Skip to comments.

Ron Paul vs. the Federal Reserve

Right Side News ^

| January 10, 2011

| Strapado Wrack

Posted on 01/10/2011 6:17:58 AM PST by IbJensen

The Patriot-Liberty movement has railed against the Federal Reserve for decades. Inexorably attached to the abolishment of the private banking monopoly, the entire political career of Ron Paul is an inspiration for any citizen who values liberty and defends the U.S. Constitution. The Federal Reserve is the Enemy of America.

The central cause for the financial collapse of the country rests upon the fractional reserve debt created money racket, which relegates the taxpayer to chattel slave status. You know this is true, and the politicians fear that at some breaking point you will rise up and force a return to honest money.

Ron Paul states the obvious in the Congressional Record.

“Though the Federal Reserve policy harms the average American, it benefits those in a position to take advantage of the cycles in monetary policy. The main beneficiaries are those who receive access to artificially inflated money and/or credit before the inflationary effects of the policy impact the entire economy. Federal Reserve policies also benefit big spending politicians who use the inflated currency created by the Fed to hide the true costs of the welfare-warfare state. It is time for Congress to put the interests of the American people ahead of the special interests and their own appetite for big government.

Abolishing the Federal Reserve will allow Congress to reassert its constitutional authority over monetary policy. The United States Constitution grants to Congress the authority to coin money and regulate the value of the currency. The Constitution does not give Congress the authority to delegate control over monetary policy to a central bank. Furthermore, the Constitution certainly does not empower the federal government to erode the American standard of living via an inflationary monetary policy”.

Is it possible to replace a private banking cartel as the issuer of money? Career politicians spend trillions of Federal Reserve Notes that accrue interest payments upon the very creation of money. In this political environment, can this tribute payable to the central bank, be eliminated?

Listen to an NPR radio “All Things Considered”, and compare the fairy tale viewpoint of the role and function of the Federal Reserve by NPR to the rational and fiscally sound solutions that Congressman Paul presents. The apologists for the central banking swindle are “Tools” not of capital but of elite’s bankstersthat hold hostage an entire economy. Business no longer has the effective ability to overcome the excessive burden of unnecessary systemic interest. This is the inevitable consequence of a debt pyramid, when governments are required to pay tribute on money created by an accounting addition. It is sad that self-professed intellectuals are so ignorant of the functions and ultimate purpose of the Federal Reserve.

Viewing Ron Paul 0wnz the Federal Reserve and on Dylan Ratigan Jan 6 2011 provides valuable background and a hint of what may be possible. Expectations need to be realistic. While the dam is buckling and a flood is poised to wipe out the valley, only a perspective from high ground can attempt to ease the pain, which is inevitable. Paul is playing down the immediate prospects of replacing the Fed, not because he lost his nerve, but because of the squishy, all things considered mentality, that permeates the society. In order to right the ship of state, the bailing needs to start with stopping the bail outs.

Such measures are pale when placed in context with the real power that rules both the money centers and the political suites. Remember your history before you risk its repeat . . .

“The high office of the President has been used to foment a plot to destroy the American's freedom and before I leave office, I must inform the citizens of this plight.” — President John Fitzgerald Kennedy - In a speech made to Columbia University on Nov. 12, 1963, ten days before his assassination!

Challenging the Central Bank stands as a risky venture and surviving not always guaranteed. The following is from President John F. Kennedy, The Federal Reserve And Executive Order 11110.

Section 1. Executive Order No. 10289 of September 19, 1951, as amended, is hereby further amended-

By adding at the end of paragraph 1 thereof the following subparagraph (j):

(j) The authority vested in the President by paragraph (b) of section 43 of the Act of May 12,1933, as amended (31 U.S.C.821(b)), to issue silver certificates against any silver bullion, silver, or standard silver dollars in the Treasury not then held for redemption of any outstanding silver certificates, to prescribe the denomination of such silver certificates, and to coin standard silver dollars and subsidiary silver currency for their redemption

and --

By revoking subparagraphs (b) and (c) of paragraph 2 thereof.

Sec. 2. The amendments made by this Order shall not affect any act done, or any right accruing or accrued or any suit or proceeding had or commenced in any civil or criminal cause prior to the date of this Order but all such liabilities shall continue and may be enforced as if said amendments had not been made.

John F. Kennedy The White House, June 4, 1963.

Just coincidental or is there a direct message when one seeks to remove the gravy train from the inside circle of the real conspirators? Note that devoted followers of Ron Paul need to recognize that one man standing alone needs protection. The best way to secure that a serious audit of the Federal Reserve will take place is to coordinate among all factions and ideologies the imperative requirement that the Central Bank is accountable to the People. An audit is not nearly the resolution to replace the Fed, but it can be the starting point to invoke righteous outrage of the populace that might spread to the newly elected representatives on the Hill.

If Congressman Dennis Kucinich can agree with Ron Paul, The Tea Party freshmen can take the leap. In 2007, Paul Introduces H.R. 2755: To Abolish the Federal Reserve. Section (b) Repeal of Federal Reserve Act- Effective at the end of the 1-year period beginning on the date of the enactment of this Act, the Federal Reserve Act is hereby repealed. The enactment of this simple directive would be the most earth shattering and economic liberating action seen in the lifetime of everyone alive. If you doubt this conclusion, examine the significance of the American Financial Stability Act of 2010. Thomas R. Eddlem states, “In short, the bill would allow any investment risks that federal government regulators find acceptable and ban any regulators find unacceptable”.

Federal Reserve Bank of Philadelphia admits that the Dodd-Frank Financial Reform Act will increase the power of the Fed.

“The Financial Stability Act establishes the Financial Stability Oversight Council, which will have the responsibility to promote market discipline, coordinate with other regulators to identify and respond to threats to financial stability, and resolve gaps in regulation.

The council will have the authority to place a systemically important financial institution under the supervision of the Federal Reserve. Nonbank institutions may be required to establish an intermediate holding company to be regulated by the Federal Reserve and may be required to divest holdings. The Federal Reserve, in consultation with the council, will tighten prudential standards for the large, interconnected BHCs and financial institutions it supervises. These firms will undergo annual stress tests and will be subject to credit exposure limits. Conferees added a House-passed provision that will require such institutions to maintain a leverage ratio of 15 to 1”.

Just imagine expanding the Fed to regulate banking when the Federal Reserve should be under the microscope as the most vicious criminal syndicate of all time. When the Central Bank buys government bonds that must pay interest by the Treasury, this rigged game of extortion is out of control. “Now with holdings of $821.1 billion, the Fed is officially the second largest holder of U.S. Treasury’s, next to China and is just $25 billion away from being the Treasury's largest creditor”.

The Daily Paul is the flagship site for all things Ron Paul. Their total number of visits since 1/21/2007 reported to be over 42,403,507. The Ron Paul Forum on Liberty Forest has over 27,290 members. Both services have a devoted and loyal following. Nevertheless, this core group of activists is not enough to drive a national campaign with a single purpose. ABOLISH the Federal Reserve.

A Bloomberg National Poll conducted by Selzer & Company, has the top two issues as Unemployment and jobs at 50% and the Federal deficit and spending at 25%. The jobs and deficit issue is a direct result of the criminal central banking system. A major component of excessive spending is interest. In FY2010, the Treasury Department spent $414 Billion of your money on interest payments to the holders of the National Debt. The reason for the decline in the purchasing power of the Dollar is inescapable. In order for Ron Paul to lead the crusade against the Fed, he needs a bodyguard of millions to save the American Dream. The life you save is really your own.

TOPICS: Business/Economy; Constitution/Conservatism; Crime/Corruption; Government

KEYWORDS: fed; fedup; ronpaul

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-137 next last

To: Leisler

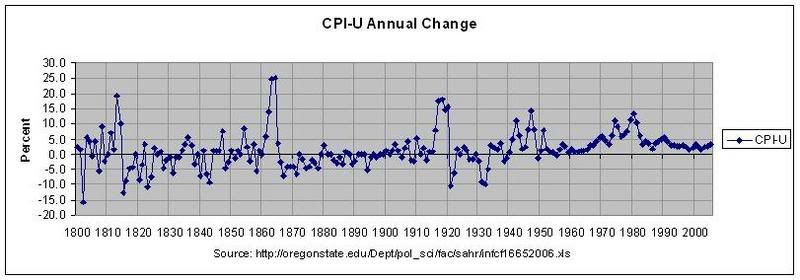

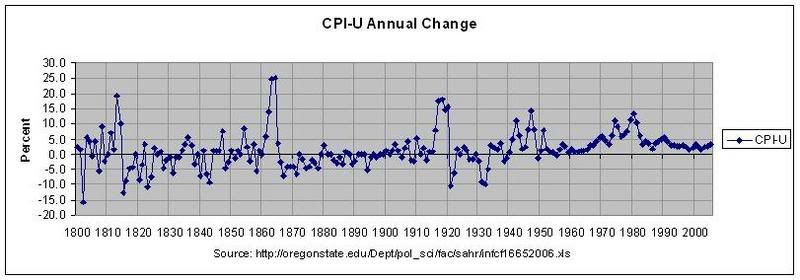

From the late 1700 until the beginnings of the Federal Reserve we had a stable US dollar Stable? Really? You have a chart showing that?

21

posted on

01/10/2011 8:23:02 AM PST

by

Toddsterpatriot

(Math is hard. Harder if you're stupid.)

To: DManA

The Fed’s goal is stable prices. They choose to err on the side of slight inflation because deflation is much more harmful. Managing the supply of money to meet demand, and not create inflation or deflation in the process, ain’t easy. They’ve done a pretty good job of it over the past 50 years or so. Stable prices were pretty hard to come by when we were on the gold standard. We’d experience a year of massive deflation followed by a year of massive inflation. These wild swings wiped out a lot of businesses, especially farmers.

22

posted on

01/10/2011 8:25:44 AM PST

by

Mase

(Save me from the people who would save me from myself!)

To: DannyTN

"This is the real cause, not the Fed, or lending."Two words. Moral Hazard.

Receive our top stories daily

optional

History of U.S. Gov’t Bailouts

#bailouts-key th {padding: 10px; text-align: center; vertical-align: middle; line-height: 1.2em;}

#bailouts-key td, #bailouts-key th {border-bottom: 1px solid #000;}

#bailouts-key td {padding: 10px; line-height: 1.2em; text-align: center; vertical-align: middle;}

#bailouts-key td.kakbail {text-align: left;}

History of U.S. Gov't Bailouts

Updated: April 15, 2009 12:02 pm EDT

With the flurry of recent government bailouts, we decided to try to put them in perspective. The circles below represent the size of U.S. government bailout, calculated in 2008 dollars. They are also in chronological order. Our chart focuses on U.S. government bailouts of U.S. corporations (and one city). We have not included instances where the U.S. government aided other nations.

Check out how the Treasury did in the end after initial government outlays. Also, check out our ultimate bailout guide. We're tracking every taxpayer dollar, every recipient and every program in the current financial crisis. All searchable – and translated into English.

Want to receive an e-mail alert when we publish public data and documents on ProPublica? Sign up here.

| |

Industry/Corporation |

Year |

What Happened |

Cost in 2008 U.S. Dollars |

|

| ● |

Penn Central Railroad |

1970 |

In May 1970, Penn Central Railroad, then on the verge of bankruptcy, appealed to the Federal Reserve for aid on the grounds that it provided crucial national defense transportation services. The Nixon administration and the Federal Reserve supported providing financial assistance to Penn Central, but Congress refused to adopt the measure. Penn Central declared bankruptcy on June 21, 1970, which freed the corporation from its commercial paper obligations. To counteract the devastating ripple effects to the money market, the Federal Reserve Board told commercial banks it would provide the reserves needed to allow them to meet the credit needs of their customers. (What happened after the bailout?) |

$3.2 billion |

|

| ● |

Lockheed |

1971 |

In August 1971, Congress passed the Emergency Loan Guarantee Act, which could provide funds to any major business enterprise in crisis. Lockheed was the first recipient. Its failure would have meant significant job loss in California, a loss to the GNP and an impact on national defense. (What happened after the bailout?) |

$1.4 billion |

|

| ● |

Franklin National Bank |

1974 |

In the first five months of 1974 the bank lost $63.6 million. The Federal Reserve stepped in with a loan of $1.75 billion. (What happened after the bailout?) |

$7.8 billion |

|

| ● |

New York City |

1975 |

During the 1970s, New York City became over-extended and entered a period of financial crisis. In 1975 President Ford signed the New York City Seasonal Financing Act, which released $2.3 billion in loans to the city. (What happened after the bailout?) |

$9.4 billion |

|

| ● |

Chrysler |

1980 |

In 1979 Chrysler suffered a loss of $1.1 billion. That year the corporation requested aid from the government. In 1980 the Chrysler Loan Guarantee Act was passed, which provided $1.5 billion in loans to rescue Chrysler from insolvency. In addition, the government's aid was to be matched by U.S. and foreign banks. (What happened after the bailout?) |

$4.0 billion |

|

| ● |

Continental Illinois National Bank and Trust Company |

1984 |

Then the nation's eighth largest bank, Continental Illinois had suffered significant losses after purchasing $1 billion in energy loans from the failed Penn Square Bank of Oklahoma. The FDIC and Federal Reserve devised a plan to rescue the bank that included replacing the bank's top executives. (What happened after the bailout?) |

$9.5 billion |

|

| ● |

Savings & Loan |

1989 |

After the widespread failure of savings and loan institutions, President George H. W. Bush signed and Congress enacted the Financial Institutions Reform Recovery and Enforcement Act in 1989. (What happened after the bailout?) |

$293.3 billion |

|

| ● |

Airline Industry |

2001 |

The terrorist attacks of September 11 crippled an already financially troubled industry. To bail out the airlines, President Bush signed into law the Air Transportation Safety and Stabilization Act, which compensated airlines for the mandatory grounding of aircraft after the attacks. The act released $5 billion in compensation and an additional $10 billion in loan guarantees or other federal credit instruments. (What happened after the bailout?) |

$18.6 billion |

|

| ● |

Bear Stearns |

2008 |

JP Morgan Chase and the federal government bailed out Bear Stearns when the financial giant neared collapse. JP Morgan purchased Bear Stearns for $236 million; the Federal Reserve provided a $30 billion credit line to ensure the sale could move forward. |

$30 billion |

|

| ● |

Fannie Mae / Freddie Mac |

2008 |

On Sep. 7, 2008, Fannie and Freddie were essentially nationalized: placed under the conservatorship of the Federal Housing Finance Agency. Under the terms of the rescue, the Treasury has invested billions to cover the companies' losses. Initially, Treasury Secretary Hank Paulson put a ceiling of $100 billion for investments in each company. In February, Tim Geithner raised it to $200 billion. The money was authorized by the Housing and Economic Recovery Act of 2008. |

$400 billion |

|

| ● |

American International Group (A.I.G.) |

2008 |

On four separate occasions, the government has offered aid to AIG to keep it from collapsing, rising from an initial $85 billion credit line from the Federal Reserve to a combined $180 billion effort between the Treasury ($70 billion) and Fed ($110 billion). ($40 billion of the Treasury’s commitment is also included in the TARP total.) |

$180 billion |

|

| ● |

Auto Industry |

2008 |

In late September 2008, Congress approved a more than $630 billion spending bill, which included a measure for $25 billion in loans to the auto industry. These low-interest loans are intended to aid the industry in its push to build more fuel-efficient, environmentally-friendly vehicles. The Detroit 3 -- General Motors, Ford and Chrysler -- will be the primary beneficiaries. |

$25 billion |

|

| ● |

Troubled Asset Relief Program |

2008 |

In October 2008, Congress passed the Emergency Economic Stabilization Act, which authorized the Treasury Department to spend $700 billion to combat the financial crisis. Treasury has been doling out the money via an alphabet soup of different programs. Here’s our running tally of companies getting TARP funds. |

$700 billion |

|

| ● |

Citigroup |

2008 |

Citigroup received a $25 billion investment through the TARP in October and another $20 billion in November. (That $45 billion is also included in the TARP total.) Additional aid has come in the form of government guarantees to limit losses from a $301 billion pool of toxic assets. In addition to the Treasury's $5 billion commitment, the FDIC has committed $10 billion and the Federal Reserve up to about $220 billion. |

$280 billion |

|

| ● |

Bank of America |

2009 |

Bank of America has received $45 billion through the TARP, which includes $10 billion originally meant for Merrill Lynch. (That $45 billion is also included in the TARP total.) In addition, the government has made guarantees to limit losses from a $118 billion pool of troubled assets. In addition to the Treasury's $7.5 billion commitment, the FDIC has committed $2.5 billion and the Federal Reserve up to $87.2 billion. |

$142.2 billion |

| Jesse Nankin, Eric Umansky, Krista Kjellman, Scott Klein |

23

posted on

01/10/2011 8:26:03 AM PST

by

Leisler

(They always lie, and have for so much and for so long, that they no longer know what about.)

To: Leisler

"History of U.S. Gov’t Bailouts"Don't talk to me about the moral hazard of bailing out the banking system from temporary short term liquidity crises, until you can explain how to prevent the panics and depressions of the 1800's when we were on a gold standard.

Is your plan to shut down all banking and lending and use of currency? Go back to the barter economies of 3000 years ago? Because I have a news flash for you. Money creation occurs with any lending. Any lending at all creates money. If you have 5 gold pieces and you loan that to your brother, you now have a receivable worth 5 gold pieces, and your brother has 5 gold pieces. You just increased assets from 5 to 10. That's money creation and it didn't take the Federal Reserve to make it happen.

24

posted on

01/10/2011 8:33:19 AM PST

by

DannyTN

To: Mase

Who’s this we, in we experienced price swings? There were millions of ‘we’s’, many did not experience price swings.( who knows? No one, so, how can anyone make a true statement as to the conditions back then? Do you trust the then poor, biased, agenda history? I don’t. I’m not saying they are lying, just that economic, political, fincial stats in history are not clear enough to repeat often heard mantras. For example, FDR ‘saved us’ from the Depression. He did not. He, and Hoover and the Fed, made it worse.)

And further in a free market, what’s wrong with price swings? What, are you a price welfare socialist that thinks that the same people that brought you, for example, lovely public housing, stable housing, that many ‘we’s’ enjoy, that we all know is a crowning success( /sarcasm ) that the same central planning in state finance will also produce a smooth, mono-culture welfare finance state. Are you for the welfarization, the socialization of finance.

25

posted on

01/10/2011 8:34:30 AM PST

by

Leisler

(They always lie, and have for so much and for so long, that they no longer know what about.)

To: Leisler; DManA

The market is highly resistant to deflation, specifically in the labor market. A low rate of inflation allows real wages to decrease without pay cuts - employers simply freeze pay or give raises which are less than the rate of inflation. This avoids the market trauma of actual pay cuts, which have severe impacts on consumption and consumer confidence.

What you mean to say as “The Economy” is some vague, elitist notion of what they as a class feel is the present desired economy. Basically big gov, big fiance and their associated Mini-me’s.

What total BS. It's not the California Reserve, the Your Living Room Reserve, or the Cleveland Reserve. It's the Federal Reserve, and its bread and butter is the Federal economy. Is your proposal that each state have its own currency and reserve bank? Or do we need more reserve banks than that?

26

posted on

01/10/2011 8:36:38 AM PST

by

Domalais

To: DManA

"Price is information. Inflation/deflation corrupts the information."Unless the Inflation/deflation is relatively stable. Inflation/deflation has been more stable since the Federal Reserve was created than it was during the 1800's when we were on a gold standard.

The only difference is that under the Federal Reserve the direction has been mostly one way, a slow inflation. That makes the currency not a good store of long-term value, but you shouldn't use currency for that anyway.

You have inflation/deflation on any monetary system. It was worse on the gold standard. You had huge swings of 20 to 25% in a year.

27

posted on

01/10/2011 8:37:45 AM PST

by

DannyTN

To: DannyTN

I’ll talk to whom I want. Get your own site and you can ban me.

Anyway.

Why should speculative panics be ‘saved’? You use the word save, like a kid drowning in a pond. I say they are cleared, exposed, like a festering wound to daylight.

At least back then they were saved by the likes of Morgan. Private citizens not engaged in speculative behavior were not taxed, nor their future generations indebted to bail out speculators.

( TARP. It’s for the children )

28

posted on

01/10/2011 8:38:33 AM PST

by

Leisler

(They always lie, and have for so much and for so long, that they no longer know what about.)

To: Domalais

The market is highly resistant to deflation, specifically in the labor market. It is now, it wasn't always.

Yes, I would like to see state banks. The Constitution doesn't forbid it. It does forbid a Federal Bank, hence the Freddie/Frannie quality Federal Reserve, LLC. Since you are so knowing, what state still has it's own state bank. ( and is doing pretty good )

29

posted on

01/10/2011 8:42:24 AM PST

by

Leisler

(They always lie, and have for so much and for so long, that they no longer know what about.)

To: DannyTN

Inflation/deflation has been more stable since the Federal Reserve

The Fed’s record in maintaining stability in the past 20 years is bad and getting worse.

I don’t advocate a gold standard.

30

posted on

01/10/2011 8:46:11 AM PST

by

DManA

To: Leisler

Yes, I would like to see state banks. The Constitution doesn't forbid it. It does forbid a Federal Bank Is that why a Federal Bank was created when Washington was President? He didn't understand the Constitution?

what state still has it's own state bank

You're not an Ellen Brown fan, are you?

31

posted on

01/10/2011 8:50:49 AM PST

by

Toddsterpatriot

(Math is hard. Harder if you're stupid.)

To: Leisler

"What is the politically correct time frame? Who made the state, and traders the arbiters of when, how long, how fast trades should be made? Most economists think inflation of 1-3% is ideal. Deflation incents people to hoard capital as currency instead of reinvesting into the economy.

"Who made the state, and traders the arbiters of when, how long, how fast trades should be made?

Nobody really controls that. The Federal Reserve influences the rate of lending by influencing certain key lending rates. But the speed at which most trades are made is not regulated by anyone. So I don't know really what you are getting at here? I thought maybe you were asking who made the state the arbiter of the inflation rate, but that's now what you asked. The answer to that question would be Congress in 1913 when they created the Federal Reserve. Before that Inflation/Deflation was not well controlled and the nation suffered repeated bouts of depression as a result.

"From the late 1700 until the beginnings of the Federal Reserve we had a stable US dollar,"

No we didn't. It was gold backed, but it was anything but stable. Go back and look at the wild swings in the CPI. See MeasuringWorth.com. The dollar has been significantly more stable since the Federal Reserve than before it.

"and with primitive finance, bad to no information, no to very poor infrastructure, we built the wealthiest nation in the world, literally from nothing. We built cities to rival anyone. From nothing. Now? We can't pour concrete. Yeah, this is working out good."

Are you living in Mexico? Because here in the U.S. the amount of growth since I was a kid has been phenomenal. Roads, cities, infrastructure, etc. The biggest problem is that we've had some unwise trade policies that have decimated our manufacturing. And we've not has an energy policy that adequately addressed the risk of oil price shocks that we have understood since the early 70's.

We've done fantastically well under the Federal Reserve. We' survived two world wars and prospered after each one. Read up on the history of the "Long Depression." For 30 years after the Civil War we went from one recession/depression to another. That's what ending the Federal Reserve will do for you. Is it any wonder, long term projects can not be economically undertaken when you are unable to plan on stable values? From the late 1700 until the beginnings of the Federal Reserve we had a stable US dollar, and with primitive finance, bad to no information, no to very poor infrastructure, we built the wealthiest nation in the world, literally from nothing. We built cities to rival anyone. From nothing. Now? We can't pour concrete. Yeah, this is working out good.

32

posted on

01/10/2011 8:54:27 AM PST

by

DannyTN

To: Leisler

It is now, it wasn't always.

What's your solution? Go back in time and enact your suggested economic policies in the past, when they made sense?

It does forbid a Federal Bank, hence the Freddie/Frannie quality Federal Reserve, LLC.

Central banks which are independant from government are far more effective than those which are strongly tied to their government. That is the reason the Fed is organized in the current way.

Since you are so knowing, what state still has it's own state bank.

No state has a bank which operates as a central bank.

33

posted on

01/10/2011 8:56:03 AM PST

by

Domalais

To: Toddsterpatriot

I had to Google her. I don’t know her. Quick impulse, hummmm. Maybe.

The Federalist wanted a central bank, true. I’m more anti-Federalists. I wonder what the founders would think of our state today.

34

posted on

01/10/2011 9:01:14 AM PST

by

Leisler

(They always lie, and have for so much and for so long, that they no longer know what about.)

To: Leisler

I don’t know her. Quick impulse, hummmm. Maybe.Don't. She's a leftist and an idiot.

The Federalist wanted a central bank, true.

I thought you said the Constitution forbade one?

I wonder what the founders would think of our state today.

I think we all know the answer to that one. And it has very little to do with the Fed.

35

posted on

01/10/2011 9:04:16 AM PST

by

Toddsterpatriot

(Math is hard. Harder if you're stupid.)

To: Leisler

"At least back then they were saved by the likes of Morgan. Private citizens not engaged in speculative behavior were not taxed, nor their future generations indebted to bail out speculators."Private Citizens lost their jobs and lived in tent cities. Private Citizens lost their farms. You obviously don't know history, you haven't a clue the results of what you are advocating.

We didn't bail out speculators, with the exception of AIG. We bailed out banks and most of the banks weren't in trouble because of speculation. They were in trouble because the economy at large was in trouble. Most of the TARP loans have been repaid. So the bail outs are no longer that much of an issue. The reason your kids are indebted is not due to bail-outs. It's due to a congress that won't control spending. And that's a result of a lazy citizenry that keeps voting idiots into office.

No monetary system is going to save you from an idiot congress. No monetary system is going to stop Congress from borrowing. Only electing men of good character is going to free your kids.

36

posted on

01/10/2011 9:05:46 AM PST

by

DannyTN

To: Domalais

I said state bank. North Dakota. It’s pretty interesting, check it out.

Any organization that is created by government, and exists solely by government and can be abolished by government...the notion that they are ‘independent’ is ..please. That’s like saying you live in public housing and are independent.

I don’t think it matters what I think, or Ron Paul or the Tea Party, or Conservatives. I think we are in the accelerating beginning of a world wide major economic disaster. That we will see a double down to a one world currency. That the citizens in ignorance, apathy and sales pitch will accept it.

37

posted on

01/10/2011 9:09:28 AM PST

by

Leisler

(They always lie, and have for so much and for so long, that they no longer know what about.)

To: DannyTN

Wise free trade policies are at least in part responsible for the growth you recognize. You can’t prevent business from fleeing a bad tax and regulatory environment by locking the trade doors.

38

posted on

01/10/2011 9:10:29 AM PST

by

DManA

To: DannyTN

No monetary system is going to save you from an idiot congress

I agree with that completely. That is why we need a central monitory authority that is responsible for and held accountable for one thing - a stable currency.

Step #1 in reform - repeal the full employment mandate on the Fed.

39

posted on

01/10/2011 9:13:21 AM PST

by

DManA

To: Leisler

Who’s this we, in we experienced price swings? Your country. The USA.

You are free to choose what facts you wish to believe and those you wish to ignore. Price stability under the gold standard is a myth. If you think 5% inflation one year, followed by 5% deflation the next, is good for the economy, then more power to you.

I believe you and Ron Paul have an unfortunate and misguided understanding of history and the role of the Fed. JMHO, of course.

40

posted on

01/10/2011 9:14:55 AM PST

by

Mase

(Save me from the people who would save me from myself!)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-137 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson