And...

And...

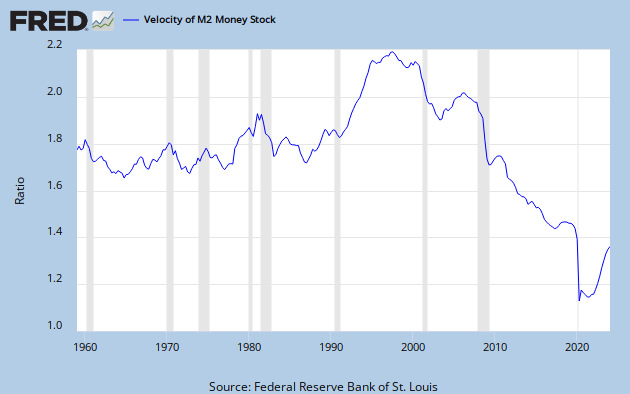

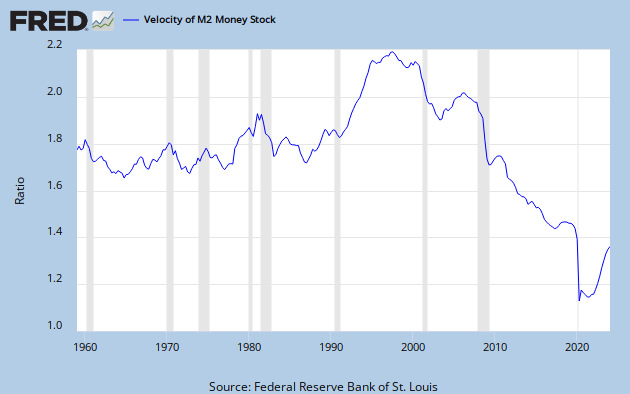

We're in a Liquidity Trap

And...

And...

We're in a Liquidity Trap

Prepare Josh Earnest with talking points. “We expect these ups and downs in the economy. The fact is, that under this President’s leadership....”

Or

“Because this Congress hasn’t passed any of the President’s economic reforms we can expect a weaker recovery.”

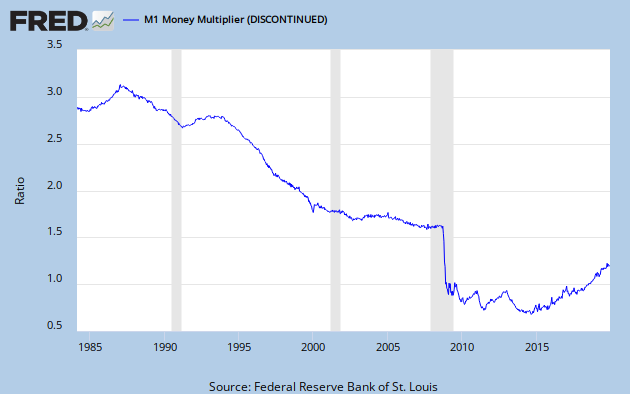

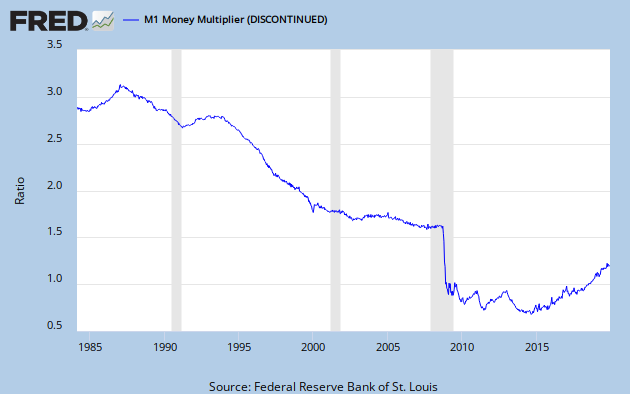

The money multiplier is only .75. That means all of the bogus stuff that's being printed has no long term effect on the economy.

The fix: increase interest rates.

I am not trained in Economics. Correct me where my hypothesis makes no sense, please.

They pulled money out of the economy, hid the real jobs numbers and forced 0% inflation.

This is what happens when Keynesians run the economy.

This is the culmination of a 50 year failed social engineering experiment that Friedman said as far back as 1968 that this would happen.

A government made liquidity trap. ZIRP exists to bailout municipalities who depend on rising property values to finance their liberal schemes. Those values were falling precipitously in most large municipalities, particularly in poor areas.

How can the county assessor tell you your property value is up, when it’s really way, way down?

What should have happened is let the market clear RE prices down to their true market rate, let credit fall and interest rates rise perhaps into the 20% range. That would then attract new capital and investor/consumer confidence. Rates would then decline as money entered the market, bargains are picked up and credit begins to expand.

Instead the opposite happened and the prudent know that these interest rates are unrealistic. In RE for every 1% rise in the interest rate you must reduce the sales price by 10-12% to keep the same payment. Borrowers buy the payment, not the price.

The most frequent rate sinc 1947 to present is 7.5% with the median at 8.75% (data from here: http://www.fedprimerate.com/wall_street_journal_prime_rate_history.htm and just a random site). Let’s assume they’re wrong on the high side and a ‘real rate’ for home purchase is just 6% long term.

If you bought and financed at 4%, you’ll now have to take a 20%-24% haircut to sell. Who can know which price is correct? They’re praying for inflation. Hence the government is short circuiting the marketplace and literally causing its own recession.

Just to be helpful I’ll translate “liquidity trap” to mean excessive gummint spending and debt. This trap does not have a smooth painless bottom when we realize we’ve hit it.