Skip to comments.

Republican Sen. Ron Johnson Opposes GOP Senate Tax Package

The Wall Street Journal ^

| 15 Nov 17

| Siobhan Hughes

Posted on 11/15/2017 4:51:41 PM PST by SkyPilot

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 81-100, 101-120, 121-140 ... 161-165 next last

To: nopardons

You spelled non sequitur wrong.

And apparently you don't know anything about rhetoric.

Depending on the timing and cadence, two sentences might be even more effective than one, if it is spoken.

101

posted on

11/15/2017 9:27:28 PM PST

by

grey_whiskers

(The opinions are silly those of the author and are subject to change without notice.)

To: lasereye

What you wrote is utter, unalloyed B.S. and in spades!

You accuse others of falling for/using DEM talking points, when YOU are using a crap article.

And FYI...those who earn $25,000 a year, for a couple, are just about at the poverty level; hardly "middle class".

To: Mears

It shouldn’t have; that poster is wrong.

To: lasereye

You don't have the vaguest idea of what the INCREASED taxes off set! LOL

It's Senate rules that they have to sort of "balance" the MUCH lower tax DEDUCTIONS FOR THE HUGE CORPORATIONS, so they're doing it on the backs of the middle class and also there's that fifth bracket on the uber wealthy that is in that mix too.

To: lasereye

I believe that the biggest benefit to the nation is the corporate tax cuts. They would significantly boost economic growth. That's only helpful if the greedy vermin in the C-level suites don't hoard all of the economic growth for themselves and the other high earners.

Used to be (even allowing for hedonic improvements, lower standard of living in general, and so forth) an average American could get a high school degree, get a regular job, and afford a middle class lifestyle for a 4-person family, including car and house. One one income, possibly supplemented by a wife working part time.

Now, with the advent of two income families, easy credit, and inflation, you need two full-time workers to make a go of it. And it takes longer to get established enough to buy a house.

GDP growth has outpaced population growth in real terms: but the upper income levels have outpaced everyone else, and disproportionately, too, in terms of accrued wealth.

105

posted on

11/15/2017 9:32:43 PM PST

by

grey_whiskers

(The opinions are silly those of the author and are subject to change without notice.)

To: grey_whiskers

That was a typo and I know timing and cadence better than you imagine that you do.

It was a dumb post, that I replied to.

To: nopardons

You’ve never done software design. Common phrase.

107

posted on

11/15/2017 9:36:52 PM PST

by

grey_whiskers

(The opinions are silly those of the author and are subject to change without notice.)

To: grey_whiskers

Not a lot of people have; ergo, it is beyond stupid to use it on this thread, since it has NO meaning for the vast majority who read/s it.

To: SkyPilot

Need to get this idiot on board we can’t afford to screw this up. It’s better than nonthing.

Snow will probably vote against it, and McCain is likely also on the no vote list if not also Mercoskty the usual democrats in republican clothing.

To: lodi90

If you have a better tax plan that will pass I am all ears. You think we’ll get a better deal from President Biden? Because that is where we are headed if the Party of No (as the Dems call the GOP) gets there way.

--------------------------------------------------

With all due respect, I asked 3 simple questions...You did not answer any of them. Answering a question with a question is either a diversion, or you don't know Ron Johnson, don't know why he does not like the tax plan, and won't say whether or not YOU support the plan...

I will be more direct and respond to your post...

1. Why would I have a tax plan? Frankly, it is not my job to write a tax plan and message and lobby effectively to get it passed. I did not run for office on a promised tax plan, and I am not not paid to be a legislator--that is what I as a citizen am paying these swampcreatures to do. That is why I voted for President Trump.

That said, I don't like the swampcreatures premises--as with their tweak of obamacare, they seem far more concerned with everyone except those who are paying the bulk of the taxes...In their mindset, they cannot reduce taxes unless they find out ways to pay for it...aka penalizing various classes of citizens. What happened to those proposed across-the-board government spending cuts?

2. President Biden? We are headed to losses in 2018 if the GOP does not produce what President Trump ran on...and this plan is not what he ran on. If you don't want a President Biden, then the GOP had better pass a decent plan...and Trump needs to get out and lead on this issue.

3. No, I don't want what a president Pedo would offer. and, no, I don't have an official plan; however I have some ideas:

1. How about real reform of the tax code instead of tweaking brackets? How about EVERYONE PAY SOMETHING. There are far too many living in this country getting money from the government with no skin in the game. What is an "earned income credit" for? Why are we giving people welfare in the name of a tax credit? Loopholes like claiming deductions for dependents living in other countries needs to be eliminated as there is rampant fraud. Tax advantages for hiring H-1B Visa holders need to be eliminated.

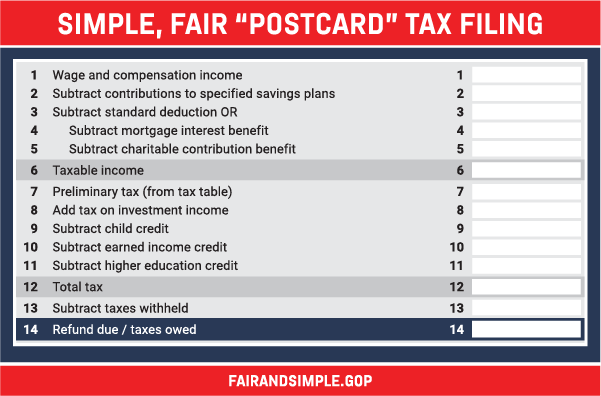

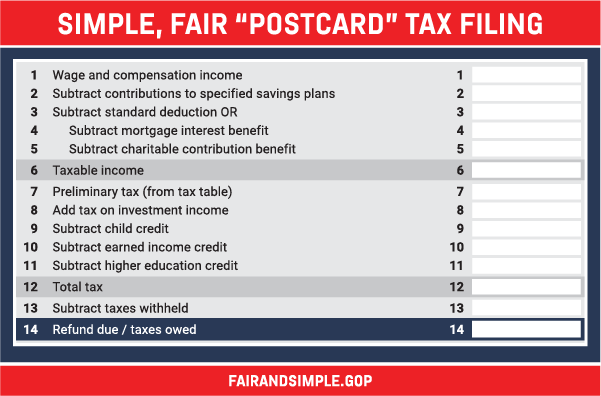

I really would love a FAIR Tax plan or a FLAT Tax plan...what happened to that postcard idea? I think small businesses here in US should get same or better tax breaks than big corporations that have gone abroad. They are the innovators and crony capitalism has devastated many because they cannot compete.

2. I think congress should be working on the tax plan Trump ran on and for which he should be leading--Why would anyone trust Ryan and McConnell to do a tax plan...Think about it, we have record deficits and yet the government is collecting record taxes every month...If I recall correctly, in addition to record tax collections in 2017, we had a bigger yearly deficit in 2017 than in the past decade or longer...Hmmm sad since we have Republican House, Senate and white house in control...They need to stop the spending! W

In my opinion, the President needs to call the entire republican side of the aisle in to watch a video presentation of what he said he platform would be and get the GOP on board. There are many things being proposed that were not part of the campaign platform. Then he needs to pitch the plan from the bully pulpet. If it does not pass, then he goes to the American people and says we need to primary out and vote out those who did not vote for it...instead of signing a mediocre bill that will not be well thought of during elections in 2018.

Your original post:

Yep. Johnson was just reelected and isn’t up for SIX YEARS. No reason for him to do this other than stick it to POTUS.

You stated it as fact--as if you knew this was the case--that there was no reason for Johnson to not support the bill ...So I wanted to know why as well as what you like about it. I am trying to learn.

110

posted on

11/15/2017 10:46:47 PM PST

by

Freedom56v2

(Inside Every Liberal is a Totalitarian Screaming to Get Out - D. Horowitz~Thx Kalamata ;))

To: tcrlaf

When you FEEL the burden, maybe you’ll get off your but and DO something about it, instead of whining about it on an obscure message board? Oh please. Don't project your own feelings and behavior towards me. That is what Democrats do.

111

posted on

11/16/2017 2:48:25 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: tcrlaf; Mariner; nopardons

When the wealthy California taxpayer, that largely votes DEMOCRAT, finally has to pay THIER FAIR SHARE, they are going to scream bloody murder about it. WHICH IS EXACTLY THE POINT, FOLKS Oh, so the point of this "tax reform" garbage of a bill has nothing to do with helping the struggling middle class, our children, young people just starting out, workers, people trying to save for retirement, or any of the other rhetoric thrown out.

All these shenanigans are really just a cynical political play to hold a gun to the head of ordinary people, in a desperate and half baked attempt to punish certain parts of the nations, in the hope that after being mauled, they will be more sympathetic to the GOPe?

Well, given the garbage leaders in the GOPe we have, you are probably right. This is all politics at its worst. But your statement (IN ALL CAPS) only solidifies our argument that this bill needs TO DIE.

It isn't about our economy, or MAGA. Kill the bill.

112

posted on

11/16/2017 2:55:37 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: lasereye

Those high tax state tax payers are effectively being subsidized by people in the low tax states. No they are not. It's the other way around. Without the tax revenue of the states that you seem to despise, the Federal revenue would be a trickle.

Further, you are advocating Double Taxation - people forced to pay taxes upon the taxes they already are paying. Since 1913, the Federal Tax code has prohibited this, because the original authors deemed it "immoral."

And then there was this:

Rep. Dan Donova (R-NY):

"Since the federal income tax was created in 1913, Washington has never violated the conservative principle that people shouldn’t pay federal taxes on the taxes they already pay to their state and local governments because to do so would be a double tax and would interfere with a state’s ability to raise and spend as it chooses. Former President Ronald Reagan didn’t change it when he had the chance in 1986, and we shouldn’t change it now. We have an opportunity for transformative action to reform the bloated, complex and job-killing tax code for the first time in 30 years. I want nothing more than to vote for a plan that unleashes our country’s full economic potential. The tax proposal released last week has great policies that will make our country’s businesses more competitive, a top priority for President Trump and House Republicans. Unfortunately, the plan would also repeal the state and local tax (SALT) deduction, sending the bill for tax cuts elsewhere in the country straight to (the) middle class......Let’s stop pretending this tax proposal is good for everybody: the middle income people of New York, California, Illinois and New Jersey are footing the bill for a tax break for people elsewhere."

And then comes the typical attack against anyone who does not want to see their individual taxes raised by this crappy bill - we are socialists and we hate capitalism.

Give me a break.

You can pull that one on your weak minded sister at Thanksgiving, but not here.

Paul Ryan and his little postcard that his staffer whipped up using Excel and PowerPoint and sent to the printer is propaganda that any thinking person is not going to swallow. Eliminating deductions (forever), while then making even the crumbs of "tax relief" they are promising individuals is worthy of contempt - but you are buying it because it probably benefits you in some way (business, stocks, etc).

Sorry, but I don't want to "subsidize" your tax break. And if you disagree with me, I won't call you a "socialist." That's your game.

/cdn.vox-cdn.com/uploads/chorus_image/image/56238953/ryan_postcard_tax.0.jpg)

http://freerepublic.com/focus/f-bloggers/3603755/posts

Whenever challenged with the reality that their proposal will result in a tax increase on many of their constituents, they exclaim, “Yes, but we are doubling the standard deduction!” Yet, not one of them ever mentions that they are, simultaneously, repealing the personal exemption deduction of $4,150, per person.

In 2018, the standard deduction for single filers will be $6,500, and for married taxpayers filing jointly $13,000, while the personal exemption will be $4,150 (per person). That means a single non-itemizer would already have received $10,650 ($6,500 standard deduction + $4,150 personal exemption) of tax exempt income before the proposal, versus $12,200 after. And, a married couple, without children and not itemizing, would already have received $21,300 of tax exempt income before the proposal, versus $24,400 after.

For single filers, the difference between $12,200 and $10,650 isn’t double, it’s only $1,550. For married couples, the difference between $24,400 and $21,300 is a mere $3,100. This isn’t a doubling of the standard deduction. It is effectively an increase to the standard deduction of $1,550 for single filers and $3,100 for couples without children. So, please stop lying to us.

113

posted on

11/16/2017 3:12:52 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: grey_whiskers; nopardons

You spelled non sequitur wrong. So now we are turning into Spelling Nazis in order to try and win the tax debate?

114

posted on

11/16/2017 3:15:51 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: Freedom56v2; lodi90

President Biden? We are headed to losses in 2018 if the GOP does not produce what President Trump ran on...and this plan is not what he ran on. If you don't want a President Biden, then the GOP had better pass a decent plan...and Trump needs to get out and lead on this issue.

Exactly Freedom. That's the money quote right there.

Trump never, ever said he was going to sign a bill that raised the taxes on millions of middle class Americans.

In fact, he said that the middle class (in addition to businesses) needed a tax cut, which is not what these bill accomplish.

Ryan and McConnell gave us these crummy bills. They have had years to work on them, and now they are trying to ram them through because "we are running out of time."

The truth is, they want to jam them up the orifices of the citizens before they can really contemplate how bad they are.

115

posted on

11/16/2017 3:22:26 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

Open borders swamp rats now trying to benefit their corpoarate buddies at the expense of individuals and small business. Trump won because he resonated with blue collar workers in the Great Lakes States. This bill would destroy that trust. Which is the entire point of this exercise - to undermine Trump.

To: boycott

This whole “Byrd Rule” has to go.

Real tax cuts usually result in short term deficit followed by economic expansion.

In the end - everyone wins, and the government collects more tax revenue.

This bill forces one group to “pay for” someone else’s cut.

Those people will necessarily have to cut back on household spending.

Just cut everyone’s taxes! Let’s start acting like we WON.

To: littleharbour

Yes, and people on this board and throughout the GOPe are trying to convince us that what is good for Facebook and Google is good for the retiree in California, the middle class family in Upstate New York, or the military family in New Jersey. Wrong.

118

posted on

11/16/2017 5:20:07 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: boycott

But lyin’ Ryan can crow, “it fits on a postcard.”

So does this:

1. How much did you make this year.

2. Please send it in.

As a small business owner and longtime conservative, the GOP sucks. Tax reform my bleeding buttocks.

Flat tax for all—income, capital gains and eliminate non-profit status. Tax breaks for charities are just another way to exert government control.

To: SkyPilot; tcrlaf

“All these shenanigans are really just a cynical political play to hold a gun to the head of ordinary people, in a desperate and half baked attempt to punish certain parts of the nations, in the hope that after being mauled, they will be more sympathetic to the GOPe?”

Of course not.

This is far more personal for tcrlaf.

You see, he hates anyone with more than he has. And if he has an opportunity to have a man with a gun take it on his behalf, he’ll use that opportunity.

He doesn’t pay income taxes but lives off the labor of others. He’s resentful as a result. And jealous.

He’s a Social Justice Warrior.

120

posted on

11/16/2017 5:56:28 AM PST

by

Mariner

(War Criminal #18)

Navigation: use the links below to view more comments.

first previous 1-20 ... 81-100, 101-120, 121-140 ... 161-165 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

/cdn.vox-cdn.com/uploads/chorus_image/image/56238953/ryan_postcard_tax.0.jpg)