Posted on 10/02/2011 4:05:19 PM PDT by blam

The Stock Market Smells Deflation

Stock-Markets / Stock Markets 2011

Oct 02, 2011 - 11:06 AM

By: Clif Droke

In previous commentaries we've talked about how the 6-year cycle is scheduled to peak around Oct. 1. That now appears to be all but certain following the last few trading sessions. Although the cycle has a 1-2 week standard deviation (plus or minus), it appears that it peaked on schedule last week and that the stock market has lost the last remaining cyclical support it had throughout most of September.

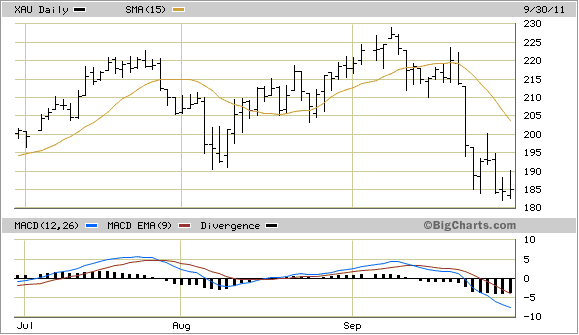

Interestingly, it was the commodity stocks that performed the strongest in the last cyclical bull market from late 2008/early 2009 until earlier this year. But in the last few months these stocks have been under heavy distribution and have lately led the way lower for the broad market. The gold/silver stocks took a big hit earlier this month as you can see in the chart of the XAU Gold Silver Index shown here.

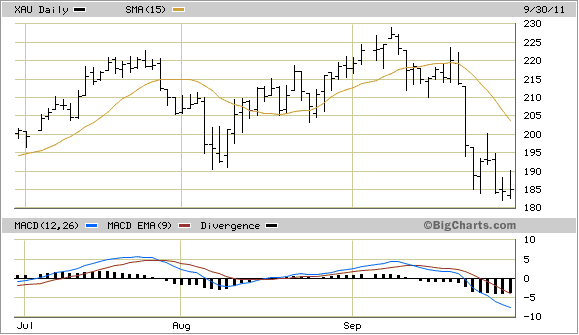

The oil and gas stocks haven't fared much better and still haven't confirmed a bottom. Even the gasoline futures price is showing signs of weakness and is on its way to giving back virtually all the gains it made since the Federal Reserve's QE2 monetary easing program began last fall. While this would be beneficial for everyone (except the oil companies), it underscores an important point that I'll be making in tonight's report, namely that deflation is starting to rear its ugly head again.

Looking at the list of stocks on the NYSE new 52-week lows list on Friday you will see a conspicuously high number of companies who either mine, explore or manufacture commodities or else service commodity related industries: Agrium (AGU), Alcoa (AA), Apache (APA), Ashland (ASH), DuPont (DD), Dow Chemical (DOW), Forest Oil (FST), Franco-Nevada (FNV), Hecla Mining (HL), National Fuel Gas (NFG), 3M (MMM), Potash of Saskatchewan (POT), Rio Tinto (RIO) and Teck Resources (TCK) just to give you an idea. This is a classic collection of industrial and hard asset related companies and many of these stocks have built up a tremendous amount of downside momentum in recent weeks and months. Never mind the near term stock market outlook, this doesn't speak well at all about the global economic outlook.

Throughout the year we've read story after story in the business and financial press about how so many U.S. based companies had decided to focus their energies on growing their business in the emerging markets overseas. Well it looks like those high hopes will have to be put on hold as the overseas markets are slowing down and will soon be entering an economic slowdown on par with the one the U.S. is currently suffering.

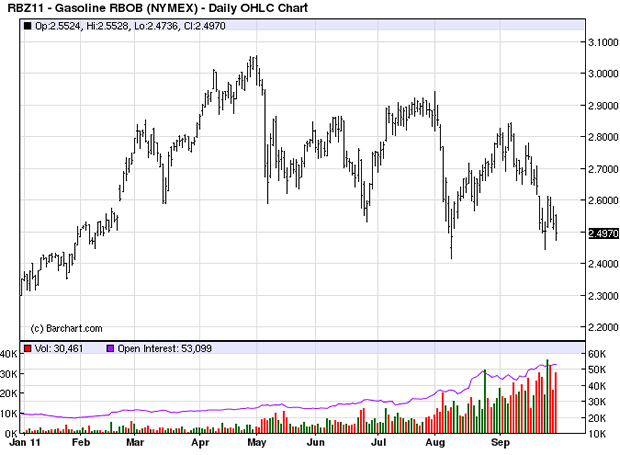

The darling of the emerging markets crowd is China and it has become an article of faith that China will someday soon eclipse the U.S. as the world's leading economic superpower. That day will have to wait as China's stock market continues to spiral lower, drastically underperforming the U.S. equities market. Keep in mind that the stock market is a barometer of future business conditions since it discounts corporate earnings 6-9 months in advance and is a reflection of where the economy is headed.

To illustrate this, below is a chart of the China 25 Index Fund ETF (FXI) in relation to the S&P 500 Index (SPX). China has been in a bear market since its stock market peaked last November. The country is suffering from a glut of commercial and residential real estate and unnecessary public works thanks to a massive stimulus on the part of China's Communist Party after the credit crisis of 2008.

China's financial sector is in major decline and already we're seeing a corresponding decline in demand for the commodities which fueled the country's mega boom. This diminishing appetite for commodities will continue as we approach the 60-year Grand Super Cycle bottom in 2014.

Meanwhile on the home front, the peaking of the 6-year cycle has taken away the last remaining cyclical pillar of support for the artificial, Fed-induced inflation of the past couple of years. Fed chief Bernanke has made no imminent plans for another round of financial stimulus. The Fed's latest gambit to revive the U.S. economy has been dubbed "Operation Twist" and involves nothing more than swapping short-term Treasuries for longer dated ones. This will register little more than a blip on the economic radar screen and will do nothing to increase aggregate demand in the U.S. economy. The Fed is likely underestimating the degree to which deflation will ravage the economy as we head closer to the long-term cycle bottom. Each passing year beginning with 2012 should bring a greater degree of deflation and it's doubtful either the Fed or the U.S. government can do anything to stop it.

It has been said that avalanches can start with insignificant snowballs rolling down the hill. In a similar vein economic collapse typically begins with financial market weakness, which tends to be overlooked by economists. While economists focus on GDP and other "big picture" lagging indicators, the real action takes place at or just below the economic surface in the financial market, which discounts economic activity by several months in advance.

As important as the commodity related companies have become in recent years, when there is as much weakness in the commodity company stocks as we're seeing right now it should give economists pause for thought. The message that the recent commodity stock liquidation is sending is that deflation is coming. Instead of discussing constructive ways of dealing with this problem, Congress is debating the merits of a potential tax increase on Americans - a policy which can only exacerbate the negative impact that deflation will have on the economy. The Fed meanwhile is whistling past the proverbial graveyard in a meager attempt at keeping the interest rate low. Both the Fed and the Congress will be taken by surprise when deflation descends with its full force and fury in the next several months.

What is it with all of these goofy indexes they use to underestimate unemployment, the real food-fuel inflation rate. and there are others

anybody with an ounce of a brain knows what is going on right now. Why then in the media and econimists always over estimate recovery and under estimate collapse ?

You have to go outside the government or quasi-government (the Fed) to get real numbers. Shadowstats is the place to go today but it costs.

Cycles schmycles, the “outlook” has been dire and deflationary since the whole house of cards started collapsing in August, 2007. The boom in commodities has been a series of bubbles fueled almost solely by US quantitative easing. Note well the date of the current collapse in commodities prices. Well, I’ll be darned, it began the day after Bernanke and the Fed announced the “twist” instead of QE3.

What scares me is that someone showed me a chart once showing me that our debt situation is something like two times worse than it was after WW2.The inflation rate after WW2 was bad enough. the 1970s were bad. but what we are heading for AFTER we bottom out fairly soon looks to be out of the world and beyond my imagination (im far from being an expert, but I like math and have common sense.

There is no leadership in the United States. There is no leadership in Europe. There are no statesmen in the west right now. That scares me more than depression. Depression is one thing. but what happens next ? Germany after WW1 ?

[Up until about four weeks ago, most of the articles were predicting high inflation and even hyperinflation.]

It is biflation, not inflation or deflation. GDP=M * V There are two variables, neither of each are fixed. That means some areas inflate, others deflate. Here’s a chapter from a book I wrote http://www.futurnamics.com/biflation.php

[Deflation in salary, and assets like houses, cars, etc). In other words things that you receive or own.

Inflation in Gas, food, energy, things that you pay for.]

Yup, its biflation, see my above post.

If the demand for money remains in excess of all the trillions provided then we are still in deflation. Inflation/deflation is always and everywhere a monetary issue.

“With all the extra money being pumped into the economy via QE I, QE II and now soon-to-be-announced, QE III, we shall be AFLOAT in Monopoly money.”

you’d think but Obama’s fiscal policy is worse than anything the fed can do

It is going to be inflation with deflation.

I’ve been writing about what the coming collapse will look like in two books.

Surviving Civil War II http://www.futurnamics.com/civilwar.php

Going Galt http://www.futurnamics.com/goinggalt.php

I’m working on one now that just goes into the financial aspects.

Sell,buy,sell,buy,sell,buy.....…

Currency diversification has seemed to be a good bet to hedge against devaluation, but it's nearly worldwide now, competitive devaluation more or less. Look at the Swiss Franc for an example of a currency regarded as a safe store of value to such a degree that it soared a bizarre amount, to the point that the Swiss were forced to devalue themselves in order to save their largely export driven economy.

I sure did. There were two editions, one per-Clinton and one during Clinton. They're still in my library. I had expected what is happening now to have happened in 1995. Anyway, I'm always early with things, lol.

People still have to eat...

Surviving Civil War II

Preparing For Economic, Social & Political Collapse

Good Luck with your book.

So for an old retired guy, what’s the downside and upside of deflation?

By definition, deflation is a reduction in the value of assets. Real estate and the “things” that one might buy to protect against inflation will deflate, go down in value.

You dont want to own real estate, gold, oil, commodities, bonds.

You dont want to be in debt.

You want to hold cash.

Think who prospered during the deflation of the Great Depression - it was those with cash. They were able to buy farms, land, buildings, etc for 10-20 cents on the dollar because they had cash and the owner needed cash. Not many buyers and lots of desperate sellers make for lower prices.

No one makes much if any money during the deflationary period. You just want to be there to buy things cheap near a bottom. Patience.

Hold cash.

Ron Paul isn’t going to like this. But when your theory doesn’t fit the facts, you just deny the facts, right?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.