Posted on 02/29/2008 3:21:52 PM PST by TigerLikesRooster

Stocks slide as investors scramble for safety

By Michael Mackenzie and Saskia Scholtes in New York

Published: February 29 2008 19:08 | Last updated: February 29 2008 21:10

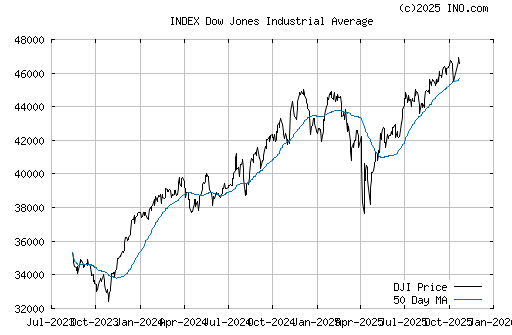

Stock prices and bond yields tumbled on Friday as fears about the stability of the financial system sent investors scrambling for the safety of government debt.

The yield on the two-year Treasury note dropped to its lowest level in nearly four years, while the S&P 500 stock index fell 2.7 per cent and the Dow Jones Industrial Average lost 2.5 per cent.

Traders said sharp falls in the prices of mortgage bonds and municipal bonds this week led to margin calls for some investors, exacerbating volatility as traders closed their books for the month and several leading investment banks marked the end of their fiscal first quarter.

“No question, margin calls are driving prices lower and there is more to come,” said Tom di Galoma, head of Treasury trading at Jefferies & Co.

Investors also reacted to dismal US economic data, continuing worries about credit insurers, a UBS report predicting that losses from the credit squeeze could reach $600bn and $15bn in writedowns from insurer AIG after the close of trading on Thursday.

“We are in the middle of a financial crisis,” said Larry Kantor, head of research at Barclays Capital.

The search for safety sent the yield on the two-year Treasury from 2.12 per cent on Monday to 1.64 per cent on Friday – its lowest level since April 2004.

The difference between the yield on the three-month Treasury bill and three-month Libor, the rate banks charge each other, was about 1.2 percentage points. That is about five times its normal spread.

Investors cut “carry” trades that involve borrowing in lower-yielding currencies to invest in higher-yielding currencies, sending the dollar to less than Y104, a four-year low against the Japanese currency. Gold rose to nearly $1,000 an ounce.

“The credit markets do appear to be in the throes of another leg down into the abyss,” said Bill O’Donnell, UBS strategist.

There was good news for one credit insurer as Wilbur Ross, the distressed situations specialist, said he would invest as much as $1bn into Assured Guaranty.

"This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan... that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years." ~~R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

I bought it at 450, now it's at 974. I can sell it for 970.

What idiot would sell it for 500, as you suggest?

You are so full of it, LL.

"I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future." ~~E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."~~Irving Fisher PhD, leading U.S. economist , New York Times, October 17, 1929

"If recession should threaten serious consequences for business (as is not indicated at present) there is little doubt that the Federal Reserve System would take steps to ease the money market and so check the movement."~~Harvard Economic Society, October 19, 1929

I mean, the current borrowing rate of 3.0% is just so punitive. /sarc

A used car salesman, back in 1929, lol!!

You call it disgusting. I call it infuriating. Yes, they were lying intentionally in the hope that their lies would induce the sleeping sheeple to complacency. To get people to keep spending.

They are still lying. That is what is infuriating to me. Their will be pain for some economically and all the liars are doing is deferring the pain, which will make it more painful for a longer duration. Sickening.

I completely agree with your assessment/thoughts/opinions on this...it's unethical, immoral, and a depraved level of greed.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.