To: expat_panama

When you have the time and the spirit moves can you (and anyone) post your theory how the Federal Reverse created so much money the last few years (since Obama took office actually and in the months prior) without major crazy inflation. Though we are beginning to see it in food and real estate in selected areas like San Fransisco and NYC. And of course it has been inflating the stock market since the low point of winter 2009 when Sands inc (las Vegas) was at $5 and today is at $73.25 http://www.marketwatch.com/investing/stock/lvs

Some stocks deserve the higher prices since winter 2009 but many are higher/much higher dues to Federal Reverse machinations. Illusory prosperity in my book.

Apple which sells world wide would be less of a case. Its higher price is more deserved because sales in Japan, Europe, worldwide are not as much due (directly at least) to Federal Reverse money printing via bond buying. Others are in the same category as Apple.

85 posted on

08/01/2014 4:55:39 AM PDT by

dennisw

(The first principle is to find out who you are then you can achieve anything -- Buddhist monk)

To: dennisw

“And of course it has been inflating the stock market since the low point of winter 2009 when Sands inc (las Vegas) was at $5 and today is at $73.25 “

That peaked at around $140 before the crash. So now it is about half way back.

86 posted on

08/01/2014 5:24:31 AM PDT by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: dennisw; Wyatt's Torch; 1010RD; All

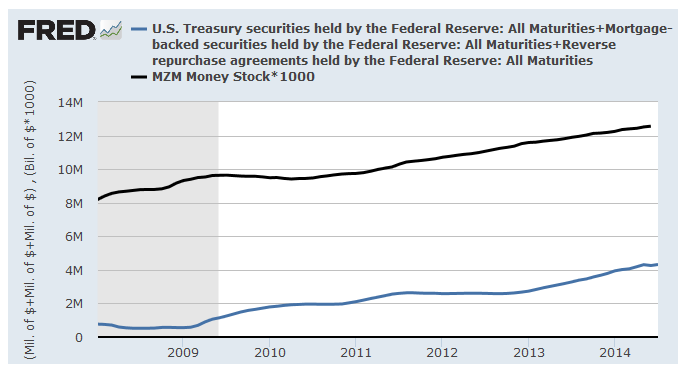

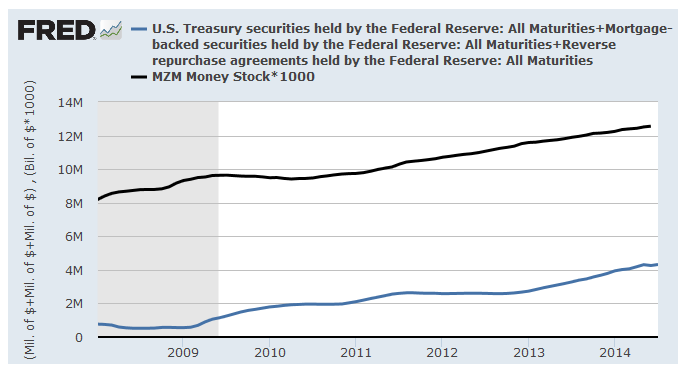

"...post your theory how the Federal Reverse created so much money the last few years (since Obama took office actually and in the months prior) without major crazy inflation." Whoa, I'm sure glad I took the time to try and explain it, 'cause I found out that what I was going to say was totally wrong. Thing is that usually almost all money is created by banks, not the Fed. Back in the end of '08 the total money supply was $9.3T and of that less than $0.6T of it had been created by the Fed printing money to buy U.S. debt (mostly T-bills, mortgages, and reverse purchase agreements. Since then the money supply's increased by $3.2T even while the Fed has poured $3.8T into the economy buying up debt.

That's big news. Every single bit of the expansion of the U.S. money supply has been thanks to the Fed. That also means that without the Fed's intervention the money supply would have collaped and the black hole of deflation would have swallowed America.

Someone tell me what I'm missing...

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson