Skip to comments.

The giant flaw in Trump’s tax plan

Yahoo News ^

| October 2nd, 2017

| Rick Newman

Posted on 10/02/2017 5:57:59 PM PDT by Mariner

To cut taxes on businesses, middle-class families and the wealthy, President Donald Trump’s tax plan relies on the elimination of key deductions that cost the federal Treasury many billions of dollars each year. Getting rid of those giveaways, in theory, will provide new federal revenue that will help offset the revenue loss that will come from lowering rates.

In principle, tax experts support the idea of a cleaner tax code with lower rates and fewer ways for people to reduce what they owe. But tax breaks tend to be popular and notoriously hard to roll back once they’re in place. And the biggest tax break Trump wants to kill — the deduction for state and local taxes, known as the SALT deduction — might just be impossible to kill.

Republicans have targeted the SALT deduction for elimination for a couple key reasons. First, it costs Washington roughly $100 billion per year in foregone revenue — a large sum that would provide a lot of headroom for other tax cuts if captured. Second, the SALT deduction disproportionately benefits residents of blue states that tend to vote Democrat. So taking it away would affect Dems more than Republicans. That supposedly makes it one of the safest ways Republicans who control Congress and the White House can effectively raise taxes on some voters, while suffering minimal electoral harm.

This is lousy logic, however, and a closer look at the numbers reveals a giant flaw in the strategy of placing the burden of tax reform disproportionately on residents of Democratic states. The SALT deduction doesn’t benefit Democratic states more just because they’re blue. It’s simply more popular in states with higher incomes ...

(Excerpt) Read more at yahoo.com ...

TOPICS: Business/Economy; Government; News/Current Events; Politics/Elections

KEYWORDS: 115th; third100days; trumptaxreform

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100 ... 141-146 next last

To: Undecided 2012

Manufacturing and agriculture create wealth also. Importing and retailing, not so much,

61

posted on

10/02/2017 7:17:28 PM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: Mariner

Just for Californians. Guess I just like the idea of seeing traitors and secessionists being brought to heel...

62

posted on

10/02/2017 7:20:28 PM PDT

by

sam_whiskey

(Peace through Strength.)

To: Undecided 2012

Still dodging the issue. Rental property, S corporations, expenses for businesses and stock transactions make a one page return impossible. Maybe you think the IRS is going to just take your word for it.

63

posted on

10/02/2017 7:21:54 PM PDT

by

arrogantsob

(Check out "Chaos and Mayhem" at Amazon.com)

To: central_va

Tariff can’t fund the military.

64

posted on

10/02/2017 7:23:21 PM PDT

by

arrogantsob

(Check out "Chaos and Mayhem" at Amazon.com)

To: arrogantsob

I said a tariff plus a sales tax. I would also keep the payroll deduction as they are until social security and medicare can be addressed separately.

65

posted on

10/02/2017 7:26:29 PM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: central_va

Those who serve the market create wealth. The Division of Labor creates wealth all along the way. In fact, every new division in the labor change creates wealth because it makes the market more efficient.

You really believe that retailing creates no value? Of course it does since a wholesaler with a warehouse full of a commodity sells it to a specialist, the retailer, who sells it for far more than if he tried to own his own. The difference between what the wholesaler could sell and the sale of the retailer.

66

posted on

10/02/2017 7:30:32 PM PDT

by

arrogantsob

(Check out "Chaos and Mayhem" at Amazon.com)

To: central_va

How does imposition of a massive sales tax not collapse the economy?

67

posted on

10/02/2017 7:33:06 PM PDT

by

arrogantsob

(Check out "Chaos and Mayhem" at Amazon.com)

To: DoughtyOne

Which is why I don’t understand the thinking behind eliminating exemptions for dependents.

I’m going to have to cut way back to afford the extra tax burden.

To: Undecided 2012

That’s crap. Get rid of all the deductions. Get a flat tax and I’ll file on a single page. As a Conservative stuck living in a Blue State (Illinois) I fully support a FLAT TAX that EVERYONE pays.

Stop this nonsense that anyone below a certain dollar amount a year pay NOTHING. Either EVERYONE has skin in the game or NO ONE has skin in the game.

Everyone pays, no exceptions.

69

posted on

10/02/2017 7:34:46 PM PDT

by

usconservative

(When The Ballot Box No Longer Counts, The Ammunition Box Does. (What's In Your Ammo Box?))

To: arrogantsob

They could just stop trying to tax all of that way more complicated investor stuff....

70

posted on

10/02/2017 7:35:09 PM PDT

by

Paladin2

(No spelchk nor wrong word auto substition on mobile dev. Please be intelligent and deal with it....)

To: mrsmith

“You don’t think reducing the corporate taxes will result in increased returns to (the itemizing) investors?”

It should.

That’s why I support 0% corporate tax.

But that has nothing to do with individual deductions nor net taxes paid by individuals.

71

posted on

10/02/2017 7:36:12 PM PDT

by

Mariner

(Pink Pussy Hats for the NFL)

To: Arthur McGowan

And yet they raise the lowest bracket from 10% to 12%.

Some “tax relief”

To: usconservative

"Everyone pays, no exceptions. "

Income tax is partial slavery. Many hours of your labor ech year are due the Feds. If peeps are not earning money, they should have to put in 0.4 x 40 hr/wk = 16 hours of their labor per week for the benefit of the gov't. That would be fair.

73

posted on

10/02/2017 7:38:16 PM PDT

by

Paladin2

(No spelchk nor wrong word auto substition on mobile dev. Please be intelligent and deal with it....)

To: Mariner

Here it does. The loss of deductions is tied to reducing the corporate tax.

74

posted on

10/02/2017 7:40:25 PM PDT

by

mrsmith

(Dumb sluts: Lifeblood of the Media, Backbone of the Democrat/RINO Party!)

To: sam_whiskey

“Just for Californians. “

North Carolina has a higher percentage of people claiming these deductions than either CA or NY.

It’s apparent you did not read the article.

75

posted on

10/02/2017 7:42:56 PM PDT

by

Mariner

(Pink Pussy Hats for the NFL)

To: Mariner

State percentages really don’t tell the whole story. The total amount of revenue to the Feds counts way more.

76

posted on

10/02/2017 7:48:50 PM PDT

by

Paladin2

(No spelchk nor wrong word auto substition on mobile dev. Please be intelligent and deal with it....)

To: arrogantsob

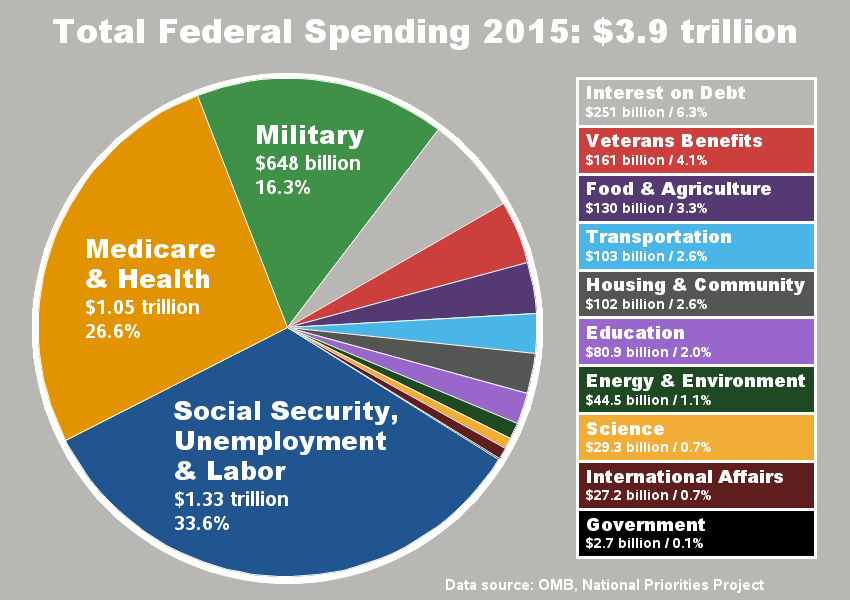

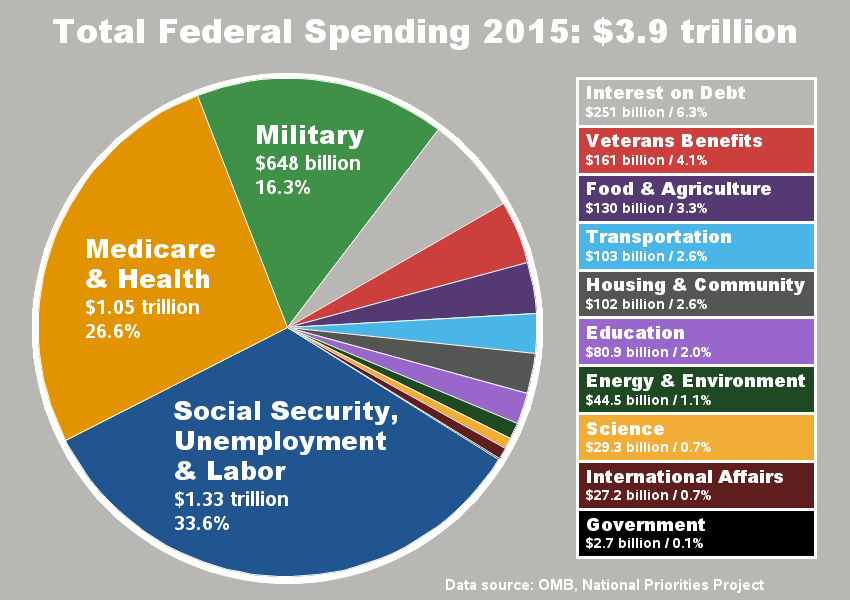

Why massive? Here is the pie chart:

I would not touch SS and MC, that is the biggest part of the budget so they would be funded by a parole tax. So the tariff and sales tax would have to add up to $1.5 trillion, not hard at all.

The issues of SS and MC would be separated from the general revenue which is another great by product of ditching the income tax.

77

posted on

10/02/2017 7:54:49 PM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: Mariner

The next tool in the disruptor's handbook:

Deny, Accuse, Reverse Victim and Offender.

78

posted on

10/02/2017 8:09:23 PM PDT

by

grey_whiskers

(The opinions are solely those of the author and are subject to change without notice.)

To: Paladin2

“The total amount of revenue to the Feds counts way more.”

Counts, for what? Social Justice?

For your prurient pleasure in who gets hurt? Vengeance?

For the individual taxpayer what really counts is their net tax.

Oh, an they count as their mortal enemies those who advocate for and enable an increase in their taxes.

79

posted on

10/02/2017 8:12:11 PM PDT

by

Mariner

(Pink Pussy Hats for the NFL)

To: mrsmith

“The loss of deductions is tied to reducing the corporate tax.”

Only because the Social Justice Warriors WANT to link them.

80

posted on

10/02/2017 8:13:55 PM PDT

by

Mariner

(Pink Pussy Hats for the NFL)

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100 ... 141-146 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson