Posted on 01/09/2011 3:22:40 PM PST by blam

Massive Silver Withdrawals From The Comex

Commodities / Gold and Silver 2011

Jan 09, 2011 - 10:49 AM

By: Jesse

It will be interesting to see how the CFTC, the Obama Administration and the Comex deal with this situation with silver, including massive paper short positions.

Harvery Organ's commentary:

"And now for the big silver report.

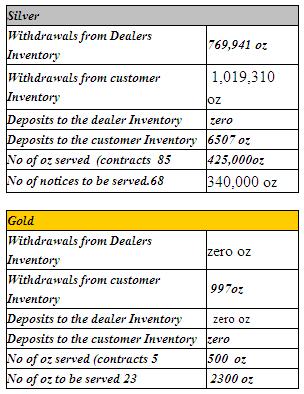

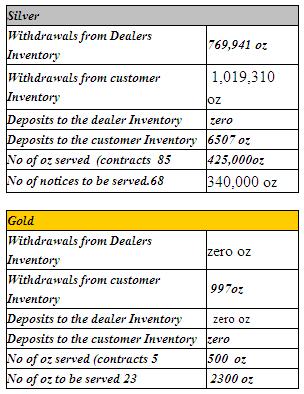

We witnessed a massive withdrawal of silver unprecedented in the history of the comex. First there was a smallish 6507 oz of silver deposited to two customers, one being 497 oz and the other 6010 oz). But just look at the huge withdrawals:

Four customers (not dealers) withdrew a total of 1,019,310 oz from the comex vaults. This is real silver leaving from 4 registered vaults. The individual withdrawals are: 579,081, 30,380, 399,994 and 9855 oz.

The dealer (our bankers) also were involved in the withdrawal of silver to the tune of 769,941 oz (there were 2 dealers involved removing 102,866 and 667,875 ozs). When you see this massive drain of silver, the fire is raging. The total silver withdrawal by both dealer and customer totalled an astronomical 1,789,251. The Brink's trucks must have been very busy yesterday.

The comex folk notified us that an amazing 85 notices were sent down for servicing for a total of 425,000 oz of silver. The total number of silver notices sent down so far total 323 or 1,615,000 oz. To obtain what is left to be served, I take the open interest for January at 153 and subtract 85 deliveries leaving a total of 68 notices or 340,000 oz left to be serviced.

Thus the total number of silver ounces standing in this non delivery month of January is as follows:

1,615,000 oz + 340,000 = 1,955,000 oz (Thursday total = 1,625,000). As promised to you, this number is rising and will continue to rise until the end of the month as our banker cartel scrambles to get any morsel of silver to satisfy the massive demand for this metal. Our bankers are stunned to see such a huge amount of silver options in a traditionally slow month.

I hope everyone caught the Eric Sprott story on Kingworld news that he is having trouble locating silver."

BTT

Long = You are betting on Silver to rise.

Short = You are betting on Silver to fall.

JP Morgan being short on silver and long on copper, means that no matter how commodities fare they make some money. This is a hedge.

If silver were to spike, JP Morgan would lose a ton of money.

I’ve read prophecies that silver will go to $600/ounce.

What’s your take on the situation currently?

Eh, my take?

I’m long on both the dollar and commodities. I think the dollar will rise over every other currency, and that commodities will rise more.

I’m one of the few who are bullish about the dollar, but that’s probably because I’m selling CDN and buying USD.

Short term, the dollar should rise, as the other currencies fall, but I expect long term, that the dollar will eventually drop. The Euro has shed a considerable amount of value, but I expect the Euro to fall all the way to 0.8 Euros to the USD.

Commodities, Gold, silver, and copper should all rise long term. I’m not buying any of these, as they are quite high right now. I’d rather buy stuff when it’s low.

Could silver spike like it did with the Hunt brothers? It could, but I’m not counting on it.

Thanks much. Interesting.

I don’t have anything significant to play with. But it’s interesting in prophetic terms.

I still expect the globalists to continue to trash the dollar and essentially every other currency in behalf of a more overt global currency.

It seems to me they might raise the Yuan high in the process.

I still think they are determined to bring the USA to it’s knees in a list of ways in order to make the overt establishment of the global government on the surface easier and faster.

Timing, of course, is everything and something mostly, few if any of us have a clue about, imho.

I don’t know what’s going to happen to gold but I don’t think it’s going to be useful for individuals to have.

I don’t have the ref but I came across a Scripture about both gold and silver being more or less worthless.

Certainly there’s the famous one about the end times of “a bag of gold for a loaf of bread.”

. . . which would indicate to me . . . that the gold supply will increase markedly—doubtful;

or the quantity of people will decrease markedly—highly likely given the globalists’ determination to reduce the world population by force to 200 million;

and/or food supply will markedly decrease.

On that score, Scripture and insider whistleblowing agree—massive famines will sweep the globe. There are predictions of folks in the USA eating aborted babies and helping their ill relatives die sooner so the remaining relatives can have a meal. That the globalists are truly eagerly plotting to engineer such famines is beyond horrific.

imho, of course.

The first step will never be the establishment of a unitary monetary system. They will have to take down the USD and the EURO in order for it to work.

China would be a great bet, but they try to maintain a peg on the USD. The result of this policy has been to finance a huge portion of the US debt, which they cannot call without destroying their own assets.

It’s like holding an asset which depreciates 10 percent a year, and not being able to sell it. I’m convinced that China would explode in revolution rather than give up on the peg to the USD.

Whereas being in cash makes you flexible to respond to changing market conditions.

EXCEEDINGLY Plausible . . . though I think you may not be quite as perceptive about China as the rest of it.

If push comes to shove, China will proudly go it alone as far as they can get away with it per the globalists.

They really are prepared to lose 800 million citizens and glory being on top of the heap of smoldering ruins of what’s left with their larger remaining population than the rest of the world—per their scenarios.

Similarly, they could lose goods in the USA but would be more likely to invade to take physical possession and rule THE BEAUTIFUL LAND directly.

imho.

“They really are prepared to lose 800 million citizens and glory being on top of the heap of smoldering ruins of what’s left with their larger remaining population than the rest of the world.”

Oh I don’t doubt. I fully anticipate revolution in China sometime in the next 15 years. What I do doubt is that they will manage to take down the rest of the world with them.

Average age in China is just 4 years less than in America. What’s going to happen when they hit 40? China’s boxed themselves in a corner.

“Similarly, they could lose goods in the USA but would be more likely to invade to take physical possession and rule THE BEAUTIFUL LAND directly”

I’ve pushed my chips into the middle behind America. I believe they are the best bet for the next century.

My neighbor from New Zealand says, "Never bet against the USA."

Hmmmmmmmm

Christianity is already turning lots of things right-side up in some areas.

However, I still think this fellow ‘saw’ events correctly:

http://www.handofhelp.com/vision_36.php

Thankfully, they don’t meet in the middle, per his view.

When we were more earnest and authentic in living out our Judeo/Christian values . . . I’d agree.

Seems to me we are headed for some serious discipline before we get any better.

I don’t see wholesale lasting improvement coming until after literal Armageddon.

Silver is excellent as a store of wealth, and as a hedge against devaluation of other commodities. It's not really a "beans, bandaids, bullets" option.

Today, SVRZF and PSLV are moving in opposite directions with a large difference in volume. Could you (or some) please comment on the relative (de)merits of these two funds?

You may want to sign up on zerohedge.com because there are a lot of precious metals types. PSLV is one of Eric Sprott’s funds in Canada. According to the posters on zerohedge.com, he appears to be a straight shooter.

Go to google finance and the symbol on the Canadian exchange is SII. He has a brokerage and asset management company in Canada.

PSLV supposedly has physical silver held in trust.

Many of the people who follow precious metals on web site s like zerohedge.com or seekingalpha.com do not trust SLV, GLD or IAU (american precious metals ETFs).

SVRZf I think is Claymore and Guggenheim. I have no comment. Another option is CEF which is a closed-end fund that has been around for 49 years. They own silver and gold bullion. www.centralfund.com

They have a silver bullion trust too at www.silverbulliontrust.com.

You may want to look at the seekingalpha.com and zerohedge.com web site. There is noise but some good information is there as well.

I personally trust long time, respected and well known providers in Canada over any banks or companies in America any more.

“...helping their ill relatives die sooner so the remaining relatives can have a meal.”

43% of people 60 or older voted for this in 2008. 50% of Baby Boomers (45 to 59 years opld) voted for this in 2008.

They are going to get what they voted for. Old folks will be the first to be “asked” to go.

http://seekingalpha.com/article/215342-beware-the-new-sprott-silver-fund

I would trust the Eric Sprott silver fund in Canada. Only physical silver to the best of their abilities. Sprott has a good reputation in the precious metals community.... He is 65 years old or ..has been around for a while. He also has a physical gold fund

Those two Sprott funds are not ETF. The largest gold ETF is not just in physical gold. They replicate the gold price but use futures and derivatives and physical gold to get there

The real gold bugs will not have money in GLD long term. They use it only for quick trading purposes because it is “no-load”

GLD functions like a bank that has 100 of its own special gold backed dollars but only has 20 units of gold in its vaults

Same for http://www.google.com/finance?client=ob&q=NYSE:SLV the large silver ETF

Thanks. According to www.silverbulliontrust.com, SVRZF is the US OTC symbol for the trust and it’s traded as SBT.UN & SBT.U on the TSX.

I’m too new to this commodity to know why Sprott (PSLV) would be up 3% with no activity on SVRZF. And what are the implications of a closed-end fund?

I’ve currently got cash locked in an IRA that I’d like to invest up there but am still unclear on the details.

hmmmmmmmm

Thx.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.