Skip to comments.

Deflation and the Dollar

Inner Workings Blog at Atol ^

| Dave Goldman

Posted on 11/25/2010 8:55:56 PM PST by Pride_of_the_Bluegrass

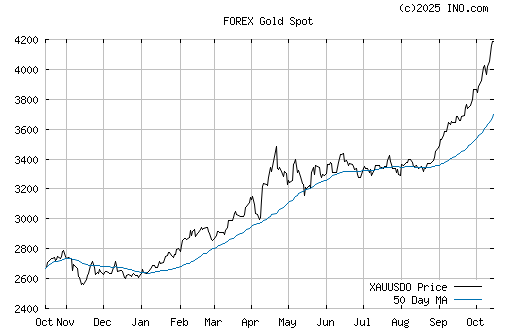

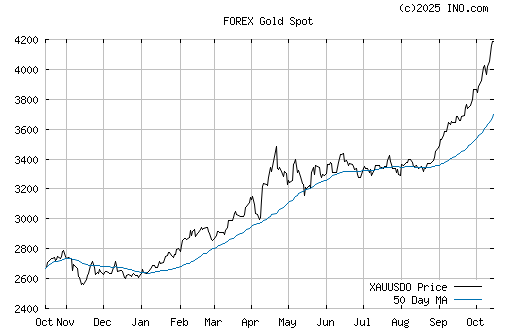

North Korea fires on South Korea and the gold price falls. Counter-intuitive? Not quite. As I’ve been arguing for the past two weeks, a chill wind of deflation is blowing through world markets. The European Community is rescuing Ireland (and probably Portugal and then Spain) because $1.3 trillion of bank assets are in jeopardy. American banks’ loan quality is not that great, either. China is tired of capital inflows from the US bubbling through its rather primitive financial system and has slapped higher reserve requirements on its banks

(Excerpt) Read more at blog.atimes.net ...

TOPICS: Government

KEYWORDS: china; dollar; economy; fed; federalreserve; gold

To: Pride_of_the_Bluegrass

Interesting observation by Spengler. Thanks for posting.

2

posted on

11/25/2010 9:46:45 PM PST

by

PGalt

To: Pride_of_the_Bluegrass; ding_dong_daddy_from_dumas; stephenjohnbanker; DoughtyOne; rabscuttle385; ..

RE :”

That’s deflation. The gold price is simply impossible to read in this context. As long as Ben Bernanke’s behavior was predictable (weak economy = more dollars off the Fed photocopiers) the markets had a one-way bet on gold. No more. As I wrote Nov. 15, “The prudent thing is to increase cash positions.”

Deflation vs inflation. It's not pretty, we will lose either way.

3

posted on

11/25/2010 9:59:37 PM PST

by

sickoflibs

("It's not the taxes, the redistribution is the federal spending=tax delayed")

To: Pride_of_the_Bluegrass

To: sickoflibs

“Deflation vs inflation. It’s not pretty, we will lose either way.”

Deflation was inevitable by 2008. Running up a 1.5 trillion a year debt for the feds was not. A huge debt followed by deflation is a lot worse than a smaller debt followed by deflation.

To: Pride_of_the_Bluegrass

I’m of the opinion that we will see “Bi-Flation”.

That is, inflation and deflation simultaneously - based upon asset class if you will.

Those things which are traditionally purchased using credit have already deflated and the markets for such products have tanked and are not coming back. Real Estate, Automobiles and high ticket consumer goods traditionally purchased with credit have deflated.

Commodities and non-discretional items such as food, clothing and low-ticket essentials will inflate in comparison to fiat currencies such as the dollar that are now being debased around the world.

6

posted on

11/26/2010 2:43:05 AM PST

by

Bon mots

("Anything you say, can and will be construed as racist...")

To: Bon mots

Commodities and non-discretional items such as food, clothing and low-ticket essentials will inflate in comparison to fiat currencies such as the dollar that are now being debased around the world.

This is happening. Right now. Anything you need for survival that doesn't require a loan is going to cost you more. Everything else is deflating. The net effect may be stagnation, but I'm leaning towards deflation myself. That housing bubble was huge and unemployment is too high right now. Not enough spending in the economy to overcome the collapse of the housing market.

7

posted on

11/26/2010 4:24:30 AM PST

by

lmr

(God punishes Conservatives by making them argue with fools.)

To: Pride_of_the_Bluegrass

Spain was a giant real estate bubble, even more so than the US, and the real estate market remains utterly frozen. And it is getting worse by the day. That's deflation. No, and the bubble was not inflation. The bubble can be expressed as speculation combined with inflation anticipation. The speculation got out of hand in places like Spain and Las Vegas. The current despeculation does not change the fact that people still anticipate inflation.

As for the gold price, the author is wrong on that too, gold was falling before the latest NK incident, then turned around and rose to a right shoulder. Now that it is falling again, it is pretty easy to see an engineered head and shoulders top. The proof that it was engineered and that inflation is still coming is that even with such a large technical top, gold will only fall to about 1300 give or take.

8

posted on

11/26/2010 4:40:42 AM PST

by

palmer

(Cooperating with Obama = helping him extend the depression and implement socialism.)

To: palmer

No, and the bubble was not inflation.I disagree.

The bubble couldn't have happened if the Fed had not flooded the market with extra cash at fire-sale interest. How can you claim it wasn't inflationary when house prices skyrocketed as the money supply soared?

It's classic inflation.

9

posted on

11/26/2010 5:23:37 AM PST

by

BfloGuy

(It is not from the benevolence of the butcher, the brewer, or the baker, that we can expect . . .)

To: sickoflibs

'yeah, but its a dry heat'.../ hudson

IOW...the 'aliens' are eating our lunch, in and out of the white hut...

10

posted on

11/26/2010 6:36:27 AM PST

by

Gilbo_3

(Gov is not reason; not eloquent; its force.Like fire,a dangerous servant & master. George Washington)

To: Bon mots

I’m of the opinion that we will see “Bi-Flation”. That is, inflation and deflation simultaneously - based upon asset class if you will.

Those things which are traditionally purchased using credit have already deflated and the markets for such products have tanked and are not coming back. Real Estate, Automobiles and high ticket consumer goods traditionally purchased with credit have deflated. Commodities and non-discretional items such as food, clothing and low-ticket essentials will inflate in comparison to fiat currencies such as the dollar that are now being debased around the world. And you would invest, how?

11

posted on

11/26/2010 1:53:15 PM PST

by

GOPJ

('Power abdicates only under the stress of counter-power." Martin Buber /a Tea-nami's coming..)

To: GOPJ

To: Pride_of_the_Bluegrass

13

posted on

11/27/2010 2:48:06 PM PST

by

GOPJ

('Power abdicates only under the stress of counter-power." Martin Buber /a Tea-nami's coming..)

To: AdmSmith; Arthur Wildfire! March; Berosus; bigheadfred; ColdOne; Convert from ECUSA; Delacon; ...

Dave Goldman sez:

North Korea fires on South Korea and the gold price falls... a chill wind of deflation is blowing through world markets. The European Community is rescuing Ireland (and probably Portugal and then Spain) because $1.3 trillion of bank assets are in jeopardy. American banks' loan quality is not that great, either. China is tired of capital inflows from the US bubbling through its rather primitive financial system and has slapped higher reserve requirements on its banks...

Slapping higher reserve requirements on its banks? I guess no one mentioned to the Chinese what happened when Herbert Hoover tried that one. Thanks Pride_of_the_Bluegrass.

14

posted on

11/27/2010 4:15:50 PM PST

by

SunkenCiv

(The 2nd Amendment follows right behind the 1st because some people are hard of hearing.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson