Skip to comments.

Here's How Much Money Some Reddit Trolls Cost the Hedge Funds, and It's Going to Get Worse

Red State ^

| 01/31/2021

| Bonchie

Posted on 01/31/2021 5:10:52 PM PST by SeekAndFind

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-47 next last

To: MinorityRepublican

The people buying and not selling yet. A lot of people pumping up the stock don’t care about their loses (A few are that make money off the scam) because they just want to break the system and emulate the pumping and dumping that occurs in cycles (Helped by Treasury/Central bank/Investment/Securities Houses) to spite the “system”.

I just have a natural distaste for people becoming gazillionaires while not creating tangible wealth.

22

posted on

01/31/2021 5:48:28 PM PST

by

dsrtsage

(Complexity is merely simplicity lacking imagination)

To: dsrtsage

You should hate the markets (Those who make a fortune off it) then since the early-1990's.

A Blow-Up doll has more integrity than all those who artificially drive up investment hype and destroyed trade/supply-chain in the United States in favor of cheap labor and offshoring.

To: Bartholomew Roberts

And just to be clear, my son improperly used the words “Inside Tip”. He did not have privileged information about the operations of GameStop. He had information that was on a public forum but was not yet widely disseminated.

Thank you to FR posters who were concerned with my verbiage.

To: SeekAndFind

Shorting stock has been going on for over 200 years in the US stock market.

What is remarkable is that hedge funds (illegally) shorted 140% of GME’s float, then act like they’re the victim when a short-squeeze/bear trap is done on them. How could they NOT expect to get burned shorting 140% ? Shows it’s a rigged club imo.

How can hedge fund shorters be so stupid, greedy and arrogant all at once? Cuz it’s an insiders’ club? They deserve everything they got out of it.

25

posted on

01/31/2021 5:55:26 PM PST

by

Justa

(If where you came from is so great then why aren't Floridians moving there?)

To: rollo tomasi

“You should hate the markets (Those who make a fortune off it) then since the early-1990’s.”

The concept of the markets as originally intended is a great thing. People being able to invest on a bet that a company will succeed is freedom. The mockery of the perversion of that system as merely a means to make money by creating hype, creating winners, and creating losers is pure unadulterated evil

26

posted on

01/31/2021 5:59:14 PM PST

by

dsrtsage

(Complexity is merely simplicity lacking imagination)

To: rollo tomasi

I’m learning about all of this. A lot of this seems abstract to me. Especially where you have hedge funds trying to short the stock and the like.

To: MinorityRepublican

Read up on “short” selling

28

posted on

01/31/2021 6:02:17 PM PST

by

Mr. K

(No consequence of repealing obamacare is worse than obamacare itself)

To: Justa

Spot.....plus the regulators seemingly turn a blind eye to shorting way over the float, when it comes to Wall st/hedge Funds.

29

posted on

01/31/2021 6:04:10 PM PST

by

crazycat

To: Husker24

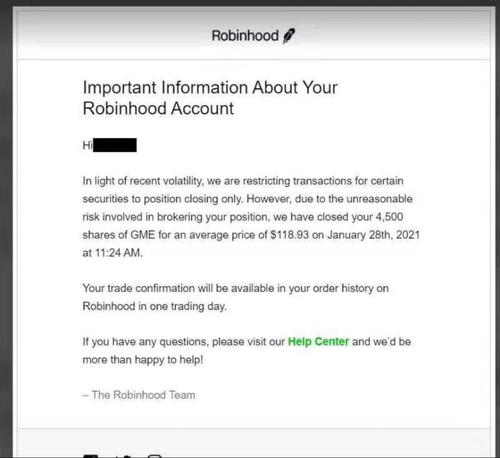

Not to mention Robinhood selling people’s stock without permission at the lowest price of the day to help said hedge funs.Did that really happen?

I read it here on one of the articles posted a few days ago, but I never read it elsewhere. Yes, Reddit applied restrictions to individual accounts, which they did NOT apply to Hedge funds (i.e., unequal treatment of their clients), and, of course, this is terrible, but I didn't read any confirmation of the 'selling shares' from their clients' accounts without permission.

Either way, Robinhood should be shuttered, but I don't believe the claim is accurate that they sold shares without permission.

30

posted on

01/31/2021 6:09:44 PM PST

by

El Cid

(Believe on the Lord Jesus Christ, and thou shalt be saved, and thy house...)

To: dsrtsage

Market was there make yields for the investor yes, but also help companies with good ideas to grow.

My contention that all this artificial market stuff begins and ends with government (Voters allow this) OVER spending and OVER leveraging that skews economic principles which spill into the marketplace.

To: MinorityRepublican

If $1400 dollars get doled out to everyone for just wearing a mask in public, then the fun times will just continue.

It's a cliche, but "Living in Interesting Times" are interesting to say the least.

To: Organic Panic

I think by the end of next week “retail” trading will be completely outlawed. That would crash the market. With such a nakedly rigged game with the government openly declaring a fascist style government/business partnership at the expense of everyone else the obvious result is that everyone would liquidate whatever stocks they have, including 401K holdings. They could freeze all sales from 401K or other draconian moves but it would make US markets radioactive for investors worldwide.

Dopey Biden might do it anyway.

33

posted on

01/31/2021 6:49:30 PM PST

by

pepsi_junkie

(Often wrong, but never in doubt!)

To: SeekAndFind

Amazing what happened, and goes to show what’s possible when people get together and act with one voice. I do wonder though how long they will hold the line.

34

posted on

01/31/2021 7:08:58 PM PST

by

spetznaz

(Nuclear-tipped Ballistic Missiles: The Ultimate Phallic Symbol)

To: jdsteel

"I do feel bad for the regular Joe’s that bought GameStop shares at too high a price and who will suffer losses as well." Some people buy a lottery ticket with the sincere hope they win. They will always be disappointed. Some people buy a lottery ticket so they can spend a day or two fantasizing about what they would do if they win. Those people always get their money's worth.

I think a lot of the Reddit crowd is like the latter. They didn't invest in game stop hoping to win big. They invested to see the hedge funds shit their pants. They have gotten their money's worth.

To: spetznaz

Many took their stimulus check (”house money”) and made a political statement—f*&^ Bidet and his Wall Street owners.

Worst case—their political statement cost them their stimulus check.

See how it works—they have nothing to lose by playing the hand all the way to the end—think of it as The People’s Executive Order #1.

36

posted on

01/31/2021 7:18:00 PM PST

by

cgbg

(A kleptocracy--if they can keep it.)

To: cgbg

I don’t think it is that simple, and that is why I am saying I wonder for how long the line will hold. Sure, there are many people who are willing to lose the money they have on the line to drive a point. Several such people have posted the same.

And yes, for the smaller investors they are using stimulus money and are thus maybe more willing to lose it.

But then there is the human condition - think of the average small retail investor who took his stimulus check, and maybe added a little more to make it $2,000, and bought some GameStop (GME).

He bought 100 shares when it was ~ $20 a share on January 12th.

He then follows the chats and cheers as the price soars and the hedge funds stumble. He is overjoyed when he gets many multiples of return - on paper - and marvels at the ability of concerted effort by many small investors to have major impact.

And then he notices that on the 28th of Jan the price had briefly touched $483 a share, which would make the value of his 100 shares $48,300 (ignoring fees and commissions and such).

Sure, it was ‘throw away’ stimulus money that had he lost the original $2,000 wouldn’t have been too much of an issue.

But now he realizes that, as much as he would want to continue to punish the hedge fund managers, that $48,300 would pay off the credit cards, take care of Timmy’s tuition for the half year, and even get the fridge the missus has been making some noises about!

He also starts to realize that there are other people who may be thinking something similar, and thus there’s a bit of the prisoner’s dilemma at play here as well. What if others pull the trigger and the share price starts to fall?

So - I am personally really enjoying the soaring of the price of GME and the impact on hedgies. I am also however very curiously watching to see if human nature will establish itself as people realize they are sitting on paper profits that can really make a positive impact on their personal lives (be it a major mortgage payment, a new kitchen, personal debt erased) and if their need to punish some hedge fund manager overcomes the ability to improve their immediate personal financial lives?

It is really quite intriguing. To see what the individual will chose, and also how the large group of individuals (the retail market as a whole) will chose - especially when they start wondering if others will hold the line.

I’m not a hedgie - I am in PE - but I am not the only one wondering about the line holding. And honestly, if there was GME stock to be borrowed this is the time to short it and short it hard! Why? GME is simply not worth what it is valued at currently. It wasn’t even worth $20 to begin with.

I would short it hard.

As for those who are long, this has also massively helped them. For example the article below shows how PE and pension funds who held GME/AMC and other shares boosted by this rise, and thought it was a bad investment, have now surreptitiously found a way to make a massive profit that would have been impossible a few weeks ago.

https://pe-insights.com/news/2021/01/30/silver-lake-cashes-out-on-amc-for-713-million-after-stock-market-rally/

Following this with great interest.

37

posted on

01/31/2021 8:51:36 PM PST

by

spetznaz

(Nuclear-tipped Ballistic Missiles: The Ultimate Phallic Symbol)

To: Salvavida

38

posted on

01/31/2021 9:47:28 PM PST

by

HANG THE EXPENSE

(Life's tough.It's tougher when you're stupid.)

To: SeekAndFind

So now should we short-sell Melvin Capital Management???

This game is VERY confusing and potentially disasterous

39

posted on

01/31/2021 11:58:24 PM PST

by

Oscar in Batangas

(An Honors Graduate from the Don Rickles School of Personal Verbal Intercourse)

To: El Cid

40

posted on

02/01/2021 12:54:13 AM PST

by

Political Junkie Too

(Freedom of the press is the People's right to publish, not CNN's right to the 1st question.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-47 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson