Posted on 08/14/2019 1:52:05 PM PDT by Kaslin

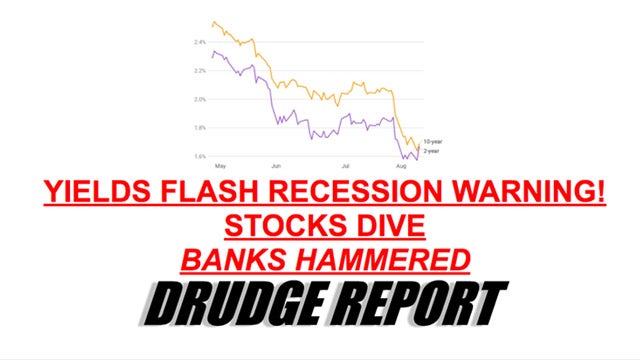

RUSH: The Drive-Bys, they’re incorrigible. Now they are literally trying to once again talk the people of this country into a recession. Now they’re doing it with the inverted yield curve. And the whole problem here is the Federal Reserve. The Federal Reserve is anti-Trump, is making a mess of the interest rate circumstance.

So many people in that town want rid of Trump that they’re going to stop at nothing. It doesn’t matter what damage they do to the economy or the country. And it’s not unprecedented, folks. This has been done before. What was it, back in 2006, the midterms, the Drive-Bys were doing everything they could to talk down the economy. We had the so-called financial crisis of 2008. And, of course, they were doing everything they could in the second Bush term to talk down the economy while sabotaging the Iraq war and war on terror efforts.

It’s never ending, and of course now you’ve got the headlines we’re just right around the corner because of this yield curve, the inversion in the yield curve. This has to do with bond prices and yields. And it’s all a function of the Federal Reserve setting interest rates and the Federal Reserve acting like they’re the central bank for poverty-stricken nations around the world instead of the central bank of the United States.

So we’ll get to this in greater detail.

BREAK TRANSCRIPT

RUSH: Speaking of the economy, I wouldn’t blame you if you thought the economy was about to tank. You turn to The Drudge Report right now: “Yields flash recession warning, stocks dive, banks hammered.”

This is the bond market. The bond market’s in trouble. And this is where the yield curve is trending so far down that it makes no sense to buy bonds, no reason to invest in them. You’ve got people in various other news stories worried about negative interest rates, which means you deposit a thousand dollars in a savings account and that thousand dollars immediately becomes $950 because you have to pay an interest rate for the bank to keep your money. They’re promising you this is happening. Then they’re promising that a recession will follow all this.

And no matter where you look, this is the mainstream media reporting and yet I have this headline “Americans apply for jobs at Koch Foods.” The unemployment situation is great. We have more people looking for jobs than there are jobs open. From the National Federation of Independent Businesses: “Small Business Optimism Continues to Defy Expectations.” I’m going to give you a pull quote from this story.

“While many are talking about a slowing economy and possible signs of a recession, the 3rd largest economy in the world continues to defy expectations, generating output, creating value, and expanding the economy,” said Juanita D. Duggan, the president and CEO of the National Federation of Independent Businesses.

Another pull quote, ” Contrary to the narrative about impending economic doom, the small business sector remains exceptional.” And of course that’s where the bulk of employment in America is. “This month’s index is a confirmation that small business owners remain very optimistic about the economy but are being hamstrung by not finding the workers they need,” said NFIB Chief Economist William Dunkelberg.

So here you have Juanita Duggan and William Dunkelberg saying small business confidence is through the roof. The only thing holding them back is they can’t find enough people to do jobs that are open. Okay. That’s the real world. This is American small business. This is where people are working and getting paid. This is where commerce is taking place. This is the definition of economic activity.

But then over here in all these esoteric places we have the yield curve is heading in the wrong way and the Feds are doing the wrong thing on interest rates and the bond market over here and the hedge funds there. And there’s this giant disconnect. Democrat Party candidates are running around talking about how awful this economy is. But they better be careful because not long ago they were trying to credit it as Obama’s economy. Right? Am I right?

I am. It wasn’t that long that every one of these people, including in the Drive-By Media, got so sick and tired of having to hear what great things Trump had done for the economy that they had to jump in and say, “Well, it’s really Obama’s.” Yeah, now they’re talking about the Obama economy into a recession.

Folks, there’s a good old standby here, and I know people have smirked at it when I’ve said it in the past: If they’re going to have a recession, just don’t participate. This recession they are trying to create is attitudinal first. They have succeeded. I remember — you probably will remember this story as well — during the Bush presidency, I forget, must have been the second term, the economy’s going great, the economy’s doing well in Bush’s second term but the media is talking about it like it’s something nobody’s experiencing.

“It’s really bad. The bottom’s about to fall out. The recession is happening. We’re on the verge.” The Democrats always, when there’s a Republican in the White House, we’re always on the verge of recession. I got a call from a guy, average ordinary guy, he said he was worried. I said, “What are you worried about?”

He said, “I’m doing really well. I mean, my economic life is good. But, man, I turn on the news and I’m hearing how everybody else in my town is about to fall off the edge.”

I said, “This is exactly the point.” There are two things at work here. You’re doing great because the economy’s doing great. You’re doing okay. The savings rate is even up. But then you turn on the news and you hear all the suffering, you hear about how it’s all about to go off the cliff. You hear about we’re on the verge of another recession, it could be the end of the country’s economy for a long time. It could be a repeat of 2008.

But you’re sitting there, you’re doing okay. So your reaction is, A, guilt. Oh my God, this is not fair, if I’m doing well — so you’re not permitted to enjoy your own reality because you’re pummeled every day with fake news about how the economy bottom is about to drop out. Don’t participate, folks. If they want to throw a recession in the news, then let them have their recession in the news, but just don’t participate.

BREAK TRANSCRIPT

RUSH: Oh, lookie here, folks. I found another economic story. This story in the Wall Street Journal. The headline is: “Chinese Economy Weakens on Several Fronts as Trade War Rages.” Now, you may have heard that Donald Trump just “blinked” in the trade war with the ChiComs. Yeah, they didn’t report that the ChiComs “blinked” last week when they tried to play the currency-manipulation game and lost. The ChiComs blinked in less than 24 hours and stopped playing the devaluation game. But now Trump has blinked. These people are obsessed.

A, they’re opposed to the trade war. They think Trump is making an economic mistake because they do not understand. People in media, in economics, do not understand it. They don’t know how to report it. They don’t know what tariffs actually are and how they raise money and how they don’t. They don’t understand the trade imbalance beyond the numbers. Yet they portray themselves as experts. They’re out there claiming, “This trade war is bad! It’s bad. (sobbing) American farmers are starving.

“American farmers are going bankrupt; Trump doesn’t care!” So Trump comes along and delays the imposition of September tariffs until December, and the media says, “Trump blinks!” Now if they were consistent, they would be happy. They’d be happy, because all this economic damage they think is being done by tariffs will stop. It’s tough to keep up with these people. But all they can do is just attack Trump no matter what. All tariffs have not been delayed!

For example, there’s a bunch of Apple products that are going to be subject to tariffs in September and a bunch of Apple products that are not going to be subject to tariffs. It depends on the categories. Not all tariffs are being suspended. If you’re wondering, the iPhone will not be subjected to tariffs; they’ll announce the iPhone in the first two weeks of September. The things are being built now. They’re being manufactured in China. They’re going to be shipped to the United States sometime when September rolls around.

They’re not going to be subject to tariffs. You’re not going to have any price increases on your iPhones. Trump and Tim Cook, they know each other; they talk. This is something that has to be done in this trade imbalance with the ChiComs. It has to be done. Trump is not blinking. He’s attempting to accomplish a number of different things at the same time, including maintain U.S. economic activity. But the headline here from the Journal tells the tale: “Chinese Economy Weakens on Several Fronts as Trade War Rages.”

You would never… Outside the Journal, you’ll not get anybody in mainstream economics that even understands the impact on China of this trade war. Because in their world, “China is making a fool out of Donald Trump,” because that’s what they want the case to be. Trump’s trade war is doing great damage to the Chinese economy. The ChiComs just don’t react the way presidents in this country do, because the ChiComs don’t care about their people as much as people are cared about in capitalist countries.

By definition! By definition, people that live in communist countries… (big sigh) They’re just statistics. They’re just bodies to be shuffled around and moved around if they think the right thing — and if they don’t think the right thing, you send them off to re-education camp. The ChiComs have a billion people. If there were an old-fashioned ground war that broke out, the ChiComs wouldn’t care. They wouldn’t mind losing some number of people. They’ve got more than they can feed anyway. Every country looks at things differently.

But when you have a media that hates Trump, every country is better than America because they hate Trump. That’s why we got all of this romanticization of communist countries and socialist countries. Anything, anything to rip into and to destroy Trump. Dirty little secret, though. Here’s a story from PJ Media: “Socialism Label Still a Drag at the Ballot Box.” The media’s not going to tell you this either, but the primary reason that Democrat candidates are running is why they’re going to lose.

This is a… You know, I like to look at things positively. We have — epecially with this Fredo Cuomo quote here, when he went down to Cuba. This is a golden opportunity we have. We have all these skulls full of mush out there, all these Millennials, college-educated Millennials who think (sniveling), “Socialism is some romantic thing. Everybody is the same and everybody is equal, and nobody’s feelings are hurt.

“And you can’t say mean things about anybody, and there’s climate change concerns,” and so forth. They have totally been lied to. We have an opportunity in the form of a presidential campaign to educate people about socialism and communism while it is still a dirty word. We better do this now. The polling data shows socialism is not widespread-believed enough to propel a candidate in a two-candidate race to the presidency.

BREAK TRANSCRIPT

RUSH: Folks, I just want to tell you: There is no recession. Do you realize the United States is the only place for people to invest money in the world, particularly among our allies? They are suffering negative interest rates because of the blockheaded stupidity of these European socialists and it’s causing havoc in the bond markets. There is no recession. But I’m telling you this: The financial people in this country are all leftist. You haven’t seen anything yet in their efforts to destroy Trump.

BREAK TRANSCRIPT

RUSH: So, I mentioned yesterday that I had an interview last Friday. After last Friday’s program, I talked to Larry Kudlow, who is head honcho of the president’s Council of Economic Advisers. It’s coming up in the next issue of The Limbaugh Letter. But I want to tell you one thing he said. The whole thing is inspirational and it’s informative, and I’m glad that you subscribers are going to be able to read it. I asked him — and, by the way, he doesn’t see any of this recession stuff. Now you would expect that.

He’s from the Trump administration and they’re not going to openly sit there and say, “Yeah, I think we’re doing a bad job. I think the recession is down the road and I think we’ve got to get ready now to fight it.” No, that’s what the media is doing. And, of course, let me tell you something. The people that run the financial markets can play a bunch of games. They can create news that results in people selling stocks. So like today, you’ve got the Dow Jones down 700 points on “fears of a recession.” Fears of a recession.

But the Kudlow answer here is key to understanding this. I said, “What is our biggest vulnerability in our economy right now? What do you think it is?” I had several things in mind based on things I had read. He said, “The rest of the world.” I said, “‘The rest of the world’? What, do you mean?” He said, “Rush, the world economy is linked, and right now we’re the only place in the world to put any money.” He began an in-depth explanation of the economic circumstances in several of our allied countries, particularly in Europe, with a focus on negative interest rates.

Do you know what negative interest rates are? They are hideous, and it’s the kind of thing that when you as a consumer hear about them, you want to pull every dollar you’ve got out of any bank and just put it under the mattress. Negative interest rates are when you pay the bank to keep your money; they don’t pay you. That’s negative interest, and this is happening in Europe right now. There are negative interest rates on savings accounts. There are negative interest rates in the interbank lending.

I said, “Why are they permitting this to happen?”

He said, “Because they have their models.”

“Models” is another word for time-honored strategies. They have their own economic models and they are simply going to stick to them. I said, “But wait. We’re talking here about various degrees of central bank-controlled socialist economic policy, even in some of these Western European democracies.” He said, “That’s right.” I said, “Why don’t they look at what’s happening in the United States now, or what happened in the United States in the ’80s, or any time that there is economic policy driven by marginal tax rate cuts? Why are they ignored?”

He said, “It’s because they don’t want to surrender that kind of power to the population. The countries we’re talking about want the people who live there to continue to think that their governments must do everything.” Now, we’re not talking about the educated 1% elites who are wealthy as can be. We’re talking about the general population. Those countries want people in the general population to look at government the way our young people do: As the answer to everything, as the reason for everything, as the fixer for everything.

Anything goes wrong? Have government fix it! Even the stuff that government breaks (sobbing), “The government’s gotta do something; the government’s gotta fix it,” which is why all the talk today in the Trump administration about self-reliance, which is why all the talk about getting rid of the public charge rule, the green cards, changing it back to what it was. “Yeah, we’ll be happy to let you in the country — if you can stand on your own two feet, if you can take care of yourself.”

Well, what this means… When the rest of the world has things like negative interest rates and no economic growth, who’s going to invest there? Nobody! Where are they going to invest? They’re going to invest here. So they’re bringing some of their dollars, which is the reserve currency. This is the international trading currency, the dollar, which is why it matters what the exchange rates are. The bottom line is, this yield curve business — inverted yield curve that (if you’re paying any attention) — you’re hearing about.

(sobbing) “It is so potentially explosive, it can wipe us out!” It’s all because all of this foreign money is pouring in, and it simply is a supply-and-demand situation. But elsewhere in the U.S. economy, we’ve got more jobs available than there are people to do them. We have become energy-independent. By 2020, it’s expected that the United States will export more energy than we import, and that will be a first since 1953. The United States right now is the world’s largest crude oil producer.

We are also the world’s top producer of petroleum and natural gas and related products. So it’s in this mix that somehow we’re destined for a recession? I wouldn’t let them get away with poisoning your mind this way. A recession, in many ways, can become a self-fulfilling prophesy. If people begin acting like the economy is going to go south, guess what might happen if enough people act that way? It’s the people of this country who make the economy work. It’s engaging in commerce, buying and selling, having disposable income to spend.

All of these things are what really comprise GDP. Now, our government is too big a share of our GDP with all of the borrowing — and that’s not something that’s going to change anytime soon or overnight. But it’s really, really important that you not let all of this Drive-By Media, fake economic news, talk you into believing that we are on the verge of another gigantic recession or maybe depression, and keep in mind why all of this is being said: There is a presidential election in 15 months and the people behind this hate Donald Trump.

They have tried everything they know to get rid of him. I don’t need to go through all of it. You know it all. You know the silent coup, the phony Russia collusion investigation, racism and bigotry. We have kids in cages at the borders. All of this! Every week, it is a new thing! When the previous week’s effort fails, they move on to something else. Now we’re on to the recession — the unavoidable recession. Democrat candidates pick up on it — and look! If we are really on the verge of recession, do you realize the things they’re talking about will finish us off?

They want $200 trillion in new spending programs on the verge of a recession? Middle-class tax increases to pay for free health care for every illegal immigrant now and in the future coming into the country? If we’re really on a verge of a recession, the Democratic Party is disqualifying itself from the presidential election right now just on the basis of the policies that they’re announcing. It’s all fake news, folks. Now economies go up and down, and just like we can’t control the temperature, we can’t really control recessions or depressions.

Because if we could, there would never be any. We can have plans in place that limit damage, soften the blow, limit the pain. But in terms of causing a recession or limiting one, there’s really not a whole lot we can do. Although, the Federal Reserve tinkering and toying around with interest rates can have an effect on what happens on Wall Street, as we’re witnessing. As Wall Street goes, a lot of people say, “Oh, my God! Wall Street is down 700 points!” They think the bottom is about to fall out. So the Fed does have an effect.

All of this is attitudinal in many ways, and they’ve been trying to make you depressed. They’ve been trying to make you fatalistic. They’ve been trying to make you think you made a mistake voting for Donald Trump. They’ve been trying to make you think you need to fix it. They’ve been trying every which way they can think of to make you think that you made the biggest mistake this country has ever made by electing Donald Trump — and they’re not going to stop. It’s only going to intensify, the efforts to smear and to destroy everything the administration has done and is trying to do.

And believe me, these people won’t care what damage is done to the country or the economy in the process, because getting rid of Trump and regaining that power themselves is all that matters. We’ve got one sound bite here. I’m going to get to the phones after the next break.

Peter Navarro, who is the director of the White House Trade Council, he was on Varney & Co. Today on the Fox Business Channel. And his question, Varney’s question: Did the ChiComs give on something? “If we gave a little bit by delaying the tariffs from September to December, what did we get?” Hmm? Is there anything?

NAVARRO: What the markets now have is total certainty about how the scenario’s going to unfold over the next three to six months. What we have here is the tariffs are moving forward, number one. Number two, we are continuing to negotiate with the Chinese and there will be another phone call within two weeks. All of the businesses that are affected by the tariffs now know how they will be affected.

RUSH: His argument here is we’ve got stability. We’ve got stability for the rest of the year. The tariffs that were going to happen in September have been delayed until December. So markets can now zero in and dial in. In the process, in the meantime, we’re going to keep talking with the ChiComs. And his point is that we’re not changing policy and we are not blinking. We are simply delaying the implementation of this round of tariffs.

I even heard Trump say something about Christmas. He didn’t want to do any damage this Christmas. This is the difference between us and the ChiComs, by the way. The ChiComs couldn’t care less what their actions do to their own people. They’re communists, they don’t care. If some of their people starve because they’re not buying U.S. agricultural products, no big deal.

There’s a billion of them over there. They don’t care, not nearly as much as leadership in democracies care, because as far as the ChiComs are concerned, it’s them who make their country run, not their people. But the dirty little secret about all this talk of recession, I’m gonna go back to a point I made with Kudlow before we go to the break.

There’s one thing — and this negative interest rate factor in Europe and some of our other allied countries is a great illustration of this — there is one thing that nobody in the world can do without. And that is access to the United States market. Access to you, access to your ability to spend disposable income. That’s why the ChiComs don’t ever want to totally take out the United States.

This is the biggest economy in the world. This economy produces wealth not just for the people of this country, it produces wealth all over the world and it feeds the world, and there isn’t another economy like it because nobody has had the guts to go full-fledged capitalism like we have from our founding.

It’s silly. It’s what Kudlow was talking about, about these people have their models and they’re going to stick to them, stubbornly, no matter what. But the bottom line is they need our market. Now, some of you saying, “Rush, don’t be so naïve. The ChiComs would love to wipe us out. The Russians would love to wipe us out.”

No, they wouldn’t like to wipe us out. They would love to gain control over us, but they don’t want to wipe us out. The world cannot do without the U.S. market, folks. I don’t care if you’re a communist, if you’re a socialist, if you’re capitalist, follow the money. Just because a country’s socialist doesn’t mean that the people that run it are poor. The people that run communist countries and socialist countries are among the richest in the world because they take everything from their people.

Money is what makes the world go around. Access to the United States market, there’s nowhere like it. There’s no other market anywhere in the world. There’s no other market where the innovation in the world has a chance to be implemented into consumer products and services like the United States of America. And certainly not at the scale that it can happen as it does here.

BREAK TRANSCRIPT

RUSH: Just to illustrate the blanketing of the Drive-By Media with this theme that we are on the verge of a recession — that it may, in fact, already be here; that it’s just a matter of time before everything Donald Trump has done causes this country to collapse. They want a recession so badly that they will practically will one into existence. They will simply say there is one even when there isn’t if that will get rid of Donald Trump.

Here’s a media montage to demonstrate what I mean…

PETER ALEXANDER: The risk of a recession in the next year is growing!

JOHN AUTHERS: …very clearly that we are likely to have a recession!

DAGEN MCDOWELL: Every recession since World War II has at least been preceded by an inversion.

GINA MARTIN ADAMS: We are already pricing in recession!

KEVIN KELLY: We can’t evade a recession forever!

KAYLA TAUSCHE: …a recession warning!

MAX BOOT: …threat of a recession on the horizon!

JONATHAN LEMIRE: A recession could be looming!

ALEXI MCCAMMOND: … looming recession under President Trump!

KATHARINE HARLOW: (music) …serious new fears of a recession. … The president’s on vacation.

RUSH: Shouldn’t that montage right there tell you this is BS when the media gets on these things — gravitas, whatever the montage is — when they’re all saying the same thing? “Looming recession! Dangerous inversion!” When they’re all saying the same thing — and when it happens to align with what the Democrat presidential candidates are saying — isn’t it time to be very suspicious of it, that this is not resulting from actual news out there.

This isn’t the result of what’s happening in the markets. This is what these people want you to think is happening. They are attempting to move public opinion so they can then go out and do a poll that will show whatever percentage of Americans are worried to death about a recession and are going to cut back their spending and they’re going to cut back their Christmas and they’re going to cut back their vacation and da da da da.

They’re going to make it look like Donald Trump has people scared to death to spend any money at all and it’s only a matter of time before it collapses. And the next story will be whatever the Democratic candidates happen to be talking about, which is giving everybody everything. “So even if there is a recession, you’re covered, because the Democrats are going to take care of you!” That is the plan. Now, just a couple more, we’ll head back to the phones. Wilbur Ross — “Willllbur” — who is the secretary of commerce.

He was on CNBC Squawk Box today. Joe Kernen, first question to Willllbur: “The yield curve, a lot of people say that this indicates a recession in 12 to 18 months.” Notice the timing: 12 to 18 months is right at the election. (chuckling) Isn’t it just remarkable how this works? “The yield curve” in the bond market, the inversion, “a lot of people say…” What people, Joe? A lot of people wandering the halls at CNBC? What people? They “say that this indicates a recession in 12 to 18 months. What do you think,” Wilbur?

ROSS: Well, formulas like that work when they work and they don’t work when they don’t work. There’s also a question of how far into the future. Eventually, there will be a recession. So the idea that 1,000th of 1% inversion — which is what I saw on your screen a little before — is going to be the end of the economy strikes me as a little aggressive.

Commerce Secretary Wilbur Ross discusses the latest on the China trade talks

RUSH: Now, Wilbur Ross is a billionaire, and he sees things differently than you and I. So he talks about the things he sees differently than you and I. So he says, “Look, there’s going to be a recession because there always is the next recession, like there’s always the next drought, and there’s always the next thunderstorm, and there’s the next hurricane. There is going to be one. There’s going to be another shooting.”

I predicted that, by the way. How smart do I look? After the Marjory Stoneman Douglas school, I predicted there was going to be another shooting. How right was I? How brilliant did I look? You know… (interruption) Well, it was very difficult to make that prediction. David Hogg was running around. The media was leading everybody to believe we could stop the next one. We were having sessions. We were having protests in Washington. We were having legislation to take away assault weapons.

We were going to have new gun control laws. We were going to stop the next one from happening. I threw cold water on it, and I said there will be another one. I was the only one with the courage to predict there would be another shooting. There have been many since I made that prediction. I’m not exaggerating.

At that point in time, the whole point is the media wants you to think we can stop them if we just have new gun laws. We can stop them if we have new this or new that or if we get rid of Trump or whatever it is, they say. And now they’re trying to say we can stop this recession if we just don’t elect Trump. We can get rid of Trump and we can stop the recession.

Now, Wilbur Ross knows full well that there’s going to be another one. And he was looking at the stats that CNBC put on the screen and he said (paraphrasing), “Look, you’re talking about 1,000th of one percent of an inversion.” That’s the yield curve, price versus yield curve in the bond market. And he said it’s 1/1000th of a one percent inversion, which means it’s still basically a straight line. And the idea that this is going to be the end of the US economy — he’s exactly right, this isn’t going to be end of the US economy. There’s been inversions before. The bond market’s been in sort of a static spot for a long time.

And the idea that it’s going to cause the end of the economy, which is exactly what they’re out predicting now. Now, there’s one more here. Wilbur Ross was asked by Joe Kernen, “Yesterday’s move by the president to unilaterally delay the next round of tariffs on the ChiComs until December, was the president doing that to make it easier for consumers at Christmastime? Did China blink on anything, or was this totally the United States blinking?”

ROSS: There had been all sorts of research done before. There were public hearings about what items to put on and nobody wants to take any chance of disrupting the Christmas season. We don’t think…

KERNAN: So you’re saying we didn’t extract anything from China to do this? There was no quid pro quo?

ROSS: …not a quid pro quo.

KERNAN: No quid pro quo.

ROSS: It was a decision to do what we decided to do.

RUSH: Okay. So, Wilbur, he’s basically giving the media what they want. “You mean Trump just gave them a delay? We didn’t get anything back?” And Wilbur said (paraphrasing), “Nope, we didn’t. We’ve got solid markets for the next six months and we got a good Christmas guaranteed. There was no quid pro quo.”

And because there was no quid pro quo, now the Democrats can run around and the media can run around saying Trump caved. The ChiComs didn’t cave, that the ChiComs are winning the trade war, making a fool of Trump. This is what they’re all wanting to say. And they are saying it, not just wanting to.

That’s some dialing. You must be an expert or something.

“A BS statement, particularly in light of the near 0% during the Obama administration. “

Everyone who knows recent economic history is aware that post 2008 rates were done in response to the collapse of the mortgage bubble. Bernanke said it himself. The group that has been paying attention quite obviously doesn’t include you.

“And Greenspan just came out saying there’s nothing preventing a negative yield.”

Well Greenspan no longer gets a vote, and thank God for that considering the Greenspan Put and other bad ideas he implemented. Negative interest rates are harder to implement than having the ability to lower positive rates. Which is why the Fed has a sweet spot for their discount rate, despite your belief that it is BS.

“Whatever metrics supported 2.5%-5% prime rate are clearly not in play anymore and haven’t been for over 10 years. “

Ten years ago was the collapse of the mortgage bubble. We had TARP and Quantitative Easing and near zero rates. That’s over now. Try to stay current.

“It’s not the US rate in a vacuum. It’s the US rate in comparison to the REST OF THE WORLD (ROW).

I never said it was. I don’t address red herring arguments that you choose to make.

” That’s why the ‘recession signal’ inverted yield curve is BS and manufactured by FED high rates vs ROW. “

I’ve posted that inverted curves don’t guarantee a recession and that it probably doesn’t mean one in this instance. So are you agreeing with that? Or does your convoluted sentence have some other meaning? Clarity isn’t your strong point.

The Fed took their rate to 2.5% because they want their primary recession fighting tool back, a discount rate in a range where they have the ability to drop it. And 2.5% is the very bottom of that range.

They have no control over long bond rates. If there’s heavy demand for Treasuries then long rates fall, and currently they are below the discount rate. It makes as much sense to claim that the market “manufactured” the inverted curve.

“This is ripping off the US courtesy of the FED-set bond yields. Got it now?”

Yeah, what I’ve gotten through all of your posts is that you don’t know what you’re talking about, but you make up for it with bad attitude.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.