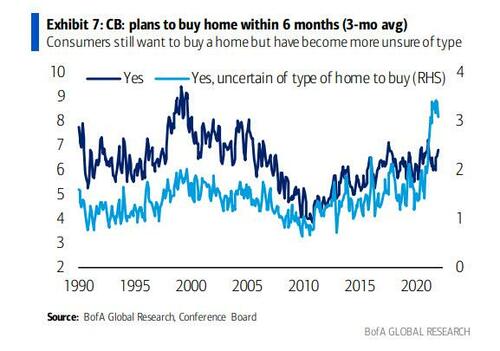

The Conference Board consumer confidence survey shows that the share of consumers planning to buy a home within 6 months has largely been steady through February. The 3-month average has actually crept up to 6.8% from 6.0% in November, despite much higher mortgage rates. At the same time, consumers have become a lot more humble about the process, highlighting the challenges in the market. The share of respondents who are uncertain about what type of home they plan to buy jumped in 2H 2021 to historically high levels, and the 3-mo average remains at an elevated 3.1% in February reflecting nearly half of total “yes” respondents.

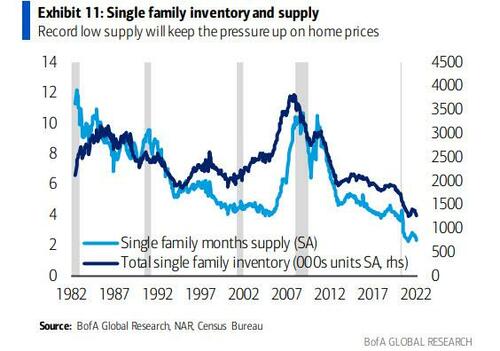

While demand is about to fall off a cliff, especially in a recession/stagflation, a quick look at the supply side also shows an ugly picture: one of the biggest challenges in the housing market has been dwindling supply, which has reached new record lows. Focusing on single-family to see a long history, months supply of new and existing homes dropped to 2.3 in January, down from the 2.6 average in 2021 and nearly half of the 4.1 average in 2019 before the pandemic (see chart below). Strong demand has been part of the equation for lower months supply, with new and existing single family home sales soaring. However, actual inventory levels have also reached historical lows: 1.27mn SA this past January, which is down from 1.33mn last year and 1.86mn in 2019.

At this point, the lack of supply is a well-known problem. Economists are aware, consumers are aware, and builders are aware. However, builders are also facing challenges: lots, labor, lumber has been the catchphrase in recent years, highlighting the three main issues in ramping up new construction, even before the pandemic.

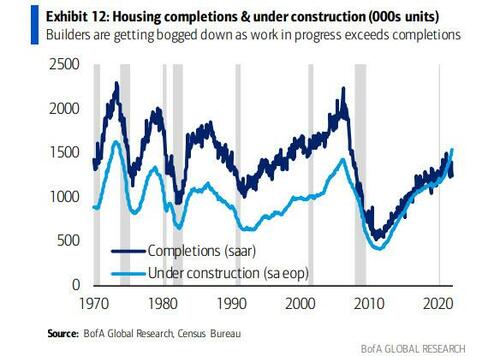

Homebuilders have been impacted by the pandemic-related supply chain chaos, extending build timelines. The number of homes under construction exceeded the number of annualized housing completions for the first time in history in June 2021, and the gap has increased further since then.

Greater multifamily build relative to single family has been a major driver of this development. Single family homes under construction remains below annualized completions, but the gap is closing fast at 142k, not far from the record low of 115k.

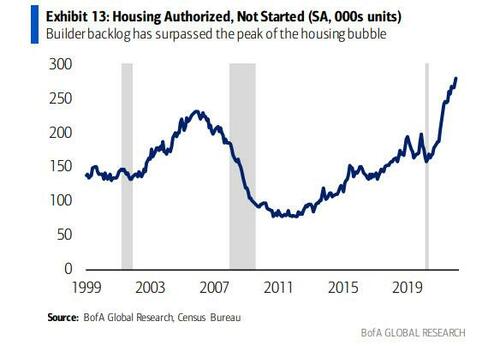

The slower building timelines means an increasing backlog, given robust demand for housing supply. Consistent with this, the number of units authorized but not started reached a record high of 280k. This compares to the peak of 231k during the housing bubble. This backlog underpins the starts and new sales trajectory even if the rates shock causes housing demand to pull back via existing home sales.

Once again, a greater share of multifamily build is the main explanation with single family units authorized but not built of 151k in January below the bubble high of 170k. Still, 151k is considerably above the 2019 average of 89k.

The Russia-Ukraine conflict threatens to add further hiccups, with materials prices being pushed higher. Lumber prices have soared over 47% over the past year and are now only 14% below the all-time peak. Russia is one of the largest lumber exporters in the world, which could pressure prices even higher, as well as a major producer of metals such as aluminum and copper

Given these extraordinary supply challenges, BofA expects home prices to stay hot at a 10% Y/Yclip in 2022 despite the record plunge in housing affordability and despite existing home sales pulling back. In other words, 2022 will likely be the last hurrah of the US housing market.

ABOUT to crash? The smoldering wreckage is just about everywhere where we are. New construction is proceeding. New builds were “from the low 300’s” and within a couple months the billboards changed to “from the low 500s” and still selling like a bargain.

Why are people so willing to go into impossible debt?

The article contradicts itself. On one hand the housing market high prices is forecast not to continue but on the other supply will continue to be limited while demand remains high.

Excellent!

We need a Serf Amerika.

The market is insane here in Charlotte. I can easily afford to buy and want to buy, but I refuse to at these absurd prices. I know at least two other people here who are in the same boat.

Despite what BofA is predicting here, if interest rates really are increased substantially and we do have a recession as many predict, demand for houses is going to plummet. People are already feeling the pinch of inflation. Wages are already not keeping up with the real rate of inflation. Consumers are not going to have the money to buy houses or like me, will simply refuse to buy until the bubble bursts…….and it is a bubble.

Housing prices will still increase significantly as supply is stupidly low and the fewer people that want to buy a new home also means fewer supply of homes since ~80% of buyers are existing owners and with nearly all recent buyers in fixed mortgages and high incomes (or all cash), almost no risk of a repeat of 2007-2010 here in housing. And there just isn’t that much new home supply - and the cost of those is significantly higher than existing stock.

If its good enough for the country to be in debt for $30+ Trillion, what’s $500k? Show of hands that think the national debt will ever be paid........

It is kind of like a situation where there are record low interest rates but nobody will lend anything to anyone with a credit score under 800.

“In other words, 2022 will likely be the last hurrah of the US housing market.”

The lumber Broker is sad

Sellers market for sure.

Is this a bubble that's going to burst or a sign of more of the same? If people keep coming, why would the price of a house go down?

“Russia is one of the largest lumber exporters in the world, which could pressure prices even higher”

Russia exports a lot of timber. They DO NOT export a lot of finished lumber.

My company bought finished boards from Russian mills(at least we did until a couple weeks ago). We purchased 1x4 & 1x6 mostly run to T&G patterns. That is because no western grading agencies will go into Russia and certify their lumber according to North American Lumber Standards. All of the boards were NO grade stamp. However, the quality of the Nordic Spruce wood fiber was the best in the world.

With companies like ours no longer buying Russian lumber, it will go to other places in the world. It will go to the Middle East, China, India, Pakistan, and other European countries.

This will mean that not as much Canadian lumber will end up going to China. It will mean that not as much US lumber will go to India and Pakistan.

The Russian sawmills are not going to shut down. They are just going to sell their product to whoever will pay the most for it. We were, now we are not.

“If people keep coming, why would the price of a house go down?”

ALL REAL ESTATE IS LOCAL

If there is a shortage of houses in Nashville, then prices will remain high. This has nothing to do with the price in Cleveland, Syracuse, Detroit, St Louis and Portland, OR.

During the Great Recession the price of oil was high. The horizontal drilling for oil boom was ongoing. So, places like Williston, ND boomed. So did Midland and Odessa, TX. Houston did Okay. However, the biggest lumber yard in metro Detroit went out of business. They took Commerica Bank for about $12M. Some metro areas got crushed, while others were ok.

Nashville, has been a boom town for several years. That area may be fine. People in the US are still moving south and west to some extent. However, the largest change in the last couple years is the exodus from California. CA residents keep moving to WA, AZ, ID, CO, MT, UT, TX and several other states. Prices have more than doubled in Boise because of it.

People from the NYC area continue to move to FL, SC, NC, NH, ME & VT. There was another article posted today about 35% occupancy of office buildings in Manhattan. People are not coming back to NYC. They are going to continue to work from home at least part time.

The covid restrictions in many of these liberal cities has made the real estate values in states like Florida boom.

We ain’t seen nuthin yet. Trump will waltz back into the WH in 2024. The Dem economic and cultural debacle is only getting started.

Add to that the costs to repair/replace failing roofs, plumbing, HVAC and foundations before significant updates can happen.

Out of my last 10 inspections, 6 buyers haven't even set foot in this state much less the house they're buying.

There is a herd panic in progress....people have no sense of value or cost.....they're qualified for insane loan amounts and by God, they're going to buy at full qualified amounts even if that means choosing the best of the worst today rather than hold back for better choices a little further down the road. Add to that the fact that the overheated market has attracted a large crop of newly minted real estate "professionals" and home flippers whose mantras appear to be "money over morals".

It's the perfect combination of expectations of instant gratification in a mass marketing society.

Location, location, location.

For most places, time will determine the direction that community goes. Most will crash and some will continue to boom.

You ought to have seen Washington DC back 12 years ago when Obastard got in. Remember the shovel ready jobs? Well in DC they were building like hell.

These stupid arrogant elites have no clue what it is really like out here outside of the asylum.

Washington DC should really be nuked. It is already contaminated with perverts, scum and snooty bastards, so might as well sterilize it.

I know. Let’s bring in millions of third world people and put them on welfare with free housing...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.