Posted on 01/20/2022 6:44:39 AM PST by blam

Planning to import goods from Asia by ocean and sell them in America this summer? Better act fast. The trans-Pacific cargo move can now take over three months. According to multiple sources, average transit times have risen to double pre-COVID levels — and they’re still increasing.

Methodologies and data sources differ, so time estimates vary. But each dataset shows the same trend: With every passing month, more vessels, container equipment and goods inventories are getting waylaid in the Pacific.

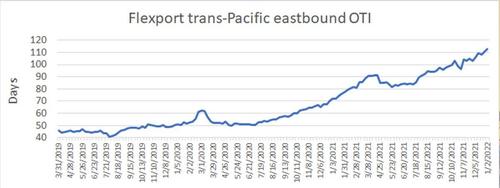

Flexport

Flexport launched its weekly Ocean Timeliness Indicator (OTI) in early December. The OTI uses data from Flexport’s freight forwarding customers back to March 2019, measuring the time from the cargo-ready date at the exporters’ gate to the date when products leave the destination port (i.e., the landside transport time from the factory to the port in Asia, the Asian port wait, the ocean journey, and the North American port wait). The OTI is an average for loads from all Asian countries to all North American ports on any of the three coasts.

Flexport’s Asia-U.S. OTI reached an all-time high of 114 days last week. That’s 41 days or 57% higher than at the same time last year, and 63 days or 125% higher than at the same time in 2020, pre-COVID.

A shipment time is not included in the average until the import cargo leaves the U.S. port, meaning the indicator is retrospective. Goods included in the average in the first week of January might have left an Asian factory in early October, at a time when the queue of waiting ships off Los Angeles/Long Beach was around 40% smaller than it is now.

Phil Levy, chief economist of Flexport, explained the value of the OTI in an interview with American Shipper. “It does speak in terms of days, and in that sense it’s supposed to give a general idea of the magnitude shippers have to deal with. But it’s not a precise, forward-looking estimate of how long it will take you to get from your factory in Vietnam to Vancouver, for example.

“This is intended as a straightforward and transparent measure of how severe the crisis is,” he said. “You see a lot of things that jump around and other fleeting measures. You might say, ‘Hey, I got a great spot rate out of Yantian so I guess the crisis is over’ or ‘There was stuff on the shelves when I went shopping yesterday so I think we must be OK.’ But the OTI is something that is fairly consistent, you can see it over time, and you can see the degree of variability over time. You can see that these are dramatically longer times than we’ve had before — and they haven’t backed off yet.

“Let’s suppose the supply chain fairy waved a wand and solved all of these problems and we went right back to the old shipping times of the pre-COVID era again. What would the ‘all clear’ look like? You wouldn’t see an immediate drop because it would take awhile for things to sort out [due to the OTI’s retrospective nature]. But you should start to see this trending down as each stage [Asia factory to ships/ocean/U.S. port] moves faster. And we haven’t seen that yet. If this resolves, you should see something very different here.”

Freightos

Another measure of trans-Pacific shipping duration is produced by Freightos. It uses data since October 2019 from bookings on its Freightos.com marketplace, including both full container load (FCL) and less than container load (LCL) business.

The average monthly transit time is measured from China to U.S. ports, with the majority going to the West Coast ports. The delivery times are measured on an end-to-end basis, generally warehouse to warehouse.

Freightos calculated that it took an average of 80 days in December for trans-Pacific cargo, with FCL at 72 days and LCL at 82 days. The average transit time is 51% or 27 days higher than in December 2020 and 86% or 37 days longer than in December 2019, pre-COVID.

Shifl

Yet another dataset is produced by Shifl. This data tracks the ocean transit time of ships from when they leave major Chinese ports (Ningbo, Qingdao, Shanghai, Yantian) to their arrival in Los Angeles/Long Beach.

As of the first half of December, Shifl calculated that the transit time was 34 days, more than double the pre-COVID average of 16 days and about two weeks more than transit times in the middle of last year.

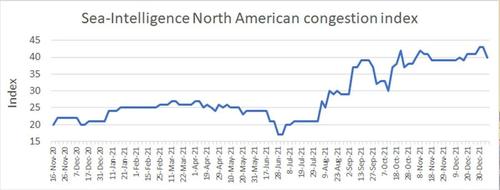

Sea-Intelligence

The second-half rise in the measures published by Shifl, Freightos and Flexport mirror the increasing number of container ships waiting offshore for berths in Los Angeles and Long Beach. According to data from the Marine Exchange of Southern California, an all-time high 105 container ships were waiting for berths on Thursday and Friday, with 103 waiting as of Tuesday.

The difference between the on-the-water data from Shifl and the end-to-end data from Flexport and Freightos confirms how much time is being lost at terminals on either side of the ocean.

Sea-Intelligence has developed an index, using data from carrier HMM, to quantify the level of terminal congestion on the North American side of the equation. That index has doubled over the past year.

Alan Murphy, CEO of Sea-Intelligence, warned this week: “It seems that there is no sign of imminent improvement. All available data shows that congestion and bottleneck problems are worsening.”

Because we live in the sticks, we buy a LOT of stuff off amazon. We’ve seen zero change.

That could change at any time, of course, but so far all of this is just noise, at least where the rubber meets the road for us.

About a decade ago....Amazon went to contracting their ships/planes for ‘goods’. They can arrange their port selection (avoiding Long Beach). So I don’t think you can find much on delays within their system.

Third quarter 2021....Wal-Mart started doing the same thing...contracting their vessels.

I think the ‘big boys’ saw this coming already in the summer of 2021.

And the tell that Buttigieg will be the anointed one for 2024 is revealed yet again.

My daughter got her bicycle from Germany seven months after she was supposed to have gotten it. She was lucky to get it at all given all the boxcars being broken into.

I recently took a hike along the California coast where we could see all the ships waiting to enter the harbor - as far as the eye could see.

What disturbed me was the very thick layer of smog over the ships. Nothing from environmentalists about that, of course.

We buy most of our groceries from Whole Foods (yes, I know it’s “Whole Paycheck”).

Since they brag about their products being mostly locally grown or made, there have been very few supply disruptions or empty shelves as far as I can tell.

At the local supermarket, it is a different story. I have to go there to get the food my cats like and it has been difficult to get for about six months now.

Our dog now gets a mixture of dry dog food and the meat from those Costco rotisserie chickens. He loves it.

I heard that one of the more serious shortages right now is cat food.

We should wean ourselves off of Chines goods…..as of years ago.

Aftermarket auto parts and electronics are the only imports I buy because there is no other choice.

When does the cheaper cost of making something overseas, and specifically China, be overcome by shipping costs?

For example, say a widget costs 5 cents to make in China versus 10 cents in the US? So, make it in China and save 50%.

But what happens when it costs 5—or more—cents to ship that widget to the USA from China?

Move the widget factory back to the USA?

Good for us!

Third quarter 2021....Wal-Mart started doing the same thing...contracting their vessels.

I think the ‘big boys’ saw this coming already in the summer of 2021.

But there will also be unintended consequences and opportunities for small business..;

We’re doomed. We have conservative freepers frequenting amazon who is the enemy of conservatives. I live rural too but haven’t bought anything from amazon in a few years other than a couple of ebooks for $2.99 each.

I avoid walmart too. I was buying soda for the wife and kids but have been catching it on sale at the local grocery instead. I buy dog food at the MFA feed store. Costs a few bucks more than walmart but not really because what I buy has the first/main ingredient of chicken by product, not corn. If I bought dog food with some sort of meat protein as the first/main ingredient at walmart, it would be just as much as the feed store. It would have to be IAMS, Purina One etc aka premium.

I do use amazon for research via the extensive reviews but then I find the product somewhere else, often direct from the manufacturer’s website. Sometimes from ebay and when I get something from ebay, I make sure the seller is in a red state if possible. Never NY, RI, CT, MA, VT, CA, etc.

If we all can’t fight in every single way possible, even the tiniest ways, we will lose.

What’s interesting is that neither of our dogs would eat CostCo rotisserie chicken - we figured if they won’t eat it, neither would we. Could never figure out why b/c both dogs LOVE rotisserie chicken from Ralph’s or Sprouts - but would turn their noses up at the CostCo chicken - including the big dog who ate anything and everything.

We stopped eating them from CostCo after that.

One thing we noticed was the costco chickens are significantly larger than the ones at Kroger and Walmart. The one I like the flavor of the most is Walmart.

However, Costco’s are $5 and walmart’s is $6. We don’t get the costco one often because where we live now, costco is 90 minutes away. It’s a bi-monthly trip.

BTW, costco loses money on those things. They are a “loss leader”.

A parcel I had shipped from Mumbai India took two days to leave after I ordered it. It spent two months sitting in the U.S. Post Office Customs before arriving. Apparently nobody reports to work anymore due to covid. Stuff just piled up and going nowhere.

I get the 10 pound bags of chicken leg quarters for my dogs at Walmart for a little over six dollars a bag.

Thanks! That is VERY useful information!

The shortages I can see are in speciality items, special pet food, certain grocery items, special materials and metals.

Not sure why, but saltine crackers are in short supply, but snack crackers are no problem. Friends in the fabrication business say high-end aluminum is scarce. After a little bad weather over the weekend, the grocery store produce section was empty - not a fresh potato or tomato in sight on Tuesday.

Make everything here and we no longer need sea ports or importing 3rd world labor and/or standard of living. There’s a thought.

All those things should have heavy import duties on them.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.