.

Posted on 05/07/2025 1:32:43 PM PDT by SeafoodGumbo

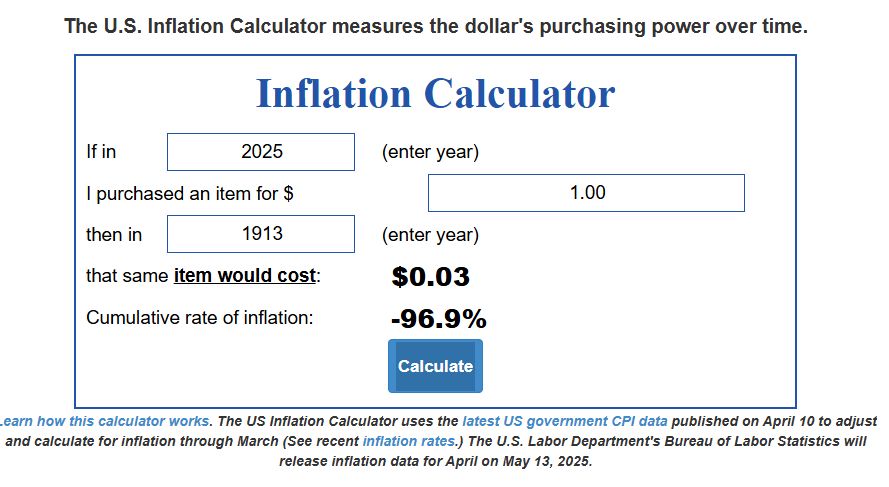

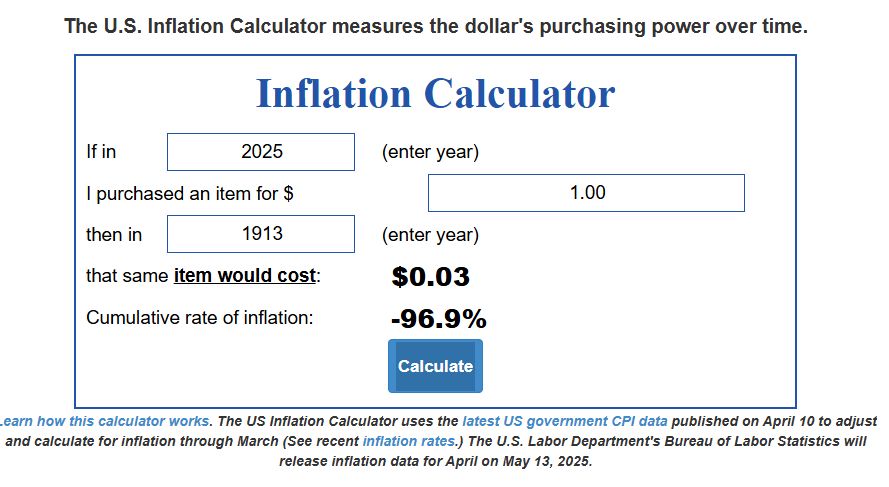

The dollar keeps losing value with accelerated devaluation appearing inevitable, stocks seem inflated, and bonds don't seem good either.

Gold and silver seem poised to go much higher, but the fees seem high for precious metal IRAs.

Thoughts?

I never understood the mentality of people who buy rocks to “protect” their money. Gold has no intrinsic value other than its use in electronics, doesn’t pay interest, doesn’t produce goods or services, and is fueled by the greater fool” theory of value.

I know “Ole’ King Cole was a merry old soul”, King Midas loved to count his gold in the counting house, and Goldfinger spent his whole (shortened) life trying to acquire more, but these seem like the pursuits of miserly misfits with no understanding of the purpose of wealth.

Gold, Bitcoin, Bonds, and other fixed-income assets are vehicles for storing excess capital until it can be put to work. They are like batteries, helpful in powering something real to meet human needs, but otherwise inert.

After the Roth IRA is started, put into your Roth 401K at work at least enough to get the employer match (if your employer does that) for you and your spouse. Note that beginning in year 2025, Secure Act 2.0 adds in income limit to who can contribute to a Roth 401K. If that's you, then put into your 401K enough to get a match. And if you have more money than that in your budget, max out your Roth IRA(s). That's $7K or $8K per person per year ($8K for age 50 and higher). (Again, do it in an IRA if you're above the income limits for a Roth IRA.) And if you have even more money left over to invest, max out your Roth 401K / 401K.

I used to tell people to weigh if it's best to invest in a traditional 401K or Roth 401K. But now that Secure Act 2.0 has an income limit on Roth 401K's, it's pretty simple: if you're income is low enough to let you put money into your Roth 401K, then it's best for you. People with higher incomes than that are in a higher tax bracket anyway and want the tax break while working, instead of the tax break later in retirement (Roth).

Eventually learn how to devise a diverse portfolio and set up your IRA/Roth IRA for that. A diverse portfolio not only helps you in retirement (something's always up to withdraw from, so you can sell high and sell less shares but get the same amount of money). It also helps you while you're working and adding to your investments. Why? Because something is always down (buy low to get more shares for the same amount).

“””You may encounter higher tax rates (28% vs 20%, for example) for investments based on precious metals, if I remember a recent article correctly...”””

And that is why holding gld or slv in an IRA is a good move.

28% cap gains tax on gold and silver.

yes, we eventually pay income taxes on ira distributions, but when that happens in retirement our tax rates are much lower.

Most custodians of conventional IRAs won’t allow you to own physical gold in the tax-advantaged account, but it’s a whole different story with a self-directed IRA (SDIRA). As the name implies, SDIRAs give you more control over what type of assets you can own, including real estate and precious metals. One potential drawback with gold IRAs is the initial purchase requirement fairly high.

I wouldn’t have the slightest idea and wouldn’t listen to anyone claiming to. IRAs are heavily controlled by the govt, that’s enough.

Kirk Elliott talks about this, has been interviewed on the podcast And We Know.

I’ve considered looking into what he offers.

The conspiracy theorists tell us gold and silver prices are artificially suppressed by the cabal.

(note the fact that the label “conspiracy theory” generally means it’s true)

I think its prudent to have some on hand as a means of barter or trade as well as alcohol. There was a thread about how a Freeper had a bunch of alcohol for trade during a tough spot in another country and how there was a huge demand for it.

Also, Google Warren Buffets thoughts on precious metals as an investment.

An IRA is a retirement account. When you are young, it can be more speculative than as you get closer to retirement age.

However, it should always have some diversity to it. That is because different sectors of the economy and the value of the stocks that serve those sectors go up and down. What you want to have in retirement accounts are a number of different stocks, ETF sectors, or mutual funds, including foreign and bond funds.

Gold is OK, but is not without costs if you want to sell it at some future point in time. It as all commodities should not be a principle component of your retirement account.

I hate to be the bearer of bad news, but I’m going to say this really loud: THERE IS NO SAFETY! Come on now, say it with me. Here’s the deal: buy the actual metal and a lot of guns, because someone (quite likely your government) will try to take it from you. Look, you’ve already likely accepted the fact that you aren’t going to live forever. Learn to accept and live with the facts about gold, the same way.

.

FDR didn’t try to seize numismatic gold coins, they were exempt from confiscation. Just saying.....

If you want gold, buy physical and store it yourself. Those ads on talk radio have ridiculous fees and all you get is paper. If you don’t hold it, you don’t have it.

That's what they said back when gold was at $1,000/oz.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.