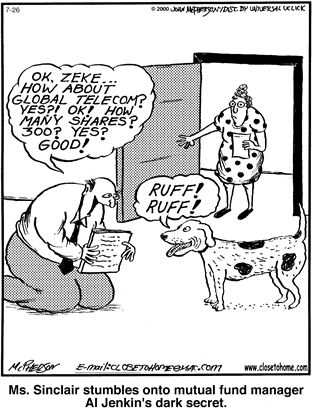

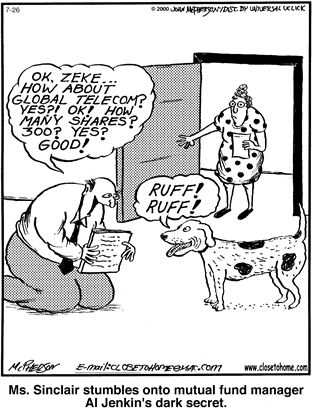

The Executive Summary for those who don't want to read the article: Actively managed portfolios and mutual funds almost never beat the index over the long term. You are much better off sticking with a diversified portfolio consisting of a handful of low cost index funds and reinvesting the dividends.

1 posted on

03/15/2015 12:07:44 PM PDT by

NRx

To: NRx

Efficient market hypothesis once again proven true...

To: NRx

This is especially true when you take into account the management fees and tax inefficiencies of many actively managed funds. The more buying and selling that is done within a mutual fund, the more taxes you'll pay on the short-term and long-term capital gains in that fund.

Index funds work well for a long-term "buy & hold" strategy. I use a mix of index funds (for long-term investing) and managed funds (where I sell occasionally for short-term gains).

3 posted on

03/15/2015 12:27:07 PM PDT by

Alberta's Child

("It doesn't work for me. I gotta have more cowbell!")

To: NRx

Nothing beats a market index that has:

... no cost

... no risk management

... no concern for loss of capital

... And propelled higher by the Plunge Protection Team at the Federal Reserve that has prevented a meltdown since quantitative easing began by buying index derivatives.

How could anything do better than a no cost, manipulated index?? Seems impossible.

Please update this evaluation after the next collapse and we can compare all the alternative strategies over a complete market cycle.

4 posted on

03/15/2015 12:45:06 PM PDT by

aMorePerfectUnion

( "Forward lies the crown, and onward is the goal.")

To: mad_as_he$$

To: NRx

I bought Apple stock for $86 last May 2014 and so far it has gone up to a high of 35%

Pick 1 stock and you can do very very well : )

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson