Rich people are smart and avoid the tax man.

Posted on 12/10/2012 10:48:27 AM PST by ksen

Dean Baker responds to inconsistent worries about robots displacing labor and the ability of a smaller number of workers per retiree to support Social Security:

... we seem to be seeing rapid improvements in productivity growth ... that are drastically reducing the demand for labor. Yet all the gains from these improvements seem to be going to owners of capital as the labor share of output has been falling sharply.

The distributional issue ... is extremely important, both for workers who are not seeing gains in living standards, and also for the economy as a whole, since a continual upward redistribution of income will lead to stagnation as a result of inadequate demand. However, it is worth noting that the concern that rapid productivity growth will lead to less demand for labor is 180 degrees at odds with the often repeated concern that productivity growth will be inadequate to sustain rising living standards in the future.

... If you are concerned that a falling ratio of workers to retirees is going to make us poor then you are not concerned that excessive productivity growth will leave tens of millions without jobs.

It is possible for too much productivity growth to be a problem, if the gains are not broadly shared. It is also possible for too little productivity growth to be a problem as a growing population of retirees impose increasing demands on the economy. But, it is not possible for both to simultaneously be problems. ...

I'm not worried about low productivity growth and stagnation. Since we are in the midst of it, it's hard to see the full impact of the digital revolution, but I believe it's a bigger force for productivity growth than we realize. There are big changes in our future as robots/machines become better and better at displacing people. However, that growth will be more unequal than ever, and it's the distribution of the gains from growth that I worry about.

In the future, we'll have the ability to produce enough stuff, and that ability won't stop growing. The problem will be distribution, and our inherently selfish nature makes it an extremely difficult problem to solve.

See #80.

So a Tax Increase that covers less than 1% of 0bama’s Budget Deficits is really what this is all about?

Where is the other 99% of the money going to come from for the “spending of course”?

Pardon me if I don’t take Fox News as a credible source of . . . well anything.

You find me a source that shows that the Tax Increase makes any dent in the deficits. Please. Feel free to use the CPUSA rag.

Hey, they were just quoting Congress’ Joint Committee on Taxation. You don’t believe Congress? The Senate is controlled by your party.

Same facts, leftist news source:

WASHINGTON A bill designed to enact President Barack Obama’s plan for a “Buffett rule” tax on the wealthy would rake in just $47billion over the next 11 years, according to an estimate by Congress’ official tax analysts obtained by the Associated Press on Tuesday.

That figure would be a drop in the bucket of the more than $7trillion in federal budget deficits projected during that period.

The Associated Press

http://usatoday30.usatoday.com/USCP/PNI/Nation/World/2012-03-21-APUSTaxesBuffettRule_ST_U.htm

So where is the other 99% of 0bama’s Deficit Spending going to come from?

(*crickets chirping*)

Rich people are smart and avoid the tax man.

Ok.

The Congressional Budget Office’s (CBO) new report shows that allowing President Bush’s 2001 and 2003 income tax cuts on income over $250,000 to expire on schedule at the end of 2012 would save $823 billion in revenue and $127 billion on interest on the nation’s debt, compared to permanently extending all of the Bush tax cuts. Overall, this would mean $950 billion in ten-year deficit reduction, a significant step in the direction of fiscal stability.

http://www.offthechartsblog.org/cbo-ending-high-income-tax-cuts-would-save-almost-1-trillion/

There’s not enough money in 0bama’s tax increase to impact the behemoth of a Federal Budget, Spend, Deficit or Debt.

There is enough marginal impact on the job creators to destroy their incentive to create jobs.

Simply, job creator are essentially on strike now due to 0bamaCare (I know lots of them, and that’s exactly what they say). With a tax increase, they will actively lay off more people.

Not big enough to fix anything Federal, big enough to destroy the motivation of entrepreneurs. That’s it.

Where’s the real plan to fund 0bambi’s massive spending splurge?

Uh, that's only the "Buffet Rule" tax and I'm not even sure if that's part of the President's deal.

Great! I’ll use YOUR numbers.

Through 2022:

$950 billion / $7,000 billion = 13.57%.

Where is the other 86.43% of 0bama’s deficits going to come from?

Sure there is. Just read the CBO report.

There is enough marginal impact on the job creators to destroy their incentive to create jobs.

simple fear-mongering

Simply, job creator are essentially on strike now due to 0bamaCare (I know lots of them, and that’s exactly what they say). With a tax increase, they will actively lay off more people.

Well, if some people you know said something then I guess that applies to the economy as a whole. And it's highly doubtful that mass layoffs are going to happen if Clinton-era tax cuts, remember the Clinton-era and its +/-5% unemployment?, get partially re-enacted. "Job creators" still have to ship product.

Not big enough to fix anything Federal, big enough to destroy the motivation of entrepreneurs. That’s it.

Nonsense.

Helping out the brethren, is 0bama.

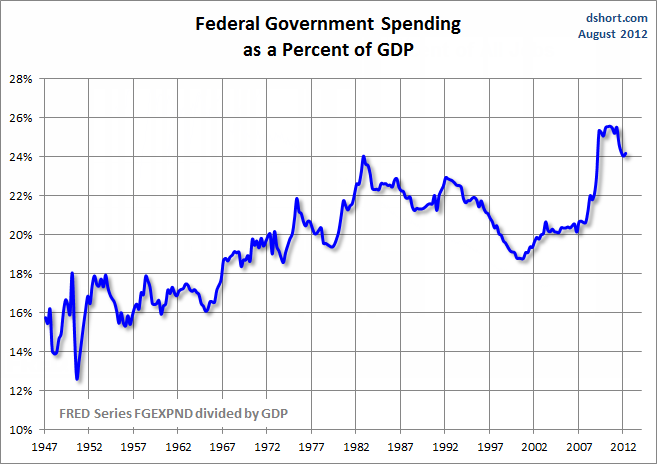

Ok, your chart says nothing about how tax rates affects unemployment numbers. I mean if you want I can also start posting charts and graphs that have nothing to do with my statements. ;)

Actually we are in the middle of a demand problem. Once that gets fixed and the economy starts growing again deficits tend to take care of themselves.

I’d like to see where you got your $7 trillion deficit number.

You’re a waste of time. Goodbye.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.