Doesn't look good...

| This thread has been locked, it will not receive new replies. |

|

Locked on 10/06/2013 7:14:15 PM PDT by Admin Moderator, reason:

Duplicate: http://www.freerepublic.com/focus/f-bloggers/3069531/posts |

Posted on 09/22/2013 4:51:14 PM PDT by whitedog57

Poor Larry Summers. He withdrew his candidacy as the Federal Reserve Board Chairman over fears of a brutal Senate confirmation hearing. Now we are left with former University of California labor economist Janet Yellen as the leading candidate.

Yellen was (allegedly) the architect of the quantitative easing programs to reduce unemployment (better known as the weak money rally). And Yellen is the darling of the labor unions because of her activist policies on labor. Hence, President Obama and Democrats are proudly supporting her appointment.

“The philosophy of Janet Yellen is activism of government policy to achieve objectives,” said Allen Sinai, president of Decision Economics Inc.

Oh great. We have activist Supreme Court and Federal judges. Now we will likely have an activist Federal Reserve Chairman.

But the US employment problem is mostly structural and cannot be undone by “easy money.” Moving labor intensive jobs off shore and putting Americans on food stamps and other forms of welfare has not worked out too well. Throw in the disastrous Obamacare that creates the environment for part-time labor, and Houston .. we have a problem.

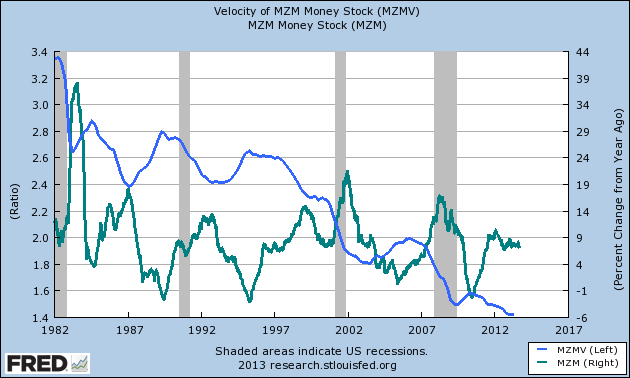

We have had “easy money” or “cheap money” since 2008. Yet labor force participation continues to fall. Along with M2 Money Velocity.

lfpm2v

And the M1 Money Multiplier has fallen to below 1 for the first time since 1984.

m1v

Here is a chart of Currency In Circulation divided by the Monetary Base. YIKES!

yikes

True, unemployment rates are falling (here is the U6 Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons). We are at 13.7%, still the highest since U6 began.

u6

The Federal Reserve keeps buying Treasuries and Agency MBS securities, swelling its balance sheet.

frb090913

And US debt to GDP is now at 101.58% (as of Q1 2013).

GFDEGDQ188S_Max_630_378 (2)

So, the Federal government and The Fed have thrown everything at the employment problem … and the results are meager. Even the Washington Post noticed that real median household incomes are below levels last seen in 1989.

medianhouseholdincome

Of course, the big “what if?” is … what would have happened if The Fed hadn’t done quantitative easing? Who knows?

But what we do know is that weak money has certainly benefit investors in the stock market.

04-qe-timeline

Will Yellen keep on with weak money policies? Time will tell, but don’t bet against it.

Sarpeidon_prosecutor

Sorry. That was the prosecutor from the Star Trek episode “All Our Yesterdays.“

Here is a photo of Janet Yellen.

OB-YN272_yellen_G_20130813101819

And here is a photo of the 1896 Sound Money Parade in New York City. My how times have changed.

MNY63606

Doesn't look good...

Depression instead of just deflation. I wonder how much flight into yuan as a medium of exchange to bypass the reserve buck is playing into this.

We live in interesting times.

anyone of janet yellen’s generation, who is a member of a minority group, (in her case, jewish), was taught that white Christian men are the cause of the worlds problems, and the oppressors.

is there any mystery as to whether she has a Marxist agenda or not?

Keynesian economics has always failed. Always!

Photo of Janet Yellen

http://confoundedinterest.files.wordpress.com/2013/09/ob-yn272_yellen_g_20130813101819.jpg?w=604

are you sure about that? Why are food/energy and lots of prices going up with low money circulation

We don't have any...

tx for the ping; imho this is REALLY where it’s at. bottom line’s the fact we got REAL problems and it’s got nothing to do with, hyperinflation, that silly trade deficit, or Rush’s goofy nonsense about the fed bailing out wall street to support Obama.

The real problem is the economy’s dieing and everyone’s clueless.

I hope everyone understands why their savings account gets .001 percent interest right now.

SPEND, SPEND, SPEND so Obama can bone you every time.

--that plus the total money supply growth is stuck while the money velocity is that a multi-decade low.

On top of that while the Fed's maxing out its ability to generate liquidity we'll probably start seeing market driven interest rate hikes. Inflation/deflation is a function of not only how much money there is, it's also affected by how much the money's circulating. It's slowing.

It's just really HARD To see with all the consuming going on around here... I get woke up at 7:30 am with hammering on new homes... Can't get into a restaurant without a reservation on Thursday through Sunday after 6:15 pm... earlier when the weather's good.

WHERE is all the bad stuff? It SURE AIN'T HERE???

They aren't. If lot's of prices were going up then we'd have inflation. We don't because in general prices are flat. Sure people say we got big time inflation but if you ask if wages are up they say wages don't count. If you ask if the housing market's booming they say that doesn't count. Gold prices don't count either. Same with silver, platinum, copper, and farm prices --all falling.

Wow, that is scary looking!

Exceptionally productive people can always create wealth any time any where, and America's got lots of 'em. I'm thinking about how the number of working age Ameircans was the same for years but in 2009 the number leaped by 15 million and has continued to grow steadily since. There are now over a hundred million working age Americans without jobs.

We’re still in a credit contraction and will be for some time. Every move the Obama Administration has made makes the situation worse. It’s Cook County Economics on the national level. We won’t clear our economic dross until someone realizes that the tax, regulatory and credit burden needs to be relieved.

The one good thing about Obamacare is that it is so destructive the only viable solution will be the free market. There are already several breakthrough apps that replace a medical degree for diagnosis. A pro-commerce Executive could work miracles by simply opening up the market and free entrepreneurs to do what they do best - solve problems.

The author states that unemployment U6 rate is dropping....but I posted this in comments....

“Instead of UE at any level....isn’t a more accurate indicator of workforce health the labor participation rate? Which, despite all the growth in PT, government FTE’s, and peak women in the work force....participation is at the lowest rate since 1979.

http://www.businessinsider.com/march-labor-force-participation-rate-2013-4

Also, unlike the Argies in the 80’s/90’s and the Zimbabweans....and of course that old bugabear Wiemar Germany......until the dollar loses its world reserve status the Fed in effect is printing gold...even though they are debasing the currency at the rate of $85b a month.

There is little noticeable inflation so far for the same reason, and as most imports are in some way or another pegged to the dollar (China/Japan) goods seem as cheap or cheaper than ever. US manufacturers are impeded from raising prices as a result.

Policy seems to be to cheapen the dollar and sell more overseas to bail out their tails.... looks too late to me. It cannot end well. Long slow death from kidney failure instead of a heart attack.

But what the heck do I know. I didn’t go to banker school or Harvard.”

Other thoughts?

I wouldn’t touch the Chinese Yuan with a 10 foot pole either. Their only “advantage” in this situation is that they are still a top-down, one party structure they still have closed capital accounts to avoid speculators running on their bankrupt banks and currency.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.