Posted on 05/12/2023 6:41:37 AM PDT by SeekAndFind

Promissory notes are stacked to the Treasury Department’s proverbial ceiling, $31.4 trillion dollars’ worth of them. Over $5 trillion of those dollars have been purchased and are held by the Federal Reserve bank; meaning the federal financial system, in effect, lends money to itself.

Because of a statutorily-set debt limit, the Treasury hasn’t be able to borrow more money from itself to fund government operations since January, 2023. To make matters more dire, soon the Treasury won’t be able scrounge any more cash to pay all the bills through “extraordinary measures.” Congress and the President need to find a way to increase the debt limit or default on obligations.

Howls of impending disaster fill the air.

Treasury Secretary Janet Yellen articulated the situation in a May 1st letter to Speaker of the House Kevin McCarthy:

“After reviewing recent federal tax receipts, our best estimate is that we will be unable to continue to satisfy all of the government’s obligations by early June… if Congress does not raise or suspend the debt limit before that time… If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests.”

Since Secretary Yellen mentions federal tax receipts, it is worthwhile to note that in Fiscal year 2022 the federal government collected $4.9 trillion in revenue, primarily from personal and corporate income taxes, spent $6.27 trillion, and financed a deficit of $1.38 trillion. This means approximately 22% of government spending was done with borrowed money in 2022.

It was the borrowed $1.38 trillion that brought the national debt to its “ceiling” and has forced the Treasury to fund government operations through “extraordinary measures.”

(Excerpt) Read more at americanthinker.com ...

And what global leadership position is Secretary Yellen worried about losing if she can’t borrow more money?

Our global leadership position is already on shaky ground since Biden took over the White House.

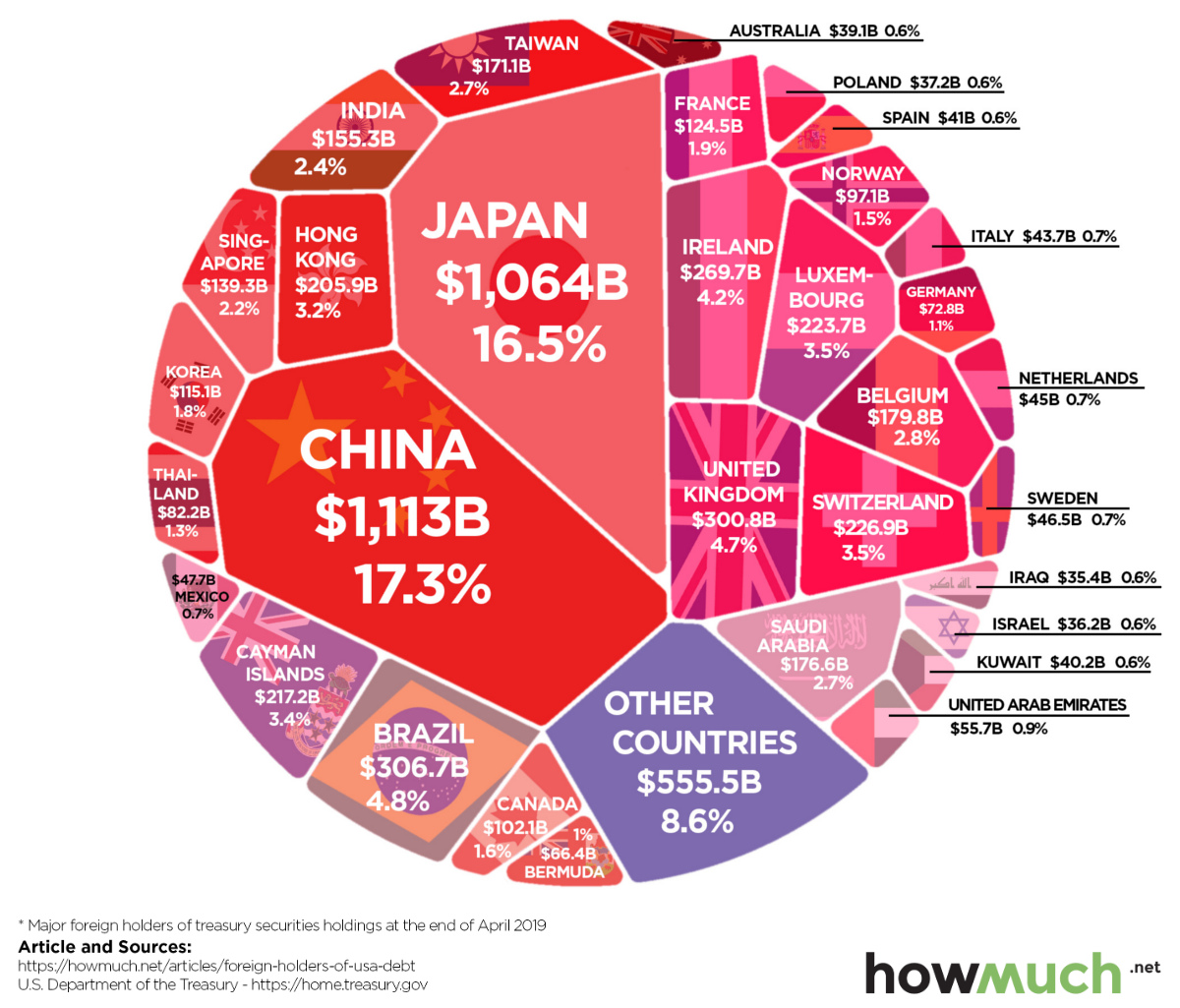

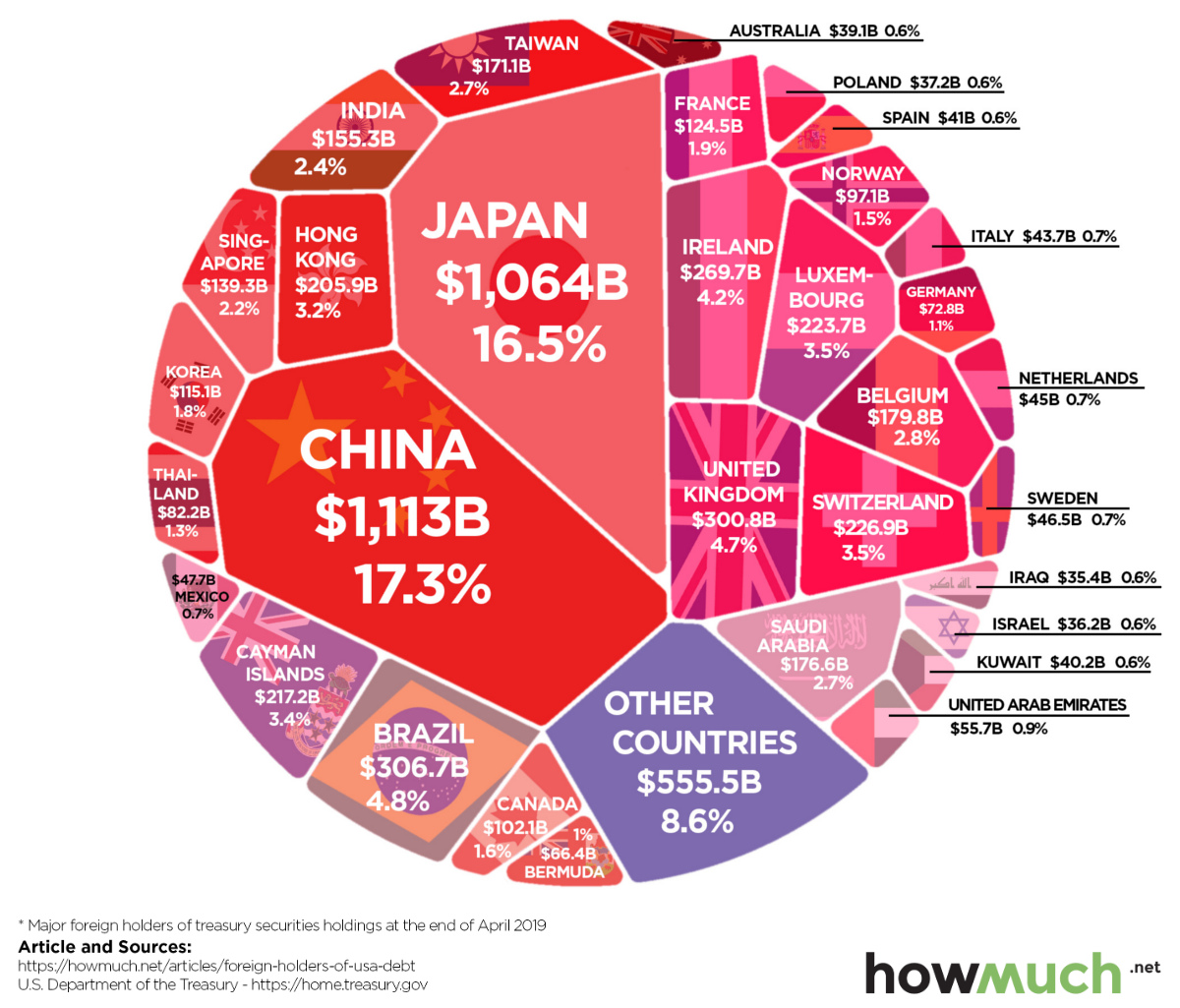

How much of our debt does CCP-China hold?

Wowzer. I had no idea Japan held that much debt!

No problem.

You can have your debt ceiling lifted.

Just give in to the spending cuts demanded by congress in their constitutionally righteous roll.

Don’t want to agree to spending cuts?

You don’t get a new debt ceiling!

Time to force these knuckleheads to play ball.

They steamroll us when they are in power but they stonewall us when we have some.

REDUCING THE SPENDING IS THE ONLY LOGICAL RESPONSE TO BEING UNABLE TO PAY YOUR DEBTS!

Cayman Islands hold 217.2 billion of our debt?

That’s 3.4% of it all wrapped up in some very wealthy entity’s offshore shell accounts. Makes you wonder who

Yeah, they’re prolific savers and US Bonds used to be the stable savings they desire.

A little more than a trillion. Japan holds a bit more than China but China gets the negative press. It’d be smart to pay off Japan and China though.

Makes me wonder how many names on that list are also on the list of visitors to Jeffrey Epstein's island getaway resort.

I guess we bumped China to first place last year. Still not a huge amount of our debt.

A trillion here and a trillion there and pretty soon you're talking about real money.

Most of our debt is held by domestic institutions.

Yep. I suspect in a lot of pension funds, too.

It’d be nice to pay it all off, but $150+ TRILLION in unfunded debt won’t ever go away, no matter how we try.

Con_gress spent an extra $6.2 trillion in less then 2 years that caused the massive inflation and high prices.

They can cut spending by $6.2 trillion for starters.

Your chart needs updating, dated 2019. China AND Japan is selling off HUGE US debt instruments, billions, that said 65 percent of the world’s nations also are- African nations, Brics , etc.all dumping.

The ONLY away to sustain our huge debt is now through heavy taxation, and as the US GDP, production, disposable incomes etc withers away, the can will be kicked down the road many be a few more inches.

The interest we are now paying on our debt ( more than some nations treasuries) is unsustainable for more than at most a few years, less if interest rates keep climbing.

US default on debt WILL occur, it will be sudden, unannounced, and historical.

Question is when? Study Argentina for clues. They used to be the richest, most prosperous nation in SA, last week they announced they are now finally broke, and have defaulted on all their debt obligations.

Their total collapse was delayed by billions of loans, ….so who will loan to the US when those days arrive? No one.

Most of our debt is held by domestic institutions.

———

Yeah, like SVB bank that cratered. The other disturbing fact is pensions, 401k’s, etc…..a leading contribution to SVB’s legendary failure was the amounts of “ excess” uninsurable money was parked in US debt instruments.

Nothing will happen to any big social programs if the debt limit is not raised this month or the next or the next. It is just a made scare tactic by yellen.

Everyone see for yourself and advance the video to 2:43.

https://www.youtube.com/watch?v=a1VqaUn0Lfo

Enough to call it due and destroy USA.

Exactly why the Deep State had Biden put us in this position.

I’m surprised it hasn’t happened already.

It’s an 1,800lb boulder hanging over our heads...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.