Posted on 10/13/2013 4:24:18 PM PDT by whitedog57

According to The Federal Reserve G.19 Report for August, consumer debt topped $3 trillion! Of course, Federal government debt has topped $16 trillion, over 5 times the amount of consumer debt. Note that pickup in Federal debt growth compared to consumer debt growth after Q2 2008 (red box).

feddebtconsumer

Here is a chart of revolving consumer credit versus non-revolving credit. Non-revolving debt (e.g., auto loans) have effectively replaced revolving debt.

revnonrev

Business loans have finally grown past the prior peak in 2008.

frbusloasn

On the government side, current expenditures (purple line) continue to grow, but the rate of growth flattened out starting in 2011. But government transfer payments (Social Security, Medicare, etc.) keep growing. The interest payments on the Federal debt (green line) are a small fraction of government spending.

usgovt

And here is a chart of WHO the government owes money to.

pm-gov_debt_v-624

So with a recovery in business lending, staggering government spending and transfer payments and consumer debt topping $3 trillion, one would think that the M1 Money Multiplier would have started rising. But alas, no. It continues its decline.

m1multi10132013

Likewise, the M2 Money Velocity (GDP/Money Supply) is declining like a paralyzed falcon.

m2veloc101313

Of course, labor force participation in the US is the second lowest in modern economies (only Mexico is lower). And has accelerated its declining starting in 2009.

lfpus

And real median household income has fallen dramatically since 2000 and then again in 2009.

rhoinmbrate

household-income-monthly-median-since-2000 (3)

The M1 Money Multiplier and M2 Money Velocity continue to fall despite staggering government spending (and debt). Not to mention a return of business borrowing and consumer loans.

paralyzedfalcon

Or the gov will wait till the stock market crashes and offer older Americans to replace their entire portfolio plus make up the losses with US T bills with one stipulation, from that point on the worker will buy only T bills till the day he/she retires or tell the retiree to take his/her chances that the market will make up for all the losses.

bfl

Promised benefits are not assets, any more than the outstanding balance on a credit card is an asset.

Many of your claims are difficult to refute; that one’s easy.

Strictly speaking, since we’ve hit the crossover point where Social Security payouts exceed FICA taxes, and the program is promised to run in perpetuity, the unfunded liabilities are actually “infinite”.

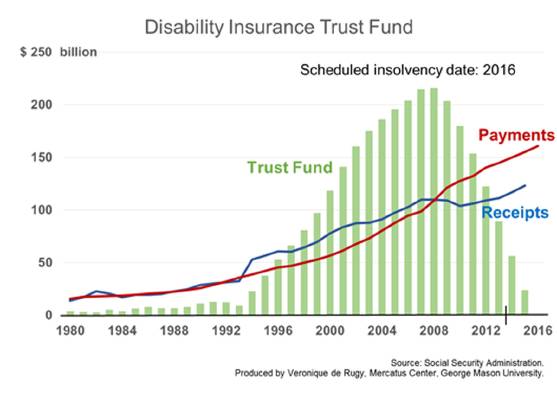

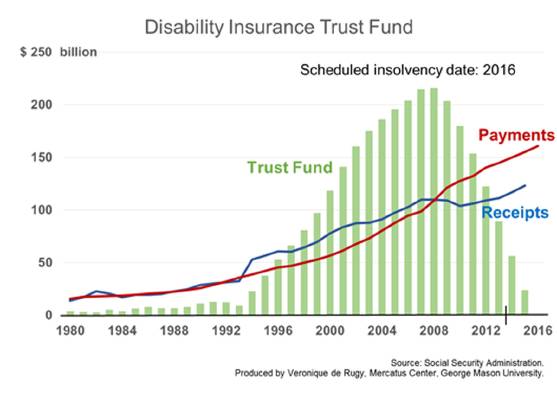

Close and certainly supporting data to my suggestion, but really looking for a graph over time of the percent of working age adults who are receiving federal disability payments.

In that case, they aren't liabilities either.

any more than the outstanding balance on a credit card is an asset.

Your example is money already spent and that's a liability. That's different than money promised to be spent.

OK, how about if we say “The Social Security program has promised to pay $126 trillion more than it has forecast revenue”?

Though, since there’s no forecast end-date to Social Security, and it’s expenses are starting to exceed revenue, its promises-to-pay in excess of its anticipated revenue are actually infinite.

They usually go out 75 years and I think the shortfall is about $12 trillion, over that timeframe.

The real problem is Medicare, the shortfall is something like $47 trillion, IIRC.

Medicare’s current expenditures are roughly $1 trillion per year and have been doubling every 8 years since 1980.

That means:

In 8 years, they will roughly equal all current Federal tax revenue.

In 16 years they will roughly equal all current Federal expenditures.

In 32 years they will roughly equal current GDP.

Something’s going to break.

5.56mm

Yup.

Why?

Why?

The markets would collapse, lending would stop, trade (LOCs) would not occur, and all asset values (i.e. real estate, etc.), would devalue.

Not saying that that is a bad thing, but that would be a bad thing in the short term.

5.56mm

Interesting claims. Why?

Have you seen the recent data on M2, and V1 (velocity)? Have you seen the recent labor force participation rate? Plus, there isn't any growth in real GDP.

5.56mm

Sure.

Have you seen the recent labor force participation rate?

Yes.

Plus, there isn't any growth in real GDP.

It's been slow.

What does that have to do with your QE claim?

What do you think is supporting the stock market? Price to earnings ratios?

I'm going to assume (bad word) that you have an elementary education in economics. If not, then I can't help you with further analysis, and the associated commentary.

5.56mm

If you take $85 billion per month (~$1 trillion per year), that’s pretty-much textbook definition of a recession if not depression.

$85 billion per month in checks that are being written to “somebody”; all of a sudden “somebody” isn’t getting $85 billion per month - they’re going to notice.

Forward earnings for the S&P 500 are higher than 2007.

Net margins (^chart) are expected to hit record highs.

Interest rates are low. Not many decent alternatives.

PE ratio isn't crazy high.

You need any more info before you explain why the end of QE puts us into a depression within 3 months?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.