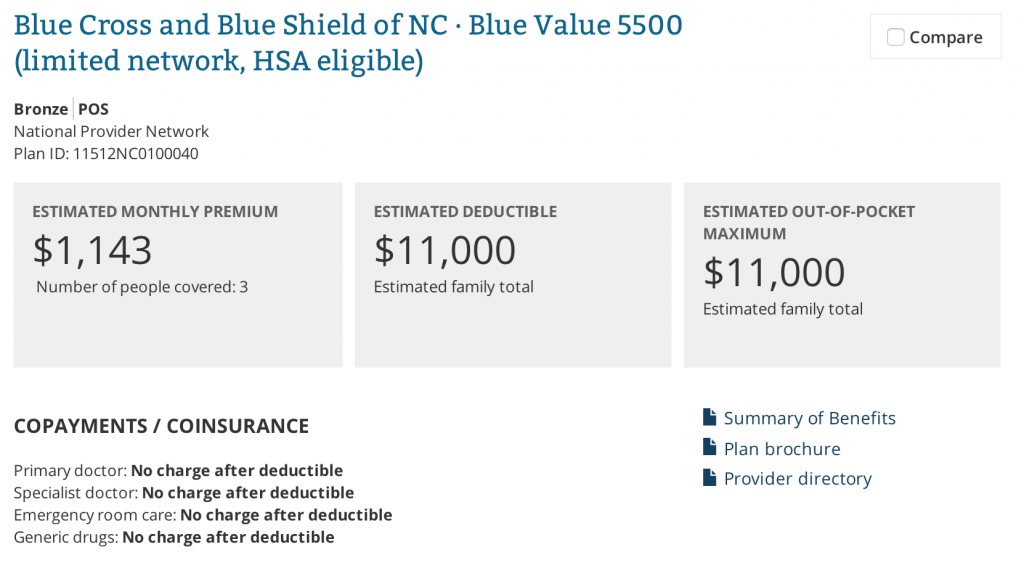

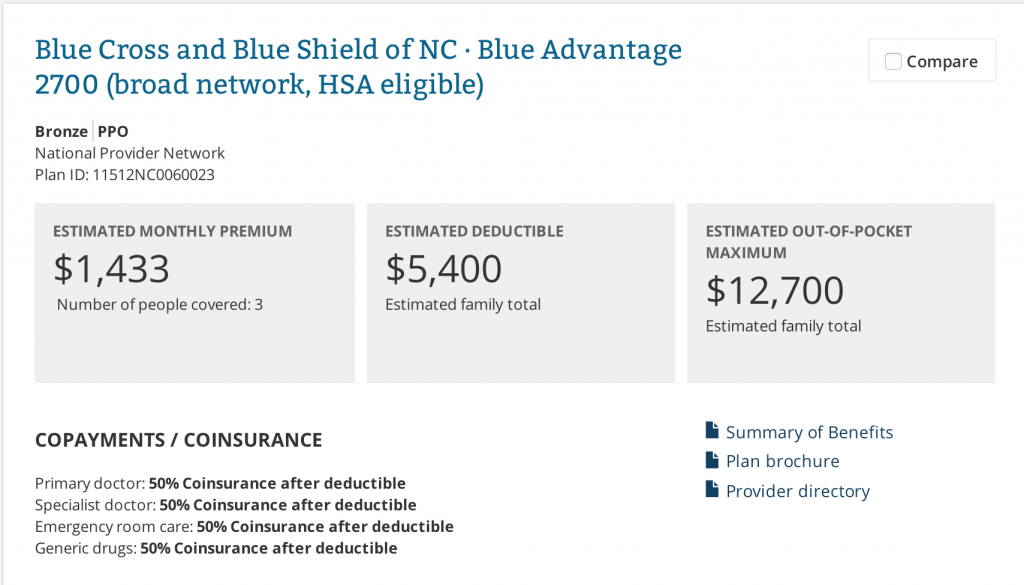

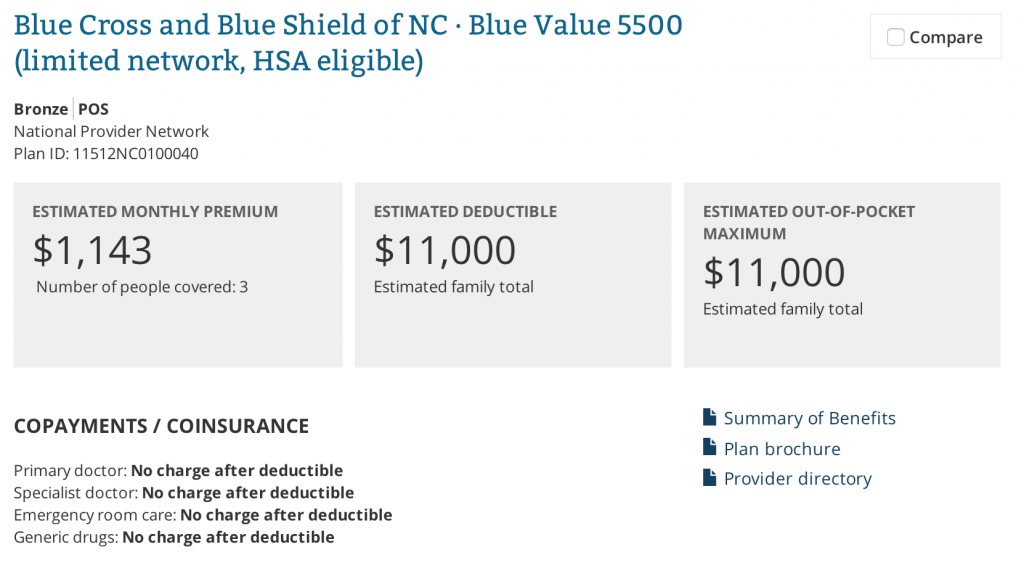

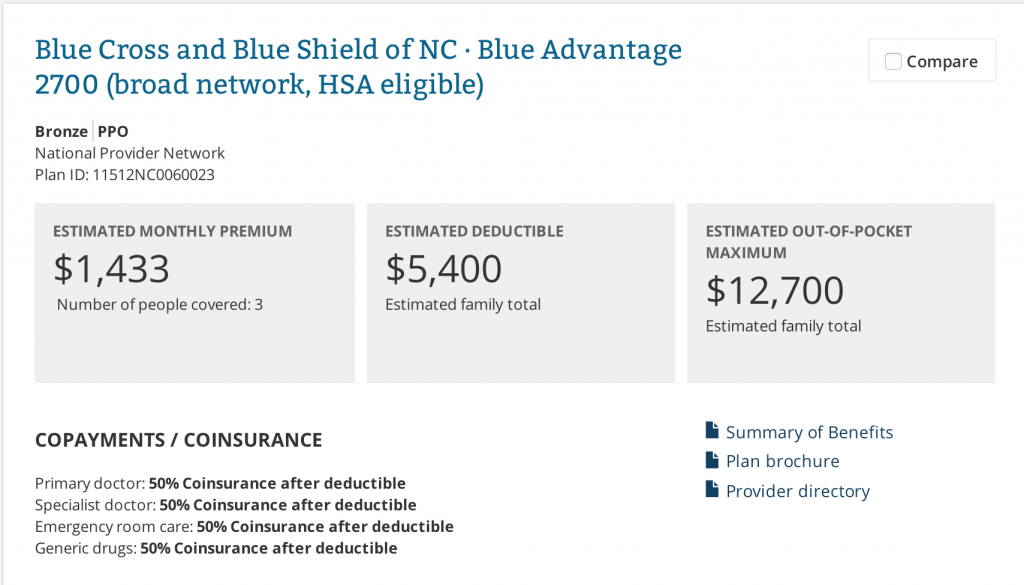

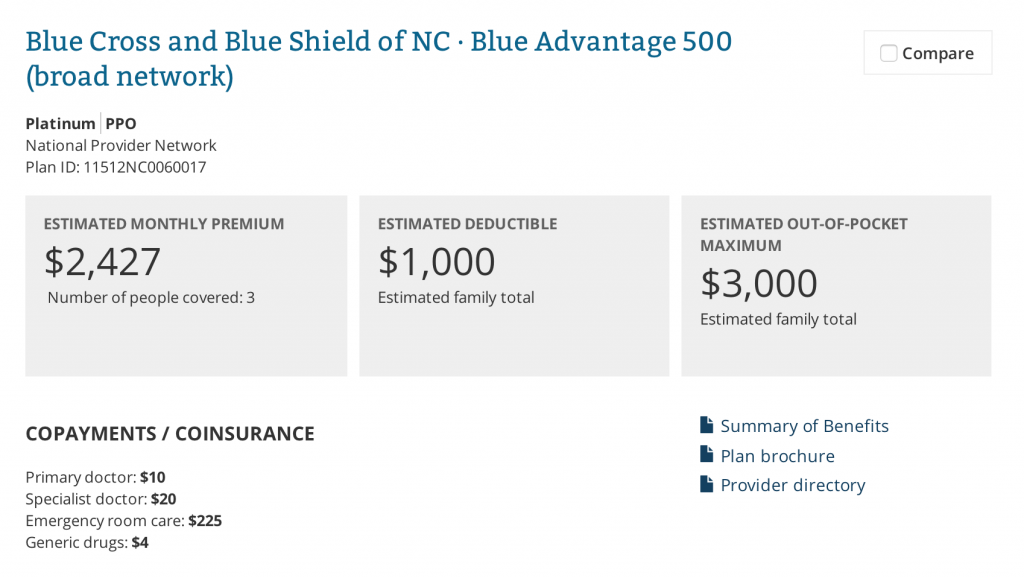

I especially like the 50% coinsurance on the midrange plan....

Posted on 11/11/2014 11:43:23 PM PST by grundle

They might want to think about changing the name of Obamacare's "Cadillac Tax" to a "Ferrari Tax."

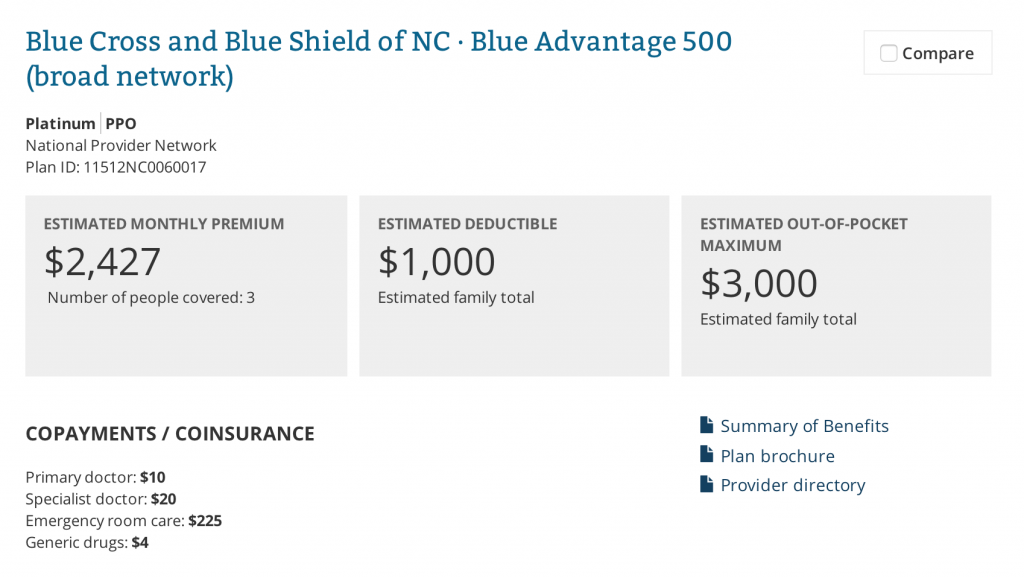

A new report that details the effects of a looming Obamacare excise tax on employer-sponsored health plans highlights the big bucks large companies will have to dole out starting in 2018 and how employees might end up getting stuck with much of the costs if bosses blanch at the tax bill.

The American Health Policy Institute analysis found that big companies subject to the tax will pay an average of $2.1 million per year from 2018 to 2024-equal to $2,700 per employee. And if companies adjust workers' wages to offset reductions in health benefits due to the tax, more than 12 million employees will face an average of $1,050 in higher payroll and income taxes per year.

"As these numbers show, this tax is going to impose real costs on both employees and employers alike," the group's report said.

... more companies will move toward plans that have higher "cost-sharing" by workers, that is plans with higher deductibles and other out-of-pocket expenses.

... employers will reduce health-care benefits to avoid the tax...

"The employees could see up to a $6,150 reduction in their health-care benefits and little or no increase in their pay," the report said.

(Excerpt) Read more at finance.yahoo.com ...

Well somebody has to pay for all the subsidized insurance plans... AKA welfare plans. Gotta love the advertising of people getting “affordable” health insurance when really someone else is paying for it. Who doesn’t like free stuff!? Yahoo!

Bathhouse Barry continues to get his way.

You voted for it America.

Enjoy it.

This is great news. The more people that can directly see how much obamacare is costing them the better.

Being self-employed I see all of the increase. It bothers me to no end to see employed people complaining about an increase in their co-pays from $10 to $15 when I have seen my monthly premiums go from $370 to $1215 a month since 2010.

(I’m guessing NEXT year is when I will start seeing that $2500 savings he promised.)

“I can make a firm pledge, under my plan, no family making less than $250,000 a year will see any form of tax increase. Not your income tax, not your payroll tax, not your capital gains taxes, not any of your taxes.”

An old obama quote.

It is really crazy - and unsustainable. And it isn’t even like these plans are based on one’s income. (Once you are above the range of the gov’t subsidies anyways.) I can’t see how most people can afford it. We can afford it and still meet our bills, so far. But have had to make changes in retirement savings, etc. (But that’s okay - Social Security will always be there! /s)

I wonder if part of the plan is to force individuals either into the government run plans, or to become employees of large companies. With large companies being able to be monitored and controlled by the government better? It is a huge redistribution of wealth, that is for sure.

I never got the appeal of the Cadillac. Big ol’ boat of a car.

Oh I forgot.

Looking at your graphics. It’s those greedy and evil doctors and stuff. We don’t need government run health insurance - we need government run health care! I’m sick and tired of those rich doctors driving their Mercedes and I’m paying $50 for “germicidal surgical wrap” (a bandaide).

That is the REAL plan. It was never about health “insurance”.

What about government retiree plans?

BC/BS I believe was one of the principal supporters of O care.

Never get between a subsidized business and their in their pocket representatives.

TOTALITARIANCARE (forced) is legal plunder. Plunder & death…it’s how socialists/fascists/totalitarians/collectivists/criminals/controlf’s roll.

That's true, but I'd take it one step further. The people can directly see how much health care in general costs them, the better.

The irony here is that this whole thing is exposing the basic flaw with any health care system based almost entirely on third-party payment, not just ObamaCare.

I'm not sure I agree with that. ObamaCare was all about propping up existing insurance pools facing all of the challenges of a demographic distortion in an aging work force. The "parasite classes" you refer to are people who were employed and insured, but the insurance companies couldn't stay in business that way because there weren't enough younger insured customers to offset the rising costs of health care for older workers.

That's why the two most important provisions of ObamaCare to the insurance industry were:

1. The individual mandate (to force a whole new set of younger and healthier clients to do business with them); and

2. The provision that required employers to cover the adult children of their employees (to inflate insurance enrollments to add more younger and healthier clients even if they didn't work for the employer).

The EXEMPT, who wrote these “Laws” for the little people,

are EXEMPT, as are all Moslems as Bathhouse Obola demanded.

Correct. Third and fourth parties introduce so many market distortions that free market price discovery is almost impossible.

People who take care of themselves would do well to check out an HSA or MSA rather than get involved with obamneycare. It's still cheaper for most middle class folks to fund and HSA AND pay the penalty than it is to pay some insane insurance premium. If you're healthy it makes no sense to reward and subsidize the masses of fat couch potato slobs.

NJ prices are much worse... My premiums are due to double next month.

I am being forced to cancel health insurance for the first time in my life for my wife and I and our 4 children. I know many people in this same position...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.