Posted on 02/20/2014 8:11:42 AM PST by xzins

U.S. consumer prices barely rose last month as a sharp increase in energy costs was offset by cheaper clothing, cars and air fares. The figures indicate inflation remains mild.

The Labor Department said Thursday that the consumer price index rose just 0.1 percent in January, down from a 0.2 percent gain in December. Prices have risen 1.6 percent in the past 12 months. Excluding the volatile food and energy categories, core prices also rose just 0.1 percent last month and 1.6 percent in the past year.

The year-over-year increase in core prices was the smallest in seven months.

The "mild uptick ... confirms the fact that inflationary pressures remain well contained," Martin Schwerdtfeger, an economist at TD Bank, said in a note to clients.

(Excerpt) Read more at newser.com ...

Are you serious? That’s amazing. They actually deduct the value of the additives in gasoline because they consider it better quality?

That is amazing deceit.

So, regular gas might be 3.50, but they’ll say it’s actually 3.30 (or whatever the deduction is.)

What are you, some sort of a nun?

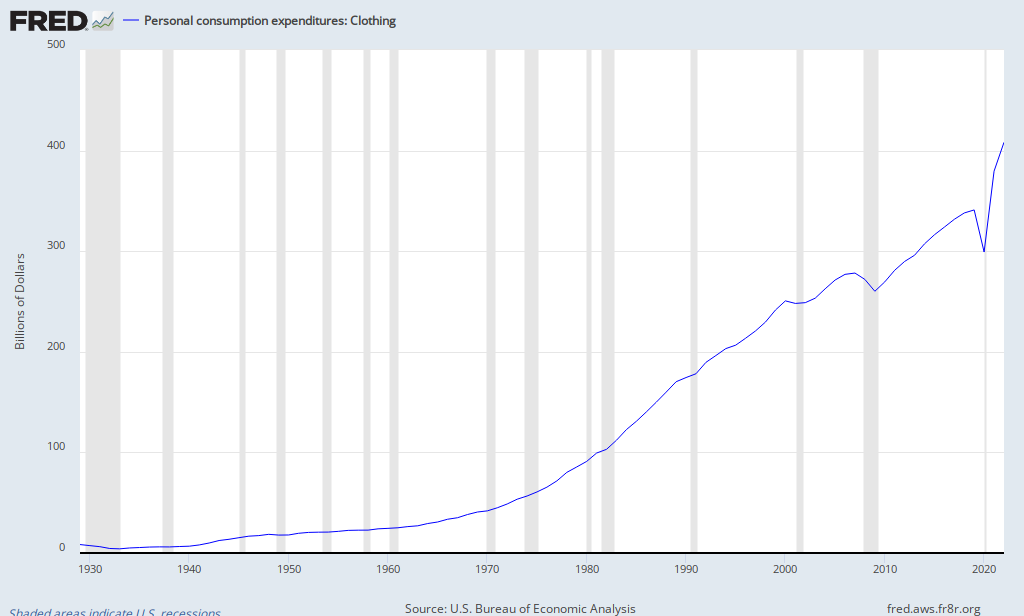

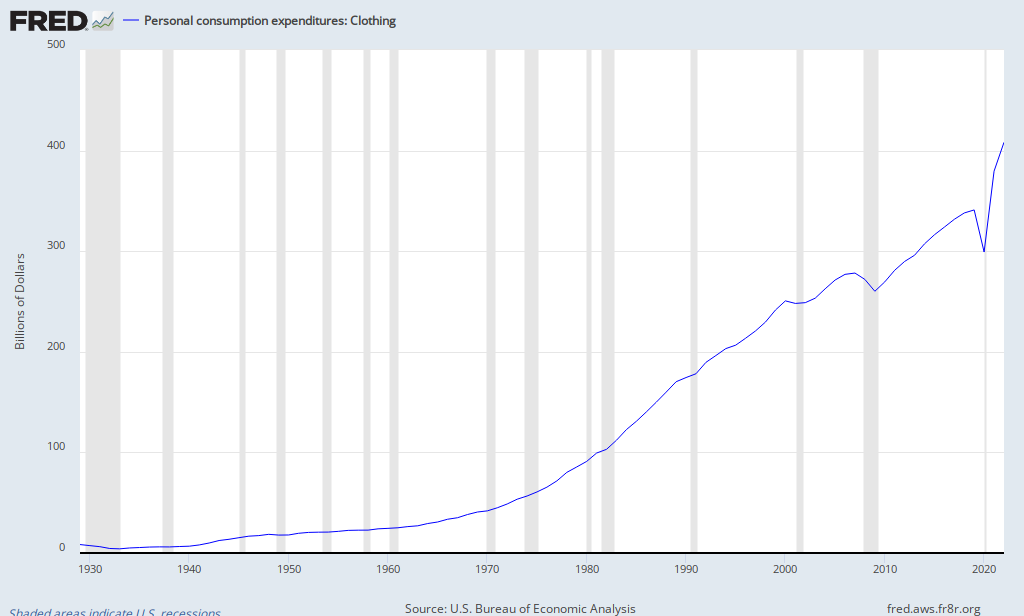

They like PCE, they also look at other measures.

You haven't proven your claim about PCE.

I think my claim was that the PCE uses what the Fed considers core inflation.

That’s pretty well settled by the link.

You said PCE subtracts volatile items.

That is what core inflation is, so yes, if you say I said the volatiles, then I believe you.

BUT, that IS core inflation, and the link said the Fed looks at lots of measures but “core inflation measures that leave out items with volatile prices can be useful in assessing inflation trends. “

Can the two even be compared, since one is seasonally-adjusted and the other, not?

_____

*subject to two more revisions

PCE doesn't use core inflation.

The Fed does look at core inflation.

The Fed often emphasizes the price inflation measure for personal consumption expenditures (PCE), produced by the Department of Commerce, largely because the PCE index covers a wide range of household spending. However, the Fed closely tracks other inflation measures as well, including the consumer price indexes and producer price indexes issued by the Department of Labor.

When evaluating the rate of inflation, Federal Reserve policymakers also take the following steps.

•Finally, policymakers examine a variety of "core" inflation measures to help identify inflation trends. The most common type of core inflation measures excludes items that tend to go up and down in price dramatically or often, like food and energy items. For those items, a large price change in one period does not necessarily tend to be followed by another large change in the same direction in the following period. Although food and energy make up an important part of the budget for most households--and policymakers ultimately seek to stabilize overall consumer prices--core inflation measures that leave out items with volatile prices can be useful in assessing inflation trends.

That last paragraph doesn't prove your claim.

It does prove my point. The Fed uses core inflation measures that excludes volatile items.

How can you say they don't use them when you've just posted the portion of the link that says they do use them?

Thanks. I think that this is the pain the lower 60% of income earners are experiencing. Do you have a chart for the overall percentage of energy and food for a family’s budget?

So you have decision makers who are in the 5th quintile (highest incomes) making decisions for the other 4/5ths. They face 50% lower costs as a percent of expenditure.

Those in the bottom 3/5ths are really feeling the pain of higher food/energy costs, plus they’re taking the brunt of the income reductions and layoffs. No wonder there is a total disconnect between the leadership and the people.

I just bought new clothes for my up coming vacation that I will travel to by air after driving to the airport in my new car, so I am good.

Defending the status quo again. At least you are consistent.

Is it a first class seat, a Mercedes, and a designer suit? :>)

So my 3.50 gas doesn’t really cost me that much. Wonder if the gas station will reimburse me the difference. LOL.

I’m sitting here shaking my head. They just turned a $250 TV into a $1350 dollar TV so they could compare it to a $1250 dollar TV to say that the price of the $1250 compared to the $250 had actually fallen by 7%.

Houdini and David Copperfield would beg to know that trick.

Would I agree to using the future value of $250 to compare to $1250? Sure. If it were a 10-15 year span, just use the inflation adjustment for those years.

$250 might be $500 after 10 years.

Wonder what they do with the government light bulbs versus the old incandescents? $5 versus 25 cents, when it isn’t an improvement at all. Less light, more toxic, worse fit, etc., etc., but they do (sort of) last a bit longer. My best case is 2 years versus 1 year.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.