Skip to comments.

The Federal Reserve May Secretly Want to Sink the Record-Breaking Stock Market

TheStreet ^

| Sep 19, 2017

| Scott Gamm

Posted on 02/05/2018 7:33:21 PM PST by familyop

A big Federal Reserve meeting is coming up. Here is one thing that could happen if the Fed gets too aggressive.

Despite its independence, the Federal Reserve may quietly want a bear market that takes down a president that loves tweeting about the stock market.

Peter Schiff, CEO of Euro Pacific Capital, told TheStreet the "[Janet] Yellen put" in the markets could expire under President Trump. "I don't know if the Fed has much love for Trump," he said, adding that the Fed had the markets' back during the Obama Administration.

"Maybe the Fed would be happy to see a bear market that could be blamed on Trump." Schiff thinks the markets could easily correct 20%.

One black swan event Schiff sees is the notion of investors abandoning the euphoria over Trump's presidency, which helped fuel the stock market rally this year.

"We've had a huge move up since the election of Trump even though prior to the election the expectation was if Trump won it [would be a disaster for markets]," he said.

When asked if the two straight quarters of double-digit earnings growth has sparked the rally in stocks this year, as opposed to solely Trump, Schiff pointed to earnings headwinds in the retail sector.

The Federal Reserve is scheduled to meet later this week.

Watch the full interview with Peter Schiff:

TOPICS: Business/Economy; Extended News; Government; News/Current Events

KEYWORDS: economy; federalreserve; janetyellen; markets; obamaholdovers; obamunists; peterschiff; stockmarketplunge; stocks; thefed; trump

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-84 next last

Is the new Fed guy a Republican & not a #NeverTRUMPer?

61

posted on

02/06/2018 5:09:18 AM PST

by

KavMan

To: KavMan

Is the new Fed guy a Republican & not a #NeverTRUMPer? Jerome Powell is a Republican who was appointed to the board by Obama. At the time the Senate had been blocking the appointment of Jeremy Stein for about a year. His appointment was a one Democrat plus one Republican deal. To the best of my knowledge Powell has been a Republican all his adult life and I've never read anything from him that might indicate he's a #NeverTrumper.

To: BuffaloJack

Yellen is just following her orders from the Deep State, i.e., let slip that since the stock market is rising faster than the Deep State wants, she’ll have to raise the interest rate. This causes the sell-off that the Deep State wants, so they can show how bad the Trump Economy is. All Yellen did was state known facts - price/earnings ratios and commercial real estate prices were at or near historic highs. Something everyone in the financial markets have known. The Fed raised interest rates three times last year, the most recent in December, and after the last rise the stock market gained another 6 to 8 percent.

Yellen needs to go. We don’t want a Deep State operative running the Fed.

Yellen is gone. Last Friday was her last day. Jerome Powell is the Fed Chair now.

To: DoodleDawg

Jerome Powell is a Republican who was appointed to the board by Obama. At the time the Senate had been blocking the appointment of Jeremy Stein for about a year. His appointment was a one Democrat plus one Republican deal. To the best of my knowledge Powell has been a Republican all his adult life and I've never read anything from him that might indicate he's a #NeverTrumper.

Fed should be fine with that guy, I didn't want TRUMP to reappoint Yellin!

She is a Democrat, she could tank the market just before the 2020 Election by raising interest rates too much or something else the markets don't like!

64

posted on

02/06/2018 5:22:18 AM PST

by

KavMan

To: DoodleDawg

The Fed kept interest rates near zero for all of Obama’s 8 years.

I didn't say that . The Fed will CONTINUE raising interest rates as they've SAID and i predicted because they want to cause a recession to destroy Trump.

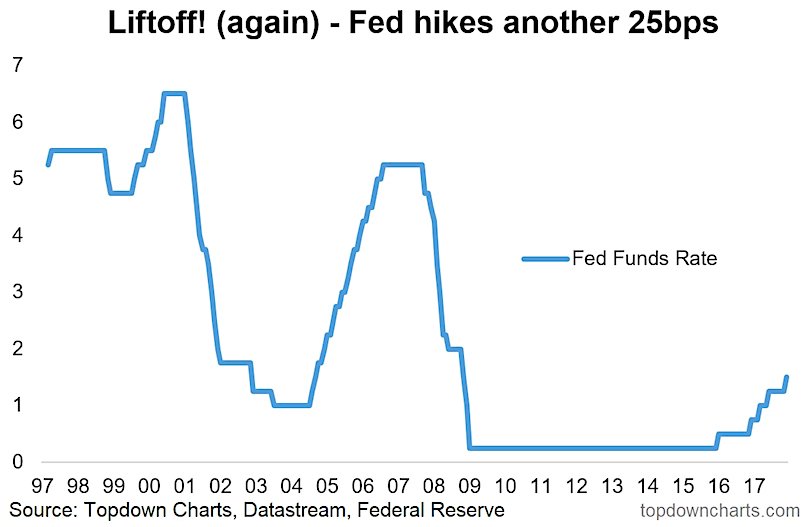

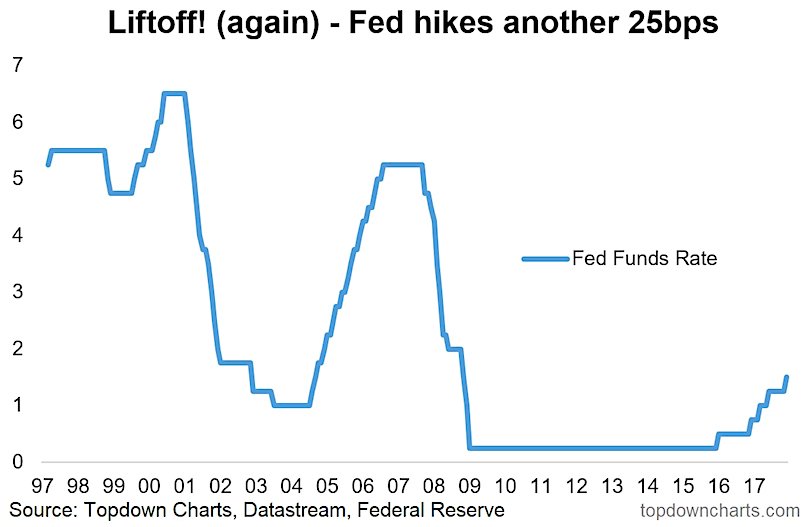

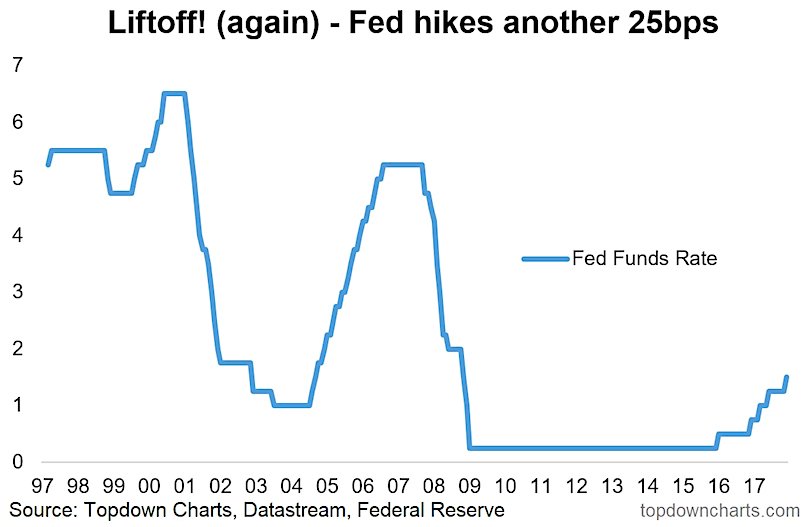

Here you can see that only in 2017 (The start of the Trump presidency) can you see the Fed raising rates at a very steep angle.

I predicted the leftist political Fed would do this. I think the Fed will continue raising rates as they SAID until they cause a recession to hurt Trump. I hope Trump can stop them somehow. audit get rid of the FED.

65

posted on

02/06/2018 5:45:23 AM PST

by

Democrat_media

(Mueller doing coup vs Trump. Obama was adding 97,000 pages of government regulations /year)

To: KavMan

She is a Democrat, she could tank the market just before the 2020 Election by raising interest rates too much or something else the markets don't like! Yellen didn't raise interest rates; the Fed Open Market Committee did. Yellen was only one vote out of nine. Powell will be one vote out of eight until Trump fills the four vacant board of governor positions.

To: DoodleDawg

Yellen didn't raise interest rates; the Fed Open Market Committee did. Yellen was only one vote out of nine. Powell will be one vote out of eight until Trump fills the four vacant board of governor positions.

Isn't the Fed Chair the most important voice? If he/she says no to interest rate hikes then it doesn't happen?

67

posted on

02/06/2018 5:51:33 AM PST

by

KavMan

To: Democrat_media

The Fed kept interest rates near zero for all of Obama’s 8 years. In case you hadn't noticed, the economy cratered in Bush's last year in office and spent the next 8 years recovering. That's why interest rates were low, to spur borrowing and growth. And a look at your chart shows that even with the 2017 increases the interest rates are still well below historical averages.

Here you can see that only in 2017 (The start of the Trump presidency) can you see the Fed raising rates at a very steep angle.

Have you not noticed how the economy has exploded in the last year? Raising interest rates are a means to keep it from overheating and inflation under control. Rising interest rates are a sign of a healthy economy, not an attempt to trash it.

To: KavMan

Isn't the Fed Chair the most important voice? If he/she says no to interest rate hikes then it doesn't happen? That's like saying isn't the Chief Justice of the Supreme Court the most important voice. On the FOMC the Fed Chair, like the Chief Justice, is first among equals. He has one vote. The other members don't march in lock step.

To: DoodleDawg

That's like saying isn't the Chief Justice of the Supreme Court the most important voice. On the FOMC the Fed Chair, like the Chief Justice, is first among equals. He has one vote. The other members don't march in lock step.

OIC but raising interest rates now is the right thing to do from what I'm hearing from Maria Bartiromo & other guys on FOX Business, the economy is going gangbusters

70

posted on

02/06/2018 6:01:41 AM PST

by

KavMan

To: DoodleDawg

Wrong. Inflation is very low.The Fed kept rates near zero for all of Obama’s 8 years.This had never been done.

After Trump gets look at the graph going up steeply. The Fed is political. You sure do trust the FEd and central control of the economy

71

posted on

02/06/2018 6:02:52 AM PST

by

Democrat_media

(Mueller doing coup vs Trump. Obama was adding 97,000 pages of government regulations /year)

To: KavMan

They're idiots or liars.

Inflation is very low .Last quarter gdp is under 3% . That's not going gangbusters.

The unemployment which they manipulated under obama is really much higher.

72

posted on

02/06/2018 6:05:29 AM PST

by

Democrat_media

(Mueller doing coup vs Trump. Obama was adding 97,000 pages of government regulations /year)

To: familyop

This is one thing that is RIDICULOUS. Trump just put his own choice in place to head the Fed and will get more choices. And just about 30 minutes ago another Fed Governor, Bullard, came out and said because of the policies of the Administration that growth can be higher without being inflationary. That moved futures in a higher direction.

73

posted on

02/06/2018 6:08:11 AM PST

by

LRoggy

(Peter's Son's Business)

To: Karl Spooner

I believe the Fed is a tool of the Elites, used against the American People.

Their weapon is inflation, and they use it to impoverish the producers of society and enrich themselves.

I support executing every executive-level employee of the Fed. they serve evil, and they know it.

My stock tip: Invest in rope!

To: Democrat_media

Inflation is very low. Inflationary pressures have been very low. Unemployment was high. Wages were stagnant. Now that the economy is taking off again, the low unemployment rate has caused companies to raise wages to attract people. That can lead to an increase in inflation if the Fed doesn't act to control it.

This had never been done.

Perhaps because we had not seen the economy tank the way it did under Obama? Not since the great depression?

The Fed is political.

Of course it is.

To: KavMan

OIC but raising interest rates now is the right thing to do from what I'm hearing from Maria Bartiromo & other guys on FOX Business, the economy is going gangbusters Which is what the Fed is doing. Their goal is to keep the economy from overheating and keep inflation under control. Rising interest rates are a sign of a healthy economy. The Fed will lower interest rates during economic downturns.

To: wastoute

"...IOW, we are witnessing the largest theft in human history...."You should keep harping on this, so that folks will finally understand.

It's a big deal. No one really notices it, it seems.

To: familyop

Yes, a publicly traded stock, but it almost wound up delisted within the past two years. It’s part of the Cramer ‘empire’.

78

posted on

02/06/2018 6:43:27 AM PST

by

SunkenCiv

(www.tapatalk.com/groups/godsgravesglyphs/, forum.darwincentral.org, www.gopbriefingroom.com)

To: SunkenCiv

"Yes, a publicly traded stock, but it almost wound up delisted within the past two years. It’s part of the Cramer ‘empire’."

Thank you!

I had stayed away from television for about 13 years and only recently tried to catch up on celebrity and popular media information because of Trump's campaign and election.

Strangest thing. Through most of the Trump campaign (and before, apparently), I had missed hints that he might really be going more conservative because of my avoidance of television.

Written information alone in free news media and political speech had indicated that he was probably riding into Republican politics on a liberal left infiltration wave, as others have done. Looked like he was right in there with Oprah, Hillary and all, chattering away on chick TV (which I had avoided even longer).

What a pleasant surprise! He used the idiocracy media to tunnel to the top, making promises to all sides! Many are very angry about it (blue state naysayers on the successful tax bill, social left, useless spending programs), but many more are happy about it (jobs, jobs, lower taxes, more power to more conservative areas, beginnings of dissolution of political correctness,...). He has gained voters since the general election.

79

posted on

02/06/2018 7:46:58 AM PST

by

familyop

(President Trump said that we're all important, so let's do something!)

To: Jim 0216

Another guy named SCHIFF?

Any connection to bug eyes???

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-84 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson