Posted on 03/05/2012 5:26:06 PM PST by SeekAndFind

The next financial bubble to burst could be loan debt owed by U.S. college students. That's just one risk confronting the country's higher-education system, according to a new Standard & Poor's study (no public link) that examined the nation's college affordability crisis.

The credit rating agency says that colleges and universities today face three key financial threats:

1. Inadequate household income. Students are struggling to pay for college because their families' stagnating income hasn't kept up with college prices. During the past decade, average U.S. household income fell from $64,232 to $60,395. That's about what New York University costs for one year.

2. Dwindling state support. State financial assistance for public universities continues to erode. Most public university systems already receive more revenue from tuition than from their state governments. The nation's largest such system, in California, passed this milestone last year.

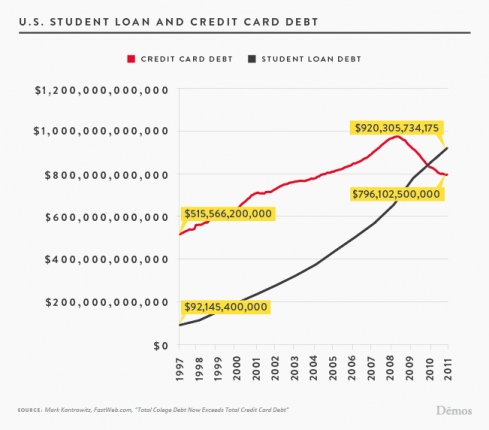

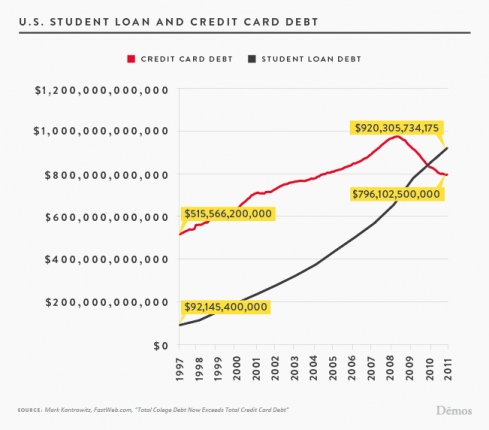

3. Skyrocketing student debt. Student-loan debt has ballooned, while more borrowers are defaulting on their obligations. College freshman are taking out nearly double the level of loans they did a decade ago. Federal data show that 8.8 percent of all students with federal loans, who needed to begin repaying their debt in a one-year period beginning in October 2008, failed to do so. That's the highest default rate since 1997.

Higher-ed bubble?

Such figures reflect the growing financial hardships on young people pursuing a college degree. But it's not a foregone conclusion that the higher-education system is set for a fall.

As long as colleges and universities enjoy a monopoly on credentialing -- namely, the bachelor's degree -- it's hard to imagine that the higher-ed world will face the same struggles that the American auto, steel, and newspaper industries have experienced, just to name a few sectors buffeted by change in recent decades.

(Excerpt) Read more at cbsnews.com ...

Profs have bird nests on the ground. Make big bucks, teach few classes. Another entitled group.

It’s part of the liberal establishment.

Offer large govt subsidized loans to anybody with a pulse.

This enables schools to charge outrageous tuition.

They pay liberal professors and staff inflated salaries.

Who then contribute to Democrats.

Just like the union dues cycle.

Where else can you find such a large machine that regularily craps on its customers and demands more in return?

I was lucky in that I worked full-time while I was in school full-time, so I had little debt when I finished (and I went to summer school every summer so I wouldn’t be there longer than 4 years). Today I think the jobs for students are limited (for those that even want them), and if they get them they pay so little compared to tuition.

1. Too expensive for their product.

2. Lousy products.

3. Lousy return on the investment.

Seems exactly why most other business also fail.

Technology will replace academia in its current state. Time for education to make the leap forward...just like manufacturing did 40 years ago!

The unions!

You left out 3 more reasons:

4.) O = Our

5.) W = Wayward

6.) S =Spoiled Children.

RE: Where else can you find such a large machine that regularily craps on its customers and demands more in return?

The even more interesting question is this — why are the number of customers INCREASING and NOT DECREASING? And why are they going into DEBT to pay for the crap?

Re your post 8, I, too, was fortunate in being able to work a little bit more than part-time all through college (Sept. 1962-Jan. 66), and tuition, room and board was so much less expensive then. I cannot remember exactly but I left there owing the government something like $1,500.

I went to summer school, too, to shorten my stay and I was out in three and a half years.

Teens are conditioned in school to think that college is the only possible path. Also with the Baraqqi Depression still in full force, the number of jobs is minimal so borrowing "free" money and heading off to school is an easy choice.

Technology will replace academia in its current state.

The cost of my last graduate course was around $2350 (in 1993), up about $500 from when I started 2.5 years earlier.

They left out reason #4: virtually constant Marxist brainwashing.

4. Retired alumni dependent on investment income in this p-poor economy have far less disposable income available for contributions, donations and endowments to their Alma Maters...

Thank you Helicopter Ben! (NOT).

The candidate that harps on that topic will win a lot of votes from folks on fixed investment incomes.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.