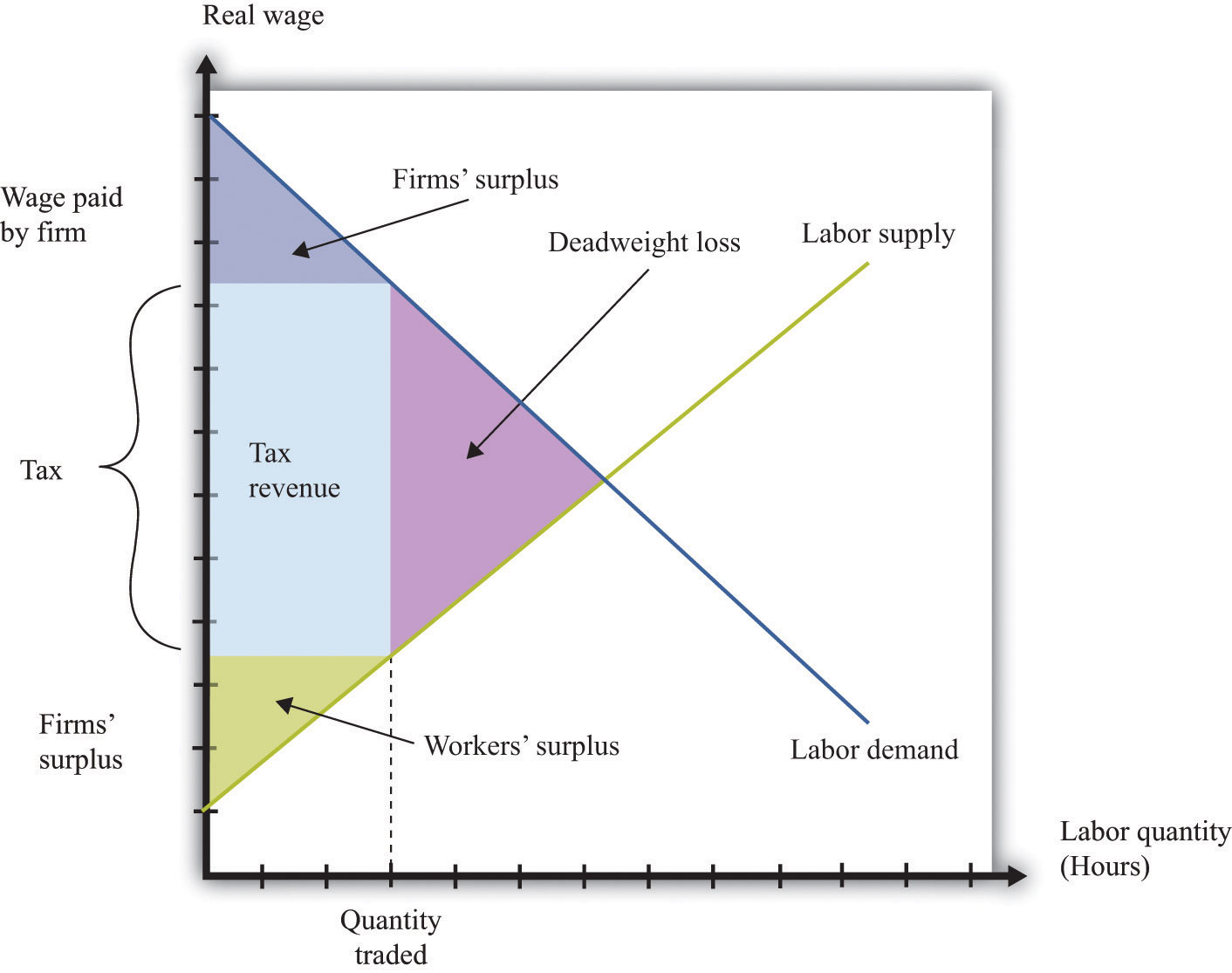

Taxes have a "Wedge Effect" between Supply and Demand, which causes a "Deadweight Loss" for the economy, shared between producer and consumer depending on the elasticity of supply and demand respectively.

Raising taxes always has this effect, regardless of what form they take. Businesses will always try to pass on tax increases to customers, and customers will balk at the higher prices. NO MATTER WHAT. So, it is impossible by definition for a tax not to have an adverse impact on the volume of goods and services an economy produces.