Posted on 01/14/2015 5:41:59 PM PST by SkyPilot

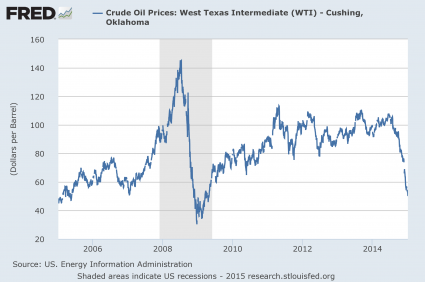

If you were waiting for a “black swan event” to come along and devastate the global economy, you don’t have to wait any longer. As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression. But following the financial crisis of 2008, the price of oil rebounded fairly rapidly. As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get. At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before. So let’s hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

(Excerpt) Read more at seekingalpha.com ...

No, I read his ‘Liar’s Poker’ some years ago and I enjoyed Lewis’ writing style but I haven’t read ‘The Big Short’. I did read reviews of it and remember thinking that there is one point that I disagreed with him on but I don’t recall what it is. I’ll know if I ever get around to reading it.

The books I have read that relate to the bubble.... ‘Chain of Blame’, Padilla & Muolo... ‘Fool’s Gold’, Gillian Tett.... ‘The Sellout’, Gasparino.... ‘ECONned’ Yves Smith. Those are the ones I can think of offhand.

And there were some memorable articles like Wired Magazine’s ‘Recipe for Disaster: The Formula the Killed Wall Street’

I gleaned a lot of information from the seemingly prophetic Housing Bubble Blog. A blog that began in 2005 and attracted a group of people who knew that something was seriously wrong in the housing market. The regulars had a lot of experience in real estate finance and investing and I was able to fill in blank spots in my own understanding.

What I think we missed at the time was the sheer size of Wall Street’s role in the whole thing which really only became obvious as it blew up and rocked the world economy. I was aware of CDOs and other bundled debt but I didn’t realize that the derivatives piled on this stuff ran into the trillions and had been sold all over the globe.

“Bring back the ‘Uptick’ rule.”

That would help end some of the abuses in shorting stocks but I don’t think it would do much to derivatives.

>>The men in this picture are going to be swinging

>>from ropes before this is all over.

Who’s going to tie the noose?

The morbidly obese McSheeple who are mesmerized watching American Idolatry and Dancing with the perverts in between commercials for Viagra, Sleeping Pills, and Depends?

The S.E.C. who couldn’t find their own arse with both hands and SQL statement telling them exactly where to find it in 2007?

Who?

But countries who's economy is based on Oil/Gas exports are getting crushed, therefore they can make dangerous decisions to change market forces. Putin turning of the NG spigot to Europe comes to mind. Keep you eye on Iran as well.

China shrinking. Velocity of money slowing.

ExtortionCare ExactionCare.

Wallets closed.

Not so far if December retail sales are an indicator. Also with record population not in the job force how much are they driving, therefore saving on gas? The mold is being broken with Odungas train wreck of an economy.

It’s your claim, you get to provide the evidence to back it up.

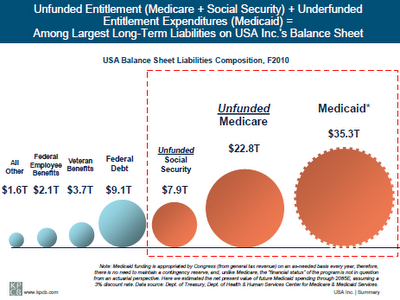

$205 Trillion in Unfunded Liabilities

There are various estimates on the exact number, but sure.

And don't forget about this:

I absolutely agree that Bretton Woods contributed to the 70's oil crisis, because oil was (and is) sold in dollars. But it is also fact that OPEC retaliated against the west for support of Israel.

A war in the Middle East would do that.

No these are the same people who were quacking about peak oil a short time ago. Petroleum based products from jet fuel to plastic bags to coat hangers will come down in price. Yes there will some deflationary pressure which is good but no crash

“2015 is shaping up to be a year of reckoning.”

And then, maybe, Progressive logic won’t make sense anymore and they’ll be thrown out on their a**es.

IMHO

We have had gasoline price drops several times over the last few decades. I don’t find any history of economic boom from then.

The reality is, the price drop in oil, is the same reason copper is also at a 5 year. Declines in global economy, particularly Europe and Asia, are going to cause more problems that the hopes of gasoline prices will solve.

Also, the oil/gas industry in the US has been a significant growth for jobs outside direct oil/gas hires. There will be more total loss from that, than gains from low gasoline prices. As it has each time we had gasoline price drops before.

I’d be curious to know what the author’s background is in terms of investing and connections to oil and banks.

Many say that Seeking Alpha is notorious for posts by those who try to manipulate the market (stock pump and dumps, etc.) So what is the motivation for this guy to “share” his insights with us? What’s in it for him?

That silver quarter with that nickel (or three silver dimes) is worth a lot more today, too, but chances are the car the gas went into cost under $3,000 new.

Stock market fat cats might suffer a bit.

But real-world people, who drive cars and eat food transported by trucks will benefit.

U.S. Equity Futures Flat as Franc Soars on Swiss Move

"Global markets were thrown into turmoil on Thursday as a shock move by Switzerland to abandon its more than three-year-old cap on the franc sent the currency soaring and Europe's shares and bond yields tumbling.....As investors scrambled for traditional safe-haven assets, there were new record low yields for Germany's government bonds and gains for the yen and gold. "This is extremely violent and totally unexpected, the central bank didn't prepare the market for it," said Alexandre Baradez, chief market analyst at IG in France. "It's sparking panic across all asset classes. It suddenly revives the risk of central bank policy mistakes, right when central bank action is what's keeping equity markets going."...Adding to the nervous mood, oil has also resumed its slide. Brent crude fell back to $47.50 as a rebound by copper and other metals after their big falls on Wednesday also started to wane.

Danggit! There goes my hedge! I have a 10 pound roll of copper wire that I bought at a tag sale for a BUCK about 5 years ago.

I was gonna be rich! RICH, I tells ya - when I cornered the Copper Market. ;)

Why give it to the oil industry? Just let the price support do the job, and spend the tariff on infrastructure instead of raising the gas tax.

Yeah. You could have put in your $12,000 Pinto. Oh..wait.

The central banks ARE a mistake.

Also, from the article I pinged folks about:

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.