Posted on 04/10/2012 6:09:52 AM PDT by Kaslin

The blatant hypocrisy and arrogance of president Obama, Nancy Pelosi, and Hillary Clinton in the video below is simple stunning.

Caroline Baum on "Obama the Omniscient"

Inquiring minds are reading Bloomberg columnist Caroline Baum's article

(Excerpt) Read more at finance.townhall.com ...

You know as well as I do that there are plenty of reserves.

Complete loony tune ignorant Progressive Democrat Fascist BS manufactured to give ignorant voters in the Democrat party an excuse to keep them from every holding their party leadership accountable for the Democras stupid, incompetent "Green" energy policy. A policy that has been in place since 1978 when Jimmy Carter introduced it.

But not owned by the investor owned oil companies. They have to keep spending money to get them.

Do you understand how fast the production rate falls on a typical Bakken Oil well? These are exponential curves of lowering production.

According to Google:

One barrel of Oil has a volume of 42 gallons (US), or 158.9873 liters.

_____

If an efficient Oil Company makes 10 cents per gallon that would be a profit of 42 gallons X 10 cents or $4.20 per barrel, assuming that all of the 42 gallons of crude oil could be converted to gasoline. The reality is that this never happens as crude is cracked into a myriad of compounds depending on the content of the crude oil.

The inefficient Governments take 4 X as much or $ 16.80, and spend in on salaries of DOE regulators that spend all their waking hours figuring out more ways to punish Oil Companies that supply America with the cheapest gasoline and diesel fuel in the World.

________

Good industry sources of information would be the API, or American Petroleum Institute, and Oil and Gas Journal.

Poor sources include the GSI, or Green Slime Institute located at 1600 Plantation Avenue, District of Corruption, USSA.

When they begin to care about that they'll turn it back on, in dribs and drabs.

Do you understand how fast the production rate falls on a typical Bakken Oil well? These are exponential curves of lowering production.

Too much fun to be had financing Israel's enemies (and ours). Russians too. You know as well as I do that the Soviets funded their war machine from the Caucasus. Reagan cut the money off with deregulated access. That's how it's gone since WWII.

1) Obama

2) DemoRATS

3) EnviroNAZIs

Amazing no one ever thinks of asking the oil companies why prices have gone up. They are the one who really know.

Now they're using tax-exempt "charitable" foundations to fund "environmental" NGOs that sue complicit government agencies to control the supply side. Read the article.

Last Saturday I found out exactly why the costs of everything are so high at the local ACE hardware. I was inquiring as to the cost of 1”X 2” X 8ft lumber, and was told it was $7.49 a stick. I about croaked on the spot as I had just sort of recovered from the discovery of $4.99 a stick price at Home Depot needing thirty sticks to complete a project. (I started this project when the lumber in question was $1.67 each, and thought that way too high.)

Regardless the fellow working the floor at ACE that told me the price of their lumber said that it was really too high a cost, and I readily agreed with him mumbling about the devalued dollar, Obama, etc. only to be told by the ACE employee that it was trucking causing the problem. I looked at him as though I forgot to flush, and asked him if he really thought trucking was the cause of the prices he is paying at the pump? He threw up his hands in a STOP expression, don’t bother me anymore with your devaluation of the dollar, Obama crap, and told me he was “a bit of an expert on the matter”.

So, there you have it from an “expert”. Truckers are ripping off America, and causing the prices at the pump.

Wondering how many such “experts” there are walking about so confident in their knowledge?

Sigh. Here we go again. As has been repeated ad nauseum on FR, thanks to the rapid industrialization of China, India & an assortment of other countries that have modernized, there is now a much greater appetite for oil. Even if the supply would double it would barely keep pace with the increasing demands of those countries. And thanks to the weak dollar (thanks Dubya), they’d benefit from an increase in production, not us. No surprise the Townhall hacks left that part out. They’re good at missing the point.

1) Obama - ban on Gulf drilling

2) Obama - ban on pipeline from Canada

3) Obama - Arab ass kisser

I am not sold on that math being accurate. The oil company sells the oil to the refinery. Their profit has nothing to do with the end product. Their profit is tied to their expenses and the price of oil at the time of the sale.

Here is a blurb from a Conoco news release.

All told, ConocoPhillips earned $17.09 per barrel of oil in the second quarter, up from $9.38 in the year-ago period.

Both numbers are much higher than your 4.20 figure. I think it gets even more complex when the company pumps, buys and refines the oil. So I don’t think you can take a number from the price of refined oil and calculate what they make per barrel of oil. I know they can’t sell it internally to their own refinery for less than market rates. So right there is a built in profit.

They may only make 10c a gallon of the refined gasoline but I would be willing to bet every barrel of oil they produce themselves reaps large profit.

Are you confusing refinery margins with profits? Also, second quarter has not happened yet, are you talking about a previous year?

From comment # 18 above the hotlink shows the composite cost of feeder stock to be approximately 100 bucks per barrel delivered to the refinery, in 2011.

If the profit margins are higher on one end product, the refiner will crack to preferentially generate more of it than for the very low profit margin of gasoline, (commonly 3 to 4 cents per gallon).

Thus, the earnings per barrel cannot be directly applied to the earnings for gasoline. After the money is earned, then expenses must be deducted to arrive at the actual profit for each product generated from a barrel of feeder stock.

However, for the sake of this discussion let us assume that ALL of the earnings are the same as the profits, and that 1/3 of the feeder stock is converted to gasoline.

Then $17.09 X 1/3 = $ 5.6961 divided by 42 = $0.13562 earnings per gallon for the second quarter, and $9.38 X 1/3 = $ 3.1263 divided by 42 = $ 0.0744 per gallon for last year’s second quarter.

For a two year average of $0.013562 + $ 0.074437 = $ 0.210058 = $ 0 .105029, or 10 1/2 cents per gallon earnings.

On a $100 per barrel purchase of crude oil feeder stock the refiner and downstream entities generate earnings of 17.09 and 9.38 % respectively, for the two quarters, and 13.235 % per year average for the average of the same two quarters.

In return for purchasing the lowest cost refined products in the World, the consumer of these refined products is enabled to move goods, services and people to every corner of the World, plus use plastics, make surgical tubing, generate heat, electricity, fertilizer, and of course jet fuel so Green Peace can send their people to protest drilling of Oil wells off of the coast of any Nation with a coast line.

BTW, what return do you get from the Federal Income Taxes that you send in to Sheriff of Nottingham, Timmy Gee, each April 15 th? My guess is that it is less than 9.38 %. Last I checked, Social Security paid 1.2 % per year, well not counting your share of the National Debt, of course.

Yes, indeed! One can ALWAYS count on the US Federal Government to deliver the greatest loss at the maximum pain level for the longest period of time.

Error check: “ - - - $0.013562 - - - “ should read $ 0.13562.

The math calculations, according to my bare fingers and toes, is correct.

There’s only one reason. Monetary policy. That’s it.

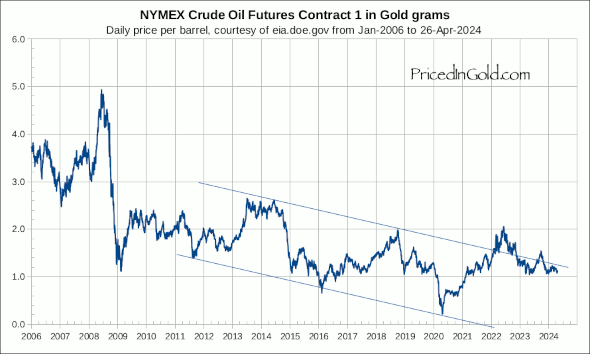

In 1932, one ounce of gold would buy 16 BBL of oil. Take today’s spot price of gold and the spot price of a BBL and you’ll find its probably 16 or so BBL/ounce of gold.

In terms of gold, the price of oil hasn’t risen at all. Not one bit.

In dollars, if you print them like you are producing toilet paper for a food poisoning festival, gas is going to be expensive. Taxes make it worse (especially if they are percentage taxes and not fee-type taxes).

It’s expensive, not because costs went up, but because the purchasing power of the dollar went down.

Thanks for posting those graphs!

Oil is actually LOWER than it was in 1950, 1984, and 2006.

That’s actually funny! It made me laugh.

Oil is going to continue to drop, given the 22 year low in oil demand and spike in surplus. Gold may continue to rise faster than oil will.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.