Posted on 05/29/2025 8:21:21 AM PDT by SeekAndFind

What’s really in the Big Beautiful Bill?

Depending on who you listen to, the Big Beautiful Bill (BBB) is either an incredible piece of legislation that will codify tax cuts while also unleashing growth and reducing the deficit, OR it’s just another 1,000+ page of pork that maintains the status quo of overspending/ growing the deficit/ increasing the debt.

The problem with this situation is that the people pushing these claims are either A) individuals who HATE the President and his agenda or B) individuals who work for the Trump administration and so have a vested interest in getting the bill passed.

Neither of those two groups are unbiased. And to be frank, I doubt ANYONE talking about this bill has even read it. Who has time? It only just passed the House on 5/22/25 and it’s 1,116 PAGES LONG!

So rather than arguing one way or the other, let’s let Mr. Market tell us the real deal with this bill.

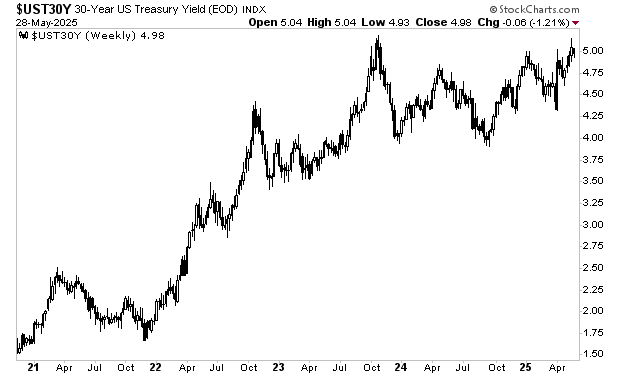

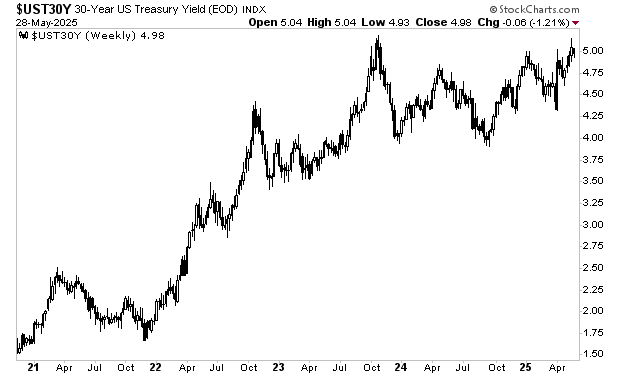

Mr. Bond is telling us the bill will increase spending. The yield on the 30-Year U.S. Treasury is at 5%, which is right near the top of its range for the last five years. This is also the highest this bond’s yield has traded since President Trump took office.

If the Big Beautiful Bill (BBB) was designed to cut spending and reduce the debt, this bond would be rallying, resulting in its yield falling. That is NOT happening.

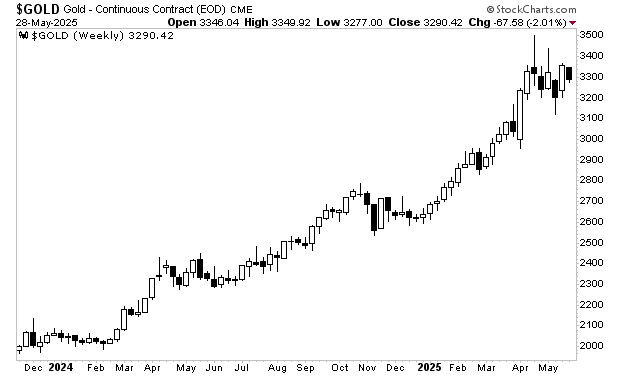

Mr. Gold is saying the same thing.

The precious metal is highly sensitive to money printing/ debt levels. And as I write this, gold is near its all-time highs, trading at roughly $3,300 per ounce. Again, if the BBB was going to reduce the debt and cut spending you’d expect this asset to be going in a different direction.

Of course, it’s possible that the markets are WRONG about the BBB. But considering that the markets are a composite of the actions of millions of people all with “skin in the game,” it’s highly likely that Mr. Market is more accurate that Trump administration officials or analysts/ commentators who openly despite the President.

As investors, our job is to make money, NOT play politics. So, when Mr. Market speaks, it’s usually a good idea to listen. And smart investors are actively taking steps now to profit from this.

more obscene spending, sadly.

Yeah, but it’s “us” doing the spending. heh

As long as it’s not “them”, it’s okay.

So there are no unbiased humans to parse this, but a bunch of investors are in the know?

RE: more obscene spending, sadly.

Yes, that was the bottom line in the article. :(

B. Just another 1,000+ page of pork that maintains the status quo of overspending/ growing the deficit/ increasing the debt.

C. Double your pleasure.

More garbage in, garbage out as far as I can see.

This is literally the most accurate way to get an overall take on the bill. People may lie to pollsters, but they don’t lie with their spending and investing decisions. The market represents a composite of all human intelligence being applied to this subject.

But the claim here is that nobody can know, not simply the wisdom of crowds.

The last sentence of the BBB:

SEC. 113001. MODIFICATION OF LIMITATION ON THE PUBLIC DEBT.

The limitation under section 3101(b) of title 31, United States Code, as most recently increased by section 401(b) of Public Law 118-5 (31 U.S.C. 3101 note), is increased by $4,000,000,000,000.

“The last sentence of the BBB:

SEC. 113001. MODIFICATION OF LIMITATION ON THE PUBLIC DEBT.

The limitation under section 3101(b) of title 31, United States Code, as most recently increased by section 401(b) of Public Law 118-5 (31 U.S.C. 3101 note), is increased by $4,000,000,000,000.”

Thank you for posting this! More to the point than the previous 1,300 pages (or however many there are).

The GOP doesn’t have the guts to spell out what the new limit is. They fear, probably correctly, that the number would appall the base.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.