Skip to comments.

RESEARCH FROM CREDIT SUISSE: AMERICA IS NOT BROKE (NOT EVEN CLOSE)

Pragmatic Capitalism ^

| 04/21/2011

| Cullen Roche

Posted on 04/21/2011 10:33:41 AM PDT by SeekAndFind

It’s nice to see some mainstream economists making logical arguments with regards to America’s financial position. In a recent research piece Credit Suisse shows that America is far from being broke. Of course, anyone who understands MMT and the actual workings of a modern fiat monetary system knows this is a preposterous notion to begin with, but CS is using a traditional framework and their evidence counters much of what we so often hear from fear mongerers and politicians:

“Some of our senior politicians and market pundits say it every day: “America is broke.”

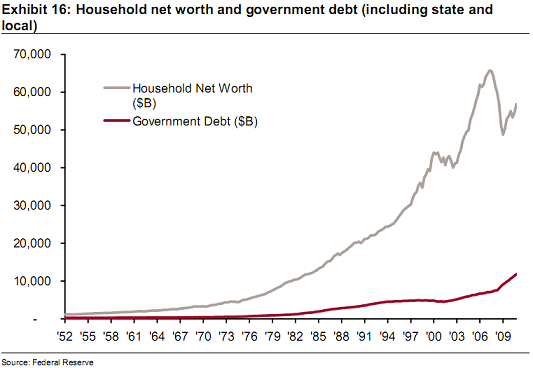

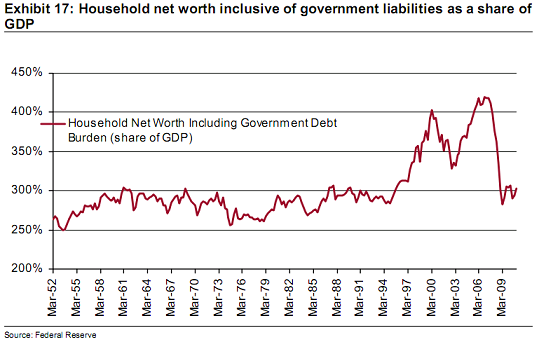

We wonder if this is meant to be a joke. America is not even close to being broke. Household net worth is $57T. Public government debt – including the state and local sector – is about $12T. If we consolidate balance sheets to reflect the fact that the household sector is ultimately responsible for repaying this debt we arrive at a household net worth of $45T or 303% of GDP. This is at the high-end of the historical norm of 250- to 300% since the data began in 1952. The current level was surpassed only in the recent tech stock and housing bubbles.

No doubt policymakers have a lot of work to do in terms of agreeing on a politically palatable way to adjust current laws to reduce the unprecedented intergenerational transfer of wealth associated with old entitlement programs and a wave of new retirees. But, ultimately, the resources are there and as we are increasingly finding out, so too is the political will.”

Source: Credit Suisse

TOPICS: Business/Economy; Culture/Society; Government; News/Current Events

KEYWORDS: bankrupcy; creditsuisse; debt

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

To: BuckeyeTexan

Technically speaking the writer of the story is correct, we are not "broke" i.e. we are not insolvent where our debts exceed our net worth. We have cash flow issues, not enough liquidity to cover our current expenditures. The article is misleading from that perspective.

As a another post stated, we could in theory liqudate $14T in assets, private and public, to create liquididty to pay the debt. I know some states are doing just that; selling or leasing public property such as toll roads to private companies to create temporary cashflow. Unfortunately that is much like a junkie pawning off his favorite guitar for his next fix...short term it works but it doesn't address the underlying systemic issue - the US economy is not creating sustainable cash flow.

21

posted on

04/21/2011 11:05:28 AM PDT

by

shawnlaw

To: SeekAndFind

We have heard all this before. Yawn. How does household wealth relate to public debt? Oh yes, confiscation.

During the French Revolution the General Assembly confiscated the property of the church to finance the needs of the “people”. Too bad they discovered too late that they could not easily liquidate or sell this property as there were insufficient buyers and money. So they just ended up printing money instead, Assignats, and we ended up with Madame Dufarge, the guillotine and Napoleon.

Also, some estimate our unfunded liabilities are near $100 TRILLION. Not sure how that factors into the discussion.

schu

22

posted on

04/21/2011 11:07:08 AM PDT

by

schu

To: SeekAndFind

As long as YOU have dollars to spend on ME everything will be fine!

So give it up you tight was sons of b!t@hes! the government says YOU OWE ME!

Sarc/off

23

posted on

04/21/2011 11:07:42 AM PDT

by

Ruy Dias de Bivar

(Click my name. See my home page, if you dare!)

To: SeekAndFind

Now THAT is frightening. What those charts imply is that if the government confiscated all OUR money they would be just fine? Am I getting that right?

To: Lurker

“Some of our senior politicians and market pundits say it every day: “America is broke.”

We wonder if this is meant to be a joke. America is not even close to being broke. Household net worth is $57T. Public government debt – including the state and local sector – is about $12T. If we consolidate balance sheets to reflect the fact that the household sector is ultimately responsible for repaying this debt we arrive at a household net worth of $45T or 303% of GDP.

I'm not broke! I may have a debt of $14 trillion, along with unfunded liabilities of over $100 trillion, but my neighbor has money! But if you "consolidate" my horrifying balance sheet with that of my neighbor, who's in the black, I've got plenty of money! So how about some more credit?"

25

posted on

04/21/2011 11:09:45 AM PDT

by

Milton Miteybad

(I am Jim Thompson. {Really.})

To: BuckeyeTexan

I assume this isn’t satire and wasn’t intended to be a joke. The only response I can post without getting censored by the moderators is: WTF?!

It must be satire. Look at the last sentence: But, ultimately, the resources are there and as we are increasingly finding out, so too is the political will

To: SeekAndFind

True, America (that would be we the people) is not broke, on average.

However, the entity that we the people have charged with defending and protecting the provisions of the Constitution (that would be the "government") most certainly IS broke...primarily because of tax and spend policies that run contrary to the original intent of the Constitution itself.

The left wants to confiscate more property from we the people in order to "balance" the ledger (and, in reality, for other more nefarious reasons).

The right wants to mandate that the government live within its means from property already confiscated from we the people (some would say "do more with less", others would say "do less with less"... either way, no more confiscation of our property).

To: SeekAndFind

This analysis only compares *current* debt to current net worth. It does not consider the future liablities of Medicare and Social Security. It also does not consider the devistating economic effects of seizing large parts of people’s net worth to pay off the debt.

FDR and LBJ’s ponzi scams are not longer sustainable. This is what people mean when they say the country is “broke.”

28

posted on

04/21/2011 11:12:47 AM PDT

by

feralcat

To: SeekAndFind

So we discover yet again why the banks are all in trouble: We can’t be broke, WE STILL HAVE CHECKS!!!

Our interest on the national debt right now is $215 billion, historically a low payment. However, the low payment is because much of it is at 0% interest, and that will not hold out much longer as the dollar value declines and inflation starts taking hold.

The average debt payment has been around $400 billion on %5-7 trillion in debt. We are now at $14 trillion in debt.

Using nominal interest rates we could easily see our interest payment hit $800 billion without breaking a sweat. Toss in slightly higher interest rates and $1.6 trillion payments could be possible.

We take in about $2 trillion in income taxes. Subtract out the debt payments and subtract out the additional debt we add every year and we are broke. We are in the hole.

29

posted on

04/21/2011 11:18:07 AM PDT

by

CodeToad

(Islam needs to be banned in the US and treated as a criminal enterprise.)

To: SeekAndFind

Credit Suisse is right - America is not broke - it’s people are.

Employing Credit Suisse logic I come to the following.

America is governed by the people, therefore People = Govt.

The government owes many foreign banks more money than we can pay so the government is broke, yet we know People = Govt.

So if People = Govt. = Broke, then logically People = Broke

We are broke, so we should declare bankruptcy, and the govt will bail us out!!

To: SeekAndFind

” Obama’s reasoning would then go like this -— BE A PATRIOTIC AMERICAN AND GIVE UP JUST 20% OF WHAT YOU OWN TO MAKE THIS COUNTRY DEBT FREE !! “

No - Obama’s reasoning would be more traditional Marxist —

“The Government owns everything, and you own nothing, so ‘su casa (and su everything else) es mi casa’....”

31

posted on

04/21/2011 11:23:03 AM PDT

by

Uncle Ike

(Rope is cheap, and there are lots of trees...)

To: SeekAndFind

A case can be made either way:

(1) net external debt is $4 trillion, or less than 25% of GDP; or

(2) debt plus unfunded liabilities is around $60 trillion.

If current wasteful entitlements remain in place, the federal deficit will remain around $1-1/2 trillion. Low estimates are deceits. Increased taxes would destroy the dynamism of the economy and the social fabric of the country.

The only way to fix the problem is to reduce the size and responsibilities of government.

To: Pearls Before Swine

More that not wanting that...I’m not havin’it!

There will be many many gub’mint thieves dying of acute lead poisoning if they try to take so much as a penny of mine in such a manner.

33

posted on

04/21/2011 11:25:07 AM PDT

by

Emperor Palpatine

(One of these days, Alice....one of these days...POW! Right in the kisser!!!!)

To: SeekAndFind

This conveniently ignores private debt while using private wealth as the basis for saying "we're not broke." Deceptive, at best, and self-serving, since most of that debt is that which was run up by institutions such as CS.

So add in household, corporate, and financial debts, and that's another $40 trillion or so.

Another poster asked why CS was using a total federal, state, and local debt of 12 trillion when we're about to hit the 14 trillion debt ceiling. The answer to that is that the approximately 2+ trillion in IOUs in the social security "trust fund" are non-marketable securities and not counted in the total government debt figures.

In order for them to be redeemed, they have to be presented to the Treasury for redemption, and Treasury would then have to issue new debt in order to raise money to pay for the redemption. Any honest accounting would include those non-marketable securities in the total debt figures, but Credit-Suisse is every bit as complicit in the debt ponzi scheme as the feds and the other big banks, so expecting honesty from them is about the same as expecting honesty from a politician.

To: farmguy

"So all washington has to do is to figure out how to seize all those household assets for redistribution. "Ahem...

From each, according to his abilities.

36

posted on

04/21/2011 11:34:46 AM PDT

by

blam

To: gleneagle

And, what about the $100 trillion plus in unfunded liabilities?

That's in the footnotes.

37

posted on

04/21/2011 11:54:44 AM PDT

by

kenavi

("Anything that can't stand up to ribbing isn't worth much to begin with." Eric Idle)

To: Timocrat

If total government debt including obligations of the states is $12T why does the debt ceiling have to be raised above $14.3T for the Federal Government alone ?Total government debt including obligations of the states is not $12T. Public government debt including obligations of the states is (according to the article) $12T. Public government debt is a subset of total government debt, which also includes intragovernment debts (including Social "Security").

38

posted on

04/21/2011 11:56:48 AM PDT

by

Darth Reardon

(No offense to drunken sailors)

To: DaisyCutter

You missed the part re ‘net’ wealth. Private debt is already factored in. This is all largely true and we are the wealthiest nation this planet has ever seen and will be for quite a long while. That’s not to diminish the debt or the deficits nor to suggest we use our private wealth to pay off the debt, merely recognition that we are extremely weatlhy still. And while everyone is quick to point out future unfunded liabilities, they ignore future unrealized growth. Given any semblence of normalcy, our wealth will outpace our debt even if we do continue down this debt ridden big govt path.

To: SeekAndFind

Yea, the headline is correct....the US is rich in greed and corruption.

40

posted on

04/21/2011 12:09:51 PM PDT

by

Razzz42

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-45 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson