|

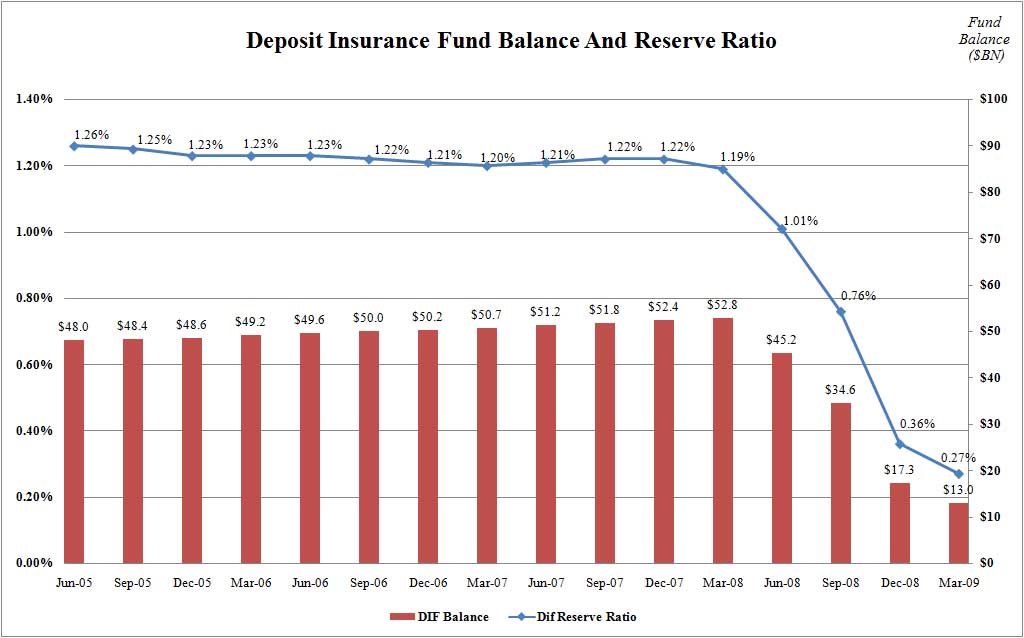

U.S. regulators are set to buttress their defenses this week against a slew of sick banks still facing closure and the risks to the dwindling fund that protects depositors. The Federal Deposit Insurance Corp has been looking at expanding the pool of potential bidders for distressed banks, providing some capital relief for troubled assets that will soon be brought back onto banks' books, and charging further industry premiums to replenish the insurance fund. All of these moves are geared to get the banking industry, and the agency charged with ensuring the industry's safety, through a financial crunch that is coming to a head. "We're working through this problem. We're not at the beginning, we're not at the end," said James Chessen, chief economist for the American Bankers Association. "We're in the middle and it's painful." Regulators have shuttered 81 banks so far this year, compared with 25 last year, and three in 2007. Analysts say the wave of failures is far from over. Richard Bove of Rochdale Securities said on Sunday that 150 to 200 more U.S. banks will fail in the current banking crisis, which started with a dramatic fall in housing prices that sent the economy into a recession and caused many borrowers to default on their loans. Bove said the continuing failures will force the FDIC to turn increasingly to non-U.S. banks and private equity funds to shore up the banking system. On Wednesday the FDIC will hold a board meeting to vote on guidelines aimed at attracting private investment money to distressed banks while ensuring the investors are serious about nursing these institutions back to health. The agency will likely relax the previously proposed guidelines after critics derided them as overly strict and predicted a chilling effect on investment. The agency will also vote on a rule that will ask banks if they need some capital relief associated with an accounting change that will bring more than $1 trillion of assets back on their books next year. On Thursday, the FDIC holds its quarterly briefing that provides critical information about its outlook for bank failures and the state of the deposit insurance fund. DRIP, DRIP, DRIP The meetings will come on the heels of two large bank failures that resulted in multibillion-dollar hits to the deposit insurance fund. The largest bank failure of the year landed on August 14, when the FDIC announced that Alabama-based Colonial Bank had been closed and its assets sold to BB&T Corp <BBT.N>. Colonial had total assets of $25 billion and is expected to cost the FDIC insurance fund $2.8 billion. This past Friday, the FDIC announced Texas-based Guaranty Bank failed, and that Spain's BBVA <BBVA.MC> was buying its assets. Guaranty, which had $13 billion in assets, drained another $3 billion from the insurance fund. Paul Miller, an analyst at FBR Capital Markets, said there will be a "drip, drip, drip" of bank failures over the next year but he does not see any more failures of the same magnitude as Colonial. "For the number of bank failures, we're in the first couple of innings. For the size, we're in the late innings," Miller said. The insurance fund has been drained to its lowest level relative to deposits since 1993, largely because the FDIC must pull out money for expected bank failures over the next year. The fund's balance stood at $13 billion as of March 31, compared to $53 billion a year earlier. The agency will provide an update on Thursday about how much more money has been drawn, and if the outlook for future bank failures has worsened. The FDIC in May raised the expected loss for the insurance fund to $70 billion over the next five years from $65 billion. |