Skip to comments.

U.K. to Eurozone Nations: We're Out, Good Luck

CBS NEWS ^

| 12-9-11

| CBS/AP

Posted on 12/08/2011 10:56:08 PM PST by tcrlaf

The 17 eurozone states and six other EU countries agreed early Friday to create a new treaty that will allow them to introduce stricter fiscal rules in the hope of containing a worsening debt crisis, but Britain's prime minister immediately threatened to block the new accord.

The failure to get agreement among all 27 members of the European Union at a summit meeting in Brussels reflected in large part a deep split between France and Germany on the one hand and Britain on the other. France and Germany are the two largest economies in the eurozone; Britain does not use the euro as its currency.

Britain's Conservative Prime Minister David Cameron said Friday "the institutions of the European Union belong to the European Union, belong to the 27" member states.

Cameron wished the eurozone nations luck in finding a solution to the crisis, which he conceded was in the interst of Britain, too, but said it was not in the U.K.'s interest to join the new treaty because he could not get special safeguards for the country's financial center.

(Excerpt) Read more at cbsnews.com ...

TOPICS: Breaking News; Government; News/Current Events; Politics/Elections; United Kingdom

KEYWORDS: angelamerkel; bailout; bondcollapse; breakup; brexit; canada; cityoflondon; constitution; davidcameron; euro; europeanunion; eurozone; france; germany; nato; nicolassarkozy; oil; robinhoodtax; tobintax; uk; unitedkingdom; usdollarcollapse

Navigation: use the links below to view more comments.

first previous 1-20 ... 81-100, 101-120, 121-140, 141-146 next last

To: ichabod1

What’s the difference between a Eurozone country and a member of the EU? Are the non-Eurozone countries lesser partners?

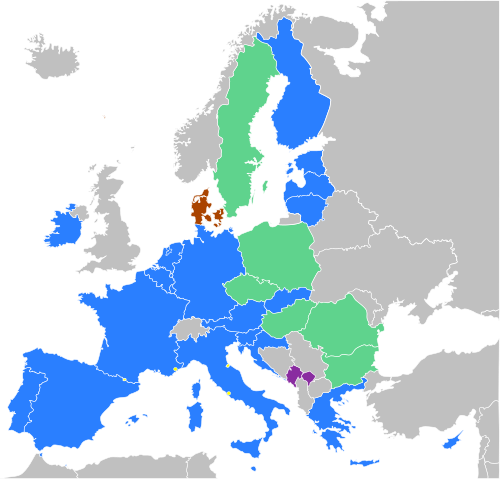

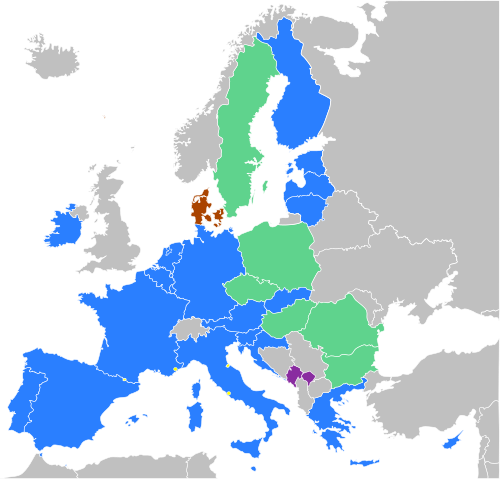

All members of the EU are part of the common market (100% free trade), send representatives to the European parliament, agree to a common legal framework (human rights, but also laws e.g. regarding companies like a Societas Europaea, a Societas Cooperativa Europaea, or a Societas Privata Europaea - i.e. Corporation, Cooperative and LLC), have common infrastructure projects, coordinate border security etc..

Within the framework of the EU additional treaties are possible, like the Eurozone, i.e. a common currency or the Schengen area (free travel within the area without border controls). While the Euro is the offical currency of the EU, i.e. the EU budget is in euros, not all EU members have to adopt it.

Blue = Eurozone

Green = Future Euro Members, with the likely exception of Sweden

Red = opt-out, no Euro

Pink = unilaterally adopted, no EU members, but use the Euro as currency instead of a volatile own currency

121

posted on

12/09/2011 2:08:40 PM PST

by

wolf78

(Inflation is a form of taxation, too. Cranky Libertarian - equal opportunity offender.)

To: EDINVA

she must have called Dominik Hasek a bum!

To: CitizenUSA

I believe Denmark was one of the later countries to join the common currency; they were part of the EU, but delayed giving up their currency.

To: tcrlaf

Euroland already went begging to the US for help and a handout through the president and treasury who in turn instructed the Federal Reserve on what to do for Euroland.

The latest news is just minor details as US taxpayer monies have already been committed to Euroland via the IMF so to insure Euroland will not fail. Because US major banks have bet heavily on Euroland’s survival and these banks can’t survive another meltdown due to losing bets.

The stock markets are up because the new money will be looking for a place to park in, everything should be fine... for about a month.

124

posted on

12/09/2011 3:28:01 PM PST

by

Razzz42

To: tcrlaf

The Euro as a currency and the EU was doomed to failure. Once a nation gives up its currency and central bank, it is no longer a nation. The lure of Nations joining is to be part of European Society, but now countries like Italy and Greece are learning the cost of this decision. Germany has basically installed Euro Statist in the parliaments.

To: Vanders9

A euro may be theoretically worth the same across the continent, but in fact you can buy far more with a euro in, say, Portugal than you can in, say, the Netherlands.Or:

A dollar may be theoretically worth the same across the continent, but in fact you can buy far more with a dollar in, say, Georgia than you can in, say, California.

126

posted on

12/09/2011 5:03:54 PM PST

by

norton

To: Pan_Yans Wife

I don’t know.

What is their reason for doing anything?

They puzzle me at times.

127

posted on

12/10/2011 12:29:40 AM PST

by

dixiechick2000

(Proud barbarian TEA Party SOB and, apparently, an evil Capitalist.)

To: Mitch86

Ireland is part of the UK, as well, but they use the Euro.

128

posted on

12/10/2011 12:31:51 AM PST

by

dixiechick2000

(Proud barbarian TEA Party SOB and, apparently, an evil Capitalist.)

To: kearnyirish2

I believe Denmark was one of the later countries to join the common currency; they were part of the EU, but delayed giving up their currency.Denmark has never joined the Euro, although it's a EU member. Euro membership was rejected in a referendum.

To: dixiechick2000

Ireland is part of the UK, as wellBit of a howler there, I'm afraid...

To: dixiechick2000

131

posted on

12/10/2011 3:27:06 AM PST

by

Mitch86

To: UKrepublican

I dont think Cameron had a lot of choice really. The UK is not pretty much completely a service economy - particularly financial services. The only thing keeping us afloat is the city of London stock exchange. There is absolutely no way that any British government can accept this proposal by Merkel and Sarkozy to institute taxes on financial transactions. It would finish us, and Cameron MUST know that.

To: ding_dong_daddy_from_dumas

But even a country as large, populous and economically powerful as the US cannot borrow money indefinitely. Sooner or later the creditors will come knocking on the door. Voters in all the Western powers just cannot seem to grasp this. They think the good times are here forever.

To: norton

Yes that’s true, but its much more marked in Europe. I mean you would expect variations inside the US because of things like local taxation, and real estate, and housing costs, but the differences in Europe go as far as very basic commodities, like food, which can cost 2-3 times more in some countries than in others.

To: Winniesboy

To: dixiechick2000

Ireland is part of the British Isles, but that’s a geographic distinction. It is not part of the United Kingdom. It is a sovereign country.

To: Vanders9

Absolutely, there is no doubt he had no choice but to take this action.

To: UKrepublican

138

posted on

12/10/2011 6:40:44 AM PST

by

Reverend Wright

(you voted for Obama to prove you're not racist, now vote against him to prove you're not stupid...)

To: dixiechick2000

probably don’t see scotland or northern ireland or wales since westminster handles foreign relations for all of them as the UK.

To: Vanders9

But even a country as large, populous and economically powerful as the US cannot borrow money indefinitely. Sooner or later the creditors will come knocking on the door. Voters in all the Western powers just cannot seem to grasp this. They think the good times are here forever.Exactly. And yet administrations from both parties love to give bailouts with borrowed money, and congress follows their lead. I believe that the Obama "stimulus" bill contained authority for Obama, or whover is POTUS, to bail out banks (in Europe or whereever) without any congressional approval. And then there is the IMF. They have so many ways to keep screwing us, but Obama says raise tax rates so everybody will "pay their fair share."

Navigation: use the links below to view more comments.

first previous 1-20 ... 81-100, 101-120, 121-140, 141-146 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson