Posted on 05/30/2023 9:07:35 PM PDT by SeekAndFind

In the small print detailing the end of the debt ceiling melodrama which, as we explained, is a farce as it boosts inflation-adjusted spending contrary to Republican promises, there was some actual news: the great student loan boondoggle is about to come to a screeching halt, after a three year "emergency pause" which redirected tens of billions in dollars away from mandatory student loan repayment to other forms of discretionary spending.

According to Goldman, the agreement announced on Saturday between uniparty leaders Joe Biden and Kevin McCarthy titled hilariously the “Fiscal Responsibility Act”, prohibits the Biden Administration from extending the pause on student loan repayments in place since March 2020, even if it does not block the Administration's student loan forgiveness plan, which would wipe out up to $20,000 in federal loans per borrower and is currently being weighed by the Supreme Court (the plan was announced last year but has not yet implemented).

Here are the details: late last year, Biden extended the repayment pause, which postpones roughly $5bn per month in student loan repayments, until 60 days after the Supreme Court ruled on the separate $400bn loan forgiveness plan the - the Supreme Court is likely to rule on loan forgiveness in June, so this likely would mean a restart of payments after August 2023.

And now, the debt limit agreement prohibits further extension of the payment pause, but remains silent on the student loan forgiveness plan which however will be nixed by SCOTUS much to the chagrin of screaming libs and lifelong members of the "free $hit" army. Prior to the announced debt limit deal Goldman had already assumed the repayment pause would end on schedule, though there was clearly a chance the White House might have extended it once again. The debt limit agreement eliminates that possibility (“except as expressly authorized by an act of Congress") and should result in a restart of student loan payments in September 2023.

What happens then?

Well, according to Jefferies, the return of monthly loan payments presents risks similar to the effects of the 2013 fiscal cliff, when tax increases led to reduced consumer spending. And in a note released Monday (available to pro subscribers), JPMorgan’s chief US economist Michael Feroli said that the end of the payment moratorium will reduce annual disposable personal income by $38 billion, which will reduce consumer spending.

Separately, a March analysis by FreightWaves found that federal government programs boosted personal income by an estimated $2.3 trillion from March 2020 to December 2022. According to The Motley Fool, consumers received an average of $3,450 in stimulus during the COVID economy. This included direct payments into bank accounts, an expanded Child Tax Credit and an expanded Earned Income Tax Credit. But one of the biggest COVID-related stimulus programs was not factored into the s numbers: student loan forbearance.

As noted above, Education Secretary Miguel Cardona said the student loan deferment program will end no later than June 30, 2023, and payments are expected to resume by Sept. 1, 2023: "The amount of money we are talking about, in excess of a trillion dollars, is staggering. Student loans represent 7% of U.S. GDP" according to FrightWaves.

Putting these numbers in context, 64% of the $1.7 trillion in student loan debt have been in forbearance for the past three years, amounting to $1.1 trillion. Many of the 25 million Americans who have deferred payments for student debt are aged 18-44 years old, one of the most important demographic groups that drive consumer spending.

Some more math: according to a New York Fed study, the average student loan payment is $393 per month.

For consumers taking advantage of the program, they have deferred 39 months worth of payments, resulting in more than $15,327 in additional discretionary income during the period, much larger than the amount most consumers received from other COVID stimulus programs.

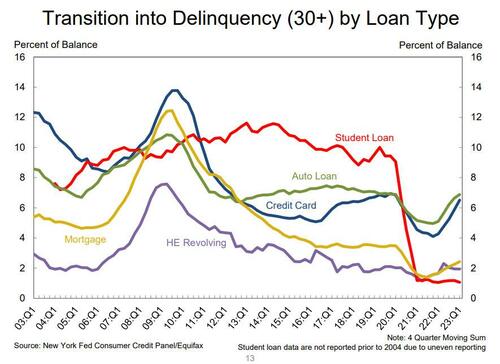

The forbearance program, when originally conceived, was intended to be a short-term program to protect consumers from the COVID black swan event. But many consumers made financial decisions based on this short-term cash flow boost, treating the cash as permanent. In fact, as the latest NY Fed household debt study showed, delinquency on student loans - until 2020 the highest among all types of credit - collapsed to near zero courtesy of the repayment moratorium. Expect the red line to soar higher in coming quarters.

A sudden increase of $393 per month in "new" - but really old - loan repayments will force prime-age consumers (those aged 18-44 years) old to cut back on discretionary spending. Since portions of this demographic have a tendency to prioritize experiences over goods consumption, we can expect this will have a much bigger impact on services demand and spending, which as discussed previously, has been the only pillar supporting the US economy now that goods spending has fallen off a cliff.

Time and money wasted in college is 1 freaking 7th of the nation’s GDP?

Oh no, the deadbeats might actually have to start paying back the money they borrowed for their useless degrees.

Gee, I guess there are consequences to decisions after all.

Too bad, so sad.

you said ..” have to start paying back the money “

And a lot of that money is sitting in “robinhood” style stock accounts...

Wonder why the markets seem to be out of wack?

Retail money has swarmed in. Buy the dip is the mantra of hoards of young people who have never seen a bear market.

As interest rates rise and new bond issues hit the market

to fill up the treasury .... liquidity will flow from the real economy, the market will dip ... and dip ....and dip.

A lot of young “investors” will be very puzzled.

All those paper profits will fade away.

Add that to the bazzillion $$ they will have to send to uncle sweety and the howling will be deafening.

Did that student really put that meme on their mortarboard??

If so, spot on!

if I read it eight in another article not only are the dead beats going to have to start repaying, but their benevolent govt is going to tack all accrued interest from the pause on top. these “educated” people are about to get a lesson in basic economics

After spending $150,000 to major in “Queer Studies” it’s not difficult to imagine the borrower defaulting on the loans.

Massive Zimbabwe like inflation coupled with huge raises in minimum wage should make paying off those loans possible for a burgger flipper.

Legislation and regulation are of no significance for this issue.

The “debts” (actually, the reassignment of Deep State funding from Congress to a bunch of 18 year olds) are never going to be repaid.

The budget agreement is as flimsy as the paper it was printed on. Biden is not forbidden from continuing to delay the student loan program.

The student loan forgiveness “threat” bought the needed votes in 2022. Now it’s useless so “good bye” I wonder what the Democrats will come up with in 2024 to buy votes?

The rest of us are paying their principal and interest. Boy, were we stupid not taking loans but paying on time for us and the kids. Also, stupid for attending in the first place. Should have learned trade skills. Even before today’s social diversity required courses, I’ve yet to use British Lit, Trig, Western Civ, Abnormal Psych or ... While some classes were interesting, they did not contribute in any way to earning an income.

The leftist parasites' top priority is the purchasing of votes. They will never abandon the forgiveness of student debt. "Demographics are destiny" is a Rat mantra. And household spending may or may not collapse, but Rat attempts to forgive student loans will never cease. After all, universities are a prime source of socialist brainwashing.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.