Skip to comments.

The Real Reason Democrats Hate Losing the State and Local Tax Deduction

Townhall.com ^

| Nov 29, 2017

| Bob Barr

Posted on 11/28/2017 9:39:50 PM PST by Oshkalaboomboom

If you have ever wondered why leaders of liberal cities and states become giddy at any new spending opportunity – investments into light rail infrastructure, social programs for illegal aliens, public schools that look like palaces, billion-dollar sports stadiums – it is not because they are more public-minded than Republicans, or possess an innate sense of altruism. It is because such projects get them re-elected, especially when people other than their constituents are picking up the tab. And, thanks largely to the State and Local Tax (SALT) Deduction for federal income tax purposes, that is exactly what is happening.

In the current federal tax code, SALT deductions allow individuals to deduct state and local taxes, including property taxes, from their federal returns. On the surface, this seems like a great idea, as it generally reduces tax burdens, especially for those living in high-tax localities. At its core, however, the deduction is more a clever burden-shifting scheme to make it easier for state and local governments to over-spend, than it is a way to ease the burden on federal taxpayers.

Since state and local taxes can be deducted, the tax burden is shifted from those governments to the federal government, which in turn makes up for this lost revenue by keeping taxes higher on the rest of the country. In effect, taxpayers in low-tax states and cities, like those in the South, are forced to subsidize the lavish public spending of liberals in New York, New Jersey, Connecticut, and California, who have little incentive to reduce the local taxes that fund their pet projects. It is much like making charitable donations online using someone else’s credit card. It does not make you Robin Hood. It makes you a charlatan, which is why rather than pay the bill, the millionaires who helped put these Democrats in power, would rather flee like cowards.

It also makes for a very sticky wicket when it comes to the GOP’s current tax reform proposals, which hinge on finding ways to help offset the “costs” of reducing federal taxes. Eliminating SALT deductions would make a sizeable dent in this gap; potentially $1 trillion in revenue over 10 years. Yet, the objections of Democrats, and even some Republicans from the states most impacted, threaten to derail the entire process because of the political ramifications of exposing taxpayers, for the first time, to the true costs of their elected officials’ fiscal irresponsibility at the local level.

This also illustrates a perennial problem with every modern tax cut bill. Our massive and long-standing tax system is built almost entirely around political favors and deductions. Until we have a complete overhaul of the entire tax system, it will remain extremely difficult, if not next to impossible, to do completely away with any deduction of any meaningful significance, because someone’s prized ox is bound to be gored with every move to drop or scale back a deduction; or just as likely, a new one is added in its place as Congress negotiates with the hold-outs.

In an ideal scenario, Republicans would remember what it is to have a spine, and perhaps we might see real reform, such as a flat tax, where the only debate would be what the new tax rate should be, what should be the annual standard deduction that replaces every other deduction promised over the years as a political handout; and bring spending down to the level necessary to operate within the monies raised by the flat tax.

Of course, even in the ideal scenario, spending at all levels of government remains the central problem. Out-of-control spending at the local level is what causes higher taxes that makes eliminating SALT deductions so controversial. Out-of-control spending at the federal level is why Republicans are struggling to pay for tax reform by only eliminating deductions. And, without a plan for cutting spending – a long-forgotten ideal even of many self-styled congressional “conservatives” – the tax rates proposed in this tax reform are the best we can hope for, as either automatic trigger increases kick in 10 years down the road or the inevitable deficit catastrophe forces rates back up.

And, were this to happen, the GOP would rightfully deserve the fallout for its refusal to address spending. Notwithstanding this dilemma, tax reform is so badly overdue that even without spending cuts in place yet to offset the deficit, it is a worthwhile first step. But, it cannot be the last step either. Until the GOP gets serious about cutting spending, shirking this responsibility in the short term will have even greater consequences in the long-term – unfortunately a perspective not often exhibited in Washington.

TOPICS: Business/Economy; Government; News/Current Events; Politics/Elections

KEYWORDS: salt; senatetaxplan; trumptaxplan

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60 last

To: Pelham

41

posted on

11/29/2017 8:24:28 AM PST

by

MeganC

(Democrat by birth, Republican by default, Conservative by principle.)

To: Mariner; SkyPilot

42

posted on

11/29/2017 8:25:32 AM PST

by

MeganC

(Democrat by birth, Republican by default, Conservative by principle.)

To: Oshkalaboomboom

In an ideal scenario, Republicans would remember what it is to have a spine,Good luck with that

43

posted on

11/29/2017 8:28:36 AM PST

by

Teacher317

(We have now sunk to a depth at which restatement of the obvious is the first duty of intelligent men)

To: MeganC; SkyPilot

I’ll address the fallacies as best I can:

“It is because such projects get them re-elected, especially when people other than their constituents are picking up the tab. And, thanks largely to the State and Local Tax (SALT) Deduction for federal income tax purposes, that is exactly what is happening.”

In 100% of the cases it is the state taxpayer picking up the tab. With the exception being when Federal Funds are being expended. This would be a good point for the uninformed to inquire about donor states vs parasite states. These projects born in commie largess are paid for, 100% by the local taxpayer.

“In effect, taxpayers in low-tax states and cities, like those in the South, are forced to subsidize the lavish public spending of liberals in New York, New Jersey, Connecticut, and California, who have little incentive to reduce the local taxes that fund their pet projects.”

A damnable lie.

I go back to taxation 101 and refer the ignorant to the difference between donor states and parasite states. All four of the states above, listed by the author pay more in federal income taxes than they receive back in federal expenditure of any kind. Both net and per capita.

Additionally, the author’s reference to subsidy is the left’s Holy Grail. The idea that the pie is of fixed size, the government is entitled to as much of that pie as it wants, and it it doesn’t take it from you it must take it from me. Even if they are taking more from me already.

” threaten to derail the entire process because of the political ramifications of exposing taxpayers, for the first time, to the true costs of their elected officials’ fiscal irresponsibility at the local level.”

Even in the most extreme scenarios, 70% of the state taxes are paid directly by the local taxpayer on the hope that their Federal burden will be reduced by 30% of the SALT amount.

Be aware, the primary determinant for itemization, and therefore SALT deductions is NOT the state in which one resides. It is holding a mortgage and being in the upper-middle class. If you make over $100k total for the household and are paying on a house over $250k you are ABSOLUTELY itemizing and taking the SALT deductions...in every state in the union.

That CA, NY, NJ etc. use this deduction disproportionately is testimony to the fact there are more upper-middle class households in those states than others.

There is no other criteria of note.

” In an ideal scenario, Republicans would remember what it is to have a spine, and perhaps we might see real reform, such as a flat tax, where the only debate would be what the new tax rate should be, what should be the annual standard deduction that replaces every other deduction promised over the years as a political handout; and bring spending down to the level necessary to operate within the monies raised by the flat tax.”

Finally the author exhibits some good sense.

Frankly I expected better from Bob Barr. He knows better. That he spilled so much nonsense in the first 3/4 of his opinion piece shows he has another agenda, or is being paid to say a particular thing directly or obliquely.

44

posted on

11/29/2017 9:23:43 AM PST

by

Mariner

(War Criminal #18)

To: Oshkalaboomboom

“fact that they are passing their costs on to the rest of the country”

Please explain the flow of money that indicates these costs are passed to anyone outside the offending state.

In 100% of cases the taxes and expenditures within any state, absent Federal expenditures, are local.

Nobody in any state pays money into California except via federal expenditure.

And you cannot identify a money flow that shows otherwise.

45

posted on

11/29/2017 9:28:56 AM PST

by

Mariner

(War Criminal #18)

To: Sam_Damon

“Effective subsidization of state and local taxes really, really, in my view skews the whole relationship between the states and the federal government.”

How does money flow from any other taxpayer in any other state to the government of CA?

46

posted on

11/29/2017 9:31:13 AM PST

by

Mariner

(War Criminal #18)

To: KC_Conspirator

“These states that have this bogus deduction, are getting away with spending other peoples money.”

Just how does the money flow from “other people” to these states?

47

posted on

11/29/2017 9:32:55 AM PST

by

Mariner

(War Criminal #18)

To: Mariner

From the article:

"Since state and local taxes can be deducted, the tax burden is shifted from those governments to the federal government, which in turn makes up for this lost revenue by keeping taxes higher on the rest of the country. In effect, taxpayers in low-tax states and cities, like those in the South, are forced to subsidize the lavish public spending of liberals in New York, New Jersey, Connecticut, and California, who have little incentive to reduce the local taxes that fund their pet projects. And add Maryland to that list.

To: Jarhead9297; JayGalt

That Federalist article deliberately conflates bundles of Blue states and Red states.

It does so to obfuscate the fact that CA, NY, NJ and IL are all net donor states, both per capita and net.

It in no way debunks that fact.

49

posted on

11/29/2017 9:43:57 AM PST

by

Mariner

(War Criminal #18)

To: Mariner

Against a national average of $1,935 in intergovernmental spending per American, red states receive just $1,879. Blue states get considerably more, at $2,124 per resident.

50

posted on

11/29/2017 10:02:36 AM PST

by

JayGalt

(Let Trump Be Trump)

To: JayGalt

He bundles all Red states into one group.

And all blue states into another.

Go to the original Pew data and search for NY, NJ, CA and Il.

51

posted on

11/29/2017 10:08:36 AM PST

by

Mariner

(War Criminal #18)

To: JayGalt

Oh, and those number only account for 15% of all Federal Expenditures...specifically, block transfers of money from the feds to state budgets.

52

posted on

11/29/2017 10:10:04 AM PST

by

Mariner

(War Criminal #18)

To: Mariner

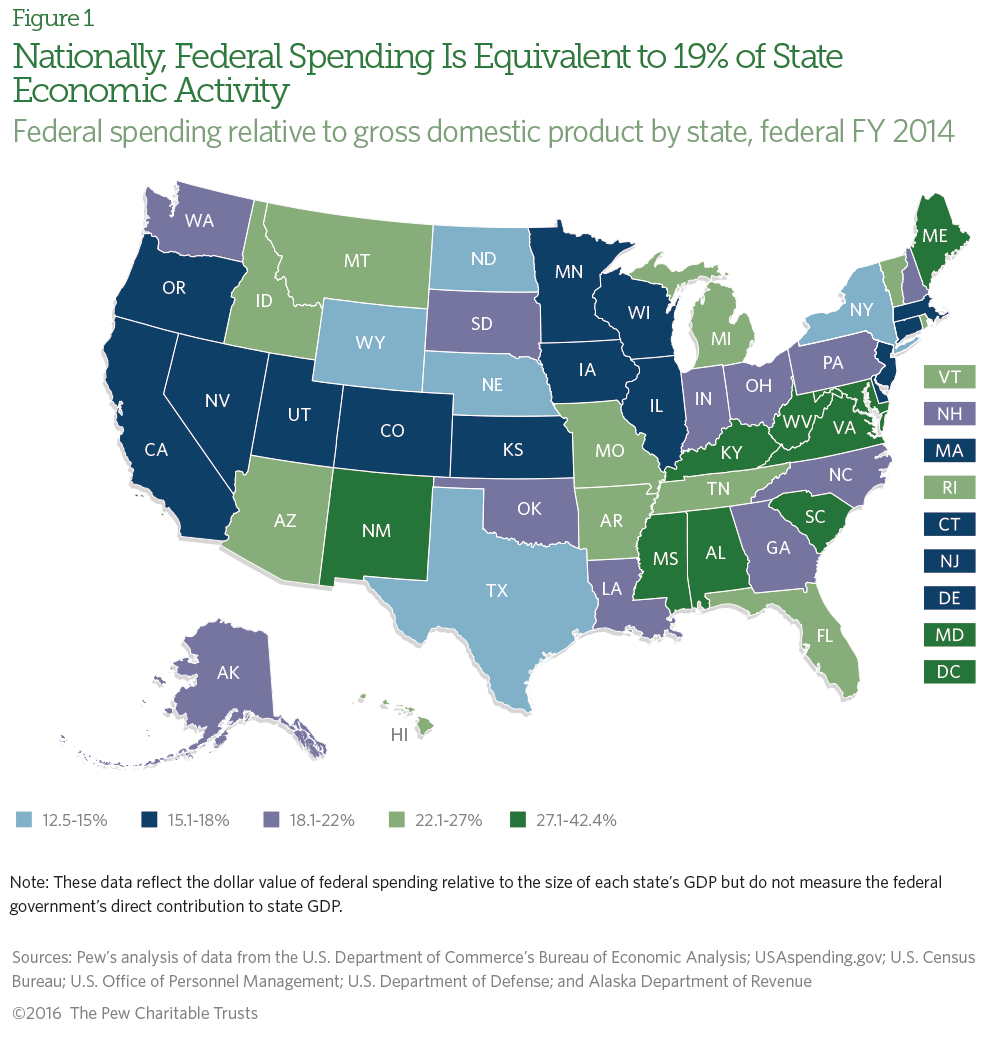

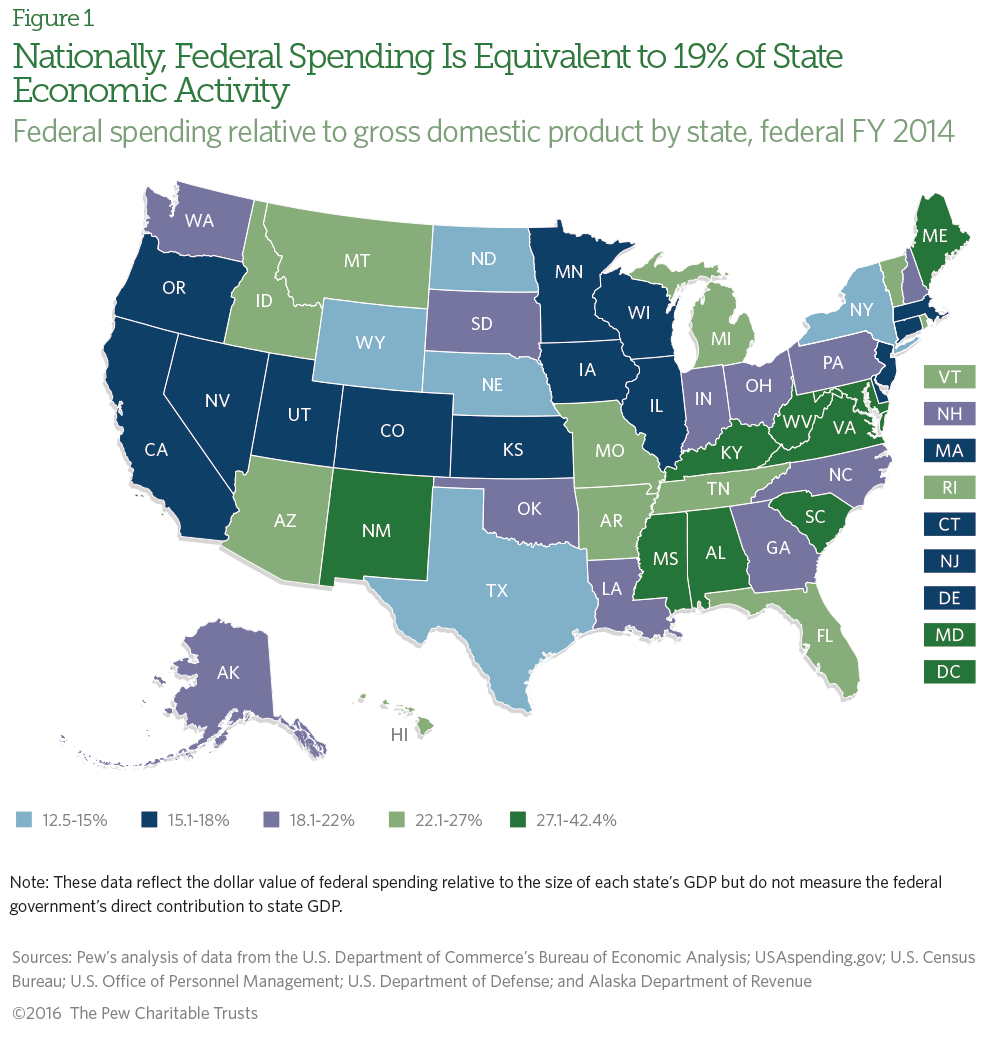

This chart delineates the % of budget in each state covered by Federal contributions. There are many ways to look at the complex nature of money paid out by the citizens and money returned to the state and individuals of that state by the Feds. The problem is that none of the methods accounts for all the factors. The budgets in the blue states are much higher because of the sanctuary cities and poor bugetary control so the states look like they are pulling a better percentage of their own weight but that is a spurious assumption. That is why I like the $/ individual I referred to earlier.

Against a national average of $1,935 in intergovernmental spending per American, red states receive just $1,879. Blue states get considerably more, at $2,124 per resident. Purple states see the least of their money returned to them per capita, at just $1,770. Measured in this way, the blue states are getting quite a bit more than the red or purple.

That data is not broken down by state anywhere I have seen.

53

posted on

11/29/2017 10:28:32 AM PST

by

JayGalt

(Let Trump Be Trump)

To: JayGalt

” in intergovernmental spending per American,”

That only references direct transfers from the feds to the state government. A paltry 15% of Federal expenditures fall into that category.

The author was deliberately trying to deceive when that chart was put up.

54

posted on

11/29/2017 11:39:13 AM PST

by

Mariner

(War Criminal #18)

To: Oshkalaboomboom

Imposing Federal tax liabilities just because people must raise enough money to pay their state and local taxes is illegal, unconstitutional, unwise, and just plain wrong.

If I own property, I am FORCED to earn money to pay the state tax on that. When I do, that is “net income zero.”

If I now, thanks to “tax reform,” have to pay the Feds a tribute just because I pay my State tax, that’s not income tax, that’s now a form of Federal Property tax! Unconstitutional!

I might have to own less property all because of that FED tax on property.

Again, if you have to pay a Federal tax because you own property, that’s Federal property tax. Illegal.

It is also not a proper function of the Federal Government to try to tax We the People in such a way as to prevent our States from raising money to perform their State functions.

It is better for the States to get first crack. That’s how it is supposed to be in these USA.

The Federal government is supposed to be LIMITED ... it can take its taxes BASED ON, and from, our LEFTOVERS.

Money that We the People do not get because our states keep it is NOT INCOME. Money we give to the States is STATE money and the Feds do not get to PENALIZE us for funding our states as we see fit.

There might be some nice side effects to this tax scheme where crazy Progressive states get hit more, but since when do Freepers believe that “the end justifies the means” in our government’s operation ??? Think about this.

Moreover, the proposal will does not in the long run reduce tax receipts by government, anyway, and that is what all Freepers want, less control by Government.

How the hell are we going to get government under control if we do not starve it even a little? Government control is significantly proportional to the money it gets. To control government, limit it with law, and starve it with money.

It is all a FAKE argument that expanding the things that government gets to tax if good. Now you want a Federal property tax too? You advocates of this are arguing to EXPAND Federal taxing authority and extent. Think it over, you do not want it.

I want a better tax proposal!

(also see https://www.freerepublic.com/focus/news/3609000/posts?page=17#17)

55

posted on

11/29/2017 1:00:12 PM PST

by

Weirdad

(Orthodox Americanism: It's what's good for the world! (Not communofascism!))

To: Mariner

You might want to check out this article on California.

Since that seems to be your focus I did a bit of research.

http://www.latimes.com/politics/la-pol-sac-california-federal-government-money-20170205-story.html

To me the whole argument is irrelevant. The Government should not be taking money from the States & then doling it back. The consensus is that Ca get $0.99 back for every $1 it sends in taxes to the Feds. So why do we need to waste $ on personnel and the inefficiency of the double transfer? The whole system stinks and it will not improve while people are arguing to maintain SALT deductions instead of lowering what goes to the Feds in the first place.

56

posted on

11/29/2017 1:10:06 PM PST

by

JayGalt

(Let Trump Be Trump)

To: PTBAA

”Without any reduction in spending, agreeing to this tax plan means more will be taken from you now and they will still banckrupt you later. Why is that a good idea? Flat tax that everyone pays, anything else is more of the socialist same.” I don’t disagree with you, and I’d love to see either a flat tax or the “fair tax.” I’m very disappointed that Republicans have completely ignored the need to reduce federal spending in concert with any tax cuts, but it is what it is at this point. I was just making a point about the fact that the scam of shifting the burden of poor local taxing decisions by allowing residents of those jurisdictions to deduct onerous local taxes from their federal taxes has to stop, and I don’t see any way to do that without some initial pain. The intent should be to force those states and municipalities that have chosen to tax themselves to death to have to bear the entire burden of their own decisions, and thereby to push them toward reducing taxes at those levels as well.

There’s no principled argument against this, though I do concede that there are a number of pragmatic arguments to be made regarding how to accomplish this without hurting innocent people in the process. I just don’t see how this travesty can be corrected, though, without pain. Ultimately, people should have to bear the burden of choosing to live in high tax states. It’s at least as “unfair” for residents of those states to shift their burden onto the people of more responsible, lower-tax states as it is to simply require the residents of the high tax states to finally take ownership of their state’s and cities’ choices (and their choice to continue to live there).

57

posted on

11/29/2017 2:35:20 PM PST

by

noiseman

(The only thing necessary for the triumph of evil is for good men to do nothing.)

To: Yogafist

To: Sam_Damon

59

posted on

11/30/2017 8:01:52 AM PST

by

Yogafist

(Smith Storme)

To: Yogafist

Fair enough consideration.

The thing IMO we should all want: limited government. I’m not suggesting the US go whole libertarian, but we have really gotten away from the model of federalism the founding fathers had envisioned.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson