Posted on 05/17/2022 4:34:50 PM PDT by blam

One month after the April Fund Manager Survey was downright “apocalyptic” with the majority seeing a bear market and stagflation – yet nobody rushing to sell – and with optimism plunging to levels right before Lehman, today Bank of America published the latest, May FMS (available to pro subscribers in the usual place) in which the bank’s doom-and-gloomy Chief Investment Strategist Michael Hartnett (who most recently warned that the bear market will end when the S&P hits 3,000 in October) found that his view is shared by a growing number of even more apocalyptic Wall Street professionals, because the survey which polled 331 panelists managing $986 billion in AUM, revealed global growth expectations plunged even more compared to last month, and dropped to fresh all-time lows (net -72%) …

… with profit expectations slumping past the COVID lows to net -66% (from 63%), the weakest since Oct’08, smack in the middle of the Global Financial Crisis. (note lows in global profit expectations consistent with other crisis moments such as LTCM, Dotcom bubble burst, Lehman bankruptcy, and COVID)…

… and stagflation fears soaring to 77% (from 66%) the highest since August 2008.

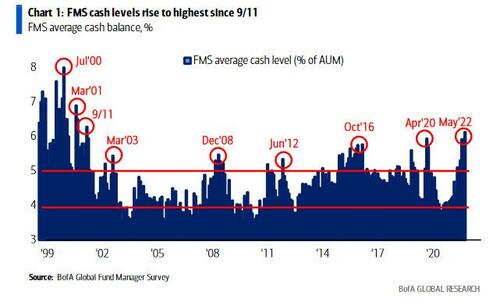

And while the mood has rarely been more pessimistic, with the FMS signaling the highest cash levels in 20 years, since Sept 11, indicative of major risk aversion…

,/A>

,/A>

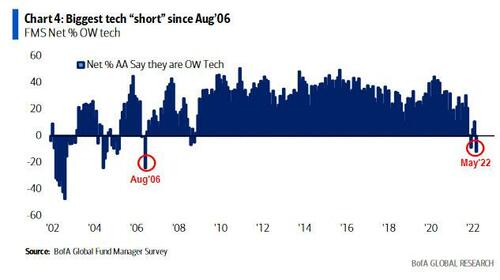

… as Wall Street finds itself most short tech – everyone’s darling sector as recently as 2021 – since Aug 2006…

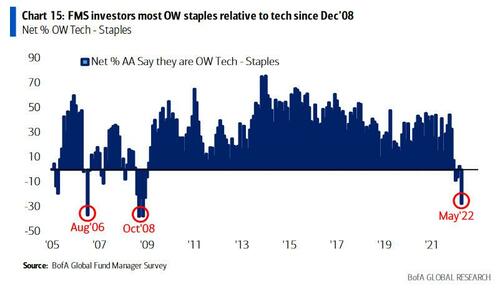

… as a big rotation out of tech drives the relative investor overweight in tech vs staples (really underweight) to Oct 2008 lows…

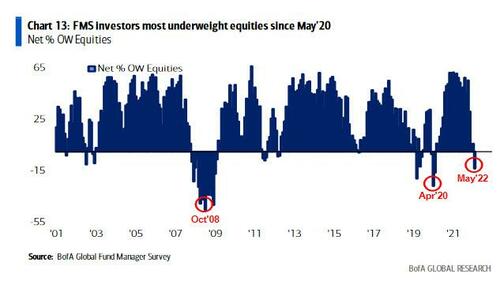

…. sparked by the biggest equity underweight since May 2020 (at net 13% UW vs net 6% OW in Apr)….

… and a BofA Bull & Bear Indicator at 2.0, just on the verge of the ‘contrarian buy” level, which would give a brief all-clear window to buy, we are still missing what Hartnett calls the “full capitulation” piece.

(snip)

Charts, sharts!

2008 could never happen again...

Or something...

In other words, do the opposite. Buy

Time to pay the Piper/road for the can is getting shorter even for the FG, though the body has assets up the ying-yang. Interesting times.

The Bear Market will end when Republicans take back the house and senate, impeach and remove Biden and Harris, begin the Nuremberg II trials, incarcerate Fauci, Zuckerberg, Dorsey, Clinton, etc. And finally, round up and execute (by lethal injection) all the coup plotters. /spit

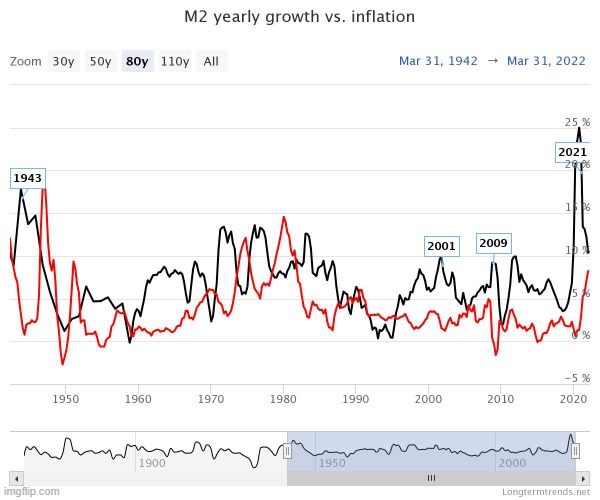

I’m not an economist but that graph is insane. And we can’t raise interest rates like the early 1980s’ or all our tax money will go to servicing the debt (remember Ross Perot screaming about our debts in......1992?)

The charts appear to be made by a 4th grader . Two inch space at 50% on the up side and three inch space at 50% on the bottom . Exaggeration by charts . I don’t need that to convince me tptb have spent us into a big deep hole. Common sense or as the Bible terms it Wisdom tells me that there is a payday . Hang on to your sheckels and please take the Mark on your right hand to pay for that pack of baloney . It’s late !

I have kept my purchasing the same and moved the Trump years into preservation.

We're headed into a short squeeze rally, mainly because it's an election year, and the Demagogic Party is colluding with its Media Shills to engineer another lockdown, riot chaos, and election steal.

Not true if inflation lasts less than 2 years. Most of the national debt is in long term bonds. Those pay the same low interest until maturity. Only NEW debt will require higher interest rates.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.