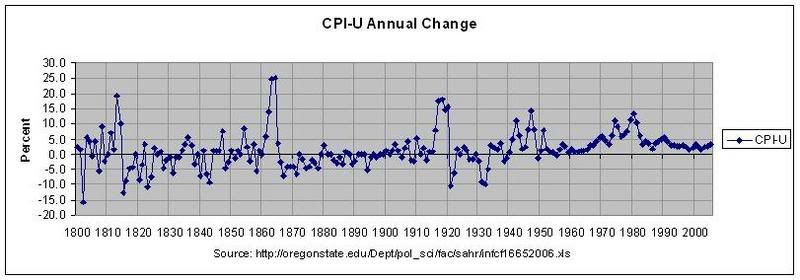

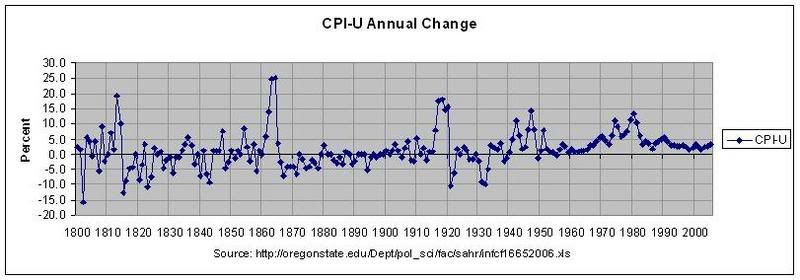

Not especially the almost totally flat nature of prices between 1870 and 1910.

The chart shows deflation between 1870 and 1910, not stability. 1992 to the end of the chart was more stable.

Posted on 01/10/2011 6:17:58 AM PST by IbJensen

The Patriot-Liberty movement has railed against the Federal Reserve for decades. Inexorably attached to the abolishment of the private banking monopoly, the entire political career of Ron Paul is an inspiration for any citizen who values liberty and defends the U.S. Constitution. The Federal Reserve is the Enemy of America.

The central cause for the financial collapse of the country rests upon the fractional reserve debt created money racket, which relegates the taxpayer to chattel slave status. You know this is true, and the politicians fear that at some breaking point you will rise up and force a return to honest money.

Ron Paul states the obvious in the Congressional Record.

“Though the Federal Reserve policy harms the average American, it benefits those in a position to take advantage of the cycles in monetary policy. The main beneficiaries are those who receive access to artificially inflated money and/or credit before the inflationary effects of the policy impact the entire economy. Federal Reserve policies also benefit big spending politicians who use the inflated currency created by the Fed to hide the true costs of the welfare-warfare state. It is time for Congress to put the interests of the American people ahead of the special interests and their own appetite for big government.

Abolishing the Federal Reserve will allow Congress to reassert its constitutional authority over monetary policy. The United States Constitution grants to Congress the authority to coin money and regulate the value of the currency. The Constitution does not give Congress the authority to delegate control over monetary policy to a central bank. Furthermore, the Constitution certainly does not empower the federal government to erode the American standard of living via an inflationary monetary policy”.

Is it possible to replace a private banking cartel as the issuer of money? Career politicians spend trillions of Federal Reserve Notes that accrue interest payments upon the very creation of money. In this political environment, can this tribute payable to the central bank, be eliminated?

Listen to an NPR radio “All Things Considered”, and compare the fairy tale viewpoint of the role and function of the Federal Reserve by NPR to the rational and fiscally sound solutions that Congressman Paul presents. The apologists for the central banking swindle are “Tools” not of capital but of elite’s bankstersthat hold hostage an entire economy. Business no longer has the effective ability to overcome the excessive burden of unnecessary systemic interest. This is the inevitable consequence of a debt pyramid, when governments are required to pay tribute on money created by an accounting addition. It is sad that self-professed intellectuals are so ignorant of the functions and ultimate purpose of the Federal Reserve.

Viewing Ron Paul 0wnz the Federal Reserve and on Dylan Ratigan Jan 6 2011 provides valuable background and a hint of what may be possible. Expectations need to be realistic. While the dam is buckling and a flood is poised to wipe out the valley, only a perspective from high ground can attempt to ease the pain, which is inevitable. Paul is playing down the immediate prospects of replacing the Fed, not because he lost his nerve, but because of the squishy, all things considered mentality, that permeates the society. In order to right the ship of state, the bailing needs to start with stopping the bail outs.

Such measures are pale when placed in context with the real power that rules both the money centers and the political suites. Remember your history before you risk its repeat . . .

“The high office of the President has been used to foment a plot to destroy the American's freedom and before I leave office, I must inform the citizens of this plight.” — President John Fitzgerald Kennedy - In a speech made to Columbia University on Nov. 12, 1963, ten days before his assassination!

Challenging the Central Bank stands as a risky venture and surviving not always guaranteed. The following is from President John F. Kennedy, The Federal Reserve And Executive Order 11110.

Section 1. Executive Order No. 10289 of September 19, 1951, as amended, is hereby further amended-

By adding at the end of paragraph 1 thereof the following subparagraph (j):

(j) The authority vested in the President by paragraph (b) of section 43 of the Act of May 12,1933, as amended (31 U.S.C.821(b)), to issue silver certificates against any silver bullion, silver, or standard silver dollars in the Treasury not then held for redemption of any outstanding silver certificates, to prescribe the denomination of such silver certificates, and to coin standard silver dollars and subsidiary silver currency for their redemption

and --

By revoking subparagraphs (b) and (c) of paragraph 2 thereof.

Sec. 2. The amendments made by this Order shall not affect any act done, or any right accruing or accrued or any suit or proceeding had or commenced in any civil or criminal cause prior to the date of this Order but all such liabilities shall continue and may be enforced as if said amendments had not been made.

John F. Kennedy The White House, June 4, 1963.

Just coincidental or is there a direct message when one seeks to remove the gravy train from the inside circle of the real conspirators? Note that devoted followers of Ron Paul need to recognize that one man standing alone needs protection. The best way to secure that a serious audit of the Federal Reserve will take place is to coordinate among all factions and ideologies the imperative requirement that the Central Bank is accountable to the People. An audit is not nearly the resolution to replace the Fed, but it can be the starting point to invoke righteous outrage of the populace that might spread to the newly elected representatives on the Hill.

If Congressman Dennis Kucinich can agree with Ron Paul, The Tea Party freshmen can take the leap. In 2007, Paul Introduces H.R. 2755: To Abolish the Federal Reserve. Section (b) Repeal of Federal Reserve Act- Effective at the end of the 1-year period beginning on the date of the enactment of this Act, the Federal Reserve Act is hereby repealed. The enactment of this simple directive would be the most earth shattering and economic liberating action seen in the lifetime of everyone alive. If you doubt this conclusion, examine the significance of the American Financial Stability Act of 2010. Thomas R. Eddlem states, “In short, the bill would allow any investment risks that federal government regulators find acceptable and ban any regulators find unacceptable”.

Federal Reserve Bank of Philadelphia admits that the Dodd-Frank Financial Reform Act will increase the power of the Fed.

“The Financial Stability Act establishes the Financial Stability Oversight Council, which will have the responsibility to promote market discipline, coordinate with other regulators to identify and respond to threats to financial stability, and resolve gaps in regulation.

The council will have the authority to place a systemically important financial institution under the supervision of the Federal Reserve. Nonbank institutions may be required to establish an intermediate holding company to be regulated by the Federal Reserve and may be required to divest holdings. The Federal Reserve, in consultation with the council, will tighten prudential standards for the large, interconnected BHCs and financial institutions it supervises. These firms will undergo annual stress tests and will be subject to credit exposure limits. Conferees added a House-passed provision that will require such institutions to maintain a leverage ratio of 15 to 1”.

Just imagine expanding the Fed to regulate banking when the Federal Reserve should be under the microscope as the most vicious criminal syndicate of all time. When the Central Bank buys government bonds that must pay interest by the Treasury, this rigged game of extortion is out of control. “Now with holdings of $821.1 billion, the Fed is officially the second largest holder of U.S. Treasury’s, next to China and is just $25 billion away from being the Treasury's largest creditor”.

The Daily Paul is the flagship site for all things Ron Paul. Their total number of visits since 1/21/2007 reported to be over 42,403,507. The Ron Paul Forum on Liberty Forest has over 27,290 members. Both services have a devoted and loyal following. Nevertheless, this core group of activists is not enough to drive a national campaign with a single purpose. ABOLISH the Federal Reserve.

A Bloomberg National Poll conducted by Selzer & Company, has the top two issues as Unemployment and jobs at 50% and the Federal deficit and spending at 25%. The jobs and deficit issue is a direct result of the criminal central banking system. A major component of excessive spending is interest. In FY2010, the Treasury Department spent $414 Billion of your money on interest payments to the holders of the National Debt. The reason for the decline in the purchasing power of the Dollar is inescapable. In order for Ron Paul to lead the crusade against the Fed, he needs a bodyguard of millions to save the American Dream. The life you save is really your own.

I’m uber weak on the idea, but I am attracted to the notion of ‘free banking’. If you want to bank at a fractional reserve bank, go right ahead. Bank at a bank with one to ten, one to a hundred reserves.

Why is that a public problem?

Money is too important, too personal to be in government hands.

If the American people ever allow the banks to control issuance of their currency, first by inflation and then by deflation, the banks and corporations that grow up around them will deprive the people of all property until their children will wake up homeless on the continent their fathers occupied. Thomas Jefferson

Mind also that this was a era of immense shortages of skilled labor, material, very high costs transport, primitive finance and finance information, and also very limitied government control, taxes( at least internally ), radical mobility.

Funny how people left alone, more or less, with little government built the nation from NOTHING, and now with great government, can not even maintain what previous generations made.

Connection? Nawh. Fugendaboutit.

Next year! More centralization! Upwards and onwards to Detroit like prosperity!

Not especially the almost totally flat nature of prices between 1870 and 1910.

The chart shows deflation between 1870 and 1910, not stability. 1992 to the end of the chart was more stable.

Fake Jefferson quote!

M1 includes currency in circulation and demand deposits.

You deposit 10 $20s in the bank. The banks loans out 9 $20s and keeps one in reserve. The money supply is your checking account ($200) plus the $180 that is in circulation. The money supply grows by $180 whether your $20s are gold coins, gold certificates or FRNs.

So after the original bank loans out 9 of my 20s, I change my mind and wish to withdraw 5 of the 10 I deposited. The bank only has one of those 20s in its vault. It cannot possibly give me what it has promised.

Now, if I deposited the 10 20s into a CD where I specifically fore go access to my money for a specified time, then things are very different. Those funds may certainly be lent out and the difference between the rate paid on the CD and the interest charged on the loan if the bankers profit.

The difference is that in the first instance, the bank promises to redeem upon demand that which it no longer has. But in the second, I willingly give up my claim on the funds for a specified time, with substantial penalty for early withdrawal.

He accepted HW Bush as his VP too. Twice.

Sure it can.

Now, if I deposited the 10 20s into a CD where I specifically fore go access to my money for a specified time, then things are very different.

CDs have a 0% reserve requirement. Demand deposits require 10%.

Are you recommending 0% reserves for our fractional reserve banking?

But in the second, I willingly give up my claim on the funds for a specified time, with substantial penalty for early withdrawal.

How can you withdraw early? The bank has nothing in the vault.

What if the borrower defaults and you go back after your CD matures? The bank now has no money available. Is that fraud?

Does that change the fact that you didn’t know our brackets were adjusted for inflation?

It's true that if you eliminate banking, bank runs can not occur. But eliminating banking, will NOT stop economic recessions and depressions from occurring. Those have more to do with consumer psychology than banking.

And if you eliminate banking, economic growth and innovation will be significantly slowed as capital will not be effectively reinvested.

Can you provide any examples of countries that have prospered while eliminating banking?

You call banking "fraud", but almost everyone understands that when they deposit in a bank, the money gets lent out to others. So you would deny everyone the opportunity to collect interest, just to avoid the possibility of bank runs?

The protections on the banking industry that were put in place after the Great Depression have worked well to reduce bank runs. I believe it was a mistake to repeal Glass-Steagall and lower the bank reserve ratio to historic lows. I think these protections were removed to compete better globally, but we should have had a spine and required global competitors to come up to our standards if they wanted to compete in our market.

a reasonably close paraphrase of the closing sentence in Jefferson's to John Taylor:

And I sincerely believe, with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity( future generations) on a large scale.

Is that not what is going on now?http://www.snopes.com/quotes/jefferson/banks.asp

Aside from my explanation of why it is fraudulent above, it is the major cause of the boom/bust cycle we experience.

If you look back to the banking panics of the 1800s, most were created by the local banks practice of frb. By artificially increasing the money supply, it generates inflation and sends a message of a more powerful economy than really exists. This leads to mal-investment (the over-capacity that we see today) and inevitably ends in deflation. It is no co-incidence that the 30s depression was preceded by "The Roaring Twenties" and our current situation was similarly strong during the 90s.

Our banking establishments obviously crushed Hitler and Tojo. Jefferson wasn't the best authority on economics.

the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity( future generations) on a large scale.

No argument there.

Why have any government, central planned standards at all? If you want to bank at a junk bank, junk bank. People that couldn’t change a tire, have no mechanical engineering degrees, know a Yugo was junk and a Mercedes was good. They now know KIAs were junk, but now are good cars. I don’t know of anything,or service or product which free people are not able to distinguish poor quality from good quality. Near illiterate street hustlers in Havana to North Korea know good paper from bad paper. People know their bum brother in law is a bad loan risk, and their rich uncle will want a return.

I’m told that great industrial concerns need ...I don’t know...big finance. Well, they’re so smart, let them figure it out. I’m told farmers at crop time need cash. Like it is the 1880’s. ( Even then that was true of SOME farmers. Marginal farmers ) Today there are futures markets. Crops can be sold before they are planted.

I would mind less if we had the class leadership we had at a hundred years ago. But no one can tell me that by and large the quality, over all, of the people in government has anything but gone down, way down. You take an organization, decrease its labor quality and up its work load and responsibilities and you tell me what is going on. I didn’t care one bit when GM was circling the drain because twenty other car manufactures were supplying me. But when Fedgov goes down, whom am I going to go to?

Of course, any student of history will tell you that it can’t happen here.

?

When two poorly led, mis managed, middle sized, primitive mystic regimes, each take on half the world, eh. I don’t think banking was a critical function. Both regimes success were a function of sucker punch tactics. England and Russia, might well of alone been able to defeat Hitler.

(Great book by the way( lousy movie) Fatherland.)

My readings of internal political and industrial management of both Hitler’s Germany and Imperial Japan make the post Stalin Soviet Union look like Wharton. Stalin was an excellent organizer, well understanding his culture, motivations and enemy. I don’t think he had much need for banking support.

How? It only has 1 $20 bill left, it loaned the rest out.

CDs have a zero percent requirement because there is clear title to the money in it for a specified time. Demand deposits should have a 100% reserve ratio. That is what I am recommending.

Who said I wanted to eliminate banking? I want to eliminate fraud. True, today, the two are nearly indistinguishable, but they really aren’t the same thing.

Are you saying our armies were more dangerous than our banks? I'm shocked.

You know, there was a time the Forrest Service squelched every little fire. So what happened? The fuel....THE RISK...piled up. Eventually a little fire couldn’t be contained, and all that fuel that would of been burnt in many smaller fires was available to burn and you get a great big fire.

Small panics, repeated every generation, clear out the risk. Educated each generation, and are quickly recoverable.

We haven’t had one for a long time.

It will come, and it will make two years ago look like a hickup.

We will need a dictatorship to hold the bloated, corrupt, hack infested paper shufflers, and the mass of fat, lazy, public edjamakted ignorant,deluded masses at bay.

They could sell their loan or pledge it as security for a loan.

CDs have a zero percent requirement because there is clear title to the money in it for a specified time.

You don't have clear title to your bank account?

Demand deposits should have a 100% reserve ratio.

Why would banks accept demand deposits?

That is what I am recommending.

It's a bad idea.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.