Posted on 09/07/2012 10:56:05 AM PDT by Innovative

The tax cuts enacted by Congress in 2001 and 2003 - often referred to as the Bush tax cuts - provided a broad range of tax relief, including lower tax rates on income, long term capital gains, and qualified dividends. We dodged the expiration of these lower taxes back in 2010 when Congress extended the tax cuts for two years (through 2012). Now cuts are set to expire on December 31, 2012, and any action will likely come down to the wire as it did in 2010.

It's difficult to predict what will happen, but three scenarios are possible:

All the tax cuts could expire if Congress and the president fail to reach an agreement before December 31. In this case, the new Congress could act in 2013 to reinstate some of or all the tax cuts.

The tax cuts could be extended temporarily, giving Congress time to act on a permanent solution—possibly by reforming the tax code.

Some type of compromise could be reached in the lame duck session, with some taxes extended or modified and others allowed to expire.

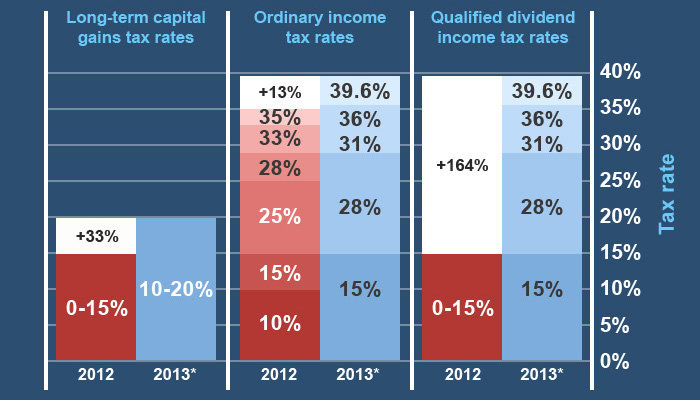

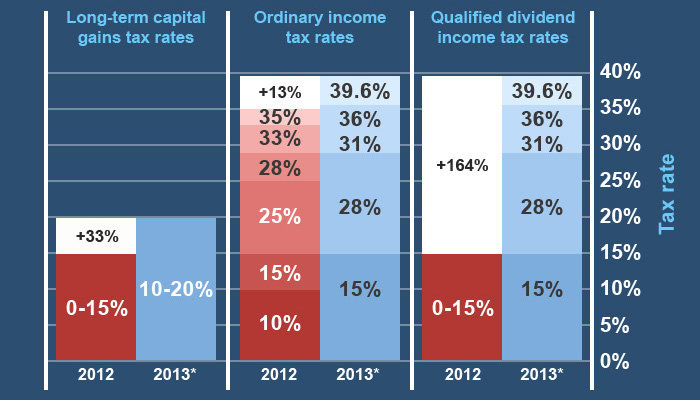

One area of uncertainty is income tax rates. Without action, the 25%, 28%, 33%, and 35% tax rates will increase, and the 10% tax bracket will go away.

The tax rates on long-term capital gains and qualified dividends, which are currently 15% (0% for taxpayers in the lowest two income brackets) are also set to change. Without Congressional action, the long-term capital gains rate would revert to 20% for most taxpayers and to 10% for those in the 15% income tax bracket in 2013. Qualified dividends, meanwhile, would go back to being taxed as ordinary income, so for some investors, the top tax rate could rise to 39.6%.

(Excerpt) Read more at 401k.fidelity.com ...

Good luck.

I’ll have to study this some more, but don’t think this will directly impact me much.

“Now cuts are set to expire on December 31, 2012”

That’s OK. The US will cease to exist as a sovereign nation on Dec. 21, 2012. The new Islamic Socialist Republic of the Western Hemisphere will takes it’s place, with Valerie Jarret as Chairman Val.

Impossible? Tin-foil hat ? (women wearing female genital costumes are parading on NATIONAL TV in front of children, and people think I’m crazy)

Maybe. We’ll know soon.

The GOP should push to alter and simplify the AMT so that regardless of the number of deductions, credits, exemptions ... EVERYONE has to pay in at least the lowest tax rate on their taxable income.

They are the Obama tax cuts. He took ownership when he extended them.

I agree. If half the country has no skin in the game,many will vote for a welfare POTUS, because it is in their interest to do so.

Unless you pay no income tax, note the bottome rung eliminates the lowest bracket entirely. Next up, if married, the marriage tax is back....so much so that my wife and I agreed if the SOB manages to do that, we get a paper divorce and become cohabitating adults for tax purposes. I am not giving that Kenyan one sou more than I absolutely have to.

I'm glad it doesn't affect you much, but for most people who income, savings, or investments, it is a brutal tax increase.

The AMT needs to die.

There is a Democrat running for Senate in Indiana named Joe Donnelly. In the House he has a solid record voting for all the Obama programs. But in his campaign, he tries to come off as a "moderate". He has a commercial supporting continuing the "Bush tax cuts" LOL.

Those of us who own small businesses had zero taxable profit this year, anyway, so what difference does it make?

Once everyone is subject to the AMT .. it will die

Are you sure that the rate is 164% for qualified dividends above the 15% tax rate pre-2013? I bet it is a typo.

15 * 1.64 = 24.8 + 15 = 39.8

Oh, I see. The number is white is supposed to represent the increase as a percentage. A thousand pardons.

I a curious if one of you can claim head of household?

No...no kids here.

Reference bump.

All this breathless news flash from your friendly fidelity financial advisor. And just what brilliant strategy do they suggest you take to make a dazzling response to this to realize your retirement dreams?

Factual but just useless.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.