Brandon is probably scared straight about Desantis Ron could send him back to Delaware.

Seems Trump has Desantis' back all the time:

Posted on 09/25/2022 4:37:11 AM PDT by Alas Babylon!

The Talk Shows

September 25th, 2022

Guests to be interviewed today on major television talk shows:

FOX NEWS SUNDAY (Fox Network): New permanent anchor Shannon Bream: Rep. Elise Stefanik (R-N.Y.); Sen. Joe Manchin (D-W.Va.); retired Gen. Jack Keane. Panel: Katie Pavlich, Howard Kurtz, Jeff Mason and Harold Ford Jr.

MEET THE PRESS (NBC): Hosted by Chuck U. Toad: National security adviser Jake Sullivan; Rep. Jamie Raskin (D-Md.); Rep. Nancy Mace (R-S.C.). Panel: Sara Fagen, Mike Memoli, Amna Nawaz and Jen Pisaki—just another easily forgotten group of angry Leftists slinging anti-American balderdash.

FACE THE NATION (CBS): Margaret Brennan anchors: Ukrainian President Volodymyr Zelenskyy; national security adviser Jake Sullivan; Rep. Pete Aguilar (D-Calif.); President and CEO of the Federal Reserve Bank of Atlanta Raphael Bostic; CBS pollster Anthony Salvanto.

THIS WEEK (ABC): Hosted by Little Georgie Steponallofus: National security adviser Jake Sullivan; Sen. John Barrasso (R-Wyo.).. Panel: Dan Abrams, Sarah Isgur, Chris Christie, Donna BrazileNut, Rachel Scott and Julie Pace–more Fat RINOs and Left-wing Propagandists!

STATE OF THE UNION (CNN): Anchored by Jake Toe-Tapper: British PM Liz Truss; Rep. Adam Schitt (D-Calif.);--former GOP governor of Tennessee 2012-2018 Bill Haslam and former democrat governor of Tennessee from 2003 to 2011 Phil Bredesen. They’ve launched a podcast aimed at bringing together opposing views for civil conversations on complex issues—Tapper doesn’t always have a panel, but when he does, it is made up of fruits and nuts!

SUNDAY MORNING FUTURES (FNC): The Show to watch! Hosted by Maria Bartiromo: Sen. Mike Lee (R-Utah); Sen. Tom Cotton (R-Ark.) ; House Minority Whip Steve Scalise (R-La.) and Arizona GOP nominee for governor Kari Lake.

So who remembers the 1980's mantra - Just in Time deliveries.

Well that worked for a while, the U.S. offshored manufacturing of all manner of things.

Forty plus years later we have consequences.

Every generation will re-learn history one way or another

Margaret Brennan now the latest anorexic. She must weigh 90 lbs. What is wrong with these women? Bad enoough to be on the left much worse to sabotage your own body.

I too agree that we are about to relive the late 1920s/early 1030s.

I believe we are in the "bad" portion of The Fourth Turning cycle.

Mostly this leads to war

Barron's--The Last Thing the World Needs Is an Italian Debt Crisis

The last thing that a fragile world economy needs right now is another round of the European sovereign-debt crisis. Yet judging by recent Italian economic and political developments, that is what could very well happen as early as this winter. These dynamics will constitute a major challenge for a European Central Bank that is working to keep the euro zone together. It could also add to world financial market volatility.

Italy’s systemic importance is underlined by its very size. Not only is Italy’s $2 trillion economy some ten times that of Greece, its almost $3 trillion sovereign-debt market is the world’s third largest, following the U.S. and Japan. If in 2010 a Greek sovereign-debt crisis sent shock waves through the world economy, how much more so would an Italian sovereign-debt crisis do so today?

Italy’s main economic vulnerabilities are its mountain of public debt and its sclerotic economic growth. At around 150%, Italy’s public debt-to-GDP ratio is now the highest in that country’s history and the second highest in the euro zone, after Greece. Meanwhile, Italy’s per capita income today is barely higher than it was in 1999, when Italy joined the euro.

Up until recently, markets had not raised serious questions about Italy’s debt sustainability. With interest rates at ultralow levels, Italy’s debt servicing costs were not particularly high. At the same time, as part of its quantitative easing program, over the past two years the ECB bought €250 billion of Italian government bonds (equivalent to $250 billion today). That represented more than the entirety of the Italian government’s net bond issuance.

Now, markets are starting to question the sustainability of Italy’s debt. The spread between 10-year government bonds issued by Italy and Germany has widened to their highest levels since the pandemic began. They are doing so as the ECB has begun an interest-rate hiking cycle and has terminated its quantitative easing programs. Simultaneously, Russian President Vladimir Putin’s decision to shut down Russian natural-gas exports to Europe threatens to throw Italy along with the rest of Europe into a meaningful economic recession.

It hardly helps matters that Italy’s euro membership makes it difficult for that country to put its public debt on a better footing through budget austerity. If it had its own currency, Italy could resort to exchange rate depreciation to incentivize its export sector as an offset to budget belt tightening. But as a member of the euro, this is impossible. Budget austerity would instead be counterproductive, since it could have the effect of deepening the Italian economic recession.

Brandon is probably scared straight about Desantis Ron could send him back to Delaware.

Seems Trump has Desantis' back all the time:

IF true, than we will see Israel react.

And that will see the price of Gas/Oil go through the roof

Sep 21, 2022

Today, the Federal Reserve announced another 0.75 percentage point increase in the target for the federal funds rate. The increase in that rate, which is the interest rate at which commercial banks lend to one another overnight, is meant to help tame rising inflation; however, the increase also has implications for the federal government’s borrowing costs and therefore the nation’s fiscal picture.

The Fed’s move will set the target range for the federal funds rate to between 3.00 and 3.25 percent. It reflects the fifth time the central bank has raised rates this year after holding them close to zero since the onset of the pandemic. The federal funds rate is the benchmark for Treasury bills and other short-term securities. Adjusting the rate is an important tool for the Federal Reserve to help achieve their statutory mandate, which is to promote the goals of maximum employment, stable prices, and moderate long-term interest rates. Expectations about the short-term rates, combined with other factors, may also affect longer-term rates that are applied to business investment loans and consumer borrowing such as mortgages and car loans.

However, as interest rates on U.S. Treasury securities rise, so too will the federal government’s borrowing costs. The United States was able to borrow cheaply to respond to the pandemic because interest rates were historically low. However, as the Federal Reserve increases the federal funds rate, short-term rates on Treasury securities will rise as well — making some federal borrowing more expensive. Expectations about short-term rates and inflation have already pushed up longer-term rates as well.

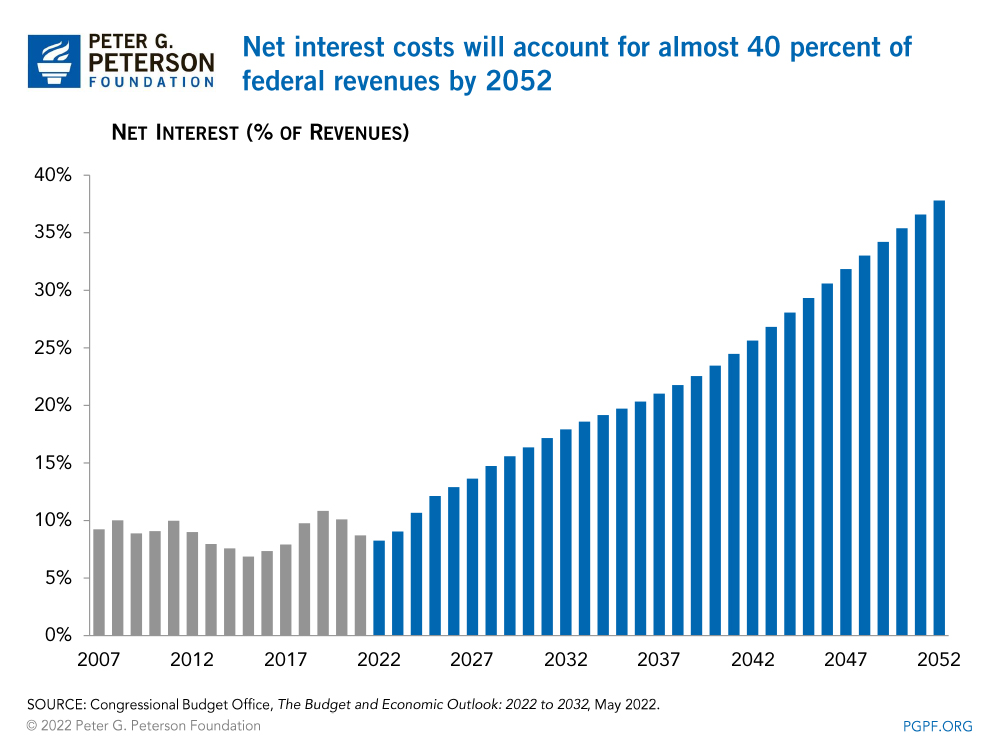

In late May, the Congressional Budget Office (CBO) projected that annual net interest costs would total $399 billion in 2022 and nearly triple over the upcoming decade, soaring from $442 billion to $1.2 trillion and summing to $8.1 trillion over that period. However, if inflation is higher than CBO’s projections and if the Fed raises interest rates by larger amounts than the agency projected, such costs may rise even faster than anticipated.

The growth in interest costs presents a significant challenge in the long-term as well. According to CBO’s projections, interest payments would total around $66 trillion over the next 30 years and would take up nearly 40 percent of all federal revenues by 2052. Interest costs would also become the largest “program” over the next few decades — surpassing defense spending in 2029, Medicare in 2046, and Social Security in 2049.

2. Italy or Japan - The Japs have had 30+ years of ever increasing Debt - I wonder if/when Soros will do to the Japs what he did to the British Pound the last time the Pound had parity with the $

3. Today's Italian Elections - will be interesting, wonder if they will have an impact on Monday's Wall Street open

SSI will see an 8-8.5 % increase tis year. This will be official sometime in mid/late November.

So add some more $ to the deficit

Japan was ascendant in the 1980s, and since they used Just in Time deliveries, we decided that the way to beat them was to use Just in Time deliveries. The only problem was, Japan’s supply chain was fairly local.

Thanks for the link.

Meanwhile, bogus raids, NY attorney general with no proof shown that someone was hurt by alleged fraud.

MSM pounding the alternative universe where Saint Joey, and archangel Hunter are squeaky clean...

almost anywhere within the cone of uncertainty lands on “relatively” sparse populations east or west of Apalachee Bay. -—as opposed to highly populated areas.

I’d call that good news, (unless it hit me directly with cat 4 winds and floods)

Let’s hope your COC analysis develops into a weak hurricane.

When Jews were being put in overs the average German was judging himself and his neighbors based on things like how nice their 'window (flower) boxes looked.

The best armed population in the history of the world would NOT plan an 'insurrection' using flagpoles as 'weapon of choice'. January 6th was a first amendment protected protest that went violent. Chuck Todd and Liz Cheney are impressed with each other's window boxes.

Let us relive some recent history.

Let us visit the New York Real Estate market, the time the Japs were buying up all of that high $$ real Estate

Japan Buys the Center of New York - New York Slimes - Nov. 3 1989

Israel may NOT react to Iran now that Bibi is on the shelf. The new Prime Misister Lapid just proposed to the UN that Israel be partitioned to give “Palestinians” a homeland also. “The Peace Process” has gone to hell. Jared Kushner and Trump ushered in a huge peace deal with other Arab nations under the Abraham Accords - but like all Trump good ideas, FJB immediately proceeded to undermine and scuttle them.

https://www.msn.com/en-us/news/world/israeli-prime-minister-to-give-support-to-two-state-solution-during-un-general-assembly/ar-AA125Sp1

A interesting history of Just in Time deliveries Old mean Henry Ford, he build factories that provided "just in Time" Parts for his assembly plants.

Then the Japs after the war took this policy one step further to improve employment - they SUBCONTRACTED just-in-time to local 3rd parties.

The Koreans have their own version - CHAEBOLS

A chaebol is a large industrial South Korean conglomerate run and controlled by an individual or family. A chaebol often consists of multiple diversified affiliates, controlled by a person or group whose power over the group often exceeds legal authority.

We both know things won’t get any better until we get brandon/obama out of power. They are purposely trying to destroy the country. That’s had to overcome.

So the obvious question - How long will "Lipid's" minority g'ment last?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.