Posted on 01/10/2011 6:17:58 AM PST by IbJensen

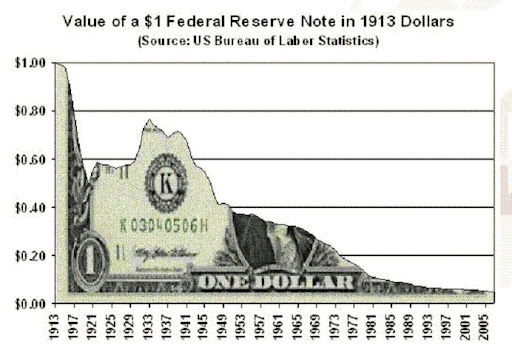

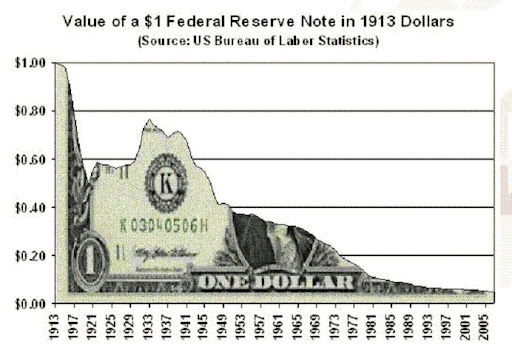

Since the Fed was established they have had on goal (two after Humphrey/Hawkins) - maintain a stable currency.

By any objective standard they have failed. So let’s start with the PREMISE that something has to change.

We need to discuss what a new currency system will look like and stop focusing on the idiosyncrasies of the people calling for change.

I listen to NPR a fair amount, so I know what they are like. But just a few days ago I heard them discuss the Fed and they had my mouth hanging open in disbelief.

Basically (they said) the Fed has no connection to the government, and can create trillions of US dollars out of thin air any time they want. Apparently this is a good thing. And (they said) this has no impact on taxpayers in any way. Why is that, you ask? Because the Fed has no connection to the government.

You have to willfully suspend all disbelief in order to drink this kool-aid. No one with an open mind would buy it.

BTTT

Private banking and private money. Money is too important to be in the Governments hands.

After we take care of our own economic interests, then the government can levy a tax to get money. But not to have the ability to print( yeah, I know ), and raise debts as it pleases.

This of course would destroy the modern welfare/corporate state. Which I would like.

So, I think we will slouch along, each year getting more welfare, more weakly and pathetically dependent upon Fedgov cheese, money, ‘assistance’ until we are serfs, generations deep into financial serfdom and no youth remembers liberty as it died out generations before.

Heck, we are already there.

Ron Paul is planning an audit of the Federal Reserve thus he is clearly a threat to those who own it. History bears out that persons in the past who have tried to establish a national currency which would have circumvented the bank that operated under the Congressional charter and now the Federal Reserve bank met their untimely deaths by bullets. I pray for Ron Paul and his family’s safety.

Problem is most politicians and their lap dog economists define “stable currency” as a controlled descent.

The hump between 29 and 45 shows that DEflation is just as dangerous as INflation.

Borrowing increases the money supply, even under the gold standard.

which relegates the taxpayer to chattel slave status.

Huh?

The main beneficiaries are those who receive access to artificially inflated money and/or credit before the inflationary effects of the policy impact the entire economy.

When the Fed buys a bond, the seller gets cash with 0% yield. How is that a benefit?

In this political environment, can this tribute payable to the central bank, be eliminated?

What does the central bank do with the "tribute"?

Viewing Ron Paul 0wnz the Federal Reserve and on Dylan Ratigan Jan 6 2011 provides valuable background and a hint of what may be possible

If you watch Dylan the Rat, you may be too stupid to breathe.

The high office of the President has been used to foment a plot to destroy the American's freedom and before I leave office, I must inform the citizens of this plight

Fake quote!

If Congressman Dennis Kucinich can agree with Ron Paul...

It's proof that they're both nutz.

A slow rate of inflation is actually good for the economy.

Key word being slow.

That is what we have been taught. I don’t believe it.

What I know is true is that the author is an idiot. And he/she doesn't have a clue about economics or his own idiocy."

What about Oil Price shock, Consumer Psychology, Bush Standing up before the nation and scaring the heck out of us demanding $700 billion bank bailout, Bank Reserve Rates at historic lows, Repeal of banking industry protections, Failure to regulate derivatives, Failure to regulate bank use of credit default swaps, Credit Card companies raising rates and forcing their customers into bankruptcy, unwise trade policies that have stripped our manufacturing, etc. This is the real cause, not the Fed, or lending.

That was an INfalatioany period. The dollar was buying less from 1929 to the end of the war. Prices were going up, and there were shortages. From 29 to, say, 37 or so, the government was doing what it is doing now, doing everything it can to keep crop, commodity, wages( some ) high, even though a lot of people had no work and could not afford those INFLATED prices. ( They said the Depression wasn’t bad if you had a job ) The late 30’s though the war was total government printing money, chasing totally socilist/command manufacturing, so goods and service prices soared and savings became worth less. Like now. Prices kept, or attempted to be kept high, savings at zero.

Don’t expect currency to be a long-term store of value. If you want to hoard dollars, do it in an interest bearing asset or in precious metals.

Currency only needs to be a stable short-term store of value to facilitate transactions.

Or, would you prefer that the Fed get it exactly right every time? That's easy, right? They should simply hit the button......

There is no “The Economy”. There are 300 million economies, each with different values, wants and needs.

What you mean to say as “The Economy” is some vague, elitist notion of what they as a class feel is the present desired economy. Basically big gov, big fiance and their associated Mini-me’s.

The notion of a single, unifying economy is very anti-democrat, anti-liberty. It is vaguely central finance planning to the benefit of the state and those that strap them selves, and the state to themselves as one.

Price is information. Inflation/deflation corrupts the information.

I would prefer that the Fed’s GOAL is stable prices. If your goal is slight inflation you will end up with more inflation than you want.

What is the politically corect time frame? Who made the state, and traders the arbiters of when, how long, how fast trades should be made? Is it any wonder, long term projects can not be economically undertaken when you are unable to plan on stable values? From the late 1700 until the beginnings of the Federal Reserve we had a stable US dollar, and with primitive finance, bad to no information, no to very poor infrastructure, we built the wealthiest nation in the world, literally from nothing. We built cities to rival anyone. From nothing. Now? We can't pour concrete. Yeah, this is working out good.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.