Skip to comments.

Dallas Fed Richard Fisher: Fed Risks 'Hotel California' Monetary Policy

Townhall.com ^

| December 15, 2012

| Mike Shedlock

Posted on 12/15/2012 8:42:59 AM PST by Kaslin

At least one Fed governor understands the Bernanke Fed's hyper-accommodative monetary policy has no exit.

Today on CNBC "Squawk Box", Dallas Fed governor Richard Fisher complained Fed Risks 'Hotel California' Monetary Policy.

Dallas Fed President Richard Fisher told CNBC that he's worried the U.S. central bank is in a "Hotel California" type of monetary policy because of its "engorged balance sheet." Evoking lyrics from the famous song by The Eagles, he said he feared the Fed would be able to "check out anytime you like, but never leave."

Fisher said on "Squawk Box" that he argued against revealing the new inflation and unemployment targets set by the Fed this week, saying he's worried that the markets will become "overly concerned" with the thresholds.

Fisher would not comment on any contingency plans at the Fed should Republicans and President Barack Obama fail to strike a deal to prevent the automatic tax increases and spending cuts from taking effect in the new year.

"What you see is what you get here," Fisher said. "We have a hyper-accommodative monetary policy here ... cheap and abundant money that the Fed has made widely available."

No Exit Strategy

Any rational thinking person understands the Fed has no exit policy. I have stated that for years, most recently in

Exit Strategy? What Exit Strategy? just a couple days ago.

Recall when the Fed pretended it was working on an exit strategy to reduce its balance sheet at the appropriate time?

It was a lie then and it's an even bigger, more apparent lie now (which is why you no longer hear Bernanke mentioning it) . The simple fact of the matter is that every Fed asset purchase makes it more difficult to exit.

When interest rates do start to tick up (which could be a while based on Fed statements), interest on the national debt would soar if the Fed unloaded treasuries. Likewise, mortgage rates would soar if the Fed unloaded agencies at a time interest rates were creeping up.

There never was an exit strategy and there never will be one.

Unfortunately, the average Joe on the street has no idea what is happening at all, and one of the reasons is mainstream media is often devoid of rational thinking.

Perhaps this comment by Fisher will wake some people up as to what is happening, but don't count on it.

Hotel California Video

In Tribute to the Eagles, and also Fed governor Richard Fisher I present this video from the Eagle's Farewell Tour.

Link if video does not play:

Hotel California

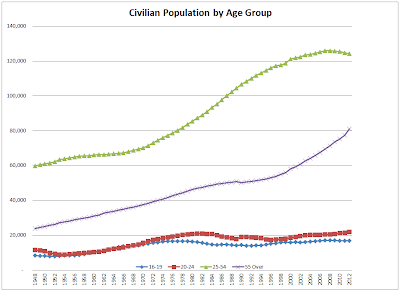

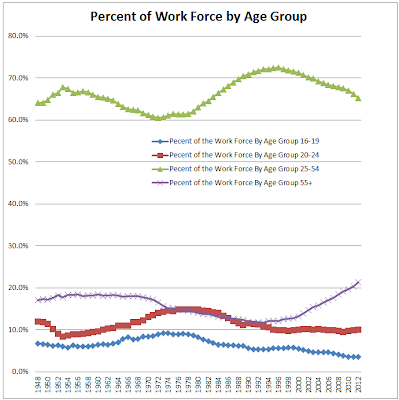

A week ago in Startling Look at Job Demographics by Age I posted the following chart made with data that I downloaded from the St. Louis Fed.

Employment Demographics by Age Group

click on chart for sharper image

One person suggested the chart was "very misleading" because it did not properly reflect the aging workforce.

However, I did comment at the time 'Boomer demographics certainly explains "some" of this trend'.

I could not quantify the amount at the time because there was no civilian population data on the St. Louis Fed website (at least that I could find).

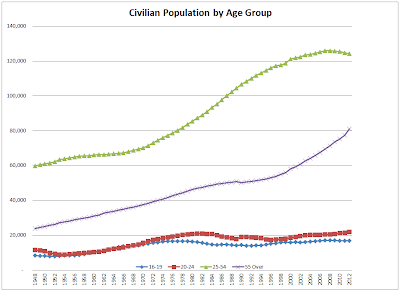

Since then, I asked my friend Tim Wallace to see what he could come up with, and with a few calls to the BLS he did get the population data from which we could make more accurate assessments. Here are the key comparisons.

2007 vs. Now for Age Group 25-54

- In 2007, the Civilian Noninstitutional Population for age group 25-54 was 125,978,000

- Currently the Civilian Noninstitutional Population for age group 25-54 is 124,248,000

- In 2007, Employment in age group 25-54 was 101,083,000

- Currently, Employment in age group 25-54 is 94,523,000

- Since 2007, the Civilian Noninstitutional Population for age 25-54 declined by 1,730,000

- Since 2007, Civilian Employment declined by 6,560,000

Quantification of "Some"

I can now quantify "some" more precisely: 279% of the decline in employment in age group 25-54 between 2007 and now is due to economic weakness as opposed to shifting demographic trends.

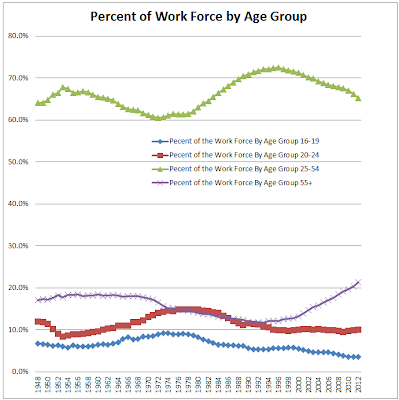

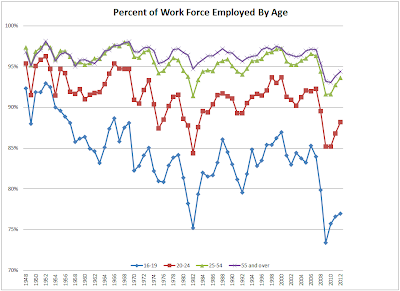

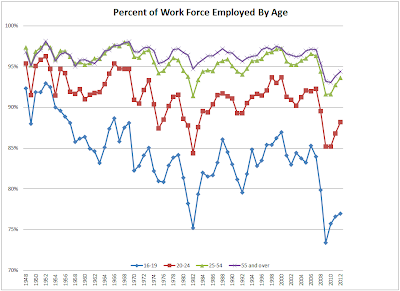

Here is a collection of interesting jobs charts by reader Tim Wallace.

click on any chart for sharper image

Civilian Population by Age Group

Percent of Work Force by Age Group

Percent of Work Force by Age Group

Participation Rate by Age Group

Participation Rate by Age Group

Work Force Percent Unemployed by Age Group

Work Force Percent Unemployed by Age Group

Percent of Work Force Employed by Age Group

Percent of Work Force Employed by Age Group

Civilian Population Not Working by Age Group

Civilian Population Not Working by Age Group

Thanks Tim!

Definitions and Notes

- The participation rate is the ratio of the civilian labor force to the total noninstitutionalized civilian population 16 years of age and over.

- The noninstitutionalized civilian population consists of civilians not in prison, mental facilities, wards of the state, etc.

- The labor force consists of those who have a job or are seeking a job, are at least 16 years old, are not serving in the military and are not institutionalized.

- There are strict requirements on what constitutes "seeking a job". Reading want-ads or jobs on "Monster" does not count. One actually needs to apply for a job, go on an interview, or send in a resume.

- Please see Reader Question Regarding "Dropping Out of the Workforce" for an explanation of how the BLS determines someone is actively seeking a job.

The final chart above shows the number of people in each age group that is not working. Recall that, "not working" and "unemployed" are different things.

I would prefer a more simple definition of unemployment: those who want a job but do not have one. Instead, we have definitions that purposely mask (by many millions) the current sorry state of affairs.

TOPICS: Business/Economy; Culture/Society; Editorial

KEYWORDS: jobless; thefed; underemployment; unemployment

Navigation: use the links below to view more comments.

first 1-20, 21 next last

1

posted on

12/15/2012 8:43:04 AM PST

by

Kaslin

To: Kaslin

The big problem is that BOTH parties are lying.

The GOP are offshoring every job they can offshore.

The Dems are not (quite) as actively offshoring, but are attacking things from the other side with strikes.

How about someone stand up for Americans for a change?

This has gone on now for nearly two decades. Stop it.

Bring back American jobs.

To: Kaslin

Yet another Hidden in Plain Sight.

The Fed portolio of government debt is too big to be sold off in the foreseeable future.

Ergo, Congress is spending money that is ultimately not tax revenue, it’s not really “borrowed” (because it can’t be repaid) so it is, in effect, just like printing money and spending it.

Americans need to be informed and educated on this.

The capital markets establishment elites want the game to continue which makes the money bubble grow - they want this because they are comfortable themselves, they are intellectually lazy and they are not significant owners of the banks and other businesses that they manage (the mega-banks are publicly-held), they are just highly-compensated employees.

3

posted on

12/15/2012 9:01:47 AM PST

by

PieterCasparzen

(We have to fix things ourselves)

To: Cringing Negativism Network

Bring back American jobs. That can never happen. We've globalized ourselves and there is no return.

All of those foreign and exchange students we've have in our universities go back home and use our technology to advance their economies. The internet now allows commerce on a world wide basis.

Even China has now joined the economic competition. We will be hard pressed to keep up with the leaders.

Instead of the climate and nuclear concerns we should be working on treaties about patent and copyright protections in order to maintain a level playing field.

4

posted on

12/15/2012 9:08:35 AM PST

by

oldbrowser

(Put Obama in check, now.)

To: Kaslin

Regardless of what clever language (e.g., quantitative easing, bond purchases, etc.) the Fed uses to describe its hyper-accommodative monetary policy it all gets down to the simple matter of printing lots of money, which de-values our currency and distorts market pricing mechanisms. And consider that the Fed produces nothing yet has a balance sheet approaching $4 trillion dollars. This futile exercise in central planning is complete insanity.

5

posted on

12/15/2012 9:08:44 AM PST

by

Starboard

To: PieterCasparzen

“The capital markets establishment elites want the game to continue”

***********

Of course, they don’t want the game shut down. They are having too much fun winning money in the government run casino.

6

posted on

12/15/2012 9:12:27 AM PST

by

Starboard

To: oldbrowser

I disagree.

More strongly every day.

We need a concerted effort, from our government on down, to protect AMERICAN jobs.

Now.

This is beyond critical. We are about to collapse.

Everything is in place.

Turn it around! Now.

To: PieterCasparzen

Americans need to be informed and educated on this.

That was very evident on Nov 6, 2012. Everywhere I look I see dumb sheeple being fed lies 24 x 7 from the 19" peep hole into paradise and their "i-somethings".

8

posted on

12/15/2012 10:01:46 AM PST

by

Cheerio

(Barry Hussein Soetoro-0bama=The Complete Destruction of American Capitalism)

To: Kaslin; Cringing Negativism Network; oldbrowser; Starboard; Cheerio

Exploratory Discussion Group

Judeo-Christian, Small Business (JCSB) Think Tank

You don't for vote for them - or even know them. But they govern your life.

Congress needs small business morals and common sense - they work.

FReepmail me if you want to be on or off the JCSB Think Tank ping list.

9

posted on

12/15/2012 10:58:27 AM PST

by

PieterCasparzen

(We have to fix things ourselves)

To: Kaslin

How does an ordinary person economically protect themselves?

To: Cringing Negativism Network

Too bad nobama disagrees with everything you want.

He’s working hard to oppose all of that.

11

posted on

12/15/2012 11:14:43 AM PST

by

upchuck

(America's at an awkward stage. Too late to work within the system, too early to shoot the bastards.)

To: upchuck

So why is not our side, advocating all of that?

That is my unanswered question. The GOP is absent.

Where is the GOP???

To: AtlasStalled

Farm land, gold, silver and seeds lots and lots of seeds.

13

posted on

12/15/2012 11:41:56 AM PST

by

jpsb

To: Cringing Negativism Network

Ooops I forgot guns and ammo too. Lots and lots of ammo.

14

posted on

12/15/2012 11:42:58 AM PST

by

jpsb

To: Cringing Negativism Network

Where is the GOP??? Holed up in the far corner, with their eyes tight shut and their hands over their ears.

15

posted on

12/15/2012 11:45:14 AM PST

by

okie01

(THE MAINSTREAM MEDIA; Ignorance on parade.)

To: Kaslin

[CNBC "Squawk Box", quoting Fed governor Fisher]

Evoking lyrics from the famous song by The Eagles, he said he feared the Fed would be able to "check out anytime you like, but never leave."

Wait until he gets a load of Obama's economic policy, called "A Horse With No Name".

To: jpsb

In BLOAT We Trust.

To: oldbrowser

Even China has now joined the economic competition. Temporarily. People who follow industrial-commodities prices and seaport activity (large bulk cargo-carriers are riding idly at anchor in a number of Chinese ports, unable to offload because their receiving customers have had their letters of credit pulled) are telling us that the Chinese economy is about to come to a crashing halt.

To: oldbrowser

Instead of the climate and nuclear concerns we should be working on treaties about patent and copyright protections in order to maintain a level playing field.Dude, stop talking like a Democrat. There is no level playing field. You play the hand you're dealt and American business has been handed a bad one.

Patent and copyright protections play a part, but inflation, taxes, and regulations are all controllable, too.

Oh, by the way:

The internet now allows commerce on a world wide basis.

That's a good thing.

19

posted on

12/15/2012 4:10:12 PM PST

by

BfloGuy

(Workers and consumers are, of course, identical.)

To: BfloGuy

Dude, stop talking like a Democrat. There is no level playing field. You play the hand you're dealt and American business has been handed a bad one. We cannot compete with other countries on labor cost. Our advantage is innovation and R&D. If other countries are able to use our research to make products cheaper than we can I don't see how we will compete.

20

posted on

12/15/2012 4:20:52 PM PST

by

oldbrowser

(Put Obama in check, now.)

Navigation: use the links below to view more comments.

first 1-20, 21 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson