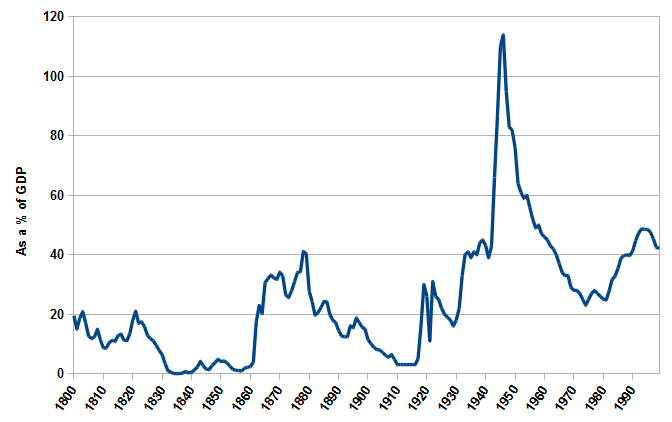

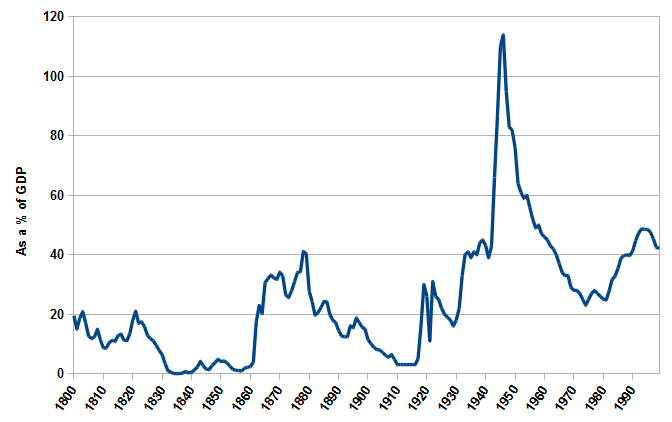

In fact US federal debts in the late 1850s were near their lowest levels ever:

Posted on 06/23/2016 2:04:08 PM PDT by ColdOne

A measure to bar confederate flags from cemeteries run by the Department of Veterans Affairs was removed from legislation passed by the House early Thursday.

The flag ban was added to the VA funding bill in May by a vote of 265-159, with most Republicans voting against the ban. But Speaker Paul Ryan (R-Wis.) and Majority Leader Kevin McCarthy (R-Calif.) both supported the measure. Ryan was commended for allowing a vote on the controversial measure, but has since limited what amendments can be offered on the floor.

(Excerpt) Read more at politico.com ...

Believe me, I know what you meant to say, but were just too shy to spit it all out.

No problem, you're welcome.

1860...............63,131,000...............33,100,000

There must be a message here that you are trying to convey which I am not grasping. I recognize that the import revenues paid for that 63-69 million dollar Federal Budget, but the economic impact to the North of Southern independence was likely closer to 10 times that amount.

It was a major component of their every day economic lives.

They might have been willing to make up a 69 million short fall, but to make up a 470 million short fall?

No, that was a bridge too far.

You said: “There must be a message here that you are trying to convey which I am not grasping...”

Total Federal spending was not only well beyond its basic responsibilities, but also well beyond its revenue. The government began borrowing large amounts of money to meet its obligations, and had incurred very large debt just prior to the secession of the Southern states.

In preparation for the President’s state of the union report, Howell Cobb (of Georgia), the Secretary of the Treasury (Buchanan Administration), reported to Congress that based on projected spending, there would be dramatic increases in the debt of the government.

In his state of the Union report of December 5, 1859, President Buchanan’s Secretary of the United States Treasury issued his report stating that for fiscal year 1859, the total revenue of the US Treasury was $88,090,787. This was misleading, because $28,185,000 was ‘income’ from government borrowing. The actual total revenue from tariffs, and less the funds from the sale of public lands was $49,566,000. Tariff revenue contributed 92% of the total revenue of the country.

But the Congress spent $69,071,000, which was 29% more than it took in.

Just an aside here, to put a human face on this, the going price of a black male between 16 and 40 years old in the 1850’s was $1,200 dollars.

My own speculation is that this is the beginning of the Finance driven deficit spending spree upon which the nation was about to embark to the great joy of the major financiers in New York.

It's too early for John Maynard Keynes, but i'm sure some folk back then had a natural preference for pump priming spending sprees in which the money funneled through them.

I think John Keynes just came along later with a good sounding justification for what they wanted to do anyway.

I have never had any issues with people keeping the fruit of their labor and their wise investments, but unearned income has always seemed to me to be a form of theft.

You know, kinda like slavery. In fact, exactly like slavery.

One of the slogans of the New York riots was that "Slaves lives were worth more than theirs". (Speaking of the $300.00 exemption fee.)

How much of that debt beyond their obligations was for subsidization of Northern industries I wonder?

See #1597 and subtract normal expenses from total expenses. That gives you a fairly accurate figure.

Southern infrastructure spending was largely privately financed. That included railroads, dredging, and roads.

In June, 1860, a loan of twenty million dollars had been authorized by Congress. Of this amount, ten million was offered in October in a five per cent stock, and it had been bought by investors.

Before any installments were paid, the secession panic that followed the election affected credit, and many bids were withdrawn.

This so seriously crippled the Treasury Department, that as the New Year approached, it seemed likely there would be no funds with which to meet the interest on the National debt....essentially the failure of the Union treasury was at hand.

By the Act of December 17th, 1860, an issue of ten million dollars, in treasury notes, was authorized, to bear a rate of interest as might be offered by the lowest bidders, but so shaken was credit, few bids were made, and some of them at a rate of thirty-six per cent interest per annum.

The investors interested in the Government credit finally took one million five hundred thousand dollars of one-year treasury notes, at twelve per cent per annum (the amount was subsequently raised to five million dollars), on condition that the money should be applied to paying the interest on the national debt.

This was certainly a dark day in the Capitol, when the Federal Government, which had earned the honor of being the only nation that had ever paid its debts in full—principal and interest—and which in 1856, with an overflowing treasury, had paid twenty-two per cent premium for its own stock, was now reduced to give twelve per cent interest, for a few millions, and to engage to protect its credit with the money.

This, combined with the reality that as soon as the primary cotton and tobacco producing states seceded with the subsequent massive loss in exportable products, that the US Treasury was in extreme jeopardy.

"It is now just a year since the first of the bills, of which we have spoken, was passed, and we wish to note its effects.

These have been as, during this crisis of our affairs, we most desired to have them, namely:1. First -- A reduction in the value of articles of luxury imported.

2. Second -- The accumulation and retention of specie (the basis of all financial operations) in the country.

3. Third -- An increase in the revenue arising from the levy of duty on those articles which would always be imported, in times of peace or war; and,

4. Fourth -- A prospective increase in the manufacturing interests and capital of the country."

Driving up the tariff reduced the amount of imports. That is protectionism. They got less real tariff income as a result. Their money was worth less.

Your quote above is from the New York Times of March 15, 1862. Let’s look at what the Times said about the Morrill Tariff a year earlier.

The New York Times, March 29, 1861 [my bold, red, and paragraph break below]:

Our Revenue Policy

It is of course a matter of surprise to no one that we are obliged to read, upon each fresh arrival from Europe, such denunciations of our new tariff law, as we reproduce in other columns of this paper. There never, in fact, was an important measure that attracted less attention on its passage, or, when the public consciousness was fully aroused, was more reprobated the world over as ill-timed and mischievous to the last degree, than the enactment in question. We resisted its passage upon the very grounds that are now almost universally urged for its repeal; and showed that it would alienate the Border States, lose us the sympathy of Europe, and above all, yield neither revenue, nor protect our industry, because it could not be enforced. …

The public, however, could not be awakened from its lethargy, and in a community now unanimous for its repeal, we found difficulty in getting a second. But the measure is a law. What is to be done with it? Repeal it, as a matter of course. This should be the first act of the Administration. It is a commercial as well as a political necessity. The crisis is imminent and demands immediate action.

Some desire by the Times to have the raised tariff back then, huh? Quite a different take on the tariff.

Here's the New York Times as quoted by the New Orleans Picayune of April 3, 1861 [my bold again]:

Never was a nation in greater embarrassment. We confess our inability to enforce the most important laws we enact, and sit passively down and see them violated without raising a finger. How can we maintain any national spirit under such humiliation? We take the step of all others most calculated to alienate the border States and foreign nations. We can neither collect our revenue nor afford protection. Who, under such circumstances would dare to embark in any enterprise? How much revenue can we collect in Northern ports? No one can answer these questions.

…

The door to borrowing is still left open. But it has been entirely contrary to the genius of our Government to borrow without any present or prospective means of payment. The Government fortunately can, by borrowing, temporarily supply all its wants. ... We learn that Secretary Chase has already declared that the tariff must be repealed.

[BroJoeK]: rustbucket: "Let’s look at cotton mills in the North, The city of Lowell, Massachusetts had many cotton mills. From Wikipedia:"

[BroJoeK]: Sure, but similar could be said of other wars, wars we don't usually blame on Marxist class warfare reasoning.

I'm sorry, you absolutely lost me there. Marx supported the North in this war [Link]. If cotton supplies became limited during the war, wouldn't you look to see if there was an effect on the cotton mills that Appleton's said there was? But instead you see Marxest class warfare rather than a confirmation that Appleton's was right?

In that same issue, the New Orleans Picayune quoted from Gore's General Advertiser, the oldest established newspaper in Liverpool, England as follows [my emphasis below]:

The Southern States know well that the commercial intercourse between them and the manufacturing countries of the old world, especially Great Britain, cannot be too untrammeled by fiscal regulations. The commerce-killing tariffs of the North are hateful in their eyes. What interest have they in the iron foundries Pennsylvania, or the cotton factories of Lowell? They care not to protect the shipping of the North. Their object is our object, only more naturally theirs than ours, "to sell in the dearest and buy in the cheapest markets of the world."

We therefore confidently assert that the question of slavery is not the real bone of contention between the Northern and the Southern States. The question at issue is that of free-trade, or protection so insatiable in its demands and so selfish and its exclusiveness as to impose a prohibitory duty on articles in the production of which it cannot hope to compete with those who possess infinitely superior facilities for the work.

"I had disguised the ship, so that she deceived those who had known her, and was standing in (unnoticed), when the Wyandotte commenced making signals, which I did not answer, but stood on."

"The steamer then put herself in my way and Captain Meigs, who was aboard, hailed me and I stopped."

"In twenty minutes more I should have been inside (Pensacola harbor) or sunk."

Signed: D.D. Porter

Had DD Porter not been interdicted by Captain Meigs, would his "sinking" have initiated the war?

Why would he think he might be sunk?

The Civil War fiscal crisis began before April 12, 1861. The U.S. Treasury tottered in a state of utmost confusion months before the firing on Fort Sumter.

Traditionally the “dynamic center” of government, the Treasury now faced “being placed before the world in the aspect of a mendicant.” The department's secretary, John A. Dix, notified Congress on February 11, 1861 that “little more” than $500,000 remained in the central depository in Washington.

Demands for $2 million “unanswered” requisitions had accumulated in the department, with $6 million more due to public creditors in early March. Dix predicted a $21.6 million shortfall by the end of the fiscal year.

Staff in most executive departments could not draw their salaries that January. Members of Congress had gone unpaid since the start of the session the previous December. Worse yet, according to Dix, “The War and Navy departments have calls for large requisitions [that] have been delayed on account of the exhausted condition of the Treasury.”

More on this later, but for the moment let's notice that Democrat Buchanan ran a Democrat administration supported in the beginning by a Democrat Congress, Democrat Supreme Court and let's remember that Democrat politicians ultimately owed allegiance to the Southern slave-power.

In 1857, when Democrat Buchanan took office he appointed Southern Democrats to his key cabinet posts making Democrat control in Washington DC almost continuous since its founding.

That resulted, among other things, in the Supreme Court's lopsided 1857 Dred-Scott decision.

So, whatever corruptions you discover in the Buchanan era, you will not be able to blame on Republicans, FRiends.

When time permits, I'll return to your debt question.

If you'll review the charts in my post #1568 above, you'll see that in the overall big picture those economic changes of 1857 to 1860 were not major.

So your posts here exaggerate their importance.

In fact US federal debts in the late 1850s were near their lowest levels ever:

No, it's you who are stuck & addicted to Marxist dialectical materialism explanations for historical events.

Like you, Marx insisted that only economic explanations and class warfare truly describe historical events.

Marx took the older Hegelian dialectics, which did allow for more spiritual motives (i.e., ideals & religious beliefs), and said, in effect: "no, it's all just economics & class warfare, so follow the money."

For a brief introduction to Marx's dialectics you can start here.

You can be 100% certain that whatever federal largess was being handed out in those days, Southern politicians received no less than their "fair share".

But in fact most "infrastructure" work then was privately or state-governments financed.

Federal debts in the late 1850s were near all-time low levels.

Sure, but as with other Northerners of that time, they all soon made adjustments, adapted and continued to prosper.

Congress found other ways to collect revenues and tariffs soon became less important to the Federal treasury.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.