Posted on 05/14/2009 10:31:04 AM PDT by BGHater

The peak in initial claims might be in but the peak in unemployment is nowhere close. Continuing claims hit 6.56 million, setting a record for the 15th straight week.

Please consider the Department of Labor Weekly Claims Report.

SEASONALLY ADJUSTED DATAUnemployment Claims

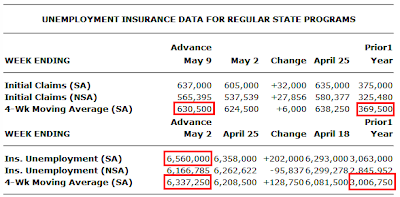

In the week ending May 9, the advance figure for seasonally adjusted initial claims was 637,000, an increase of 32,000 from the previous week's revised figure of 605,000. The 4-week moving average was 630,500, an increase of 6,000 from the previous week's revised average of 624,500.

The advance seasonally adjusted insured unemployment rate was 4.9 percent for the week ending May 2, an increase of 0.1 percentage point from the prior week's unrevised rate of 4.8 percent.

The advance number for seasonally adjusted insured unemployment during the week ending May 2 was 6,560,000, an increase of 202,000 from the preceding week's revised level of 6,358,000. The 4-week moving average was 6,337,250, an increase of 128,750 from the preceding week's revised average of 6,208,500.

The fiscal year-to-date average for seasonally adjusted insured unemployment for all programs is 5.011 million.

bfl

News like this, and the stock market is UP?! I know employment is a lagging indicator, but let’s get real here. The indicators are all still pointing down, down down!

I want to know what can possibly be sustaining the stock market value right now, other than some temporary unnatural mechanism that is keeping it inflated.

There is no underlying fundamental that could be supporting this. Given the job numbers today, the prospect of losing tens of thousands more very soon when GM and Chrysler close hundreds of dealships, and a myriad of other bonafide dismal economic realities, this makes no sense at all.

I have a bad feeling this is just being pumped as high as possible by folks who know that it’s not going to last in an effort to get regular folks back into it, then they’re going to dump and once again nail our 401ks.

I’m not buying it. I shut off inputs to my 401k months ago and that’s how it’s staying for the forseeable future. We’re gonna come up on the cliff quickly and lots of folks aren’t going to see it until they’re going over the edge.

The market tanked 50% off its peak.

These numbers are FUDGED as it doesn’t include all let go Chrysler people.

My friends got let go from Chrysler after a bunch of years but DIDN’T GET UNEMPLOYMENT.

Employees getting a buy out from a plant closing aren’t on the unemployment list..

ALSO alot of dealers will be closing. Those employees won’t hit till next month.

You don’t think a lot of terrible news isn’t priced into the economy? The market should never have dropped 50%. It was an over-reaction. The market will drift between 8-10K for the next couple of years unless the news gets catastrophic.

Are you looking for a job?

This thread is updated on a regular basis:

http://www.freerepublic.com/focus/chat/2136635/posts

Are you looking for a job?

This thread is updated on a regular basis:

http://www.freerepublic.com/focus/chat/2136635/posts

Are you looking for a job?

This thread is updated on a regular basis:

http://www.freerepublic.com/focus/chat/2136635/posts

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.