Unemployed people spending no more than they were when they were employed probably won't cause inflation.

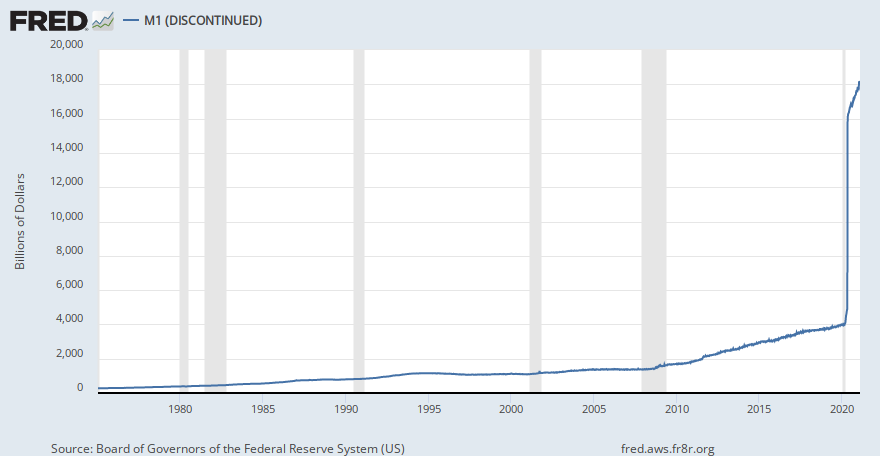

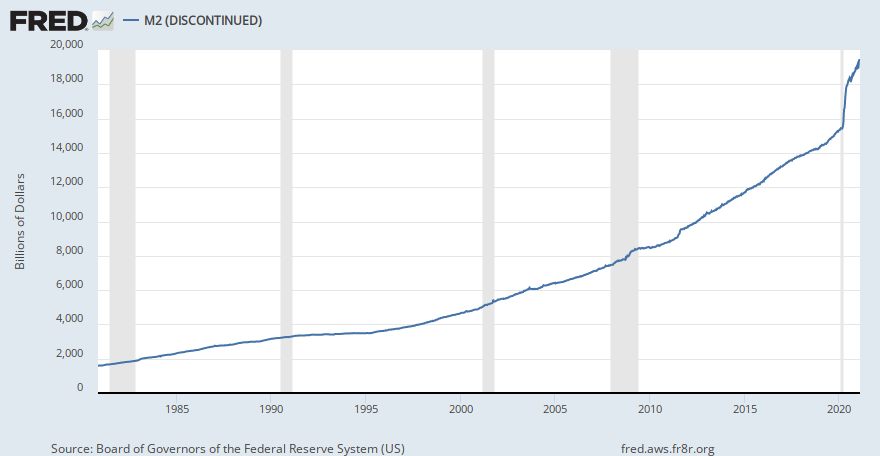

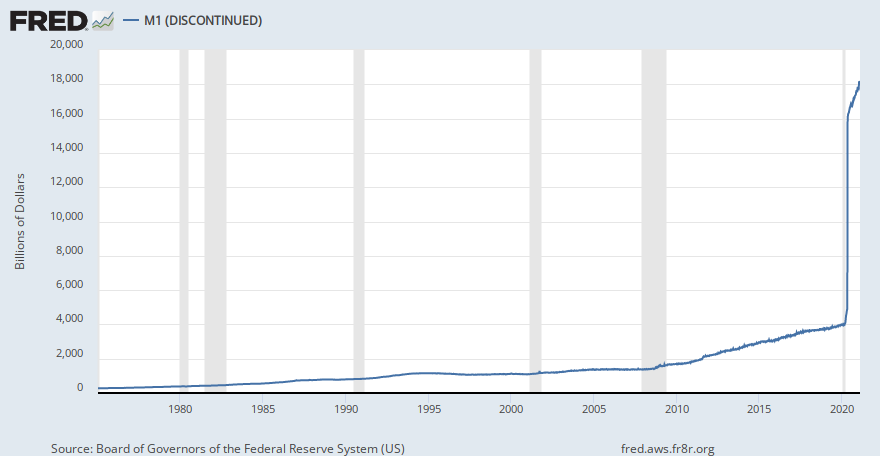

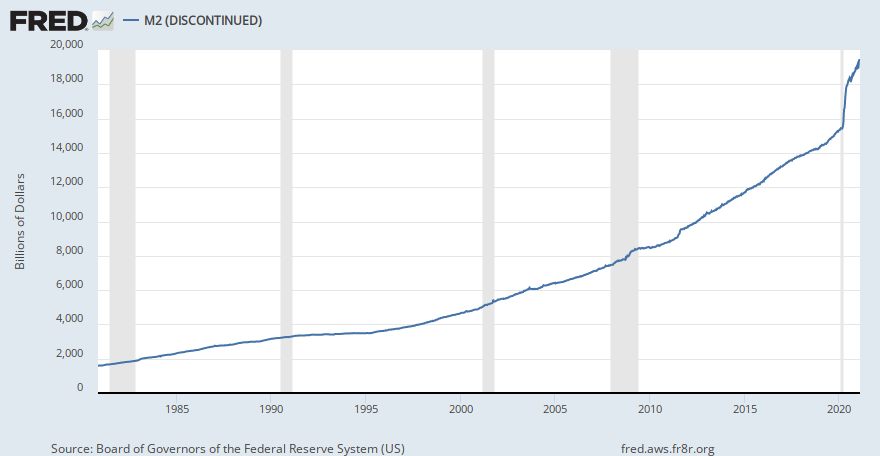

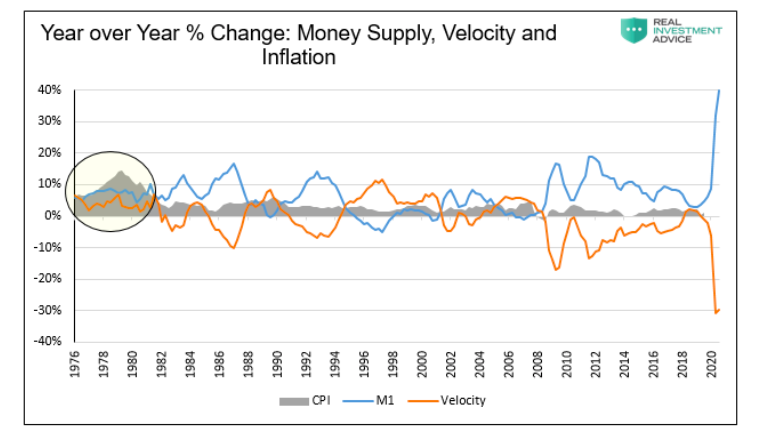

The charts on M1 and M2 are scary. And the FED recently redefined M2. M2 is not as bad as M1. But still..

Of course inflation’s coming. It’s already here. “Modern Monetary Theory” is a bunch of crap.

We won’t be on this financial system much longer. Its already bankrupted.

In 1990 the cheapest new cars were about 1/4 of the median income. Today, they are more than 1/2. In real dollars cars have doubled in price in 30 years. (To be honest, they’ve also gotten a lot better) That is inflation.

Inflation is built into the system. Money is based on air and has no inherent value. The government prints more dollars and deflates the value of the currency. Politicians crow about how well the economy is doing, when it’s nothing more than inflated numbers giving the illusion of economic growth.

Stagflation makes a comeback.

It was Soooo fun the first time around.

Unemployed people spending no more than they were when they were employed probably won't cause inflation.

The charts on M1 and M2 are scary. And the FED recently redefined M2. M2 is not as bad as M1. But still..

To make matters worse, Congress will finally push through a $15/hr minimum wage, IMHO.

Hmmm...

I see ice-cream 1/2 gallon has risen, in past 2-months, from $2.39 to $4.98...

I see gasoline per gallon has risen from $2.19 to $2.89...

I see a can of Maxwell house coffee has risen from $6.25 to $8.25...

I see street walkers .... Oh wait... Never mind...

What does it mean when some nitwit now says inflation is “coming in the future?

Yay, fear porn.

Oh, how f***ing wonderful-a nostalgic revisit of the years of the Carter malaise-me getting laid off the job I’d had since graduating from college, my hubby working an extra job evenings and weekends so we could keep the bills paid and send the little cub to a private school instead of the inferior public one, squeezing every dollar and every gallon of gas-just what I’ve been wanting to do again...

Well at least this time around I work for myself and don’t have a cub at home to support, so...

The paper we pass around as money is worthless. Making more of it makes it even more worthless. Inflation ensues. Quite simple actually.

“Modern” anything on the social ‘science’ world is akin to phrenology or astrology. There’s a reason those clowns went into the marshmallow and easy world of making things up and believing.

That’s the plan, isn’t it?

Welcome to Weimar America.

U.S. currency being a world standard, the effects of the inflation will probably be dispersed world-wide, which means that its overall effect will be lessened and poor people in Ethiopia will pay for our monetary sins.

2021 M2 is 2.6 times 2007.

Assume in the worst case that the supply of goods hasn't changed since 2007 and that spending on goods is proportional to M2.

Then we are talking about potential inflation of 260% since 2007.

Now let's refine our model

GDP has risen from 3071B to 4289B. 2007 to 2021. A 1.4 increase.

That's not nominal dollars so even if that 1.4 increase reflects some inflation, it's inflation that we don't have to worry about in the future because it's already manifested.

Thus 7471B/3071B = a ratio of M2/GDP = 2.43 in 2017

Compared to 19,394/4289 = 4.53 in 2021.

4.53/2.43 = a potential inflation of 1.86 or 86%.

Bad but better than 260%.

Now lets look at the spending assumption by examining what has happened to savings.

Personal savings have risen from 380B in 2007 to 3930B in 2021. On a per person savings thats, 380B/320M citizens = $1,188 per person in 2007 to 3930/320M citizens = $12,281 per person in 2021.

You could argue that the personal savings represents a much needed improvement.

And people probably aren't going to dissave in a time of crisis and they may make that change permanent.

So that's my back of the envelope analysis. We might be looking at inflation but it's not going to be hyper inflation (defined as 50% a month) or even 50% a year. A lot depends on what the FED and US government does in the future.

I'm guessing less than 10% a year, as the FED does have a number of ways to manage this. They can reduce the money supply as people go back to work. They can raise interest rates if the economy becomes overheated and bottlenecks start to appear which would decrease the velocity of money. Higher interest rates would increase the government deficit, but the FED could increase their purchases of gov't debt causing the interest payments to flow right back to the treasury. So the impact on the deficit could be mitigated. Still government needs to learn to live within their means. Starting with policies like tariffs that bring the economic engine to full capacity and prevent jobs from going overseas. And tax policies that keeps the engine running instead of being a disincentive. Getting the economy going full speed, cuts government spending in a number of ways, while providing more tax revenues.

.

MMT does not deny that printing money produces inflation. The key to understanding MMT is simply that it is a unique interpretation of the concept of money that the promoters use to justify the same policies that we’ve been pursuing for the last 80 years anyway. Nothing is new except the pinhead logic behind it.

One word:

“Duh.”

They are going to do negative interest rates. The more the Treasury borrows from the FED, the lower the debt will go.

And we will pay the banks to hold our money.

Hopefully they will eliminate the federal income tax.