Sep 21, 2022

Today, the Federal Reserve announced another 0.75 percentage point increase in the target for the federal funds rate. The increase in that rate, which is the interest rate at which commercial banks lend to one another overnight, is meant to help tame rising inflation; however, the increase also has implications for the federal government’s borrowing costs and therefore the nation’s fiscal picture.

The Fed’s move will set the target range for the federal funds rate to between 3.00 and 3.25 percent. It reflects the fifth time the central bank has raised rates this year after holding them close to zero since the onset of the pandemic. The federal funds rate is the benchmark for Treasury bills and other short-term securities. Adjusting the rate is an important tool for the Federal Reserve to help achieve their statutory mandate, which is to promote the goals of maximum employment, stable prices, and moderate long-term interest rates. Expectations about the short-term rates, combined with other factors, may also affect longer-term rates that are applied to business investment loans and consumer borrowing such as mortgages and car loans.

However, as interest rates on U.S. Treasury securities rise, so too will the federal government’s borrowing costs. The United States was able to borrow cheaply to respond to the pandemic because interest rates were historically low. However, as the Federal Reserve increases the federal funds rate, short-term rates on Treasury securities will rise as well — making some federal borrowing more expensive. Expectations about short-term rates and inflation have already pushed up longer-term rates as well.

In late May, the Congressional Budget Office (CBO) projected that annual net interest costs would total $399 billion in 2022 and nearly triple over the upcoming decade, soaring from $442 billion to $1.2 trillion and summing to $8.1 trillion over that period. However, if inflation is higher than CBO’s projections and if the Fed raises interest rates by larger amounts than the agency projected, such costs may rise even faster than anticipated.

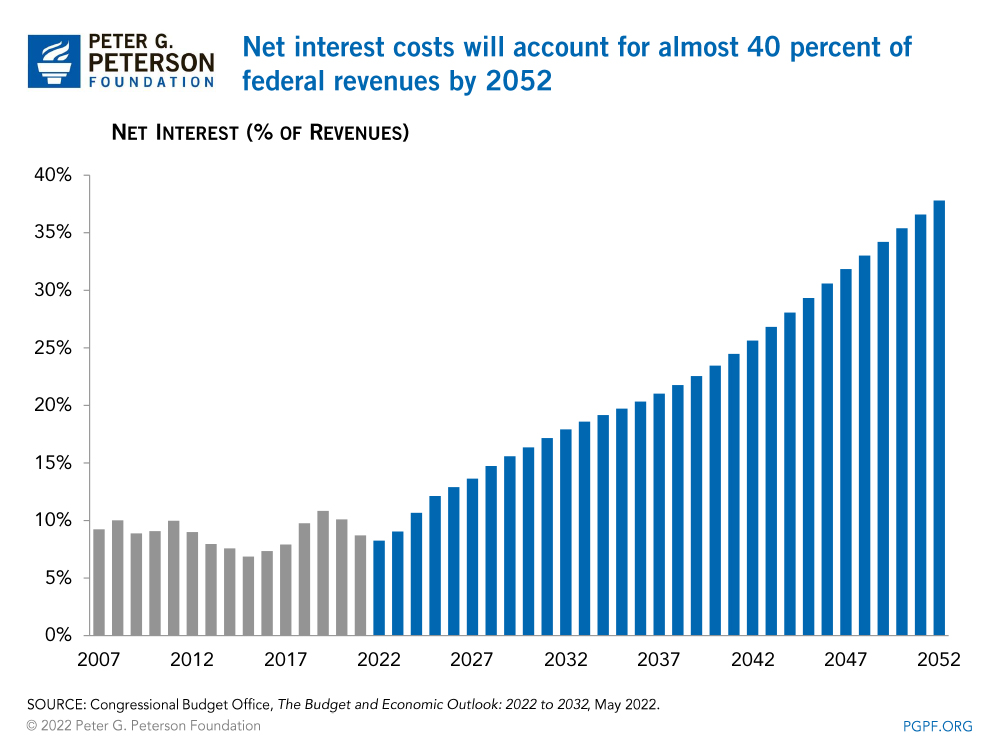

The growth in interest costs presents a significant challenge in the long-term as well. According to CBO’s projections, interest payments would total around $66 trillion over the next 30 years and would take up nearly 40 percent of all federal revenues by 2052. Interest costs would also become the largest “program” over the next few decades — surpassing defense spending in 2029, Medicare in 2046, and Social Security in 2049.