Posted on 10/13/2013 4:24:18 PM PDT by whitedog57

According to The Federal Reserve G.19 Report for August, consumer debt topped $3 trillion! Of course, Federal government debt has topped $16 trillion, over 5 times the amount of consumer debt. Note that pickup in Federal debt growth compared to consumer debt growth after Q2 2008 (red box).

feddebtconsumer

Here is a chart of revolving consumer credit versus non-revolving credit. Non-revolving debt (e.g., auto loans) have effectively replaced revolving debt.

revnonrev

Business loans have finally grown past the prior peak in 2008.

frbusloasn

On the government side, current expenditures (purple line) continue to grow, but the rate of growth flattened out starting in 2011. But government transfer payments (Social Security, Medicare, etc.) keep growing. The interest payments on the Federal debt (green line) are a small fraction of government spending.

usgovt

And here is a chart of WHO the government owes money to.

pm-gov_debt_v-624

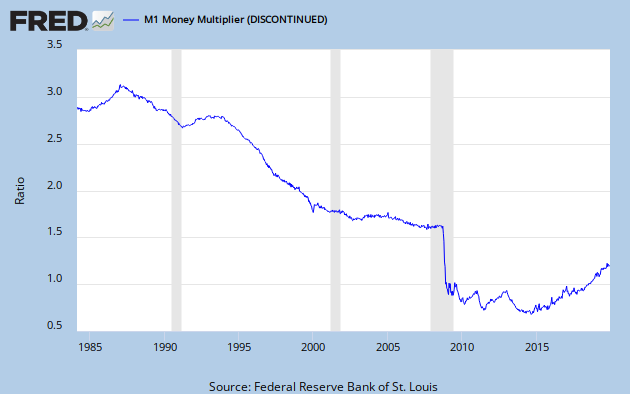

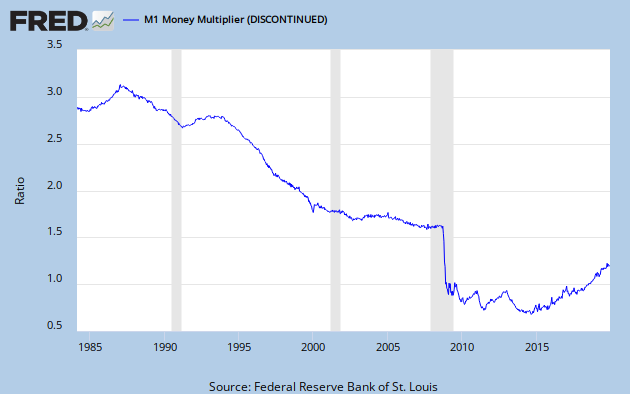

So with a recovery in business lending, staggering government spending and transfer payments and consumer debt topping $3 trillion, one would think that the M1 Money Multiplier would have started rising. But alas, no. It continues its decline.

m1multi10132013

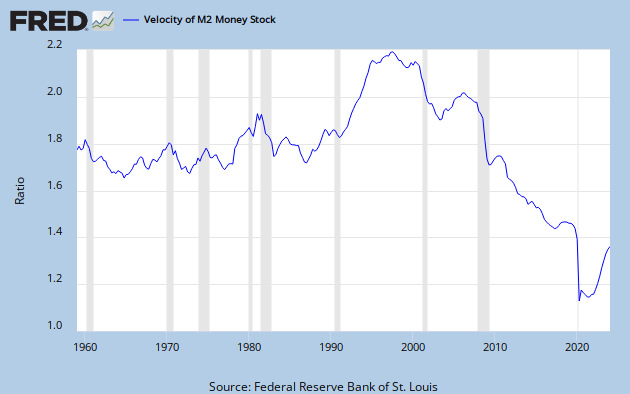

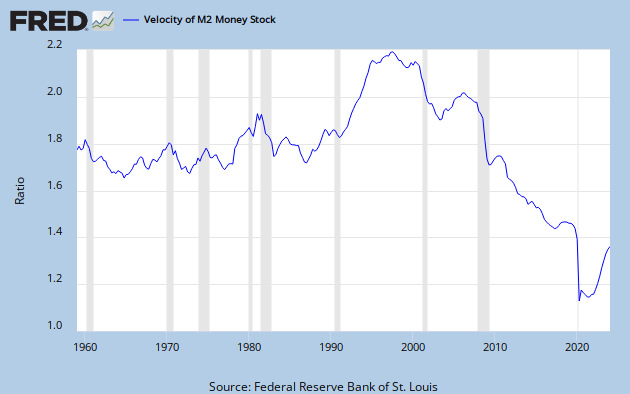

Likewise, the M2 Money Velocity (GDP/Money Supply) is declining like a paralyzed falcon.

m2veloc101313

Of course, labor force participation in the US is the second lowest in modern economies (only Mexico is lower). And has accelerated its declining starting in 2009.

lfpus

And real median household income has fallen dramatically since 2000 and then again in 2009.

rhoinmbrate

household-income-monthly-median-since-2000 (3)

The M1 Money Multiplier and M2 Money Velocity continue to fall despite staggering government spending (and debt). Not to mention a return of business borrowing and consumer loans.

paralyzedfalcon

ping

I’m trying to do my part by not turning money around.

At least we don’t have negative equity.

Did somebody saw Negative equity?

Current Unfunded Liabilities $126 Trillion

Current liability per taxpayer - $1,010,000

Current assets - $105 Trillion

I’m still making money. It’s just that my purchasing power

has decreased and I’m hemmed in on raising my prices because

of the progressive income tax, Obamacare and the slimy rats

that hire wetbacks. In other words the federal government.

Obama sucks and anyone who tries to convince me otherwise

sucks too. I’ll be damned if I’m going to work half my time

for this government and the worthless people it supports.

Obamanomics is killing the US economy.

The working poor are deciding to NOT work and instead are collecting a variety of government benefits because incentives are available to them to do so.

Do you ever wonder why politicians always warn that social security will run out of funding, but no one says that welfare will ever run out of funding...

He did in another thread, incorrectly.

Current Unfunded Liabilities $126 Trillion

What are the current unfunded assets?

I think the multiplier falling isn’t a bad thing. If it were rising, with all the stimulation we’ve had, inflation would be through the roof.

The problem is that no establishment politician and few economists will advocate short term pain for longer term gain. It’s all kick the can measures. If the multiplier ever rises again... watch out!

I see the author drinks at the cup of the FED. They are of course looking at the wrong thing.

Probably $126 trillion less than liabilities, which is why they’re called “Unfunded Liabilities”.

I’m confused. If debt is rising, doesn’t that mean people are spending? Which in turn implies the velocity of $$ is increasing?

Financial Times of London just did an analysis of QE. We doubled our money supply but consumer prices barely moved above 2 percent, historically it should be 5 percent using the new BLS formulas that exclude food and fuel. The FT conclude that the US all those 5 years may have been suffering from severe deflation. If the Fed Reserve did not print money and QE, we would had negative price growth. It also shows that something happen to the US economic structure that is causing deflation when in the past inflation would have ignited from all the money printing. Problem the Fed faces is all the QE has not moved the economy and severely impaired the value and prestige of the dollar. As the US prints more dollars, it ignites inflation in many overseas nations because the US dollar is the world reserve currency and all food/raw materials/commodities prices are expressed in US dollars. The Fed is trying on one hand reignite the US economy and counter the rest of the world (especially BRICS) from trying to set up an alternate system to the US dollar as basis for trade. These nations cannot afford to wait for the US Fed to reignite the US economy while their societies destabilize from rising food prices.

I don’t think the US is alone in printing. The EU, Britain, and Japan are doing it too—which has helped us get away with it.

All the promised benefits are assets. The unfunded assets are equal to the unfunded liabilities. See how that works?

US relies heavily on foreign nations to buy her T Bills. Japan debt is 200 percent of GDP, but her citizens buy 90 percent of the T Bills sold. The US has to print money to buy back 40 to 75 percent of the new T Bills offered. Japan demonstrated that gov can keep printing as long as her citizens are willing to buy most of the gov T Bills. This maybe one mechanism the US gov will cope with high deficits financed by dollar printing. Force all Americans to invest in T Bills. US did that after WW2 to pay off her war bonds. It worked. Low interest rates help people in debt to deleverage. IMHO the US banks probably have huge leveraged liabilities that are hidden from the public and badly need the low interest rates. IMHO the US gov will print unless the dollar is being dumped by overseas holders, or inflation is starting to reel its ugly head, and at that moment the US gov will begin financial repression by making US gov workers invest in T bills only in their TSP to protect them from the stock market. Or the gov will wait till the stock market crashes and offer older Americans to replace their entire portfolio plus make up the losses with US T bills with one stipulation, from that point on the worker will buy only T bills till the day he/she retires or tell the retiree to take his/her chances that the market will make up for all the losses.

Between financial repression, and new found revenues from fracking oil and gas, the US gov may stabilize its financial situation assuming no Black Swan event.

Also need a graph: percent of working age adults receiving Social Security disability pay over same period of time.

Over the last 6 years, the Fed has only bought about 17% of new debt issued.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.