Skip to comments.

Income Inequality and the Death of Trickledown

Naked Capitalism ^

| 9/15/2012

| Hugh

Posted on 12/31/2012 8:25:40 AM PST by ksen

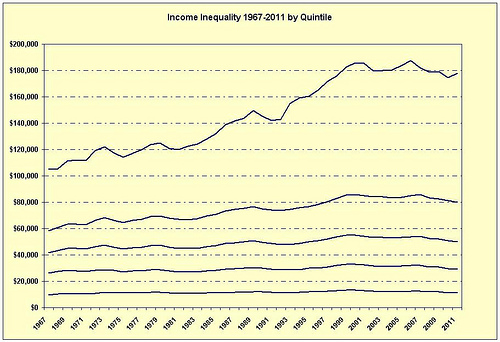

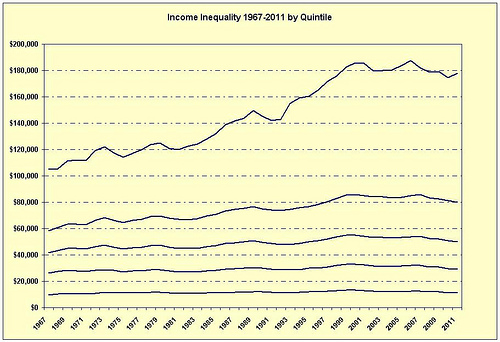

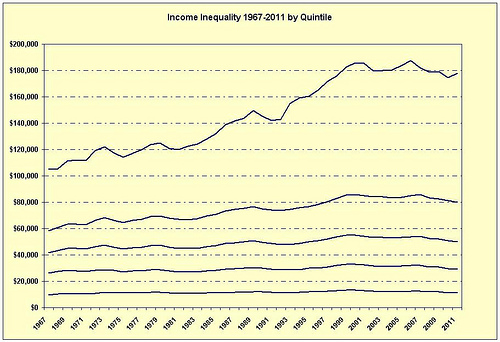

On September 12, 2012, the Census issued its report on Income, Poverty, and Healthcare Coverage in the United States: 2011. While the full report has some nice charts, one that was conspicuously missing was on income inequality. The data for such a chart was in the tables, and so I was able to construct the chart above from them. Mean household (not individual) income for each quintile (20%) is expressed in real (inflation-adjusted) dollars.

One feature that jumps out at you are how relatively flat mean income has been for the bottom 80% over the last 45 years and how much it has grown for the top 20%, from an already high baseline. I thought this merited some further investigation.

If you look at the far left, in 1967, the income difference between the quintiles of the bottom 80% was remarkably similar, less than $17,000 between each group ($16,679 between the 1st (lowest quintile) and 2nd; $15,572 between the 2nd and 3rd; and $16,631 between the 3rd and 4th). But even in 1967, we see significant income disparity ($46,619) between the 4th and 5th (top) quintile. The top 20% have an income difference nearly 3 times as great as the other quintiles.

In the succeeding decades, difference between the 4 lower quintiles showed some moderate spreading. For 2011, they are $17,965 from 1st to 2nd; $20,638 from 2nd to 3rd; $30,238 from 3rd to 4th; and $97,940 from 4th to highest 5th). What we see in this is a movement of the top 20% from around 3 times the initial 1967 spreads between quintiles (~$17,000) to something over 5 times them ($97,940).

What is interesting is that the mean income of the top 20% increased $73,100 from 1967 to 2011. About $20,000 of this increase occurred during the Reagan years, but what often gets overlooked is that about $43,000 of it happened during the Clinton years.

Because the first 4 quintiles are so flat, it is worthwhile to look at their averages over the 45 years of data.

For the bottom 20%, their average mean income was $11,618. For the second 20%, it was $29,425. For the third 20%, it was $48,938. For the fourth 20%, it was $74,183. For the highest fifth 20%, it was $146,693.

Now compare these to the 2011 mean income numbers.

For the bottom 20%, it was $11,239. For the second 20%, it was $29,204. For the third 20%, it was $49,842. For the fourth 20%, it was $80,080. For the highest fifth 20%, it was $178,020.

The lowest 40% are essentially unchanged, actually slightly worse, than their 45 year average. The middle 20% is also not much changed, but slightly better than its average. The fourth quintile is doing modestly better, about a $6,000 increase. The highest 20% is doing about $31,000 better than its average.

You can see this effect in the chart where dramatic rises in the income of the top 20% are reflected in smaller and smaller rises as we go down from one quintile to the next until we arrive at the bottom 20% where there is almost no change at all.

If you think about it, this chart completely refutes trickledown economics. As I said, the periods of greatest income growth in the top 20% correspond to the Reagan and Clinton Administrations. But what we see is that great increases in income at the top have only modest effects on the incomes of the nearest quintiles and have almost no effect at all on the lowest quintiles. That is very little trickles down, and almost nothing trickles down to the bottom.

The chart shows in easy accessible terms much of what we already knew. Wages have been flat for most of us our whole working lives even as the rich have been making out like bandits. But it also shows that theory so near and dear to neoliberals: trickledown aka supply side economics aka Reaganomics aka “job creators” doesn’t work, has never worked.

TOPICS: Business/Economy; Government; Miscellaneous; Politics

KEYWORDS: fff

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-59 next last

Here's the chart:

And another article about given the "propensity to consume" it is not the wealthy that create jobs but consumers.

If trickledown were true then with the top 10% of earners currently enjoying their largest share of the national income in about the last hundred years we should have more jobs than we can fill.

1

posted on

12/31/2012 8:25:58 AM PST

by

ksen

To: ksen

Trickle down is the norm and part of the cycle of capitalism. Unfortunately, these aren't normal times and we aren't really a capitalist, producer nation/economy any longer.

Instead, we have become a government economy of consumers that produces debt, exports natural resources and consumes goods and services other nations produce for us.

Politicians and the Fed have gamed the system and so altered the national landscape that trickle down now comes as pain: that which flows from taxes and regulations and government's politically determined distribution, rather than that which comes via natural market forces.

2

posted on

12/31/2012 8:38:58 AM PST

by

GBA

(Here in the Matrix, life is but a dream.)

To: ksen

Except people don’t stay in the same quintiles all their working lives. They usually progress. That means most of the people who were in a lower quintile progress to the next quintile. In short, they get richer. Sorry pal, Marxism is still a rotten economic theory. But if your Fearless Leader Obama and others like him keep getting voted in as president, total destruction of all wealth is assured.

To: driftless2

Ok, that doesn’t address the problem at all.

4

posted on

12/31/2012 8:48:52 AM PST

by

ksen

To: GBA

Trickle down is the norm and part of the cycle of capitalism. Nonsense. NONSENSE! How do you think "it" gets up there to trickle down in the first place?

5

posted on

12/31/2012 8:52:45 AM PST

by

DManA

To: driftless2

6

posted on

12/31/2012 9:02:13 AM PST

by

Captain Rhino

(Determined effort is the hammer that Human Will uses to forge Tomorrow on the anvil of Today.)

To: Captain Rhino

When = we

Sorry for the typo...

7

posted on

12/31/2012 9:03:48 AM PST

by

Captain Rhino

(Determined effort is the hammer that Human Will uses to forge Tomorrow on the anvil of Today.)

To: ksen

If you think about it, this chart completely refutes trickledown economics.If you think about it, this chart completely confirms human nature. Nothing more, nothing less.

5.56mm

8

posted on

12/31/2012 9:10:25 AM PST

by

M Kehoe

To: ksen

Apparently enough of our electorate now agrees with this argument to say that yes, Reaganomics is dead. At least until we’ve tried out all the alternatives.

To: ksen

If you think about it, this chart completely refutes trickledown economics. No it doesn't

In a modern, free, division of labor society, with a just government, the gains of the rich do not cause a loss to the non-rich and lead to gains for all.This is what the chart shows.

In a modern, free, division of labor society, with a just government, the gains of the rich do not cause a loss to the non-rich and lead to gains for all.This is what the chart shows.

From 1967 to about 2001, while the rich were gaining, everyone was gaining. After 2001, while the rich were declining, everyone was declining. The greater gain of the rich is a result of their greater contribution to production relative to the non-rich, and does not result from stealing from the non-rich or exploiting them.

10

posted on

12/31/2012 9:10:59 AM PST

by

mjp

((pro-{God, reality, reason, egoism, individualism, natural rights, limited government, capitalism}))

To: GBA

Trickle down is the norm and part of the cycle of capitalism.citation needed

Unfortunately, these aren't normal times and we aren't really a capitalist, producer nation/economy any longer.

Sure we are. America is still the number one (maybe number 2) manufacturer in the world.

Instead, we have become a government economy of consumers that produces debt, exports natural resources and consumes goods and services other nations produce for us.

Consumers always drive job creation. No consumers, no business. So the way to solve the problem is to enact policies that help put cash in the hands of those most likely to spend it, i.e. the lower 80%. It doesn't have to be done through a raw exercise in government power.

Politicians and the Fed have gamed the system and so altered the national landscape that trickle down now comes as pain: that which flows from taxes and regulations and government's politically determined distribution, rather than that which comes via natural market forces.

What are these "natural market forces" you are talking about?

11

posted on

12/31/2012 9:10:59 AM PST

by

ksen

To: mjp

In a modern, free, division of labor society,there's the rub because right now the labor market is anything but "free" in any meaningful sense. all the power is on the side of the labor consumer so they are able to set whatever wage rate they want. while the labor provider is pushed by necessity, through having to have that job just to provide the basic food, shelter, and medical expenses to keep him and his family alive, to take the first bad offer that comes his way.

provide a society where people don't have to take the first awful job that comes along just to stay alive and then you might have a freer labor market. right now it's just a con game.

The greater gain of the rich is a result of their greater contribution to production relative to the non-rich, and does not result from stealing from the non-rich or exploiting them.

that's ridiculous. you can't make a cogent argument that the average executive is hundreds of times more productive than the people actually making the widgets. as worker productivity has risen their share of their productivity has gotten smaller and smaller so yes, they have been exploited and have had a portion of their labor stolen.

12

posted on

12/31/2012 9:20:53 AM PST

by

ksen

To: ksen

Sure we are. America is still the number one (maybe number 2) manufacturer in the world. Once upon a time, perhaps, but looking at labels, I see that Walmart and Target no longer shop here. Both of the vehicles in my garage were assembled here from parts made elsewhere. The clothing I'm wearing used to be made a few miles down the road from me by average skilled people, but now it's all made by someone else in some other country from cotton grown here.

Those consumers you speak of are borrowing to consume using zero interest money. They, individuals, families, cities and states, aren't saving in the good years, they are partying hearty thinking it will last forever.

There is a balance to things and cycles revolve around that balance. Unfortunately, the balance has been upset in favor of a state controlled artificial entitlement economy.

We can rewrite the natural laws where ever we find them as long as we have the money to do so, but the money ran out a long time ago.

There is a reckoning coming, but for now, this is the calm eye of the hurricane that can't last for very long. When the backwall gets here, we'll wish things were as good as after the crashes of 2008.

13

posted on

12/31/2012 9:52:02 AM PST

by

GBA

(Here in the Matrix, life is but a dream.)

To: DManA

Nonsense. NONSENSE! How do you think "it" gets up there to trickle down in the first place? There is always a source. I believe "it" comes from driven individuals whose efforts and ingenuity, along with their willingness to take on risk, creates a good or service that others want for themselves and are willing to trade for it.

They are the source of what trickles down. They are the ones who create products and they hire people to fill the jobs that produce those products.

The better the productive "they" do, the better we all do, as it all trickles down from their initial drive and creativity.

The more you hamper them, the more that interference trickles down via lost jobs, lower wages, fewer goods and services available, etc.

It all flows from the source, whether you poison the well or keep it pure.

14

posted on

12/31/2012 10:07:35 AM PST

by

GBA

(Here in the Matrix, life is but a dream.)

To: ksen

"Trickle-down" is an epithet concocted to discourage effective policies that remove roadblocks and incentivize investment. When people think that investing in business is a good idea with an effective rate of return, they do so and jobs increase all around. Increasing the risk on investment in job-creating enterprise, and et voila, people invest in other things. Unable to refute this, liberals recast it as letting rich people pay fewer taxes in hopes they would spend the money on services. Having a debate about "trickle-down" economics is a framing error which concedes the field to the taxers.

"trickle-down" is tired old BS, there was never any such thing to begin with.

15

posted on

12/31/2012 10:14:11 AM PST

by

no-s

(when democracy is displaced by tyranny, the armed citizen still gets to vote)

To: ksen

"Trickle-down" is an epithet concocted to discourage effective policies that remove roadblocks and incentivize investment. When people think that investing in business is a good idea with an effective rate of return, they do so and jobs increase all around. Increasing the risk on investment in job-creating enterprise, and et voila, people invest in other things. Unable to refute this, liberals recast it as letting rich people pay fewer taxes in hopes they would spend the money on services. Having a debate about "trickle-down" economics is a framing error which concedes the field to the taxers.

"trickle-down" is tired old BS, there was never any such thing to begin with.

16

posted on

12/31/2012 10:14:14 AM PST

by

no-s

(when democracy is displaced by tyranny, the armed citizen still gets to vote)

To: GBA

The more you hamper them, the more that interference trickles down via lost jobs, lower wages, fewer goods and services available, etc.And yet right now they are enjoying their largest share of the nation's wealth in a century but they aren't trickling anything down. Right now their corporations are experiencing record levels of proft but they aren't trickling anything down. Instead they are hoarding.

To keep the economy growing and moving cash needs to be in hands of people that will spend it. Increased concentration of wealth and cash hinder economic growth and expansion. The danger of the fiscal cliff isn't that taxes will be raised back to Clinton levels, it's that government spending will slow too quickly in an era where private spending isn't picking up the slack.

It all flows from the source, whether you poison the well or keep it pure.

Without customers the best idea in the world will fail.

17

posted on

12/31/2012 10:17:24 AM PST

by

ksen

To: ksen

Household income metrics comparing the past with the present are only relevant comparisons if households are a stable unit.

The simple fact is this: A single household with a married couple each earning $40,000, will be presented as a one household with an income of $80,000. For a sample size of one, the mean household income is $80K.

If the couple divorces and moves into separate residences, there are now two households each with an income of $40K. For a sample size of two, the mean household income is $40K.

No one got a pay cut. No one lost a job. But household income declined by half.

Now consider the number of single people living by themselves, as people tend to marry later. Consider the number of single mothers. Consider the number of divorced couples.

Comparing today's household income statistics with 20 and 40 year old data is an irrelevant comparison if the goal is to make an accurate presumption on how much individuals (not households) earn. Individual income statistics are much more relevant.

18

posted on

12/31/2012 10:23:09 AM PST

by

magellan

To: ksen

Where to begin?

This article is a complete load of horse$hit. First of all, there is no "problem". If you use your own graph, the bottom quintiles stayed the same, through Johnson, Nixon, Ford, Carter, Reagan, Bush, Clinton, Bush and now Obama. All of whom had differing ideas on the economy.

Notice that rich people keep doing things that make them, wait for it...rich.

Also people don't stay in the bottom quintile their ENTIRE lives unless they are losers, mentally handicapped, lazy, or liberal welfare parasites.

And the biggest reason why this article is total garbage?

For the same reason that statistically HALF of the population is below the mean. Can you imagine that?

How can we live in a country where half of the population has an IQ that is below the mean? And 20% of the population lives in the bottom quintile. 80% are in higher quintiles. Just imagine!

19

posted on

12/31/2012 10:23:16 AM PST

by

boop

("You don't look so bad, here's another")

To: GBA

#15 expresses well the reason I criticize people for adopting this nonsense imagery.

20

posted on

12/31/2012 10:36:23 AM PST

by

DManA

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-59 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson