Posted on 10/21/2022 1:11:34 PM PDT by RomanSoldier19

Treasury-market liquidity is drying up and it’s going to get worse. The problem is bigger than it seems.

Liquidity in the U.S. bond market, the world’s largest, has been deteriorating since the Federal Reserve began raising interest rates earlier this year. The end of massive monthly bond purchases followed by the start of quantitative tightening has worsened the problem as the Fed tries to extricate itself from Treasury and mortgage markets after buying a third of each. Treasury Secretary Janet Yellen recently said she was “worried about a loss of adequate liquidity in the market,” as Treasury supply booms to fund government spending but regulations limit big financial institutions’ willingness to serve as market makers. At the same time, traders see the potential for another 2% in rate hikes by March 2023.

(Excerpt) Read more at barrons.com ...

Why do we have a Federal Reserve? What’s the point?

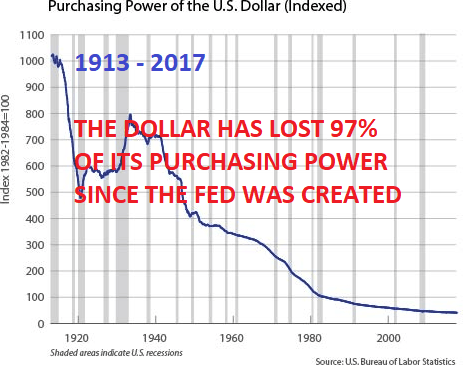

Since its creation we’ve had the 1929 Great Depression, 1970’s stagflation, the 2008 Great Recession and now this.

Weren’t they supposed to stabilize the value of our currency?

Anything could happen

Folks pay attention to the Dow and the stock market. A lot of them have no clue that the bond market is where the “real” money is. If it freezes up, it’s lights out.

I think we are a ways away from that. But, as the man once said, “You go bankrupt slowly…then all at once.”

I suggest listening to this if you have the time. https://www.youtube.com/watch?v=lu_VqX6J93k It will explain the real reason for the Fed.

Printing more without manufacturing, (USA has become service dominate) weakens the value to the point of being abandoned as the reserve currency.

That's when the real hurt begins.

the market is def volatile these days. Up 700+ today. What do you think happens Monday? I think it plummets

Global liberals got Truss to quit, after being elected Prime Minister of the UK. I see this as an attempt to do the same, preemptively, in the US. Not gonna work.

No. They are supposed to be focused on solid employment, stable interest rates, and stable inflation. They failed. But they have gone beyond that and have meddled in many other aspects of the economy and markets to wit buying up stocks, housing loans and more to grease wall street wheels and prop up foreign governments who are overleveraged and since the Dollar remains the reserve currency they have to intervene worldwide to keep markets liquid.

I don't envy their position. Based on data generated over the last year they make decisions today that won't have a meaningful impact until a year later. It's a crappy job.

As to the issue at hand and your question "why/what's the point" it is to a degree a check and balance on Congress. If there was no Federal Reserve then Congress would order the Treasury to keep the presses running 24 hours a day. Which might be a better solution (get rid of the fed) because right now they bury inflation in long term debt but if the Treasury was printing 24/7 every man woman and child would feel the effects of massive long-term inflation and would vote accordingly to get rid of the tax and spend morons.

What Yellen is seeing is the market in action - they are having trouble selling Treasuries to finance our Debt and I have some guesses as to why but would like to look into it more. None of this is to say I support the existence of the Fed or its actions. They have been way behind the curve as inflation was really hot in many sectors during the pandemic but not felt across the board because producers ate the margins to keep goods moving where they could and Congress gave away what was it $7 trillion(?) so that helped prevent a total economic collapse. Now the Fed seem to have over-reacted to inflation and we won't see the impact of it until mid to late 2023 (and beyond).

No. They are supposed to be focused on solid employment, stable interest rates, and stable inflation. They failed. But they have gone beyond that and have meddled in many other aspects of the economy and markets to wit buying up stocks, housing loans and more to grease wall street wheels and prop up foreign governments who are overleveraged and since the Dollar remains the reserve currency they have to intervene worldwide to keep markets liquid.

I don't envy their position. Based on data generated over the last year they make decisions today that won't have a meaningful impact until a year later. It's a crappy job.

As to the issue at hand and your question "why/what's the point" it is to a degree a check and balance on Congress. If there was no Federal Reserve then Congress would order the Treasury to keep the presses running 24 hours a day. Which might be a better solution (get rid of the fed) because right now they bury inflation in long term debt but if the Treasury was printing 24/7 every man woman and child would feel the effects of massive long-term inflation and would vote accordingly to get rid of the tax and spend morons.

What Yellen is seeing is the market in action - they are having trouble selling Treasuries to finance our Debt and I have some guesses as to why but would like to look into it more. None of this is to say I support the existence of the Fed or its actions. They have been way behind the curve as inflation was really hot in many sectors during the pandemic but not felt across the board because producers ate the margins to keep goods moving where they could and Congress gave away what was it $7 trillion(?) so that helped prevent a total economic collapse. Now the Fed seem to have over-reacted to inflation and we won't see the impact of it until mid to late 2023 (and beyond).

.

Ha Ha Ha Ha Ha!!!!!

That's a good one!!!

.

I hate that website. They post a bunch of charts and tables, and give no analysis of any kind to provide context or explain what they’ve posted.

“They are supposed to be focused on solid employment, stable interest rates, and stable inflation.”

That is the “official” version fed to the peons as propaganda.

In the real world they are focused on making the wealthy wealthier—by any means necessary.

The Fed is not your friend.

No argument here.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.