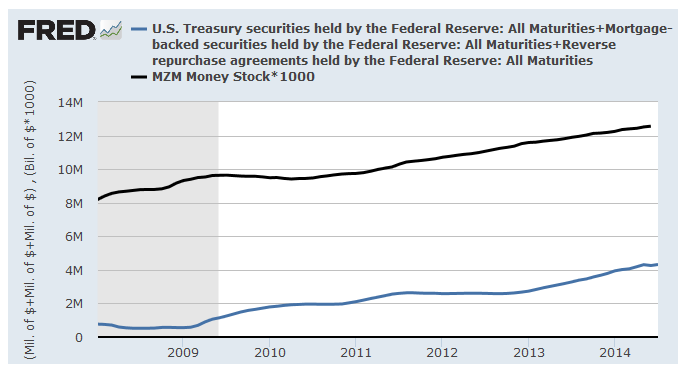

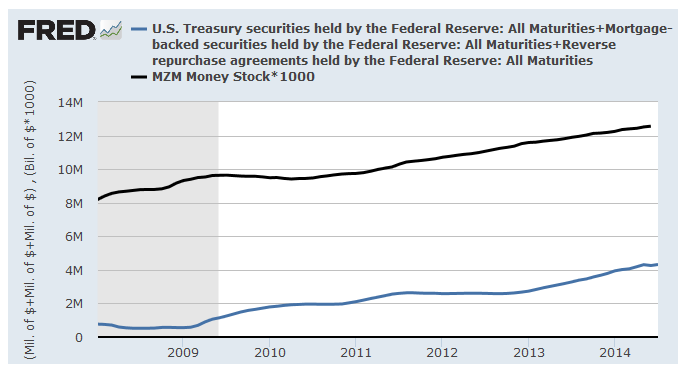

"...post your theory how the Federal Reverse created so much money the last few years (since Obama took office actually and in the months prior) without major crazy inflation." Whoa, I'm sure glad I took the time to try and explain it, 'cause I found out that what I was going to say was totally wrong. Thing is that usually almost all money is created by banks, not the Fed. Back in the end of '08 the total money supply was $9.3T and of that less than $0.6T of it had been created by the Fed printing money to buy U.S. debt (mostly T-bills, mortgages, and reverse purchase agreements. Since then the money supply's increased by $3.2T even while the Fed has poured $3.8T into the economy buying up debt.

That's big news. Every single bit of the expansion of the U.S. money supply has been thanks to the Fed. That also means that without the Fed's intervention the money supply would have collaped and the black hole of deflation would have swallowed America.

Someone tell me what I'm missing...

I think you and WT know that I’m not against deflation. Productivity improvements across an economy can cause deflation. That’s a good thing. We’re told that deflation is a bad thing, but the history of deflation in the US allowed resets of price levels to their proper market level as bubbles released their malevolence across the economy. Growth slows, goes heavily negative, cash holders and the prudent start snatching up bargains and the economy restarts.

Today we have permanent contract debt. The FED’s tools are very clumsy and limited. It’s like driving in the back seat using string tied to the steering wheel and a cane to push the accelerator and break. But, the FED isn’t alone in the car. There’s a driver called Fiscal Policy and it has two brains - the President and the Congress. They always grab the wheel and push the accelerator because that’s what politicians do.

Worse still, different parts of the economy are in different stages of the business cycle and those can be affected by local, county, and state level fiscal policies. It’s a mess. Much more resetting of debt needed to take place, particularly in RE. Many more banks needed to be taken over and/or closed, but they needed to be replaced by new banks. Capital is the life blood of an economy and it comes in the form of cash (or equivalents) and loans.

Focusing on people “underwater” is like just using your rear sight to hit a target. A majority of homes still cannot generate enough wealth to invite a sale and a purchase of a replacement home. Those people are trapped, despite no longer being “underwater”. The cost of selling and then buying new keeps them in place. Exacerbating a labor market skills mismatch. People struggle to move to where jobs are.

Toss in Democratcare and, as I believe WT has commented recently, you have permanently altered the labor market in the United States. It is a major driver of PT work. Worse, Obama and Co. are trying to play smart by reducing the number of hours considered for insurance eligible work. It used to be that FT was 40 hours plus. Now IIRC it is 29.5, but since Obama is writing the rules on the fly it could be as low as 25 hours. This will simply create less work by driving part timers under the threshold.

It’s a mess when government interferes in the market. I don’t see how they’ll ever withdraw, although I have an idea it could happen via applying Wickard v. Filburn to local, county and state laws that interfere with interstate commerce. I mean if wheat grown for personal consumption affects IC, then what government reg doesn’t? It could form a mean weapon... if only I could get standing.

That’s my two cents.

Wickard for reference: http://en.wikipedia.org/wiki/Wickard_v._Filburn

Whoa, I'm sure glad I took the time to try and explain it, 'cause I found out that what I was going to say was totally wrong. Thing is that usually almost all money is created by banks, not the Fed. Back in the end of '08 the total money supply was $9.3T and of that less than $0.6T of it had been created by the Fed printing money to buy U.S. debt (mostly T-bills, mortgages, and reverse purchase agreements. Since then the money supply's increased by $3.2T even while the Fed has poured $3.8T into the economy buying up debt. Roughly speaking, since 2009 the US money supply has increased only as much as the Federal Reserve has been printing money via buying U.S. debt (mostly T-bills, mortgages, and reverse purchase agreements

Before 2009 the FR had much less (.6 trillion) Federal securities on its balance sheet. This was the normal way of doing things which we are way beyond by now.